Binance is a very popular cryptocurrency exchange. It has the largest trading volume and many different cryptocurrencies to trade. Binance also has powerful tools for trading, like leveraged trading and options trading. They also have a lending platform. Binance is always adding new features and this surprises many experts. The CEO of Binance is Zhao “CZ” Changpeng and he is very quick to respond to events. Binance has many different versions, including one for the US called Binance US. This review talks about all the different features of Binance and any problems they have had.

Sign up for Binance HERE!

Key Advantages of Binance

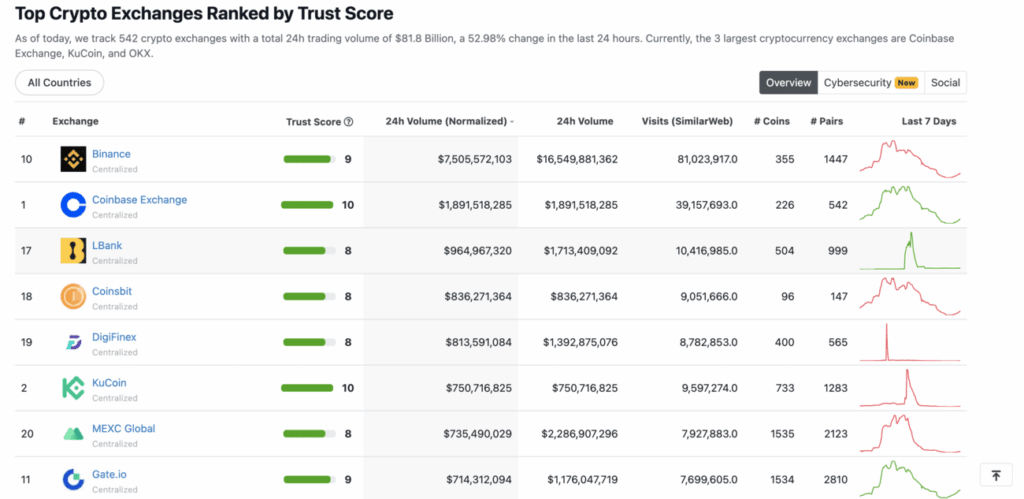

- World’s most popular exchange with the highest trade volume.

- Offers the largest range of products and services with some not even found elsewhere.

- Maintains insurance against theft and hacks.

Key Features and Functions

Binance (Binance.com)

Binance.com is the main exchange. It has all the services that Binance offers. Some of the key features are:

- It supports over 400 different cryptocurrencies including Bitcoin, Ethereum, and niche altcoins.

- It has the highest trading volume in the world.

- Binance Launchpad continues to be a platform for new cryptocurrency listings.

- Advanced Trading Tools: Offers spot trading, futures, margin trading, and options.

- DeFi Integration: Users can access decentralized finance (DeFi) services via Binance Smart Chain (BSC).

- Lending & Staking Services: Users can earn interest on their holdings through lending and staking programs.

- Enhanced Security Measures: Includes two-factor authentication (2FA), cold storage, and anti-phishing protections.

Binance US (Binance.us)

Binance US (Binance.us) was Binance’s answer to US regulations barring citizens from trading on Binance. Key features include:

- Fully compliant with U.S. regulations, ensuring adherence to evolving legal frameworks.

- Has fiat to cryptocurrency trading pairs. Users can use USD to buy cryptocurrencies directly on the Exchange.

- Bank account linking is available.

- Limited cryptocurrency offerings compared to Binance.com, but still supports major assets.

History of Binance

Binance was founded by Changpeng (CZ) Zhao in 2017. The name comes from a combination of the words “Binary” and “Finance”. Binance is originally from China. However, due to the harsh crypto regulation procedures in the country, the Exchange moved to more conducive jurisdictions outside China, eventually settling in Malta. The exchange gained rapid popularity, becoming the largest cryptocurrency exchange by trading volume within a year.

Currently, Binance is based in multiple jurisdictions. Their main site offers support in English, Chinese, Korean, Japanese, Russian, Spanish, and French. Here are some of Binance’s major milestones.

Major Milestones

2019: Binance launched Binance USD (BUSD), a stablecoin backed by USD, in partnership with Paxos. It also migrated Binance Coin (BNB) from Ethereum to its own Binance Chain.

2021: Binance introduced BNB Auto-Burn, a mechanism to reduce the total supply of Binance Coin.

