ZKsync is a layer-2 scaling solution designed to speed up transactions and lower gas fees on Ethereum. There are reports ZKsync have have their token generation event (TGE) in the coming few days. Their airdrop is also anticipated to be around 13th June 2024. Meanwhile, ZKsync airdrop could entitle you to both a ZKsync ($ZK) and an ecosystem project airdrop! Here’s how to get a potential ZKsync ($ZK) token and ecosystem airdrop.

Check out our Upcoming Crypto Airdrops! And our video guide on how to get the ZKsync $ZK token airdrop!

ZKsync ($ZK) Airdrop Step-by-step Guide

Here’s how to receive a potential ZKsync ($ZK) token airdrop:

- Add ZKsync Era Alpha Mainnet on MetaMask.

- Bridge Funds to ZKsync Lite and ZKsync Era Mainnet.

- Interact with ZKsync Lite and ZKsync Era Mainnet Alpha.

- Interact with the ZKsync ecosystem.

- Mint NFTs for ZKsync airdrop.

- Complete quests on ZKsync’s Crew3.

- Join the ZKsync Guild

- Bonus: Complete ZKsync Era tasks on RabbitHole.

- Mint Dappad zk-KYC NFT

See below for more in-depth details!

What is ZKsync?

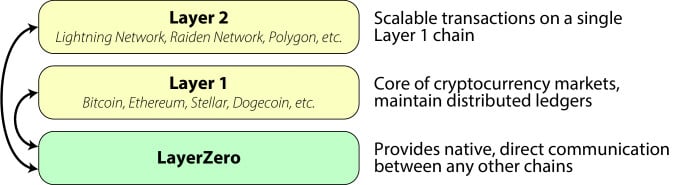

ZKsync is a layer-2 scaling solution designed to speed up transactions and lower gas fees on the Ethereum network while maintaining high security and privacy for users. It does this through Zero-Knowledge Rollup (ZK-Rollup) — transactions on Ethereum are bundled up to be processed off-chain and then sent back to the main chain after validation.

ZKsync is developed by Matter Labs. The company was co-founded in 2019 by Alex Gluchowski and Alexandr Vlasov. Matter Labs has raised over $58 million. Their latest funding was raised on 8th November 2021 from a Series B round led by Andreessen Horowitz (a16z). Other major investors include Dragonfly Capital, Placeholder, 1kx, and more.

What is a Zero-Knowledge (ZK) Rollup?

The ZK-rollup is the core element of ZKsync. ZK-rollups generate cryptographic proofs (ZK-SNARK or ZK-STARK) to verify transactions without revealing the information itself, hence the name “zero-knowledge proofs.” It maintains privacy by making transaction details such as token amounts anonymous. It is also highly secure because compressed transaction data are stored on-chain.

Unlike other layer-2 solutions, ZKsync relies on math instead of third-party validators to scale computation. Validators are known as “operators” or “sequencers” and are in charge of executing, aggregating, and submitting transactions to the main chain, but they do not validate the transactions themselves — the Ethereum smart contract does. By relying on math and cryptographic security, ZKsync ensures a truly secure and trustless environment for decentralized finance (DeFi).

What’s the Difference Between ZKsync Era and ZKsync Lite?

At its inception, ZKsync lacked support for smart contracts, preventing activities such as using DeFi or purchasing NFTs, which are common on Ethereum. However, it did provide significant scaling for Ethereum, leading to its nickname “ZKsync Lite.”

The ZKsync Era represents an upgrade to the network, delivering all the features of Ethereum while also providing more cost-effective and faster transactions.

Does ZKsync have a Token?

ZKsync has a native token known as $ZK, which was launched on 17th June 2024. The $ZK token is the native utility and governance token in the ZKsync ecosystem by maintaining and enhancing ZKsync’s operation. One main use for the ZKsync token is to pay for transaction fees on the ZKsync network and to vote on governance decisions. Users can also stake $ZK tokens and they will be rewarded with additional ZK tokens.

Is there a ZKsync ($ZK) Token Airdrop?

The ZKsync ($ZK) token airdrop started on 24th June 2024 and eligible users can claim their airdrop until 5th January 2025. 3.675 billion $ZK tokens i.e. 17.5% of the total token supply will be airdropped to eligible users.

How to claim ZKsync ($ZK) Token Airdrop

To check your eligibility and claim your ZKsync ($ZK) token airdrop, connect your wallet or GitHub username HERE.

How to Receive Potential ZKsync ($ZK) Token Airdrop?

The best chance to receive $ZKS airdrop is to interact with ZKsync Lite and ZKsync Era Mainnet Alpha. Moreover, many projects in the zkSync ecosystem also do not have a token yet. So, interacting with their ecosystem dApps may entitle you to potential airdrops from zkSync and the ecosystem project. Here’s how to receive a potential ZKsync token airdrop:

- Add ZKsync Era Alpha Mainnet on MetaMask.

- Bridge Funds to ZKsync.

- Interact with ZKsync Lite and ZKsync Era Mainnet Alpha.

- Interact with the ZKsync ecosystem.

- Complete quests on ZKsync’s Crew3.

