Table of contents

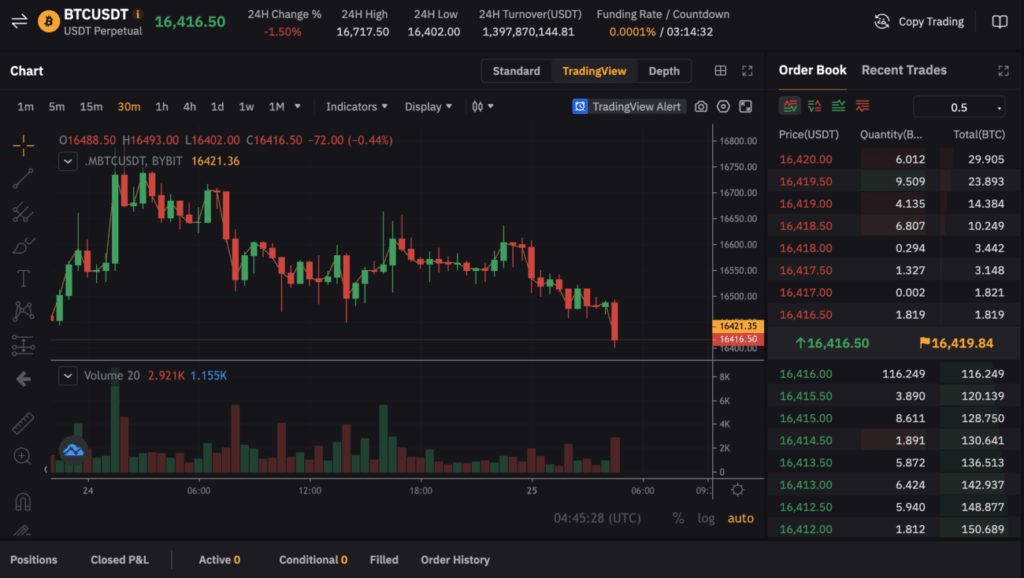

One major question all new cryptocurrency investors ask is how to actually spend their cryptocurrencies. Unfortunately, cryptocurrency is just not as widely accepted as fiat currencies. Cryptocurrencies are also subject to huge price fluctuations and volatility. Therefore, to “lock in” the price of your cryptocurrencies and as a springboard to cashing out crypto to fiat, many have converted their cryptocurrencies to stablecoins instead. This allows one to keep their dollar-pegged coins in exchanges or cold/hot wallets, so when the moment to jump back into the bull run comes, they can do so within minutes without having to deal with fiat on-ramps. Alternatively, to easily convert their stablecoins to fiat currencies for spending.

Most have considered stablecoins to be a safe means of preserving their capital without experiencing volatility and having to leave the crypto ecosystem. After all, they’re… stable, right?

In most cases, they have been, but the most recent collapse of one of the largest and well-respected stablecoins, terraUSD (UST), and other less known ones, like neutrino USD (USDN) and DEI, has led people to question the stability of all stablecoins. But is this warranted? Isn’t there a bit more nuance to the mechanisms by which a coin retains its dollar or other fiat currency peg, each with their own risks and advantages?

Although a seemingly straightforward idea, stablecoins can be quite tricky to unpack and analyze, especially when talking about non-collateralized algorithmic stablecoins, which sound too good to be true, and in some cases, are. With this in mind, let’s take a look at stablecoins, what kinds are out there, how well they are doing, and what makes them tick.

Check out our latest video- Stablecoins: Are they safe? ($UST, $USDT, $USDC, $BUSD)

Stablecoins – What Are They and How Are They Different?