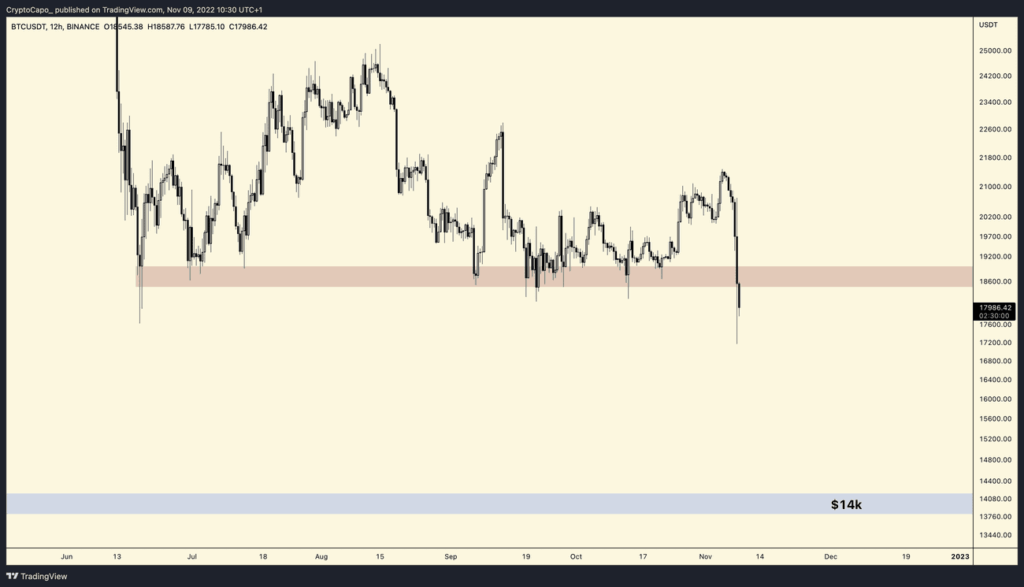

2022: Binance faced regulatory scrutiny in multiple countries, including the U.S., UK, and France, leading to increased compliance measures.

2023: Binance expanded its Web3 ecosystem, integrating decentralized finance (DeFi) services and launching Binance Pay, a crypto payment solution.

2024: Binance surpassed 250 million users, solidifying its dominance in the crypto industry.

2025: Binance continues to operate globally, with 21 regulatory approvals across different jurisdictions. Despite past controversies, it remains the largest crypto exchange, managing over $100 billion in assets.

Supported Countries

The international site Binance (Binance.com) is supported in most countries such as:

Asia & Pacific: Australia, India, Indonesia, Japan, Kazakhstan, Mongolia, New Zealand, Pakistan, Philippines, Taiwan, Vietnam.

Europe: France, Germany, Greece, Italy, Poland, Portugal, Romania, Russia, Spain, Switzerland, Turkey, Ukraine.

Middle East & Africa: Egypt, Israel, Saudi Arabia, South Africa, United Arab Emirates.

Americas: Argentina, Brazil, Chile, Colombia, Mexico, Peru.

Restricted or Banned Countries

Binance is restricted or banned in the following locations due to compliance issues and/or government sanctions:

- United States: Binance has been banned since 2019, leading to the creation of Binance.US as a compliant alternative. Therefore, US citizens can ONLY trade on Binance US (Binance.us), except for those from the following states: Connecticut, Hawaii, Idaho, Louisiana, New York, Texas, and Vermont. Note however that Binance.us has fewer supported cryptocurrencies and features compared to the international site.

- United Kingdom: The Financial Conduct Authority (FCA) revoked Binance’s permissions in 2023.

- China: Binance is not legally supported in China and accessing the platform from within the country carries legal and financial risks.

- Netherlands: Binance exited the Dutch market in 2023 after failing to secure regulatory approval.

- Nigeria: Declared Binance illegal in 2023, leading to executive detentions and service restrictions.

- Canada: Binance left Canada in 2023 due to strict regulations and was fined $4.32 million in 2024.

- Belgium: Ordered Binance to halt operations in 2023 due to non-compliance with EU financial laws.

- Other restricted locations: Cuba, Iran, Syria, North Korea, Crimea, and non-government-controlled areas of Ukraine.

US citizens can ONLY trade on Binance US (Binance.us), except for those from the following states: Connecticut, Hawaii, Idaho, Louisiana, New York, Texas, and Vermont. Note however that Binance.us has fewer supported cryptocurrencies and features compared to the international site. This is so that Binance.us is compliant with US Laws.

Supported Cryptocurrencies

Binance.com (Main Exchange)

Binance.com, the main exchange, offers a range of cryptocurrencies and coins as follows:

- Binance supports over 400 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), various altcoins and its own cryptocurrency, Binance Coin (BNB). Learn more about Binance Coin (BNB).

- Stablecoins available: USDT, BUSD, TUSD, and other fiat-backed digital assets.

- New Listings: Binance continues to add new tokens through its Binance Launchpad.

