While crypto trading bots can be profitable for users, like with any form of automated trading, there are always risks involved. Therefore, it is important to consider whether or not using a trading bot is the right decision for you. In this article, we will explain how crypto trading bots work, the advantages they offer, and the risks involved.

What are Crypto Trading Bots?

Crypto trading bots are software programs that use algorithms to analyze market data and automate trading tasks. Users can enter specific parameters for the bots to buy and sell crypto, depending on the users’ trading strategies and goals. Spot trading is the most common way to use trading bots. More experienced traders can also use bots in leveraged trading, arbitrage trading, options, and futures.

It is important to remember that trading bots are NOT money-making machines. They only execute trading orders automatically based on the commands you give them. It is essentially an extension of your trading skills. Before operating one, you should have some understanding of technical analysis (identifying bullish or bearish trends) and risk management.

How do Crypto Trading Bots Work?

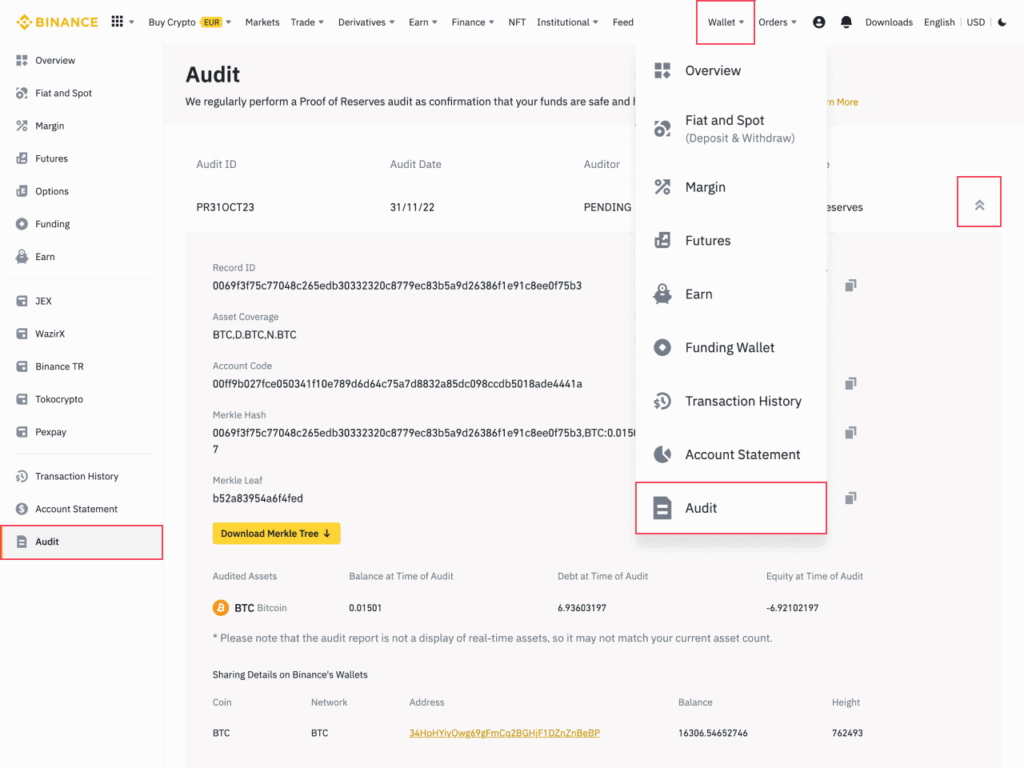

Crypto trading bots typically access a user’s crypto exchange account by using the exchange’s application programming interface (API). An API is a set of protocols and tools that allow one piece of software to interact with another. The user will first need to create an API key for the exchange. This key will grant the trading bot access to the user’s account and allow it to execute trades on the user’s behalf.

It is important to note that users must specify which specific permissions the API key should have before connecting the bot to the exchange account. Users should ONLY allow bots to execute trades, and disable other personal options such as withdrawing funds and viewing account information.

