Decentralized Finance (DeFi) has been the breakout trend of 2020. With prices of standout DeFi tokens surging and terms like “Yield Farming” getting mainstream attention, the DEFi field has taken off. This next step in the evolution of finance uses public blockchain technology and has a wide range of sub- divisions that make up the growing field. The most notable and popular of these DeFi services are decentralized exchanges, decentralized stablecoins, decentralized money markets, decentralized synthetics and decentralized insurance. To understand this emerging field, first a definition on what decentralized means must be had.

Learn more about DeFi, and liquidity pools such as Balancer, Uniswap and Curve with our video:

What is decentralized and what does it mean?

Decentralized is a term you will have definitely heard thrown around even if you are relatively new to the cryptocurrency scene. Be it on Twitter, with the various profiles espousing the benefits of decentralization and calling out centralized cryptocurrency projects, or in articles online. To give a little context, the decentralized v centralized argument is akin to economic arguments on political systems between capitalists and communists.

Part of the reasoning for many supporters of decentralization is that blockchain technology at its core was made to be decentralized. Blockchain is reliant on open source networks and has no central entity controlling it. Rather, the computer power and the overall network is split up, which is why it is decentralized. The benefits of this system are that it doesn’t have a single point of failure, making cyber attacks and poor leadership somewhat irrelevant.

As such blockchain has been earmarked as the breakout technology of the 21st century. Companies, governments and financial institutions are all clambering to bring developers on board as blockchain continues to be viewed in an increasingly glowing light. Yet, how does blockchain’s decentralized foundation play into the emerging DeFi field?

DeFi Explained

For many, blockchain is the embodiment of the DeFi field and is the promised land of finance that Satoshi Nakamoto first imagined when he created Bitcoin. The term DeFi has turned into an all encompassing term for a range of projects, but the core values of each are pretty clear. These are open access to anyone, resistance to censorship, privacy and an open democracy of finance away from singular control. The majority of DeFi sites are run through decentralized apps or Dapps, which allow for financial services to be created and be used easily by anyone.

The DeFi Market

The DeFi market is a field that has grown massively in recent months as billions of dollars are handled every hour in the sub industry. Part of DeFi’s popularity is down to its transformative effect on almost all aspects of finance. From loans to remittance markets and even insurance, the DeFi field could give financial access to people around the world as all they need is an internet connection. The technology could have an impact on the third world, where many of the population is unbanked or even in more developed financial societies as governments and financial institutions continue to lose credibility as they go from recession to recession. Sold on DeFi now? Well if so, read on for a closer look at the different blockchain applications in the field and the top companies within each subcategory.

What is a Decentralized Exchange?

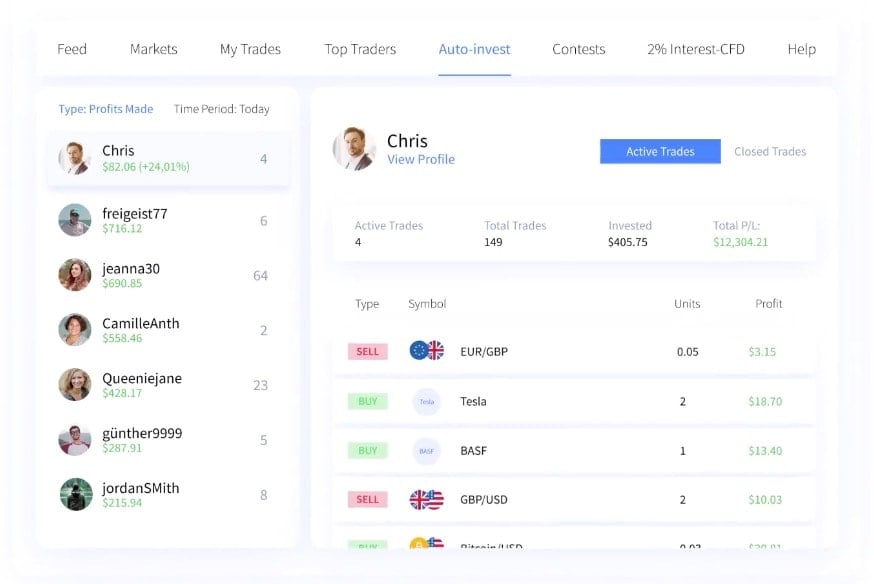

Exchanges are the heartbeat of the cryptocurrency traders. Most of you will have an idea of the more famous centralized exchanges like Binance and Coinbase, but decentralized exchanges (DEX’s) may be less so. The main difference between the two is that there is no central authority over decentralized exchanges, rather governance is determined in various ways, like through earning native tokens.