Payment Methods

Binance.com

Binance accepts payments the folllwing payment methods:

Fiat Deposits: Users can deposit fiat funds using bank transfers, credit/debit cards (Visa & MasterCard), and third-party payment providers.

Crypto Deposits: Binance supports deposits and withdrawals in all listed cryptocurrencies.

Binance Pay: A crypto payment solution allowing users to send and receive digital assets instantly.

Howevever as of 2025, Binance has restricted debit and credit card payments in several locations due to regulatory concerns and banking policies. Some of the key regions where Binance users face limitations include:

- United Kingdom: Payments to Binance using Nationwide cards are declined due to regulatory uncertainty.

- United States: Certain banks have imposed restrictions on crypto-related transactions.

- China: Binance does not officially operate in mainland China, leading to payment restrictions.

- Nigeria: Binance faced regulatory challenges, affecting payment methods.

- Canada: Binance exited the market in 2023, impacting fiat transactions.

- Belgium: Binance was ordered to halt operations in 2023, restricting payments.

- Other restricted locations: Cuba, Iran, Syria, North Korea, Crimea, and non-government-controlled areas of Ukraine.

they can trade with other cryptocurrencies on the Exchange.

Binance US (Binance.us)

Binance US supports the following payment methods:

- Bank Transfers (ACH): Users can link a bank account to deposit and withdraw USD with zero fees.

- Crypto Deposits: Binance.US allows deposits in over 130 cryptocurrencies.

- USD Trading Pairs: Users can trade major cryptocurrencies like BTC, ETH, and BNB against USD.

- Recurring Buys: Users can schedule automatic purchases of crypto on a daily, weekly, or monthly basis.

- Crypto Conversions: Binance.US offers instant conversion between USD and crypto.

- Staking Rewards: Users can stake 20+ Proof-of-Stake cryptocurrencies, including ETH, SOL, and ADA.

Deposit and Withdrawal Fees

Deposit fees

Deposit and withdrawal fees for Binance.com and Binance.US differ based on the platform and payment method.

Binance.com:

- Deposit fees:

- Cryptocurrency deposits do not have any fees.

- Fiat deposits are generally free, but some payment methods may incur processing fees.

- Withdrawal fees:

- Cryptocurrency withdrawal fees vary depending on the asset and network conditions. Some examples include:

- Bitcoin (BTC): 0.0005 BTC per withdrawal

- Ethereum (ETH): 0.00001 ETH per withdrawal

- Binance Coin (BNB): 0.00002 BNB per withdrawal

- USDT (Tether, BEP20): 10 USDT per withdrawal

- Solana (SOL): 0.002 SOL per withdrawal

- XRP (Ripple): 0.2 XRP per withdrawal

- Fiat withdrawal fees depend on the payment method, region, and banking provider.

- Cryptocurrency withdrawal fees vary depending on the asset and network conditions. Some examples include:

Binance.US:

- Deposit fees:

- Cryptocurrency deposits are free.

- Fiat deposits via ACH transfers are free, while wire transfers may have a small fee.

- Withdrawal fees:

- Cryptocurrency withdrawals follow the same asset-based fee structure as Binance.com..

- Fiat withdrawals:

- ACH transfers in the U.S. are free.

- Domestic wire transfers in the U.S. incur a $15 fee per withdrawal.

- International wire transfers incur a $35 fee per withdrawal.

Click here for the fee structures of Binance.com and Binance US respectively.

