In the crypto industry, discovering early-stage moonshot projects can be difficult. Investors who manage to enter early usually secure massive returns, and some of these projects end up becoming successful in the long run. However, there are many low-quality projects and scams looking to take advantage of early investors, resulting in pump-and-dump schemes. Therefore, the market needed a more secure mechanism to raise funds for crypto startups. This is where launchpads come in.

What is ICO? – The Origin of Crypto Fundraising

Before we take a look at what crypto launchpads are, it is important to learn about its predecessor — Initial Coin Offering (ICO) and why they are no longer practiced.

What is ICO and Why does it Matter?

Similar to all business ventures, crypto projects require capital to build their product and meet their objectives. They typically achieve this via crowdfunding, and the first fundraising model in the crypto industry is an ICO, where crypto projects would raise funds by selling a part of their total token supply to the community. This allowed investors to purchase tokens at the cheapest price possible before they are listed on a crypto exchange.

In fact, Ethereum conducted one of the first ICOs in 2014. More than 60 million ETH were created and sold to the public, raising $18.3 million USD.

ICO Bubble in 2017-2018

In 2017, ICOs began to take off thanks to Ethereum’s open-ended smart contract protocol. Developers can easily create new applications and tokens (ERC-20 tokens). Moreover, smart contracts can be executed to calculate raised funds and distribute tokens once crowdsale is complete. As a result, the majority of ICOs took place via the Ethereum network.

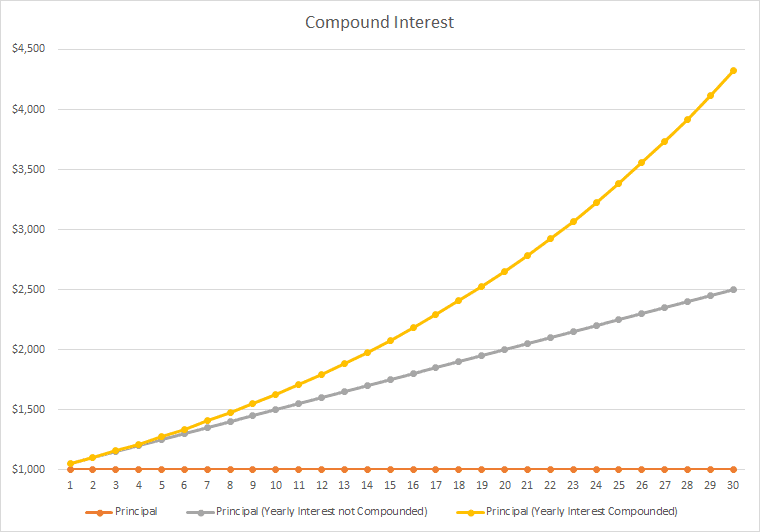

Numerous projects saw substantial gains of their token as high as 10,000x, making a lot of early investors very rich. By the end of 2017, an estimated $4.9 billion was raised through ICOs reported by the Wall Street Journal. However, ICOs quickly became a way for investors to gamble in hopes of making easy profit. As a result, project fundamentals became less important to would-be investors.

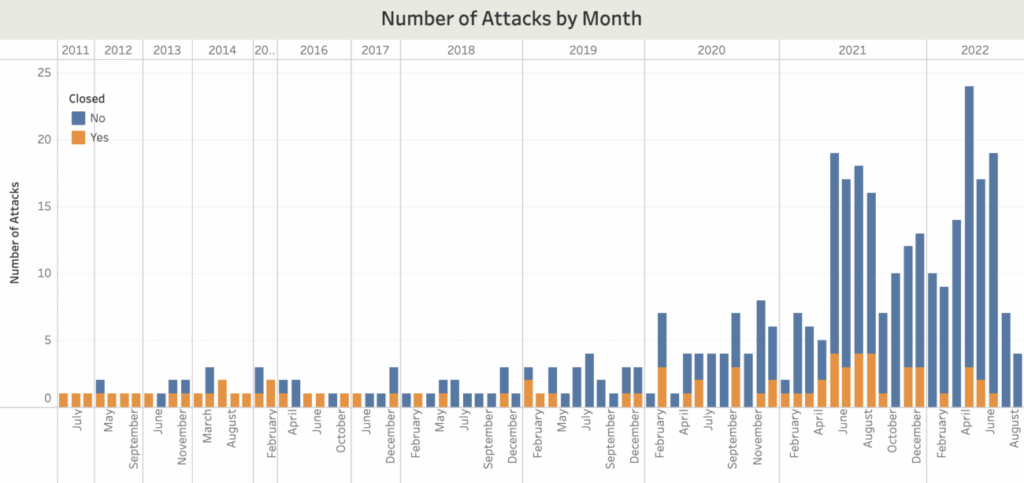

This led to many security issues. For example, since cryptocurrencies were unregulated at the time, anyone can launch an ICO anonymously. Many malicious actors took advantage of the hype and created false projects and ICOs. They would rug pull investors’ funds, or even just run away with the money, abandoning the project before it ever got listed on an exchange. It became so severe that the U.S. Securities and Exchange Commission (SEC) intervened, imposing strict securities laws on ICOs which subsequently led to ICO bans worldwide such as South Korea and China.