Focusing on namely cryptocurrencies, the decentralized exchanges offer a range of benefits. The first is security as you are not trusting a centralized exchange which could be susceptible to hacks with your funds. Instead trades are done through a peer to peer (P2P) trading network and a range of methods are used to facilitate this. Some DEX’s use proxy tokens, others multi-signature escrow systems and some use shares. Popular DEX’s are dYdX, Uniswap and Kyber network.

Decentralized Stablecoins

Much like DeFi applications, stablecoins have also seen a rise in popularity and usage in recent times. Put simply, stablecoins are less volatile tokens that are usually backed by a currency, commodity or a collection of both that enables them to keep a steady price, unlike the often wild swings of other cryptocurrencies. Some stablecoins are centralized but there is a growing amount of stablecoins that have become decentralized. These include industry favourites like DAI, USDC and Tether (USDT). To be classed as a DeFi stablecoin, there needs to be no central figure ruling the tokens or single point of failure as well as a resilient network.

What is a Decentralized Money Market?

Money markets are markets for borrowing and lending assets. The decentralized element means that users can borrow and lend cryptocurrencies without the control of a central figure. The lack of central authority is fixed using smart contracts and algorithms to determine the markets function. Decentralized money markets put interest earning potential in the hands of anyone with an internet connection in the world. Popular examples of decentralized money markets include Aave, Compound, MakerDao and Balancer. This area of DeFi has gained the most traction in recent times, especially with the bearish crypto market. This is because there are lots of profits to be made, with “Yield Farmers” churning in large sums from interest earned.

Decentralized Synthetics

Decentralized synthetics is another growing sector of the DeFi field. Synthetics or derivatives as it is also known refers to the tracking of a value for an asset. This means traders can get an insight into an asset without physically investing themselves. This representation of the asset allows traders to make educated investment decisions. There are a number of decentralized synthetic companies, the most popular ones being UMA and Synthetik. Expect more companies to pop up in the future too.

Decentralized Insurance

As blockchain gains exposure, more and more use cases appear, from accounting to product tracking. One industry that has taken to the technology is insurance. The bureaucratic side of the industry is perfect for blockchain technology and smart contracts, with a wide variety of usages for the technologies. The technology has the ability to revolutionise the insurance field as it cuts out added fees and reduces smart contract risk. Notable decentralized insurance companies include Nexus Mutual and Opyn.

Conclusion

Overall, it would appear that the DeFi field is growing and most importantly, is here to stay. People around the world are increasingly seeing the problems of a centralized method, especially in the cryptocurrency industry which has a long history of customers’ funds being lost due to hacks of centralized exchanges. Partner this with an increasingly more aware population with regards to internet privacy, you have the makings of the next big thing in the cryptocurrency industry and possibly the wider financial field.

Although the industry is in its infantile stage, there are a number of interesting projects and options, most strikingly in the decentralized exchange and money market area, which users can partake in. Boxmining has a number of guides which can help you decipher more clearly which is the best project for you. For more DeFi related information and other cryptocurrency news, subscribe to our YouTube channel and newsletter.