Trading Fees

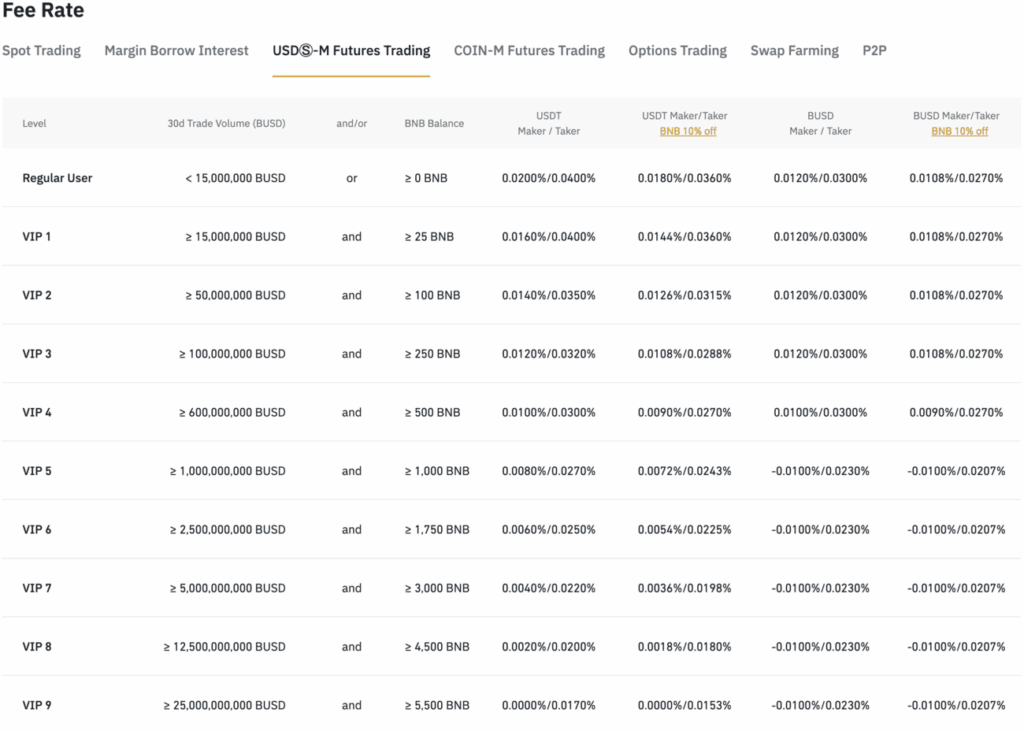

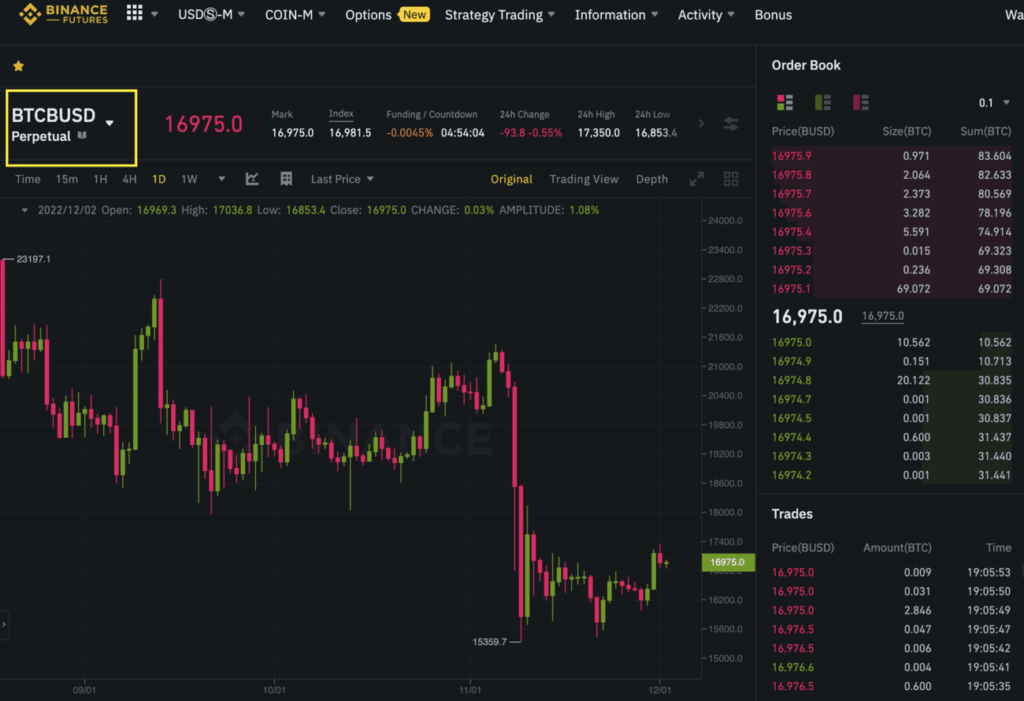

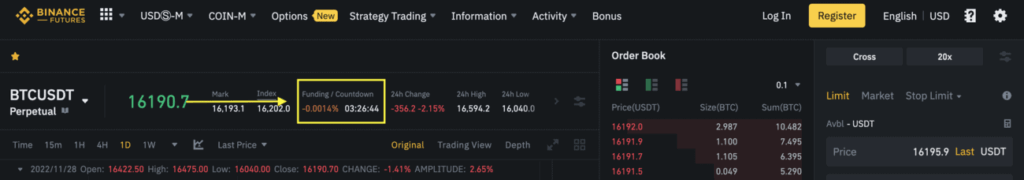

Trading fees on Binance.com and Binance.US follow a maker-taker model, where both makers and takers are charged a base fee of 0.1% per trade. Users who hold Binance Coin (BNB) in their accounts can receive a 25% discount on trading fees when paying with BNB.