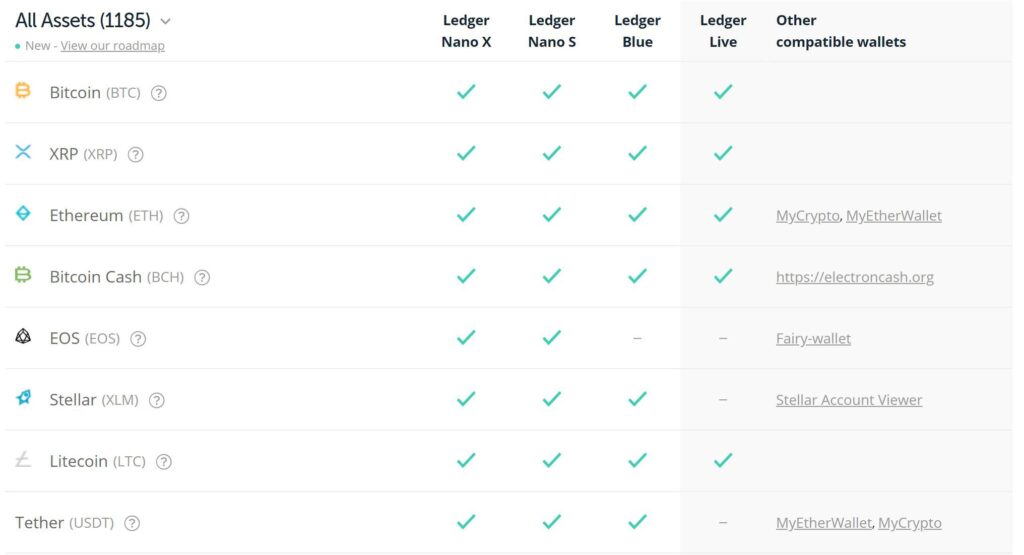

Stablecoins are cryptocurrencies that are pegged 1:1 to the value of a fiat currency, meaning that, for example, every 1 USDT (USD Tether, the biggest market cap stablecoin) is worth 1 US Dollar. There are numerous stablecoins in circulation, with different coins having different mechanisms for collateralizing their stablecoins.

The most commonly used feature to categorize stablecoins is by looking at how each of them backs their tokens, e.g. their collateral/reserves. By doing that, we can focus on using more narrow criteria for evaluating and comparing stablecoins based on the risks and advantages that stem from the chosen collateralization mechanism. Broadly speaking, there are three main types of stablecoins: Fiat-collaterized stablecoins, crypto-collaterized stablecoins and algorithmic stablecoins.

Fiat-collateralized Stablecoins

By far the most popular type, fiat-collateralized stablecoins occupy the top 3 spots (USDT, USDC, BUSD) among stablecoins by market cap, accounting for roughly 94% of the total ~$155 billion stablecoin supply.

Their working principle is the most straightforward to understand. Each of these coins is backed by a combination of real USD cash reserves, US Treasury Bills, and commercial papers (liquid short-term debt issued by companies).

Crypto-collateralized Stablecoins

Similar to fiat-backed stablecoins, crypto-backed stablecoins use cryptocurrencies as collateral, and smart contracts and, typically, governance tokens to monitor price stability. Due to the volatile nature of cryptocurrencies, crypto-backed stablecoins are over-collateralized (150% for DAI, for example) to account for periods in the market when prices of the collateral assets keep going down. Learn more about DAI.

Compared to fiat-backed stablecoins, they’ve witnessed a much slower rate of adoption. However, based on data, it does seem that they are slowly starting to gain momentum and dominance over the past years, as people begin to develop trust in the previously experimental mechanisms, which is to be expected.

There are also hybrid collateral tokens such as Reserve Tokens (RSV) that are backed by both digital and fiat assets.

(Share of Total Stablecoin Supply)

Algorithmic Stablecoins

By far the most technically complex and technologically least mature, algorithmic stablecoins rely on on-chain algorithms to handle changes in supply and demand between the stablecoins and their sister tokens that back them by burning and minting them in both directions through a process called seigniorage, to maintain a dollar peg. This, however, only works while there isn’t a strong downward pressure on the peg that keeps stressing the mechanism, which can lead to a downward death spiral during which both tokens keep losing value as users keep panic selling at the same time as the algorithm tries to stabilize the price. Although not fully collapsed, neutrinoUSD and its Waves protocol have been experiencing extreme turbulence for the better part of two months, making users lose confidence in its stability, especially as its working mechanism is very similar to that of UST.

On the less extreme side of algo-stables lie hybrid stablecoins, or fractional-algorithmic stablecoins, such as FRAX, which is partly backed by collateral, and partly algorithmically by adjusting the collateral based on the deviation of FRAX from the $1 peg.

Learn more with our Ultimate Guide to Algorithmic Stablecoins:

Criteria for Comparing Stablecoins

Decentralization

The impact of regional regulations can be a risk many would not find appealing. It’s completely reasonable to expect that the industry would be capable of creating largely decentralized stablecoins that are collateralized by one or more decentralized cryptocurrencies, and governed by a DAO. Such is the nature of MakerDAO and its DAI stablecoin, which has shown its peg strength throughout this year and especially during the most recent catastrophic UST collapse. There is a small caveat, however.

