What is Epic Cash?

Epic Cash is a privacy focused cryptocurrency designed function like cash in the digital age. It’s got in-built privacy features using Mimblewimble technology (Epic Cash is a fork of GRIN – no traceable addresses, CoinJoin and IP-shielding). What makes Epic Cash different is that it can be mined using any of the 3 of the hottest mining algorithms – RandomX, ProgPoW and Cuckoo. This means both CPU and GPU miners can mine Epic Cash. In this tutorial we’ll cover the basics to get started and tips on solo-mining (if that’s you’re thing)

To read more about the technology behind Epic Cash, check out our full guide on MimbleWimble

Epic Cash Mining Hardware

In order to mine Epic cash, you’ll need a modern Graphics Processor (GPU) or CPU that is fast enough to mine at a profitable rate. Generally speaking, hardware that is manufactured after 2018 is usually efficient enough to EPIC at a reasonable rate. Here is a list of the latest GPUs and their hashrate.

[wp-compear id=”5165″]

Epic Cash Mining Guide (Easy)

The easiest way to mine Epic Cash is via a mining-pool (easy to set-up, predictable payments)

For this setup, I’ll be using the Icemining Pool. To get started,

- Download the Epic Cash mining client on either Windows or Linux: https://epic.tech/mining/ (download epic-miner).

- Unzip the contents of the file

- Edit the file epic-miner.toml (Linux – /etc/epic-miner.toml, Windows (same folder as epic-miner.exe)

Add the following information to connect to the mining pool (replace USERNAME and PASSWORD with you’re desired information, keep this information safe as it’ll be required for withdrawal)

# listening epic stratum server url

stratum_server_addr = "epic.icemining.ca:4000"

# login for the stratum server (if required)

stratum_server_login = "USERNAME"

# password for the stratum server (if required)

stratum_server_password = "PASSWORD"Now you’re good to start mining by running epic-miner (epic-miner.exe on windows, epic-miner on linux)

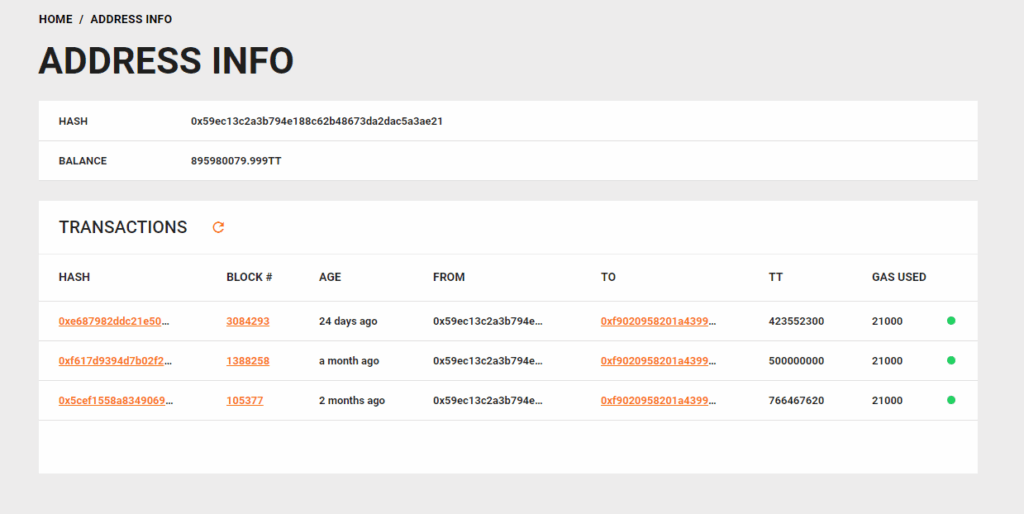

At this point you can log onto the mining dashboard at https://icemining.ca/?address= to check if your miner is successfully connected and mining. You can optimise your mining efficiency by following this guide.