Decentralised Finance (DeFi) series: tutorials, guides and more

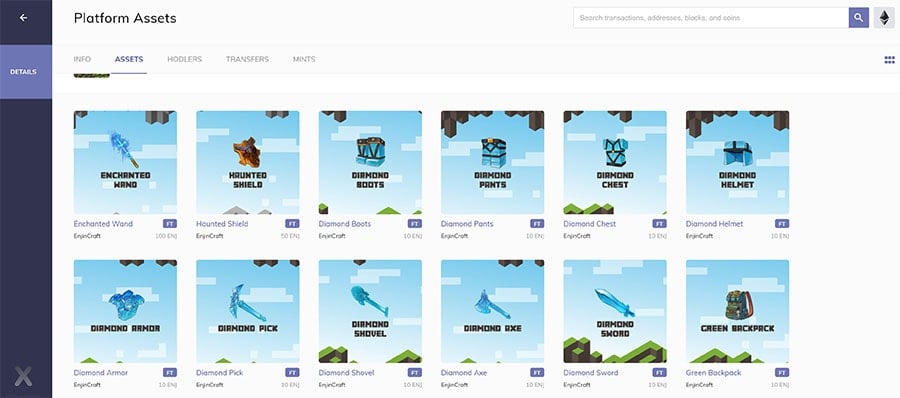

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

- MetaMask Guide: How to set up an account? PLUS tips and hacks for advanced users

- Uniswap review and tutorial: Beginners guide and advanced tips and tricks

- Serum DEX guide and review

- SushiSwap ($SUSHI) explained

- 1inch Exchange, Mooniswap and Chi GasToken: The ultimate review and guide

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.

Coinbase Earn program. Users will need to complete various online courses on different cryptocurrencies, in return you will be awarded a small amount of that cryptocurrency to trade with. Users can get up to USD $152 with Coinbase Earn.

Coinbase Earn program. Users will need to complete various online courses on different cryptocurrencies, in return you will be awarded a small amount of that cryptocurrency to trade with. Users can get up to USD $152 with Coinbase Earn.

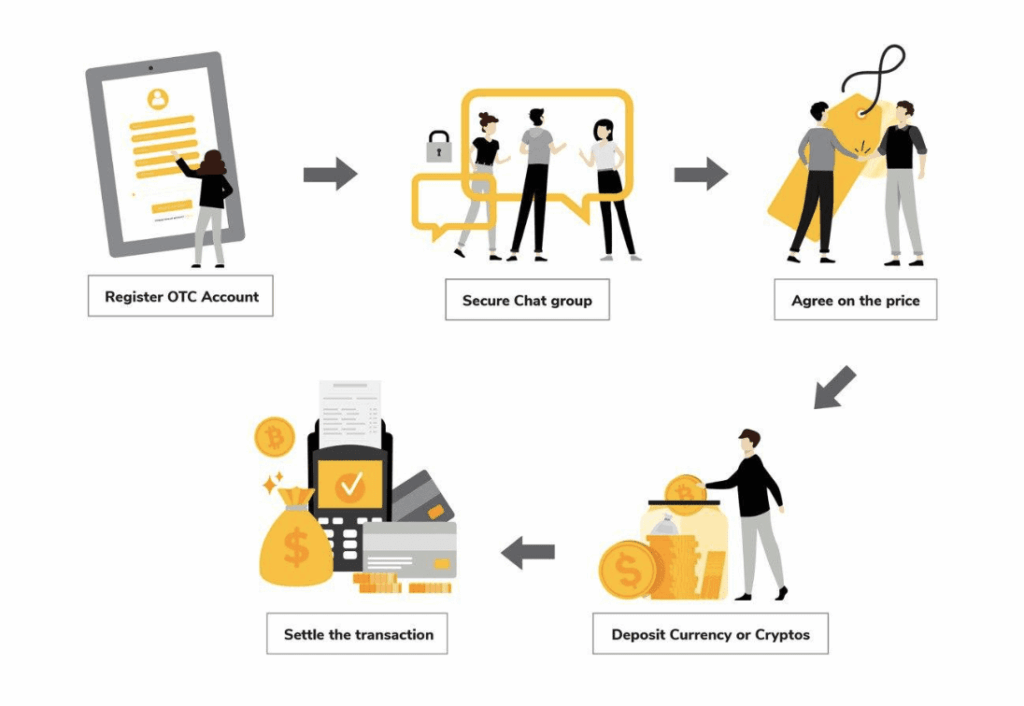

OKEx review.

OKEx review.