Add ZKsync Era Alpha Mainnet on MetaMask

You will need to connect ZKsync Era alpha mainnet to your MetaMask. To do this, go to your MetaMask and click on the network button, then “Add network”. Then, click “Add a network manually”. Add the following information and click “Save”:

- Network Name: ZKsync Era Mainnet

- New RPC URL: https://mainnet.era.zksync.io

- Chain ID: 324

- Currency Symbol: ETH

- Block Explorer URL: https://explorer.zksync.io/

- WebSocket URL: wss://mainnet.era.zksync.io/ws

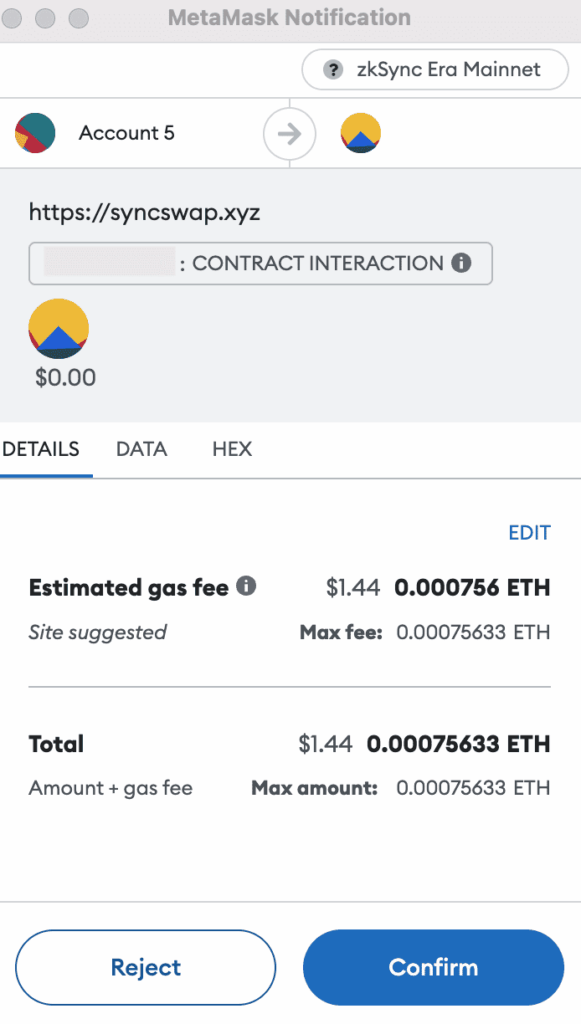

Bridge Funds to ZKsync Era Mainnet and ZKsync Lite

Bridge funds from Ethereum Mainnet to ZKsync Era Mainnet at bridge.zksync.io by connecting your wallet. Select the amount you wish to bridge and click “deposit”. Then, swap back to Ethereum Mainnet by clicking the arrows, choosing the amount you wish to bridge back to Ethereum, and click “Withdraw”.

Bridge funds to ZKsync Lite at https://lite.zksync.io/ by connecting your wallet. Then, top up your balance using the ZKsync bridge. You can also try using other bridges in the ZKsync Lite ecosystem such as Orbiter Finance and ZigZag Exchange.

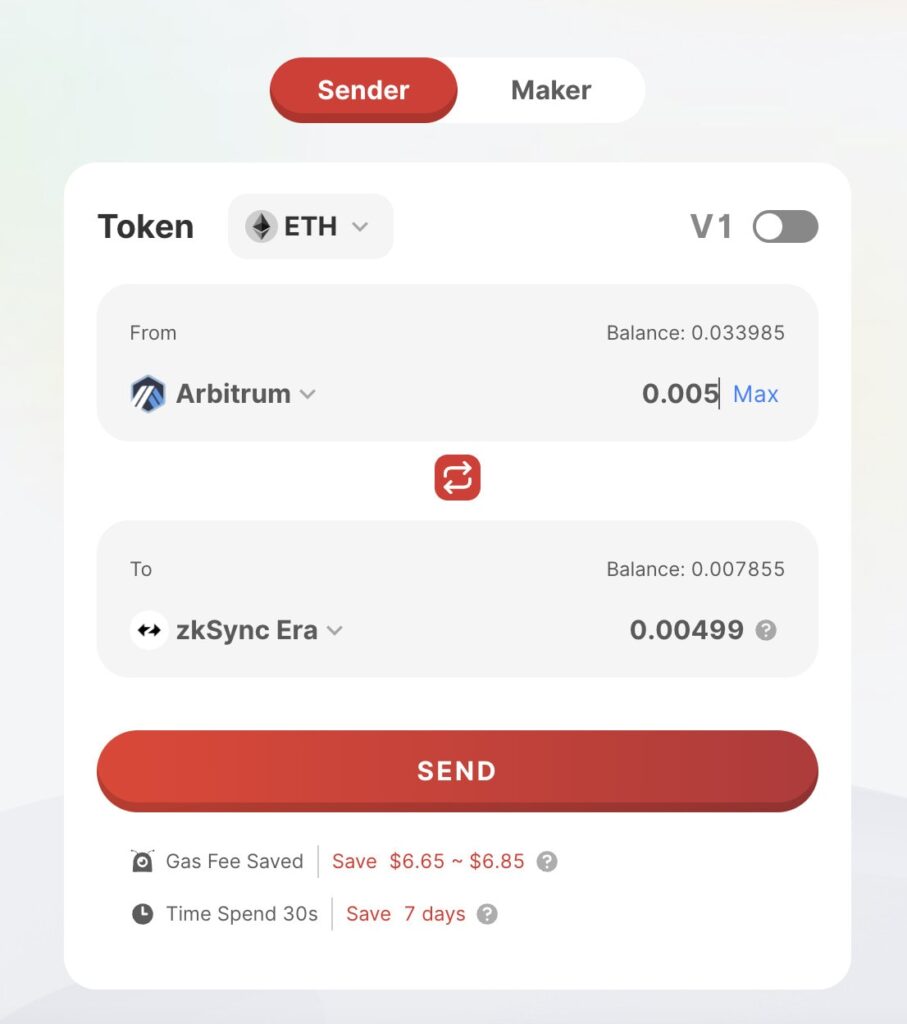

Cheapest way to bridge funds to ZKsync Era?