Binance.com offers a tiered fee structure based on 30-day trading volume and BNB holdings. Higher VIP tiers provide lower trading fees. For example:

- VIP 0 (standard users): 0.1% maker and taker fee

- VIP 1: 0.09% maker fee and 0.1% taker fee

- VIP 2: 0.08% maker fee and 0.1% taker fee

- VIP 3 and above: progressively lower fees based on trading volume

Binance.US follows a similar structure but has different fee tiers. Standard users pay 0.1% per trade, while high-volume traders can qualify for lower fees.

Trading fees for Binance.com and Binance US are generally 0.1% for makers and takers with the following exceptions:

- Binance.com and Binance.us: Users with larger trade volume or hold a specified amount of BNB are eligible to become VIPs. Higher VIP tiers give you lower trading fees. There is a 25% trading fee discount if fees are paid using BNB.

Binance has competitive trading fees compared to some other cryptocurrency exchanges. For example:

- Coinbase: 0.50% of the transaction plus a flat fee based on the transaction amount. Advanced trading fees range from 0.00% to 0.60% depending on trading volume. Did you know you can avoid their expensive withdrawal fees? Find out more at CoinBase Fees- How to Avoid Them?

- Kraken: Fees starting at 0.25% for makers and 0.40% for takers. Fees decrease with higher trading volume, reaching 0.00% maker and 0.08% taker for institutional clients.

- Poloniex: They follow a tiered fee structure based on 30-day trading volume. Standard users pay 0.200% maker and 0.200% taker fees, while higher VIP tiers receive discounts.

- OceanEX: 0.10%, discounts are offered for payments with their OceanEx coin.

- KuCoin: 0.10% is their standard fee. Discounts are offered for payments with their KCS coin.

- Huobi: 0.20%

- OKEx: Follows a tiered fee model. Regular users pay 0.080% maker and 0.100% taker fees, while VIP users receive progressively lower fees.

- BitMEX: 0% maker fees and 0.075% taker fees for derivatives trading. Spot trading fees are currently 0% for a limited time.

- BitFinex: 0.10% (maker) / 0.20% (taker) for crypto-to-crypto and crypto-to-stablecoin trades. Discounts are available for users holding UNUS SED LEO tokens.

- BitMax (also known as AscendEX): Applies spot trading fees of 0.20% for both makers and takers. Margin and futures trading fees are 0.06% for takers and 0.02% for makers.

Binance KYC

Binance requires users to complete Know Your Customer (KYC) verification to access most features on the exchange. There are two levels of verification: Verified and Verified Plus.

- Verified: Users must provide personal information, a government-issued ID, and complete facial recognition. This level allows deposits and withdrawals up to $50,000 per day, unlimited crypto deposits, withdrawals up to 100 BTC, and unrestricted peer-to-peer (P2P) transactions.

- Verified Plus: Requires additional proof of address. Users at this level can deposit and withdraw up to $200,000 per day and access all features available to Verified users.

In 2025, Binance strengthened its KYC policies to comply with global anti-money laundering (AML) regulations. Users in certain regions, such as India, must provide Permenant Acccount Number (PAN) details as part of the verification process. Binance also introduced enhanced KYC requirements for corporate accounts, requiring additional documentation such as source of funds, proof of address, and Politically Exposed Persons (PEP) declarations