Crypto Launchpads – The Beginning of IEO and IDO

Because of the ICO bubble, faith in the crypto industry was lost. This made it very difficult for legitimate blockchain projects to raise funds and build products with real value. Fortunately, not long after, crypto launchpads came to the rescue. Launchpads are essentially platforms that help crypto projects raise capital while giving access to early-stage token sales for their group of investors.

There are two main types of crypto launchpads — Initial Exchange Offering (IEO) and Initial DEX Offering (IDO). The difference between the two is where the fundraising is being held. Let’s look at the first one, IEO.

What is IEO?

An IEO is a fundraising model where the project receives the backing of a crypto exchange like Binance or FTX. The fundraising event is administered by the exchange, in contrast to an ICO where the project team themselves conducts the fundraising on their website. With IEOs, users can buy tokens on the exchange’s launchpad directly from their exchange wallet.

IEOs generally have high security as most crypto exchanges are regulated to an extent. They actively follow stringent protocols to prevent fraud including know-your-customer (KYC) and anti-money laundering (AML) verifications. The projects are carefully scrutinized, vetted, and selected by the exchange team for their IEO. Project teams must at least have a white paper and minimum viable product (MVP) ready for the exchange to review. Thus, would-be investors are assured that the startups under IEO listings are legitimate. After all, the exchange is staking its reputation behind the projects on its platform, offering a higher degree of trust behind the project.

For crypto projects looking to raise funds, an IEO offers the promise of an immediate userbase that can see their product. In other words, IEOs help create exposure to the project. This also means that the project can reduce their outside marketing funnels for fundraising, enabling them to focus only on the development of their product.

Top IEO Launchpads

Some of the top IEO launchpads include Binance Launchpad, Huobi Prime, KuCoin Spotlight, Gate.io Startup, and many others. In fact, the first IEO in history was launched by Binance Launchpad in the first quarter of 2019. Moreover, these top IEO launchpads are more than a platform for offering tokens. They also provide full advisory service for projects, leveraging their insights and experience to help build better products.

Disadvantages of IEO

Though IEOs are generally secure, not all crypto exchanges are equal. Some may not be as strict in doing due diligence or implementing regulations. This means that there is still a risk of a pump-and-dump scam, as advanced scammers could pull a meticulous long con.

Moreover, listing fees may be quite high, especially on reputable exchange platforms. Startups may also be asked to pay commission from token sales. They can be considered as centralized gatekeepers about the types of projects that proliferate, meaning that only somewhat established projects can earn a spot.

What is IDO?

On the other hand, IDOs are approved by the community of a decentralized exchange (DEX) instead of a crypto exchange. Given the decentralized nature of these exchanges, anyone can become an approver. The community can vote on projects that they are interested in. This alleviates the gatekeeping bottleneck that IEO exchanges have, giving smaller legitimate projects a chance to shine.

Similar to ICOs, some DEX teams also provide advisory service to listed startups, offering them a tool for engaging their communities in an economy that enhances their products while allowing them to make smart business decisions regarding their assets. However, unlike centralized exchanges, most IDO launchpads have their own native tokens, which in some cases serve as an entry requirement for users to participate in crowdfunding.

Top IDO Launchpads

Some of the top IDO launchpads include Polkastarter, TrustSwap, Scaleswap, DAO Maker and more. We have a complete guide on choosing the best IDO launchpads: Private: Ultimate Guide to the Best Initial DEX Offering (IDO) Launchpads.

Disadvantages of IDO

Though IDOs are more transparent and accessible to everyone, there are also drawbacks. Since DEXes tend to be a lot smaller than centralized exchanges, new projects might receive substantially smaller traffic than IEOs. Moreover, because every one gets a say in the approval process, long-con projects can also sneak their way in with eye-catching proposals and marketing.

Key Takeaway

Investing in potential crypto startups can generate massive returns if successful. IEO and IDO launchpads are a great place for you to research upcoming innovations and learn more about what they offer. Though not completely risk-free, they offer far more security advantages than ICOs.