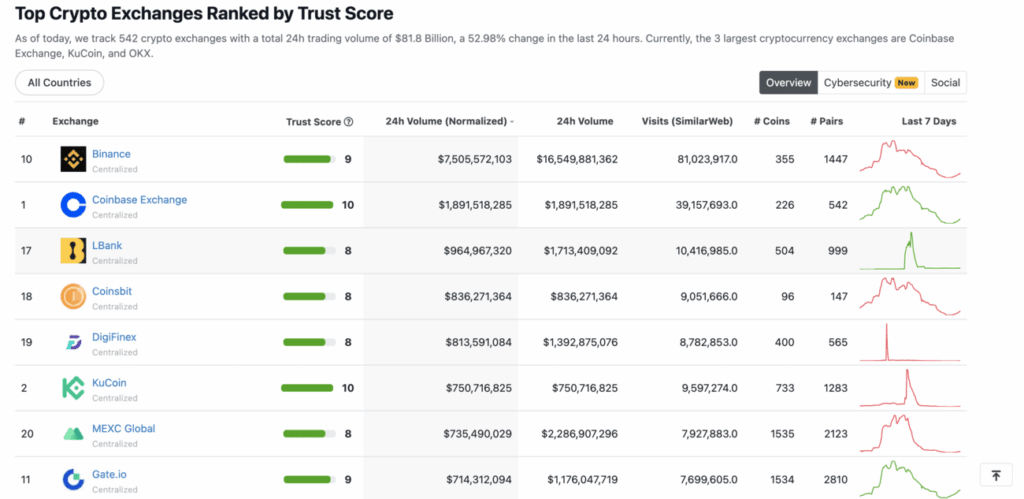

There are many reputable platforms that provide trading bot services such as 3Commas, Pionex, Cryptohopper, TradeSanta, and KuCoin Trading Bot. However, this does not mean they are risk-free. Users should carefully do their research and select the one they trust to hand over their API keys. We will cover more about the entailed risks below.

Advantages of Using Crypto Trading Bots

Crypto trading bots are generally considered to be more effective than manual trading for several reasons.

Execute orders faster and more accurately

Based on predefined rules and algorithms, trading bots can track market data for hundreds of trading pairs on several markets simultaneously and execute large trades in a matter of a few milliseconds. On the other hand, a human trader would have to spend a lot more time analyzing market conditions one by one and make decisions based on their own judgment.

Operate 24/7 without human emotion

Additionally, trading bots only follow logic, removing the emotional and psychological biases that are the bane of human traders. Trading bots can also operate 24/7 and trade on multiple crypto exchanges, taking advantage of market opportunities that may be difficult for a human trader to spot. Therefore, trading bots help automate and streamline the trading process, which saves a lot of time and reduces human error.

Efficient in building wealth over time

The efficiency of trading bots allows them to execute hundreds of trades within an hour if there is enough trading volume and volatility for the asset being traded by the bot. This is also achieved by setting the take-profit percentage low for the bot to consistently enter and exit trades. This is essentially dollar-cost averaging (DCA) on a much smaller time frame — profits are compounded over time, leading to continuous growth of the crypto portfolio.

Risks of Using Crypto Trading Bots

Though crypto trading bots are useful tools, the risk they pose is twofold: security and market conditions.

API Key Leak/Hack

One major risk is the potential for the API key to be hacked or otherwise compromised, potentially allowing an attacker to gain access to the user’s account and steal their funds or sensitive information. Additionally, if the API key is not properly secured, it may be possible for unauthorized users to access the user’s account and make trades without the user’s knowledge or consent.