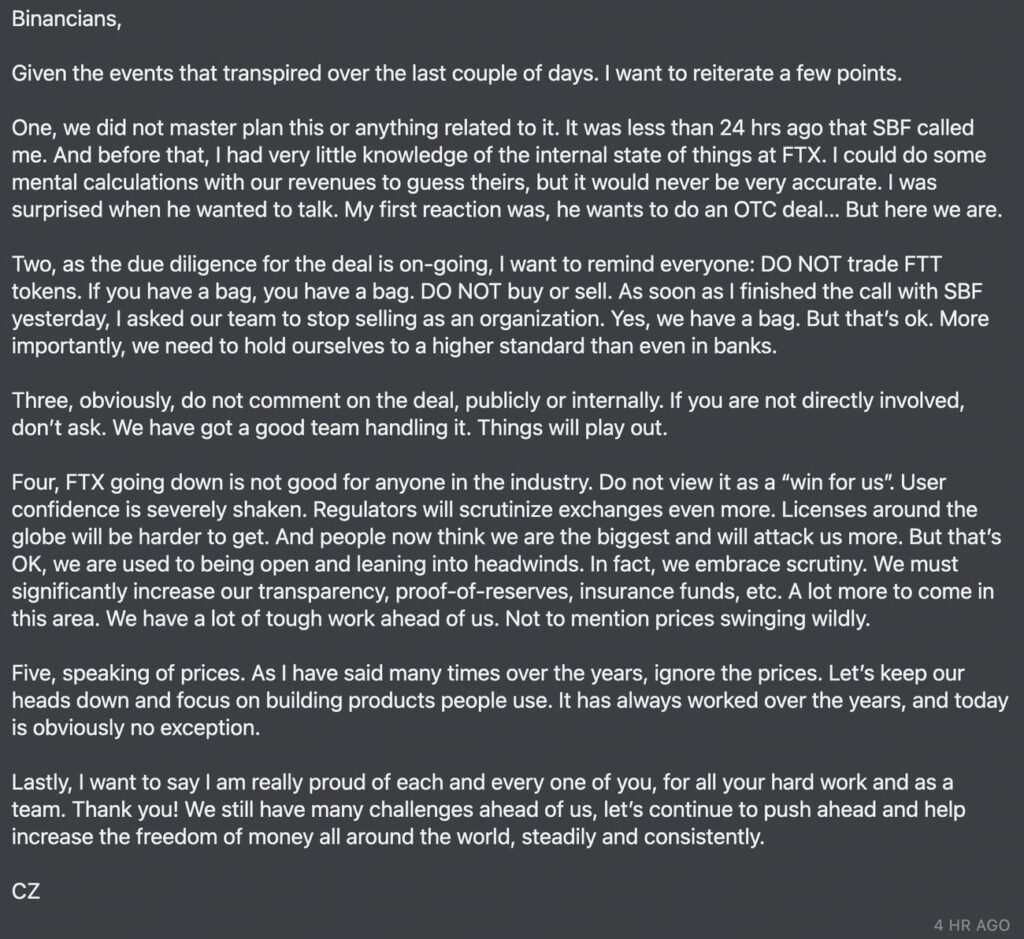

Controversies

Like any exchange, Binance is no stranger to controversies, making people question if Binance is safe. Let’s take a look at some controversies faced by the exchange.

2019 Binance Hack

- Hackers stole 7,000 Bitcoin, worth approximately US$40 million at the time.

- The attack involved phishing and malware to gain access to user accounts.

- Binance compensated affected users using its SAFU fund, an emergency insurance reserve.

2019 KYC Data Breach

- A hacker claimed to have Binance’s KYC data and demanded 300 Bitcoin in ransom.

- Binance stated that the leaked data originated from a third-party KYC provider used in 2018.

- Binance offered lifetime VIP membership and better trading conditions to affected users.

2021-2022 Money Laundering Allegations

- Reports suggested that Russian darknet drug market Hydra used Binance for transactions worth $780 million.

- Binance denied the allegations, stating that the figures were inflated due to indirect crypto flows.

- Binance strengthened its KYC policies in August 2021, requiring all users to verify their identities.

- A study found that after Binance’s stricter KYC rules, Hydra-linked transactions dropped from $30 million per month to less than $1 million.

2023 U.S. Regulatory Crackdown

- Binance faced multiple lawsuits from U.S. regulators, including the SEC and CFTC, for allegedly violating securities laws.

- Binance and its founder Changpeng Zhao (CZ) agreed to a $4.3 billion settlement in November 2023.

- CZ stepped down as CEO, and Binance implemented enhanced compliance measures.

2025 Allegations of Political Involvement

- A Wall Street Journal report alleged that CZ acted as a fixer for a Trump-affiliated crypto project, World Liberty Financial (WLF).

- CZ denied the claims, stating he had no role in WLF’s operations or connections.

- Binance criticized the report as biased and reaffirmed its commitment to transparent financial practices.

2025 SEC Lawsuit Dismissal

- The SEC dropped its lawsuit against Binance in May 2025, marking a shift in U.S. crypto regulation.

- The lawsuit, originally filed in 2023, accused Binance of serving U.S. users illegally and inflating trading volumes.

- Binance called the dismissal a major win for crypto, signaling improved relations with regulators.

Is Binance safe in 2025?

Binance remains the largest cryptocurrency exchange in 2025, with over 270 million registered users and a total asset value exceeding US$142 billion. Despite past controversies, Binance has strengthened its security measures and regulatory compliance. Here are some security measures used by Binance:

- SAFU Fund: Binance maintains the Secure Asset Fund for Users (SAFU), an emergency insurance fund valued at US$1 billion to compensate users in case of security breaches. For example, in May 2019, Binance suffered a security breach where hackers stole over 7,000 Bitcoin, valued at more than US$40 million at the time, and the exchange fully compensated affected users using the SAFU fund.

