Robinhood is a US-based stock investment company that enables customers to purchase and trade traditional stocks, ETFs, and cryptocurrencies. If you want to know if it is the right exchange for you, read this Robinhood article review.

Sign up here to get started.

What is Robinhood?

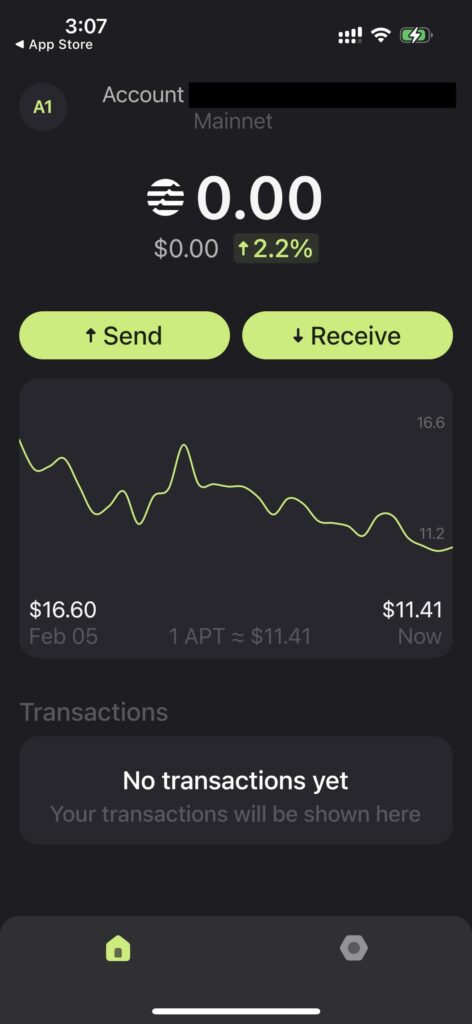

Robinhood is a US-based stock investment company that enables customers to purchase and trade traditional stocks and ETFs. Since 2018, the platform has also started supporting cryptocurrency investments, allowing users to buy and sell Bitcoin, Ethereum, and other digital assets.

It offers users unique features such as zero-commission trades. Since its launch, the platform has gained increasing attention from users, resulting in the emergence of Robinhood Crypto reviews. It also provides users with real-time market data, portfolio tracking, and a variety of educational resources.

Key Features/Advantages of Robinhood

Trade Cryptocurrency Without Commission

When it comes to cryptocurrency exchanges, fees can vary drastically. While some exchanges offer fees as low as 0.1%, others might charge up to 5%. The general benchmark of crypto exchange fees is considered to be around 0.25%. If it’s higher, it might be worth looking for an alternative. It’s important to research the fees of each exchange before trading. They can have a significant impact on your profits. Additionally, some exchanges may also charge additional fees for deposits and withdrawals. (https://northeastohiogastro.com/) It’s important to factor these in when deciding which exchange to use.

Robinhood is a popular online trading platform that offers users the chance to trade cryptocurrencies commission-free. This means that there are no fees associated with trading crypto on Robinhood. It makes it an attractive option for those looking to invest in the crypto market. It also makes it a great choice for beginner traders, as they won’t be punished as harshly for mistakes due to the lack of fees.

Offers All of the Main Cryptocurrencies

When selecting the best crypto exchange for your needs, it’s important to consider the range of supported cryptocurrencies offered by each platform.

Cryptocurrency is gaining traction and more people are now interested in a wider variety of coins than ever before. With the right cryptocurrency exchange, you can trade all the coins you want on one single platform.

In 2018, Robinhood was offering only two cryptocurrencies for trading – Bitcoin and Ethereum – which remain the two leading cryptos on the market even today.

They currently support these cryptos:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Bitcoin SV

- Litecoin

- Ethereum Classic

- Dogecoin

Although the variety of cryptocurrencies available on Robinhood is not as extensive as some users would like, the platform does offer a selection of major cryptocurrencies, such as Bitcoin and Ethereum. However, some users have noted in their Robinhood reviews that the platform does not include some major cryptocurrencies, such as XRP (Ripple).

One of the More-Reliable & Secure Investments Platforms in the US

When it comes to cryptocurrency trading, the trustworthiness of a platform is paramount in order to attract users. Crypto enthusiasts are often wary of anything that is out of the ordinary due to the prevalence of scams in the crypto market, so it is important to ensure that a platform is reputable and secure before investing.