Here’s a cheaper way to bridge funds to zkSync Era Mainnet:

- Buy ETH on a centralized exchange (e.g. Binance or Bybit)- Sign up for a Bybit account HERE!

- Send your ETH from the Exchange to your Metamask using the Arbitrum network (fees are around US$1-2)

- Use Orbiter Finance to bridge ETH from Arbitrum to ZKsync Era (fees are around US$2-3)

Interact with ZKsync Lite and ZKsync Era Mainnet Alpha

Any user can now use ZKsync Lite (formerly known as ZKsync 1.0) and ZKsync Era Mainnet Alpha. This can be a potential way for users to get a zkSync airdrop even though they missed the whitelist. To interact with zkSync Lite, connect your L1 ETH wallet on ZKsync Lite (note the single-time account activation fee of 1.279 USDT). Then, interact by moving your balances from L1 on ZKsync Lite by depositing ETH or USDT. Or, withdraw your funds back from ZKsync Lite to L1.

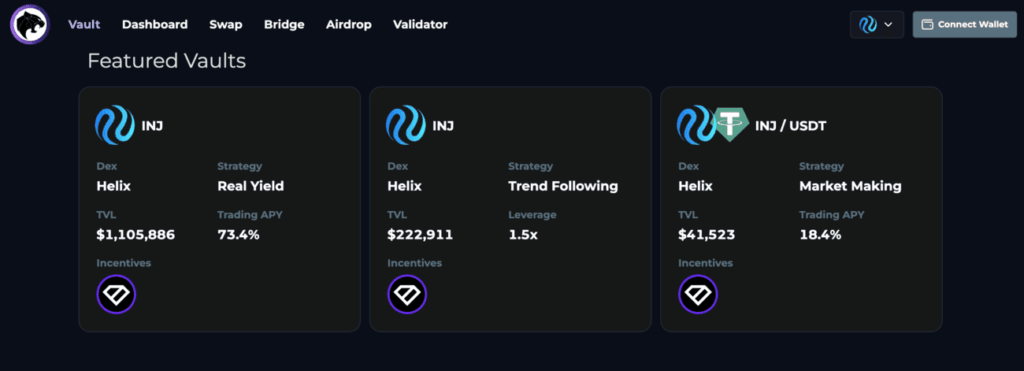

Interact with the ZKsync ecosystem

ZKsync has an entire ecosystem of protocols. Here are some top ZKsync ecosystem projects you could interact with to maximise your chances of a potential ZKsync airdrop and even double your rewards:

- Orbiter Finance

- ZigZag Exchange

- Bungee

- Argent

- Onchain Trade

- SyncSwap

- SpaceFi

- Tevaera

- Velocore

- iZUMi Finance

- Mute.io

- ZKsync Name Service

- GameSwift

Orbiter Finance

Orbiter Finance is a decentralized cross-rollup layer-2 bridge that supports ZKsync as well as Arbitrum. You can send ETH, MATIC, BNB and other tokens to ZKsync and other layer-2 blockchains via the bridge. However, these are mainnet tokens (with value) since the bridge is live, but you can always bridge them back to Ethereum. Check out our Orbiter Finance Token Airdrop Guide.

ZigZag Exchange

ZigZag Exchange is an orderbook decentralized exchange (DEX) powered by ZK-rollups. You can trade or swap on ZigZag Exchange. Do 1 buy or sell transaction between ETH and USDC every week (gas fees are less than US$0.25). Here’s how to interact with ZigZag Exchange:

- Deposit funds to https://lite.zksync.io/. Note you will need to deposit at least US$3 worth of ETH or USDC in order to pay the 1-time activation fee on Zigzag (around US$2.6).

- Connect your wallet to https://trade.zigzag.exchange/?market=ETH-USDC&network=zksync.

- Do 1 buy or sell transaction between ETH and USDC every week (gas fees are less than US$0.25).

ZigZag Exchange has also just finished its second round of airdrops (out of 7). So check out our ZigZag Exchange ($ZZ) token airdrop guide so you won’t miss out on their future airdrops!