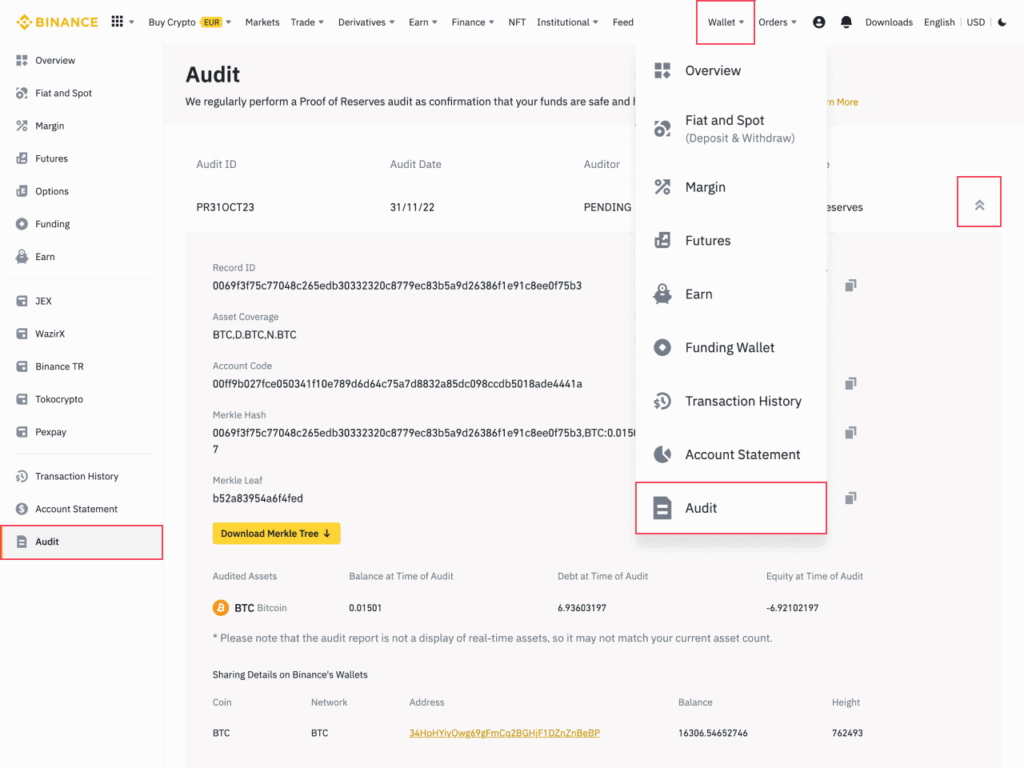

- Proof of Reserves (PoR): Binance provides real-time proof-of-reserves, ensuring that user funds are backed 1:1 with additional reserves. You can learn more about Binance’s reserves audit by checking out: Binance Audited by Mazars, Confirms Bitcoin Reserves are Fully Collateralized.

- Advanced Security Features: Binance has implemented two-factor authentication (2FA), IP whitelisting, and cold storage to protect user assets.

Is Binance safe in 2025? It looks like it is. They paid back victims of hacks, showed they have enough money, and handled big withdrawals. But no exchange is 100% safe. That’s why it is important to take your cryptocurrencies off exchanges and put them in offline hardware wallets. That way, you keep control of your cryptocurrencies.

Which hardware wallet should you get? Check out our comparison of the top 3 hardware wallets. Or read our reviews for the Ledger Nano X, Trezor Model T and KeepKey.

Conclusion: Binance Pros and Cons

Pros

- Largest Exchange by Volume: Binance continues to dominate the cryptocurrency market, handling over $100 billion in assets globally.

- Extensive Cryptocurrency Support: Offers trading for over 1,300 cryptocurrencies, including major assets like Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB).

- Competitive Trading Fees: Maintains low trading fees (starting at 0.1%) with discounts for users who pay with BNB.

- Advanced Trading Features: Provides spot trading, futures, margin trading, staking, and lending services, catering to both beginners and professional traders.

- Regulatory Approvals: Secured 21 regulatory approvals across different jurisdictions, improving compliance and user trust.

- Security Measures: Strengthened security with two-factor authentication (2FA), cold storage, and proof-of-reserves audits to ensure user funds are backed 1:1.

- Binance Smart Chain (BSC) & Web3 Expansion: Continues to support decentralized finance (DeFi) services, NFT marketplaces, and blockchain innovations.

Cons

- Regulatory Challenges: Despite improvements, Binance still faces scrutiny in certain regions, leading to restrictions in countries like the United States, United Kingdom, and China.

- Limited Binance.US Features: The Binance.US platform offers fewer cryptocurrencies and features compared to Binance.com..

- KYC Verification Delays: Some users report longer processing times (up to 13 days) for identity verification.

- Withdrawal Fees: While trading fees remain low, withdrawal fees vary depending on the asset and network conditions.

- Customer Support Issues: Response times can be slow during peak trading periods, frustrating users needing urgent assistance.

Sign up for Binance HERE!