The largest crypto-asset backed stablecoin with a $6.5 billion market cap, DAI, is still heavily backed by the second largest market cap stablecoin, USDC, which itself is backed by fiat reserves, calling into question whether it truly is as decentralized as it purports itself to be. The reality is not as grim as it might seem. Even though USDC and USDP (another fiat-backed stablecoin) comprise 28.1% of the total DAI collateral, ETH and WBTC (Wrapped BTC) boast an impressive 58.6% collateral, tipping the collateralization balance in favour of decentralized digital currencies instead of centralized stablecoins. In addition, the Maker platform with the MKR and DAI tokens, together with all of its smart contracts, lives on the Ethereum blockchain, making it truly trustless and decentralized, even if a good portion of the collateral is not.

On the other hand, the decentralization of all stablecoins might not be necessary, or even desirable, as properly regulated stablecoins almost by definition require a legal entity or a consortium of entities with exposure to major governmental bodies (especially in the US) to be behind the stablecoins, so that there is little doubt about who is responsible for ensuring a full fiat backing of their stablecoins. However, this would imply heavy centralization of control over the stablecoin supply and the general mechanisms for issuance, governance, and, crucially, potential censorship.

A centralized stablecoin is a double-edged sword. On one hand, it gives unprecedented power over a vast supply of stablecoins that a decentralization-focused industry heavily relies on to do daily business. On the other hand, it allows for companies like Binance, who are behind the popular BUSD stablecoin, to prioritize user safety and regulatory compliance, giving users peace of mind about the safety of their assets.

Thus, a strong argument can be made to safely onboard millions of new users through reasonably regulated stablecoins. It’s important for this industry to appreciate the need to offer a wide range of stablecoin alternatives, from centralized to decentralized, for users with different risk appetites and technical competencies in order to accelerate crypto adoption worldwide.

Compliance & Transparency

Closely tied with the level of decentralization of a stablecoin, regulatory compliance and transparency are absolutely crucial for companies who are backing their coins with cash reserves, and who desire to find strong and growing support by institutions, companies, and investors looking to enter the space, but who have been apprehensive to do so due to concerns about a potential inability to redeem their tokens for dollars.

It’s important to note that regulatory compliance is largely a concern for stablecoins operated by corporations, as they are the ones operating mostly behind closed doors, with most of the details about their inner workings, decisions, and collateralization mechanisms being hidden from the end-users and legislators. In such situations, it is more than reasonable to expect a regulatory body to force at least some oversight over how exactly these companies are operating their stablecoins and whether they do possess the collateral they claim to have.

The same can’t be said about open-source, decentralized governance-powered, blockchain-native, crypto asset-backed, and over-collateralized stablecoins that are being operated completely out in the open, with every decision, piece of code, and capital relocation in smart contract escrow accounts being registered on-chain. For coins such as DAI, compliance and transparency are baked into the protocol, and it can be reasonably argued that the necessity for any kind of regulatory oversight is moot, as the community and the free market cryptoeconomic pressures have organically grown a robust and freely auditable stablecoin that’s fully backed by digital currencies.

For fiat-backed currencies, the two large-cap extremes in the range of transparency and compliance are BUSD and USDT. While BUSD has been extensively cooperating with the New York State Department of Financial Services (NYFDS), and showing that every BUSD is backed by an equivalent amount of cash, USDT has been under significant scrutiny over the past years regarding its executives and the USDT backing. These allegations, combined with the lack of transparency by Tether, have made many worry whether USDT is a house of cards about to crumble as the Chinese real estate bubble begins to pop.