Bungee

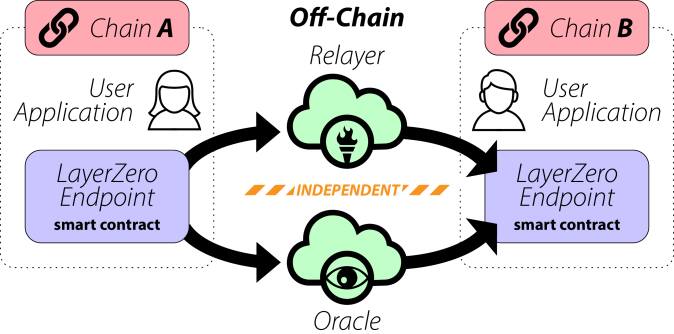

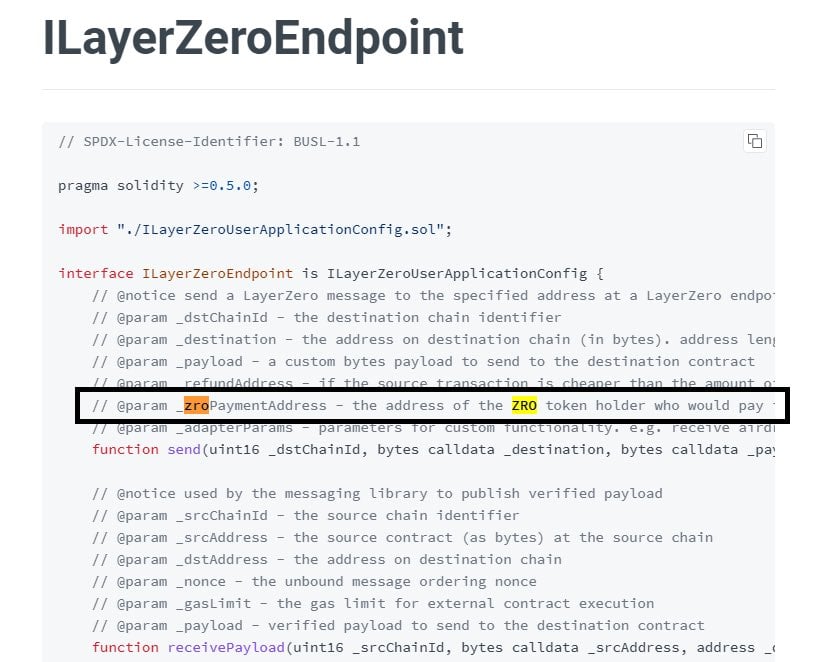

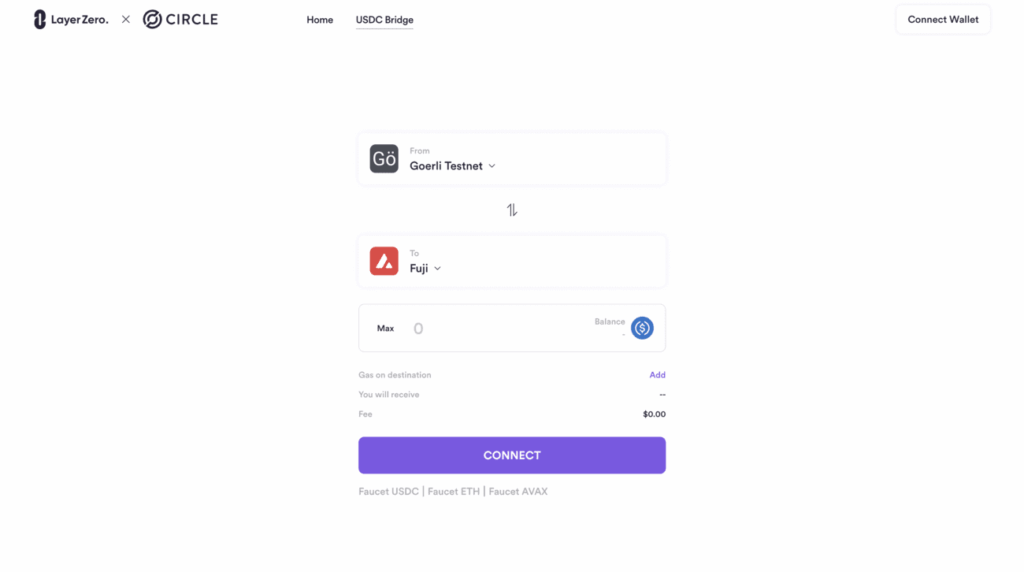

Bungee is a tool powered by Socket that helps people find the best way to move a digital token from one blockchain to another. Bungee has recently gone live on ZKsync Era. So sending tokens to and from ZKsync Era (and especially using the Stargate route) could position yourself for potential ZKsync, Bungee, Socket, Stargate AND LayerZero airdrops!

Check out how with our Bungee Token Airdrop Guide

Argent

Argent is the only crypto wallet that offers multi-signature security and social recovery. The wallet is built on ZKsync and is the first wallet for StarkNet. The wallet has a mobile version available on the App Store and Google Play. Download Argent and use their wallet! You can send and receive funds, buy, earn, and stake crypto using Argent.

Argent recently announced an NFT drop in collaboration with JediSwap, here’s how to get the NFT:

- Do a swap on JediSwap using your Argent X wallet on mainnet before 23:59 UTC on 23rd May 2023. Those who have done a swap on JediSwap using Argent X wallet before 1st April 2023 will be automatically eligible for the snapshot and won’t need to do any more swaps.

- To do the swap, either use the built-in swap feature in the Argent X wallet or do the swap at https://app.jediswap.xyz/#/swap.

- The team will take the snapshot at 23:59 UTC on 23rd May 2023. The claim/mint page will be shared afterwards, and you will have a total of 12 months from then to mint your NFT.

Onchain Trade

Onchain Trade is a money market and perps DEX offering up to 50x leverage. Connect your wallet to their protocol and test out their features! Check out our Onchain Trade ($OT) token airdrop guide (now LIVE)!

SyncSwap

SyncSwap is a DEX built on ZKsync and has recently announced its launch on ZKsync Era testnet. It is predicted they will be one of the first protocols to launch on ZKsync Era Mainnet since they are one of the first protocols built on ZKsync. Therefore, interacting with SyncSwap will put you in a good position to get a potential ZKsync token airdrop (and possibly a SyncSwap airdrop too)! (fii-institute) Here’s how to interact with Syncswap:

- Connect your wallet to Syncswap.

- Go to their Swap page. Choose the type and amount of tokens and click “Swap”. We also suggest swapping tokens on the ZKsync network using Paymaster. Paymaster allows SyncSwap users to pay gas fees using other tokens such as $USDT, $USDC and $HOLD in addition to ETH. To do this, first make sure your MetaMask wallet and SyncSwap are both on the ZKsync Era Network. Then, click and hold on your account balance and you can see the fee discounts offered by Paymaster when using other tokens to pay for gas fees. For example, you get a 50% fee discount when paying with $HOLD!