With a long-standing reputation for reliability and security, Robinhood has become a trusted stock investment platform. The same can be said for its crypto offerings, which have earned the platform a positive user review from the majority of its customers.

Crypto investments are not protected by the same insurances as traditional stock investments. The company itself warns that external factors can affect the value of crypto assets. Experienced crypto holders are well aware of this risk.

Robinhood provides users with a secure storage option for their crypto assets, keeping the majority of them in cold wallets. Cold wallets, also known as hardware wallets, are highly secure and one of the best options for storing cryptocurrencies.

A Very Simple & Beginner-Friendly Interface

When it comes to high-end cryptocurrency exchanges, simplicity and ease of use are often overlooked, but they are essential features that should not be underestimated. For example, Binance is a great example of how a user-friendly interface can make a huge difference in the user experience.

Beginner traders and investors often face a stigma surrounding the trading and investing scene, as many believe these processes to be overly complex and difficult to get into. However, with the right guidance and resources, trading and investing can be made much simpler.

Robinhood crypto reviews show that the platform is designed to be user-friendly for both new and experienced crypto traders. The streamlined interface makes it easy for beginners to get started, while experienced traders can still benefit from the platform’s features.

Key Disadvantages of Robinhood

Only Accepts Traders from the US

Many cryptocurrency exchanges have a variety of restrictions in place, particularly for US-based users. This is due to the Securities Exchange Commission (SEC), a US institution that safeguards US-based investors from potential risks associated with foreign and domestic investing. To include US residents, crypto exchanges must be certified by the SEC, which can be a complex process.

Robinhood reviews from users around the world are quite different than what you might expect. Unfortunately, this investing platform is only available to US-based investors. Meaning those from other countries are unable to use the platform. This is a major drawback for many potential investors. Additionally, once you purchase crypto on the site, you are locked to it, which is another issue that many users have with Robinhood.

No Option to Transfer Assets Outside of the Platform

If you’re a beginner trader, you may be wondering why you would need to transfer your crypto assets from Robinhood if you choose to trade on the platform. The answer is that Robinhood does not allow you to transfer your assets to a separate wallet, meaning your assets are locked to your RH account until you liquidate them.

.Cryptocurrency trading requires security. One of the best ways to ensure this is to never leave your coins on an exchange. Many traders keep a small number of assets on a platform for quicker trading, buying, and selling, but the bulk of their coins should be transferred to a secure and separate wallet. This is because exchanges are not always secure and can be vulnerable to hacks. This results in the loss of all cryptocurrency assets.

How to Use the Robinhood Exchange?

Registering and using Robinhood Crypto is easy and straightforward. The platform offers a user-friendly interface and a simple registration process. Additionally, the platform provides a variety of helpful resources to help users make informed decisions about their investments.

How to Register on Robinhood?

- Create an account on Robinhood’s official website by clicking the Sign Up button at the top-right corner of the screen.

- Create a secure password and provide your name and email address to get started.

- Upon successful registration, you will be redirected to additional pages where you will be asked to provide additional information about yourself. Depending on the time of registration, the requirements may vary. Provide your current address, postal code, contact number, and other relevant information to get started.

- Verifying your identity is a standard procedure when investing with any cryptocurrency exchange or investment platform. This is part of the KYC (Know Your Customer) regulations, which helps ensure the security and legitimacy of the platform. This also includes providing their Social Security Number.

Once you have submitted all of your documents, filled out all of your details, and passed the verification checks, you will need to wait for a period of time until your application is either accepted or denied.

The Usability Aspects of Robinhood

Robinhood users generally report positive experiences with the platform’s usability, with many noting that it is beginner-friendly and easy to use.

The process of acquiring crypto is straightforward. To purchase a specific crypto asset, simply navigate to its Details page and enter the desired amount. After reviewing the order and confirming that everything is correct, execute the order and enjoy your newly acquired crypto coins!

The purchasing process is quick and easy, making it a much more pleasant experience than the registration process.

Conclusion

If you’re looking for a top-tier cryptocurrency exchange that offers fiat-crypto and crypto-crypto trading pairs, as well as easy crypto asset withdrawals, there are better options than Robinhood.

This platform is easy to use and provides a safe and reputable financial environment to buy some of the main cryptocurrencies. However, the variety of crypto assets is limited and the site is not a crypto exchange. Furthermore, it does not support coin withdrawals, multiple crypto trading pairs, or users located outside of the US (except for Hawaii, West Virginia, Nevada, and New Hampshire).

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.