Binance Exchange Review (2025)

When evaluating a cryptocurrency exchange, several key factors determine its reliability, security, and overall user experience. Binance, as the largest cryptocurrency exchange by trading volume, continues to evolve, offering a comprehensive suite of services while navigating regulatory challenges.

Services Offered

Binance provides a wide range of trading tools, including:

- Spot Trading, Futures, and Margin Trading: Catering to both beginners and professional traders.

- Options Trading: Advanced derivatives for experienced investors.

- Lending & Staking: Users can earn passive income through lending and staking programs.

- Binance Smart Chain (BSC) & Web3 Integration: Expanding decentralized finance (DeFi) services and NFT marketplaces.

- Binance Pay: A crypto payment solution enabling seamless transactions.

Cryptocurrency Support

- Binance.com supports over 1,300 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB).

- Binance.US, the U.S.-compliant version, offers around 50 cryptocurrencies, with a strict vetting process for new listings.

Trading Fees

- Competitive Fees: Binance maintains 0.1% maker and taker fees, with VIP tiers offering lower rates.

- BNB Discounts: Users paying fees with Binance Coin (BNB) receive a 25% discount.

- Fee Comparisons: Binance remains one of the most cost-effective exchanges compared to competitors.

Security Measures

- SAFU Fund: Binance maintains a $1 billion emergency insurance fund to compensate users in case of security breaches.

- Proof of Reserves (PoR): Ensures user funds are backed 1:1 with additional reserves.

- Advanced Security Features: Includes two-factor authentication (2FA), cold storage, and anti-phishing protections.

Regulatory Compliance

- Binance has secured 21 regulatory approvals across different jurisdictions.

- Binance.US remains compliant with U.S. regulations, ensuring adherence to evolving legal frameworks.

- Restricted Countries: Binance faces bans or restrictions in regions like the United States, United Kingdom, China, and Canada.

Final Thoughts

Binance remains the largest and most influential cryptocurrency exchange in 2025, offering a vast array of services while navigating regulatory challenges. Users should stay informed about compliance changes and consider self-custody options for long-term asset security. Overall, Binance is safe but it is important to avoid storing more cryptocurrencies than needed on exchanges.

Frequently Asked Questions (FAQs)

Is Binance still the largest cryptocurrency exchange in 2025?

Yes, Binance remains the largest cryptocurrency exchange by trading volume, managing over $100 billion in assets globally.

What is Binance.US, and how is it different from Binance.com??

Binance.US is the U.S.-compliant version of Binance, offering a limited selection of cryptocurrencies (around 50) compared to Binance.com, which supports over 1,300 cryptocurrencies. Binance.US adheres to strict U.S. regulations, ensuring compliance with local laws.

Does Binance require KYC verification?

Yes, Binance requires Know Your Customer (KYC) verification for most features. Users must provide personal information, a government-issued ID, and facial recognition to access full trading capabilities.

What are Binance’s trading fees in 2025?

Binance maintains competitive trading fees:

- 0.1% maker and taker fees for standard users.

- VIP tiers offer lower fees based on trading volume.

- 25% discount for users paying fees with Binance Coin (BNB).

Is Binance safe to use?

Binance has strengthened security measures, including:

- SAFU Fund: A $1 billion emergency insurance fund to compensate users in case of security breaches.

- Proof of Reserves (PoR): Ensures user funds are backed 1:1 with additional reserves.

- Advanced Security Features: Includes two-factor authentication (2FA), cold storage, and anti-phishing protections.

Which countries have restricted or banned Binance?

Binance faces restrictions or bans in certain regions due to regulatory challenges, including:

- United States (except Binance.US)

- United Kingdom

- China

- Canada

- Nigeria

- Belgium

- Netherlands

How do I deposit and withdraw funds on Binance?

Binance supports fiat and crypto deposits:

- Fiat Deposits: Bank transfers, credit/debit cards, and third-party payment providers.

- Crypto Deposits: Supports deposits and withdrawals in all listed cryptocurrencies.

What is Binance Pay?

Binance Pay is a crypto payment solution that allows users to send and receive digital assets instantly, supporting cross-border transactions.

What is Binance Smart Chain (BSC)?

Binance Smart Chain (BSC) is a blockchain network designed for fast and low-cost transactions, supporting decentralized finance (DeFi) applications and NFT marketplaces.

Has Binance faced any controversies in 2025?

Binance has navigated regulatory challenges, including:

- SEC Lawsuit Dismissal: The U.S. SEC dropped its lawsuit against Binance in May 2025, marking a shift in crypto regulation.

- Political Allegations: Reports suggested Binance’s involvement with a Trump-affiliated crypto project, which Binance denied.

Binance continues to expand globally, securing 21 regulatory approvals while adapting to evolving compliance requirements

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.

Key Features of Binance

Key Features of Binance