- Deposit liquidity to their Pools. On the top bar, click the down arrow, “Positions” and “New Position”. Select USDC and ETH and click “Enter Pool”. Then click “Deposit” located on the left-hand side of the screen and deposit both USDC and ETH. Then, unlock your tokens and deposit them into the pool.

- Join their Discord.

- Go to their Guild page and complete the tasks.

Interacting with SyncSwap is one of the best ways to maximize your potential airdrop with the least amount of fees. Learn how with our SyncSwap token airdrop guide!

SpaceFi

SpaceFi allows users can trade, earn, mint, stake, sell, create, and invest in a variety of projects. With SpaceFi, users can also swap assets, farm rewards, mint, and stake Planet NFTs, join or create a spacebase, and invest in new projects. SpaceFi has already launched 30 million $SPACE on Evmos mainnet, and will be launching 30 million $SPACE on ZKsync 2.0 (i.e. ZKsync Era) when mainnet goes live. The team has also confirmed they will be doing an airdrop.

Since the protocol is already live on ZKsync testnet, it may be a good idea to interact with SpaceFi in anticipation of when zkSync Era mainnet goes live. To interact with SpaceFi, request testnet tokens here. Then connect your wallet to Space.io, swap some $tSPACE tokens. Then, add liquidity to their pool. Finally, join the SpaceFi Discord and their Crew3. You can also complete the tasks on Crew3 which include joining their guilds, adding them to your CoinGecko watchlist or inviting friends to their Discord.

You can check out our SpaceFi token airdrop guide!

Tevaera

Tevaera aims to build an EVM-compatible on-chain gaming ecosystem on ZKsync. Their mainnet is now live on ZKsync Era.

- Connect your wallet to log in. Make sure you are on the ZKsync Era network.

- Mint your Tevan ID and Guardian NFTs.

- Connect your citizen ID to Discord.

- Play Teva Run to earn Karma Points.

- Complete tasks on Tevaea’s Zealy Questboard.

- Mint ONFTs by going onto your portfolio and clicking “Mint ONFT bundle”.

- Bridge one ONFT from ZKsync Era to Arbitrum network.

- Optional: Add KP (Karma) to your web3 vault. Note that 1KP is around 0.021 USD.

For more details, check out our Tevaera $TEVA token airdrop guide!

Velocore

Velocore is the first ever ve(3,3) DEX on ZKsync. They have a native token $VC, so there may be a chance of a Velocore airdrop too? Here’s how to interact with Velocore:

- If you don’t have funds on ZKsync Era yet, use Orbiter.finance to bridge funds to ZKsync Era.

- Connect your wallet to Velocore’s swap page and swap some tokens. You can swap any token pairings e.g. ETH to USDT, ETH to VC etc.

- Go to their Liquidity Pools and add liquidity. There are 30 pools to choose from!

- Keep an eye on their Launchpad for upcoming projects and join in.

Check out our Velocore ($VC) token airdrop guide!

iZUMi Finance

iZUMi Finance is a multi-chain DeFi protocol that provides One-Stop Liquidity as a Service (LaaS). iZiSwap, a next-generation DEX on Multi-Chains, is live on ZKsync Era and provides concentrated liquidity AMM and generates extra income for your assets. They also have their own $iZi token. In addition to doing their own airdrop, they have also promised to distribute 50% if any ZKsync and Linea airdrops they receive! Here’s how to interact with iZUMi Finance:

- Swap $iZi tokens.

- Add liquidity.

- Earn iPoints.

- Complete Linea Voyage Week 8.

Check out our iZUMi Finance $iZi token airdrop guide!

Mute.io

Mute.io is a AMM DEX with limit orders, a farming and Bond platform. They are live on ZKsync Era. Although the mute.io team have confirmed the will NOT do an airdrop, interacting with this protocol may nevertheless be helpful in getting a ZKsync airdrop. Here’s how to interact with Mute.io:

- If you don’t have funds onZKsync Era yet, use Orbiter.finance to bridge funds to ZKsync Era.

- Connect your wallet to their Swap page and swap any amount of tokens.

- Go to their Pools and add liquidity. You can earn fees for doing this! Click “Manage” and choose the amount of liquidity you wish to add. You can also withdraw your liquidity and check your rewards at any time.

- As an optional task, you can buy their $MUTE token and lock it up here.

ZKsync Name Service

ZKsync Name Service is an omnichain name service that allows users to establish their Web3 profile. Here’s how to interact with ZKsync Name Service:

- Go to https://app.zkns.domains/.

- Search for an available domain name. If you find an available one that you want, click “Available”.

- Click “Request to register with ETH” and approve the transaction. It will cost around US$6.5 to buy a domain.

GameSwift

GameSwift aims to be a one-stop web3 gaming ecosystem based on a modular chain and zkEVM technology. From 28th September 2023, GameSwift will be hosting a GameSwift Multiverse Expansion campaign which will last for 6 weeks. In particular, week 3 of the campaign which goes live on 12th October 2023 will involve bridging to ZKsync! So completing the tasks for week 3 may position yourself for a potential GameSwift and ZKsync airdrop! Here’s how:

- Swap USDC for $GSWIFT.

- Bridge 10 $GSWIFT from Arbitrum Chain to ZKsync Network.

- Go to the “Burn” tab, switch to ZKsync network on your wallet and burn 10 $GSWIFT.

- Return to the GameSwift Galxe page and claim your Infinity Stone.

GameSwift also has tasks for interacting with the LayerZero network. So, there is a chance to also get a potential LayerZero airdrop too by doing these tasks!