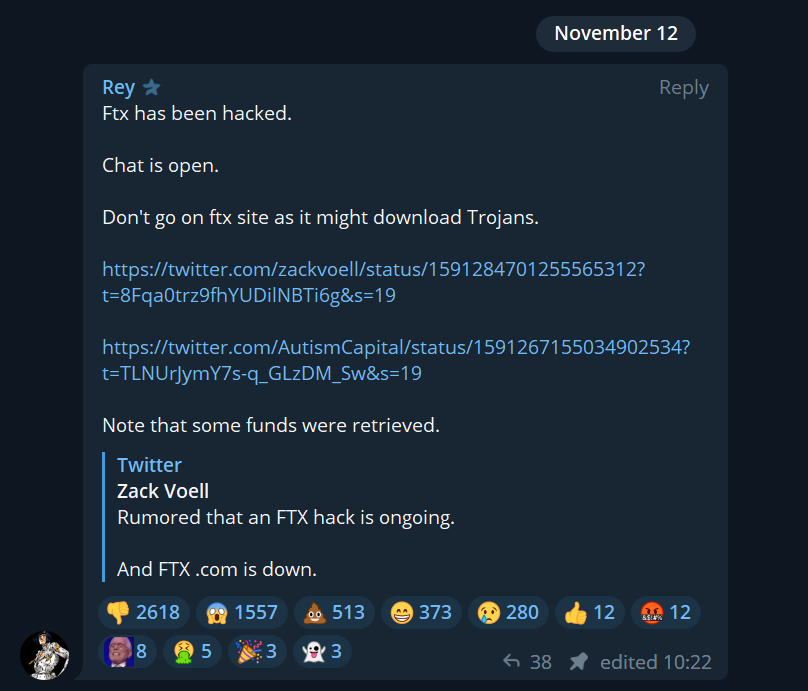

Following the collapse of FTX, there have been numerous reports of unauthorized trades initiated via API keys, suggesting a database leak in trading bot platforms such as 3Commas. Though shortly after the attack, 3Commas provided evidence that the attacks were not a result of a leak from their database. They believed that victims’ API keys were phished or compromised from an outside source.

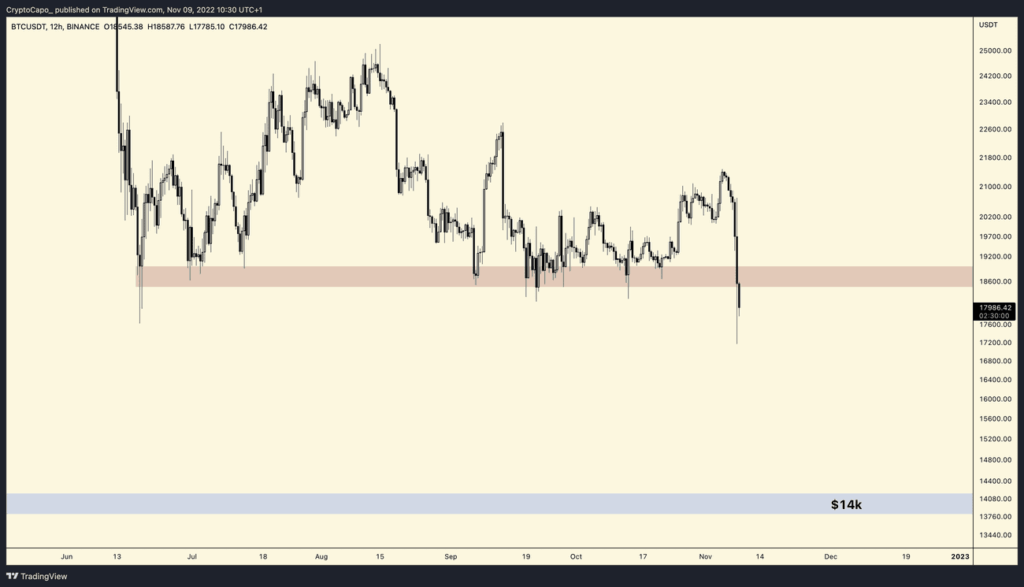

Extremely Volatile Market Movements

Sudden market movements can have a significant impact on the performance of crypto trading bots. Because these bots are designed to buy and sell cryptocurrencies based on pre-programmed rules, they cannot adapt quickly to sudden changes in the market. This could lead to bots triggering unfavorable buy orders, in which their take-profit order will never close as the market continually declines. Bots are only profitable if there is enough volatility for them to get in and out quickly and regularly.

For human traders, this is when they perform better than bots. They can take breaks and step away from the market when necessary. For these reasons, it is important for users to monitor the market and be prepared to adjust their trading strategies as needed in response to sudden changes.

Key Takeaway

While crypto trading bots can help traders take advantage of market opportunities, their risks are arguably greater than their benefits, especially given the shortcomings of many centralized platforms today. By sharing your API keys, you are practically giving a third party access to your crypto exchange accounts. Should they get hacked or become fraudulent, you run the risk of losing all your funds.

However, that is not to say that crypto trading bots are bad, especially in the longer scheme of things. After all, 90% of the stock market’s total turnover are done by algorithmic trading (trading bots), according to JPMorgan research. But with repeated cases of centralized failure in the crypto industry, it is best to approach these platforms with caution for now.