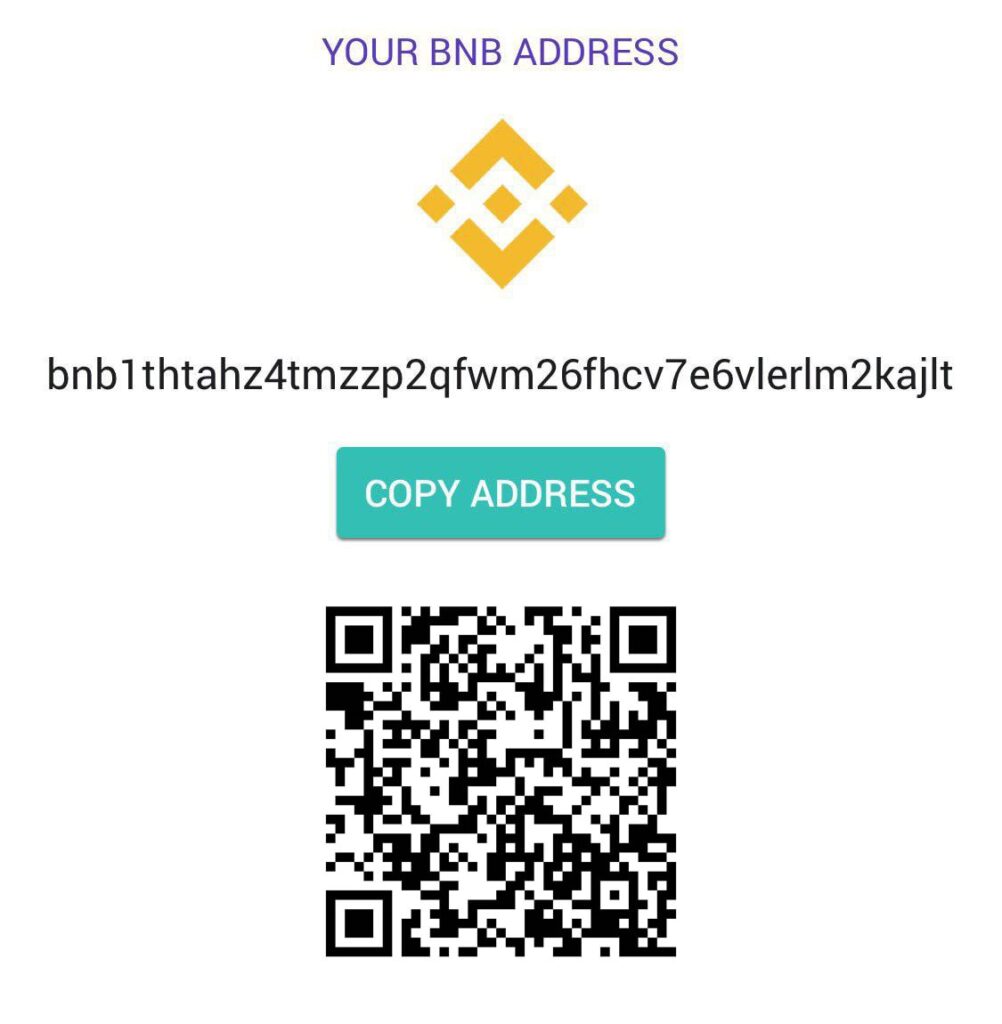

Payouts

To receive payouts from the pool, you’ll need to have a working epic-wallet. This is because unlike traditional cryptocurrencies, epic doesn’t have an “receive address”. Follow the setup guide to start your epic-wallet. To get the payouts, select “other listener” and enter your ip followed by the mining password.

Unlike Bitcoin transactions where there are cryptocurrency addresses, Epic Cash withdraw requires that your epic-node is online and accessible. This is a major advantage of MimbleWimble transactions where there are no addresses, and hence less methods to invade a user’s privacy.

How do you view balance on epic cash?

You can view your epic cash wallet balance by typing the command “epic-wallet info” (Linux) or on Windows, open epic-wallet folder and run epic-wallet-info. Make sure Epic-wallet and Epic server are both running to view the balance.

RandomX CPU mining

RandomX is a new cryptocurrency mining algorithm designed improve the distribution of mined cryptocurrencies more evenly to a broader base of users. The idea is that everyone with a computer has a CPU, and hence an algorithm that favors the CPU will be more inclusive. Random is is designed to only function on CPUs, with strong resistance to both GPU and ASIC mining. This is achieved by making use of functions only available on modern day CPUs, such as virtualization. RandomX has already been audited and is currently deployed on Epic Cash and will be deployed on Monero.

FAQ

Whats your profit / earnings: I mined with CPU only (Intel Core i7 3700) and earned about 1.1 EPIC per day at 960 hps (1st October 2019). You can find out more benchmarks at epic benchmarks.

Whats better – Solo Mining or Pool Mining: I’ve mining both solo and with the icemining pool. Pool mining was the best ways to start as I was able to find out my 24-h yield and move test send with smaller amounts of EPIC. Later one I migrated to solo-mining as I can minimize downtime as I ran my own wallet and node.

Resources

Epic Cash Code Repository: https://gitlab.com/epiccash

Mimble Wimble Guide: https://boxmining.com/mimblewimble/

Mimblewimble/grin Repository: https://github.com/mimblewimble/grin