Check out our LayerZero ($ZRO) Token Airdrop Guide

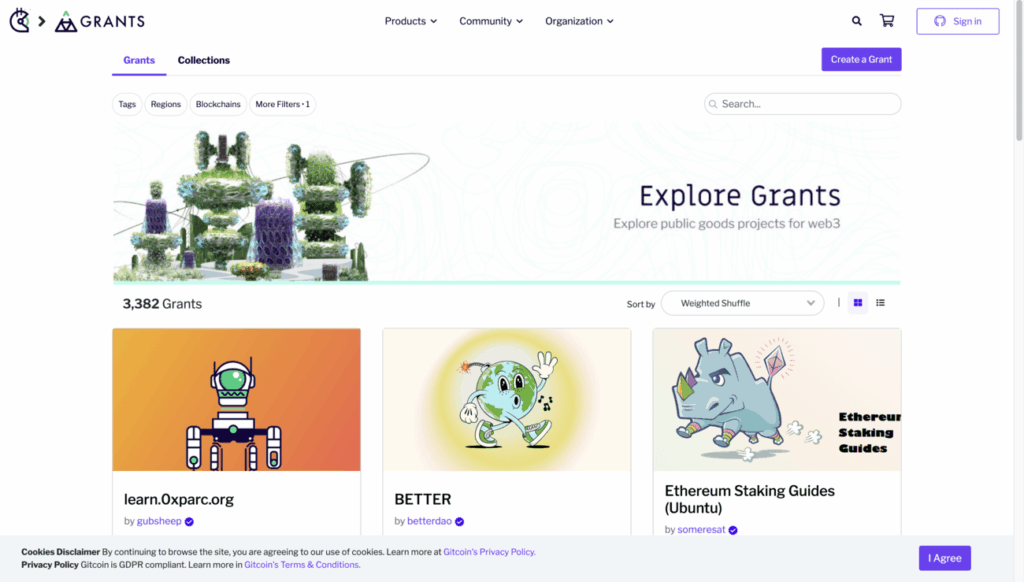

Donate on Gitcoin

Gitcoin is a community platform that funds and coordinate new open-source developments. To donate, go to the “grants” page. Pay via the ZKsync network for lower transaction fees.

Mint NFTs for a ZKsync airdrop: 3 in 1 airdrop!

We have found 3 projects which are also doing airdrops! All you have to do is complete the tasks and mint their NFTs! What’s more, these projects require you to interact with ZKsync, so you will be positioning yourself for a ZKsync airdrop as well.

Hypercomic

Hypercomic has just announced its collaboration with ZKsync and has launched a NFT minting celebration campaign. The objective is to complete the tasks and mint their exclusive ZK24 NFTs. There are 3 parts to the minting campaign, Part 1: Transaction Maker is LIVE until 9th February 2024, Part 2: ZKsync Expert will run from 5th to 15th February 2024, and Part 3: Dapp Hustler will run from 13th to 23rd February 2024.

To mint the ZK24 NFTs, connect your wallet HERE to see which NFTs you may already qualify for. For Part 1: Transaction maker, users with 30 or more ZKsync transactions, users with 50 or more ZKsync transaction and users with 100 or more ZKsync transactions will be eligible to mint 1 NFT. So, depending on the number of ZKsync transactions you have, you can get a maximum of 3 NFTs in Part 1. What’s more, the NFT you can mint for having over 100 ZKsync transactions is a Boost NFT which will help boost the cubic mining power in the Hypercomic Dapp.

To mint the ZK24 NFTs, connect your wallet HERE to see which NFTs you may already qualify for. If you qualify, you will be able to mint the NFT. Then, go to the “Airdrop” page to check your eligibility for the Hypercomic ($HYCO) airdrop. Users who have over 60 transactions are eligible to claim the HYCO token airdrop and are given on a first come first served basis for the first 15,000 people.

Tabi

Tabi is the first gaming chain on Cosmos. Whilst you need to be on Binance Smart Chain to complete the tasks, 2 of them are on ZKsync, which will position yourself for any ZKsync related airdrops. Complete the airdrop tasks on Tabi by connecting to their site and completing their tasks. These are mostly social tasks such as connecting your social media profiles and following their social media pages. You will be able to mint the NFT once you have completed the tasks.

GRVT

GRVT is an on-chain perpetuals exchange for ZKsync. They are currently running a social airdrop campaign. For now, all you need to do is join their waitlist. Joining their waitlist lets you earn invite points for airdrop rights as well as a ZKsync mystery box.

Complete quests on Crew3

Go to ZKsync’s Crew3 Questboard and complete the quests. Tasks include following them on social media, reading their articles, and completing quizzes.

Join the ZKsync Guild

Connect your wallet and Google and Discord accounts to https://guild.xyz/zksync-era. Note you will also need at least 20 points on Gitcoin Passport. To check the number of points you have on Gitcoin Passport, connect your wallet to https://passport.gitcoin.co/#/dashboard. On the same page, you can also connect your other accounts to gain more points. However, some accounts require more than just having an account. For some, there are requirements to have a certain age/status/role or completed tasks in those accounts in order to qualify, which will make it difficult. Here’s a list of the easiest/ least requirement accounts to sign up for in order to get 20 points: Twitter, Discord, Google, Github, Facebook, LinkedIn, ENS, BrightID, Proof of Humanity, ETH, ZKsync, Gnosis Safe, Trusta Labs.