Financial Sustainability

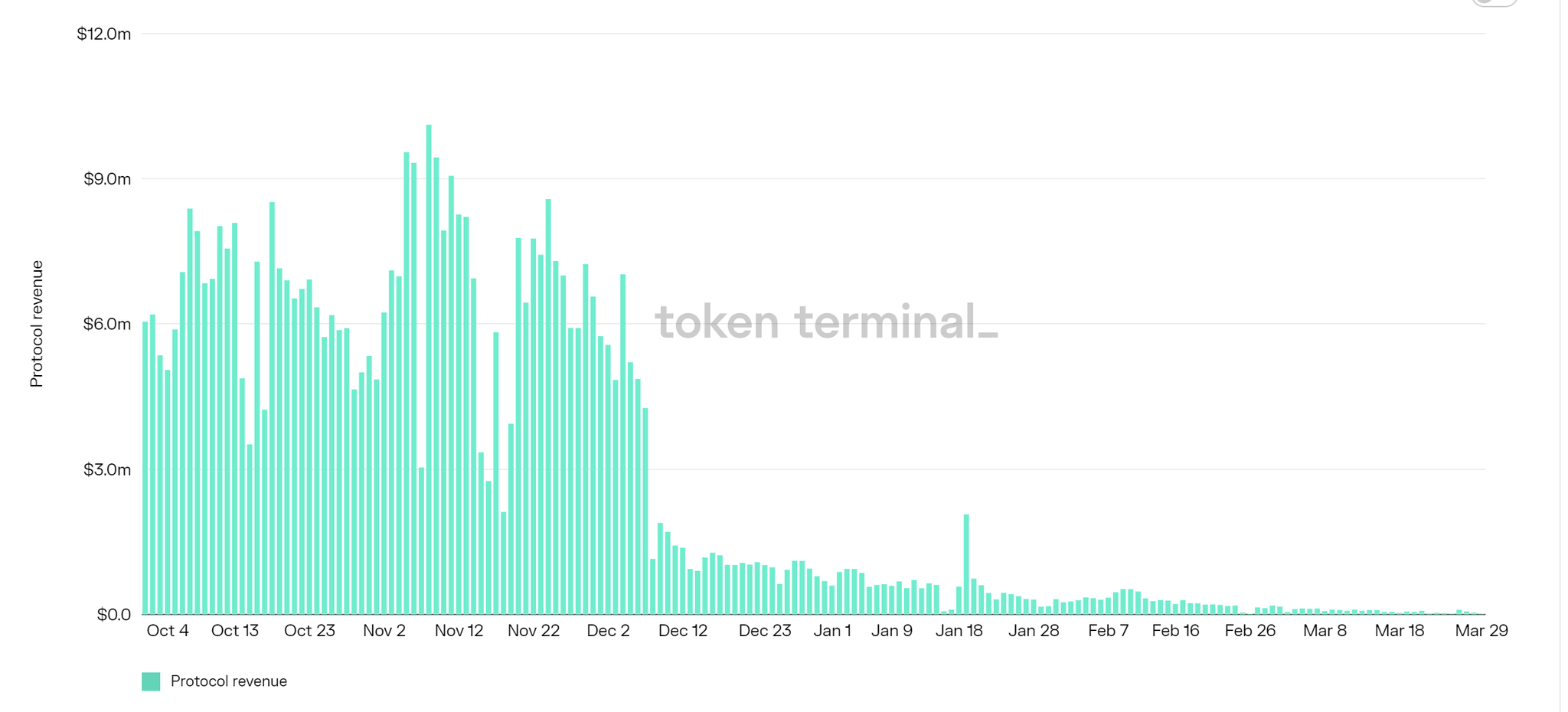

In addition to the existential risks posed by the type of collateral chosen for stablecoin reserves, another source of risk that can be analyzed for a project is its cashflow. Changes in the cashflow of a protocol can offer clues about the health of the ecosystem and its ability to withstand market shocks.

Understanding how a stablecoin protocol spends and, most importantly, earns its money, is key to making predictions about the long term sustainability of such projects. Without proper long term revenue models, protocols are left to come up with highly appealing but unsustainable practices such as incredibly high yields on stablecoin deposits (such as UST had) or very low to non-existent trading fees to make it appealing for users to use that stablecoin as their dominant medium of exchange. These kinds of practices sooner or later come back to bite them in the ass, as there is a very high probability that the high yields and low fees are paid for not from organic revenues, but rather from alternative revenue sources (as is the case for Binance), or from project’s treasury/VC investment money, in hopes that they would be able to subsidize the attractive rates for long enough to reach a critical mass of users to then eventually either lower the yields and increase the fees, or simply keep running a ponzi-like operation for as long as possible.

Risks are High, always DYOR (Do Your Own Research)

If something in crypto sounds too good to be true, it very likely is. The most recent example of this was the Anchor Protocol’s 19.5% yield for UST deposits, which should’ve been a huge red flag, and yet many, many individuals chose to deposit their life savings into a supposedly stable UST in hopes of an unsustainably high APY.

For a $50 billion project to go down to virtually nothing in a matter of weeks is nothing short of astonishing, and should serve us all as a warning to do our due diligence thoroughly, and ask uncomfortable questions, even if the whole market seems to be fully on-board with a project.

As the saying goes, “Follow the money.” If a protocol is promising unbelievable returns, if the company behind a stablecoin year after year refuses to prove their fiat reserves, and if a algorithmic stablecoin seems to have a fishy peg stabilizing mechanism that can only work in an up-only environment, then you should exercise caution. And as with everything, whether it be cryptocurrencies or stocks etc, ask yourself if you have really fully done your research and never put in more money than you can afford to lose.