Duck Liquidity Pool ($DUCK) is a DeFi Market Maker protocol, developed by DuckDAO, one of the biggest cryptocurrency community that provides funding and marketing support to early-stage crypto projects.

The boom of decentralized finance (DeFi) in recent months has ushered in a new profit-making strategy for crypto traders, beginners and advanced alike. Decentralized exchanges (DEX) rely on liquidity pools to help power their market-makers. While the Duck Liquidity Pool is a new entrant in DeFi, it has already captured the attention of many users in the space thanks to its high APY and token burning model.

What is the Duck Liquidity Pool?

The Duck Liquidity Pool (DLP) is DuckDAO’s own market maker. The funds that supply its pool came from the sale of pre-mined tokens and can be accessible in many other protocols and exchanges. In the meantime, projects that are supported by DuckDAO will be the first to be able to tap the pool. The ticker for the pool is $DUCK.

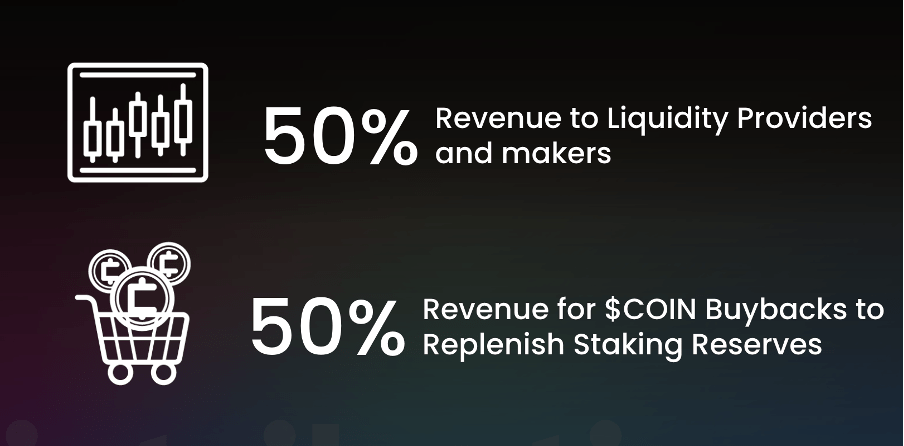

The unique feature that distinguishes DLP from others is its “unilateral burn” strategy, or the one-sided token burn model. It is designed to burn 50% of all earned rewards (more on this later).

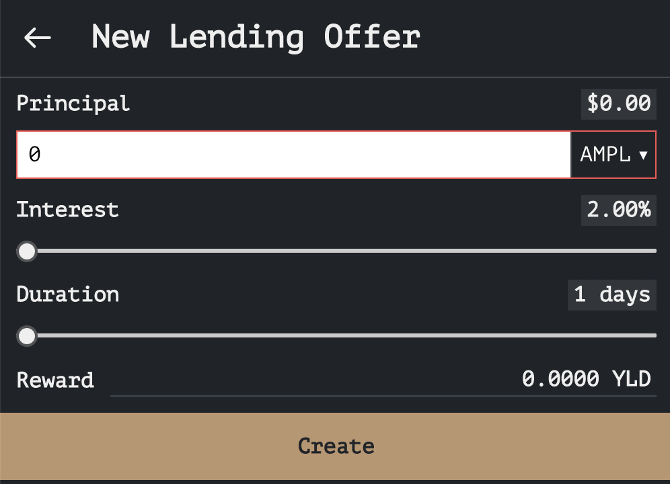

The APY level for DLP is high and its suppliers can receive as much as 50% of the profits from market making, airdrop of incubated project tokens, as well as non-fungible token (NFT) campaigns. Such a feature enables yield farmers the ability to earn profit by just providing liquidity to DuckDAO’s market maker.