Bonus: Complete ZKsync Era tasks on RabbitHole

RabbitHole now offers the first ZKsync Era quests, which include SyncSwap, EraLend, and Maverick. Completing each quest earns users NFT rewards and helps build their onchain history in the ZKsync ecosystem. The more quests you complete, the more quest rewards you become eligible for. Note that even if you have done similar tasks before, you will need to do them again to be eligible on RabbitHole. Here’s how to complete the tasks on RabbitHole:

- Make sure you are on the Ethereum network and connect your wallet to RabbitHole.

- Swap on Uniswap on Optimism.

- Deposit on Exactly on Optimism.

Mint Dappad zk-KYC NFT

Dappad is running a campaign where you can mint a non-transferable Soulbound NFT powered by ZkPass and Paymaster. Minting this NFT will give you access to future launchpads in ZKsync, and it could be key to qualifying for the potential ZKsync ($ZK) token airdrop. Note you only have 10 days (i.e. until 29th March 2024) to mint the NFT! Here’s how to mint the Dappad zk-KYC NFT:

- Go to DappLabs Galxe Page and complete the tasks.

- Download the zkPass TransGate Chrome extension HERE.

- Go to https://app.dappad.app/kyc and log in with your crypto wallet.

- Select 1 of the 5 supported centralized exchange accounts (i.e. Binance, Bybit, KuCoin, OKEx, Coinbase) for KYC verification.

- Log in to your selected exchange account when redirected. Make sure your exchange account is at least Level 1 verified.

- Approve sharing your KYC details with zkPass by clicking “START”.

- Return to the Dappad launchpad page after verification to see the ‘Already Verified KYC’.

- Your wallet app will then prompt you to sign a contract. Confirm the transaction and the non-transferable Dappad zk-KYC NFT will be sent to your wallet with 0 fees. The NFT is proof that you have successfully completed the KYC verification process.

You can also check out our step-by-step video guide HERE.

Best ZKsync Airdrop Route for swaps?

Here’s one of the best ZKsync Airdrop routes for swaps. By doing this route you can make the most of the potential ZKsync airdrop and interact with other protocols and possibly get those airdrops too!

- Swap ETH for USDC using Syncswap

- Swap USDC for WETH using Mute.io

- Swap WETH for USDT using Symbiosis

- Swap USDT for USDC using SpaceFi

- Swap USDC for ETH using Maverick

- Swap ETH for BUSD using Velocore

- Swap BUSD for ETH using KyberSwap

LATEST: 4-in-1 airdrop route ($ZNS, $BEE, $ZKP, $ZK)

Time needed: 10 minutes

With this latest airdrop route, you will be interacting with 3 different protocols to get 4-in-1 airdrop! These protocols are ZKsync Domain ($ZNS), Beecoin ($BEE), and Passport NFT ($ZKP) in addition to ZKsync.

- Mint ZKsync Domain ($ZNS)

Mint a ZKsync Domain HERE. Minting a domain will cost 0.0028 ETH but this is for lifetime ownership!

- Share referral link

Go to the Airdrop page and share your referral link. You will get more $ZNS rewards for successful invitations.

- Claim Beecoin ($BEE)

Click on “Free Mint $BEE” or to go Bee Coin. Follow their Twitter accounts, select your ZKsync Domain and click “Free Mint” to mint 1 million $BEE coins. Then click, “Add Wallet” to add your $BEE coins to your wallet. Note you will need to pay gas fees and their total supply is 100 billion coins! So, act fast before they are all minted! You can also share your invite link to receive an extra 500,000 Beecoin for each person you invite.

- Passport NFT ($ZKP)

Connect your wallet HERE and click “Free Mint” to get a NFT passport. Note you will need to pay gas fees for this. Then, invite your friends to get 200 $ZKP and boost Passport Rank per friend.

ZKsync airdrop season 1: Am I eligible?

Eligibility for season 1 of ZKsync’s token airdrop was based on a snapshot taken on ZKsync Era and ZKsync Lite on 24th March 2024 at 0:00 UTC. 2 categories of users were eligible for the ZKsync airdrop: users (89%) and contributors (11%). Users on ZKSync are those who have made transactions and reached a certain level of activity. Contributors, on the other hand, include individuals, developers, researchers, communities, and companies who have contributed to the ZKSync ecosystem and protocol through development, advocacy, or education, regardless of their network activity.

The airdrop allocations for ZKsync were calculated using a points system. Here’s how the points were calcualted:

- Activity-Based Points: Wallets earned points for actions like interacting with smart contracts, depositing liquidity into DeFi protocols, and trading ERC-20 tokens.

- ZKsync Lite Activity: Points were also awarded for activities on ZKsync Lite, such as donating to a Gitcoin round or transacting over three different months.

- Bridged Assets: Allocations were based on assets bridged to ZKsync Era, with multipliers for activity on ZKsync and Ethereum mainnet.

- Minimum and Maximum Allocations: Wallets with fewer than 450 ZK tokens had their tokens recycled, while those with more than 100,000 tokens had excess tokens recycled. The minimum allocation was up to 917 $ZK tokens per wallet.

ZKsync season 1 airdrop: How to claim?

ZKsync will conduct a one-time token airdrop of 3.675 billion $ZK tokens (i.e. 17.5%) of the total token supply. Eligible users can claim their airdrop by connecting to their wallet to https://claim.zknation.io/ starting from 24th June 2024. The airdrop claim will be open until 3rd January 2025.

ZKsync season 2 airdrop strategy guide

ZKsync season 2 airdrop has already started! 2 main strategies to best position yourself for the token airdrop is to delegate your tokens and to maintain a high time weighted average balance (TWAB).

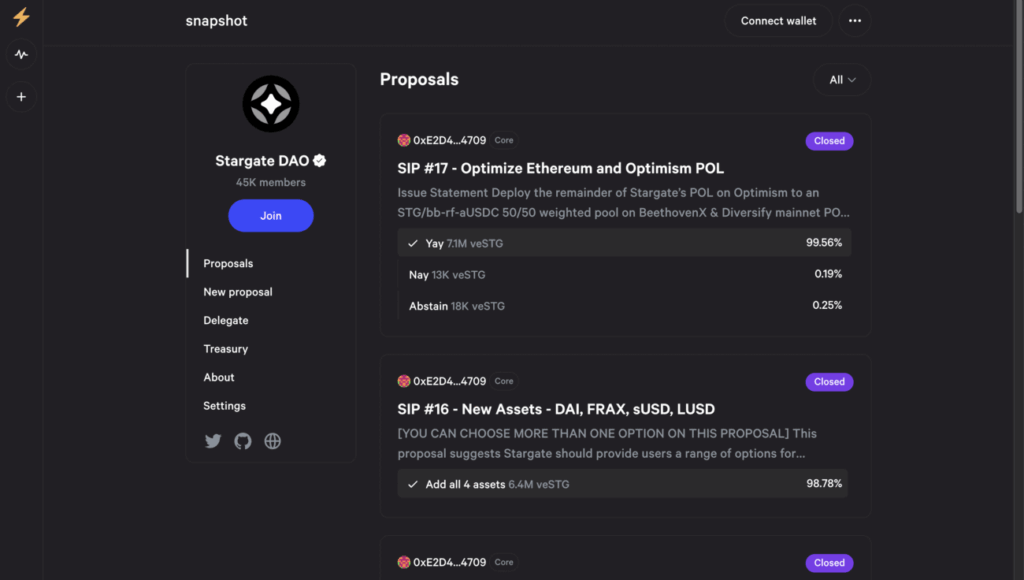

In terms of strategies to find the best delegate to delgate your $ZK token, you may want to find delegates that are active in voting on governance proposals.

How to identify and avoid ZKsync airdrop scams

ZKsync has not announced its official token yet. However, this has not stopped scammers from enticing unsuspecting victims with airdrops in order to steal their cryptocurrencies. Here are some ways in which you can identify and avoid ZKsync airdrop scammers.

Look at social media handles

Many scammers will use social media (e.g. Twitter, Telegram) handles that are confusingly similar to the official ones. For example, spelling the project name incorrectly or using different fonts and hidden characters in the handle. Other fake accounts may have spelled the project name correctly but has other words behind it e.g. ZKsync (@ freetokens). Always check the official ZKsync website.

Impersonating admins or mods

Scammers have been known to impersonate admins or mods on ZKsync’s official channels. They may send DMs asking for users’ private information in order to “participate” in airdrops, or send you a link asking you to connect your wallet and drain your funds. zkSync admins or mods would not DM users first.

Fake accounts tweeting ZKsync airdrop info

There are fake accounts tweeting ZKsync token airdrops. However, there is no official announcement yet. Always check the official channels.

ZKsync Airdrop Review

When reviewing an airdrop, there are several factors to consider. First, the likelihood the project will even do an airdrop in the first place. Then, to look at how many tokens the project intends to allocate towards airdrop campaigns, as well as the difficulty in participating in their airdrop. It is also important to look at the utility of the token so that there will be an actual use and purpose in participating in the airdrop in the first place. Finally, a factor to consider when reviewing an airdrop is whether the airdropped tokens are subject to any lockup period.

Likelihood of Airdrop: ZKsync has completed season 1 of its token airdrop.

Airdropped Token Allocation: In season 1 of the ZKsync airdrop, a total of 3.675 billion $ZK tokens will be airdropped. This is equivalent to 17.5% of the total $ZK token supply.

Airdrop Difficulty: Tasks which allowed you to be eligible for season 1 of the airdrop includes interactions, donations and bridging assets. This would not be difficult for a general crypto trader.

Token Utility: The $ZK token is used for transaction fees, governance and staking.

Token Lockup: There is no lockup period for $ZK tokens which were distributed in the airdrop.

Frequently Asked Questions (FAQs)

Here’s how to participate in the ZKsync airdrop

· Add ZKsync Era Alpha Mainnet on MetaMask.

· Bridge Funds to ZKsync Lite and ZKsync Era Mainnet.

· Interact with ZKsync Lite and ZKsync Era Mainnet Alpha.

· Interact with the ZKsync ecosystem.

· Mint NFTs for ZKsync airdrop.

· Complete quests on ZKsync’s Crew3.

· Join the ZKsync Guild

· Bonus: Complete ZKsync Era tasks on RabbitHole.

ZKsync has not announced details of any potential airdrop yet.

This will depend on the rules of the ZKsync airdrop campaign, which has not been announced.

We find SyncSwap to be the best ZKsync ecosystem dApp to interact with to position yourself for the airdrop. This is because SyncSwap refunds you 50-6 0% of your Ethereum gas fees. We’ve managed to do 30 ZKsync transactions on SyncSwap in 10 minutes for only US$3! Check out our SyncSwap ($SYNC) token airdrop guide!

The ZKsync airdrop was on 24th March 2024 at 0:00 UTC when the eligibility and allocations snapshot was taken. Eligible users can claim the airdrop from 24th June 2024 to 3rd January 2025.

ZKsync season 1 airdrop is now available for claim until 3rd January 2025.

Projects often reward early users. Follow our guide to prepare for a potential airdrop.

ZKsync has a native token known as $ZK. It is used for paying transaction fees on the network, staking and governance.

2 ways to get the potential season 2 of the ZKsync airdrop is to delegate your tokens and to maintain a high time weighted average balance (TWAB).