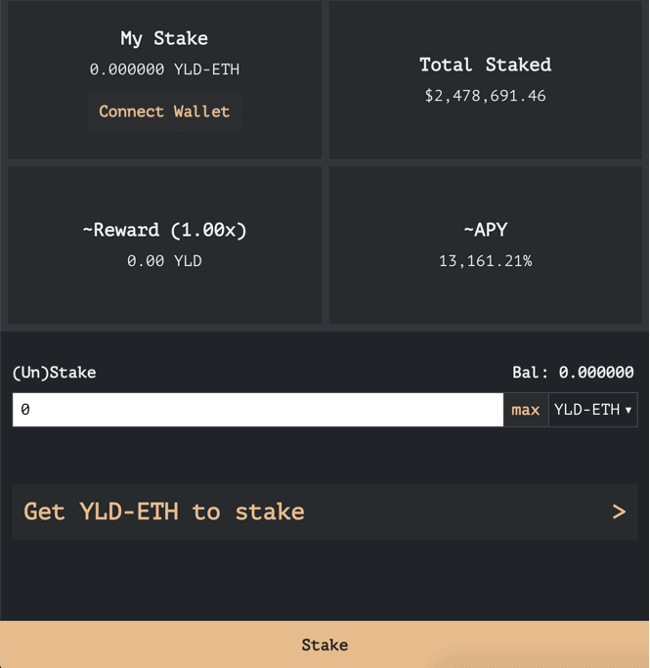

To participate in the DLP, users have to lock their cryptocurrency holdings by depositing their funds in the pool. In return, they receive DUCK tokens as a reward for supplying funds to the pool.

DuckDAO’s Native Token ($DUCK)

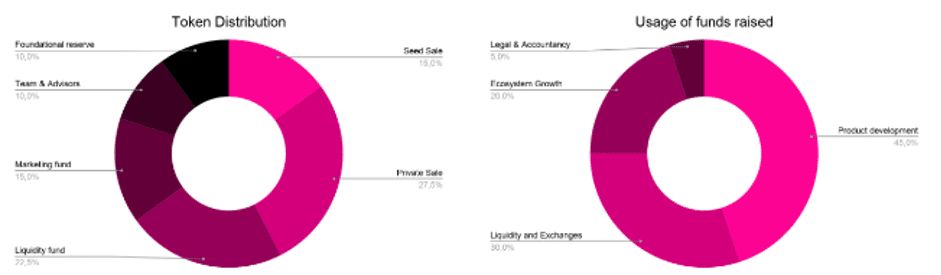

DUCK token is the DuckDAO’s native utility token, which also powers the incentive model for the Duck Liquidity Pool. The token has the following use cases:

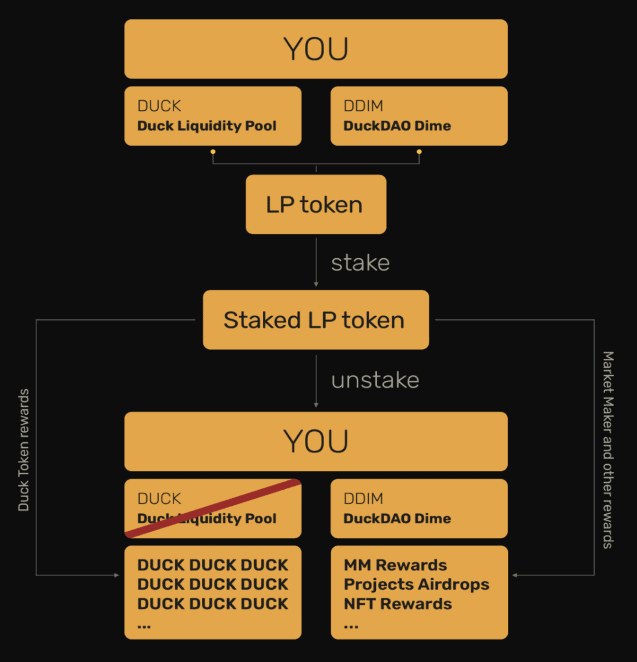

- Yield farming on Uniswap pools – Staking tokens help contribute liquidity to DUCK and DDIM pools. For this, they earn profit through DLP.

- Reward token for market-making profit – Half of the profit from the market maker is returned to the community who belong to the liquidity pool. If the performance of DLP is good, the profit for the yield farmers grows in proportion as well.

- Project token airdrops

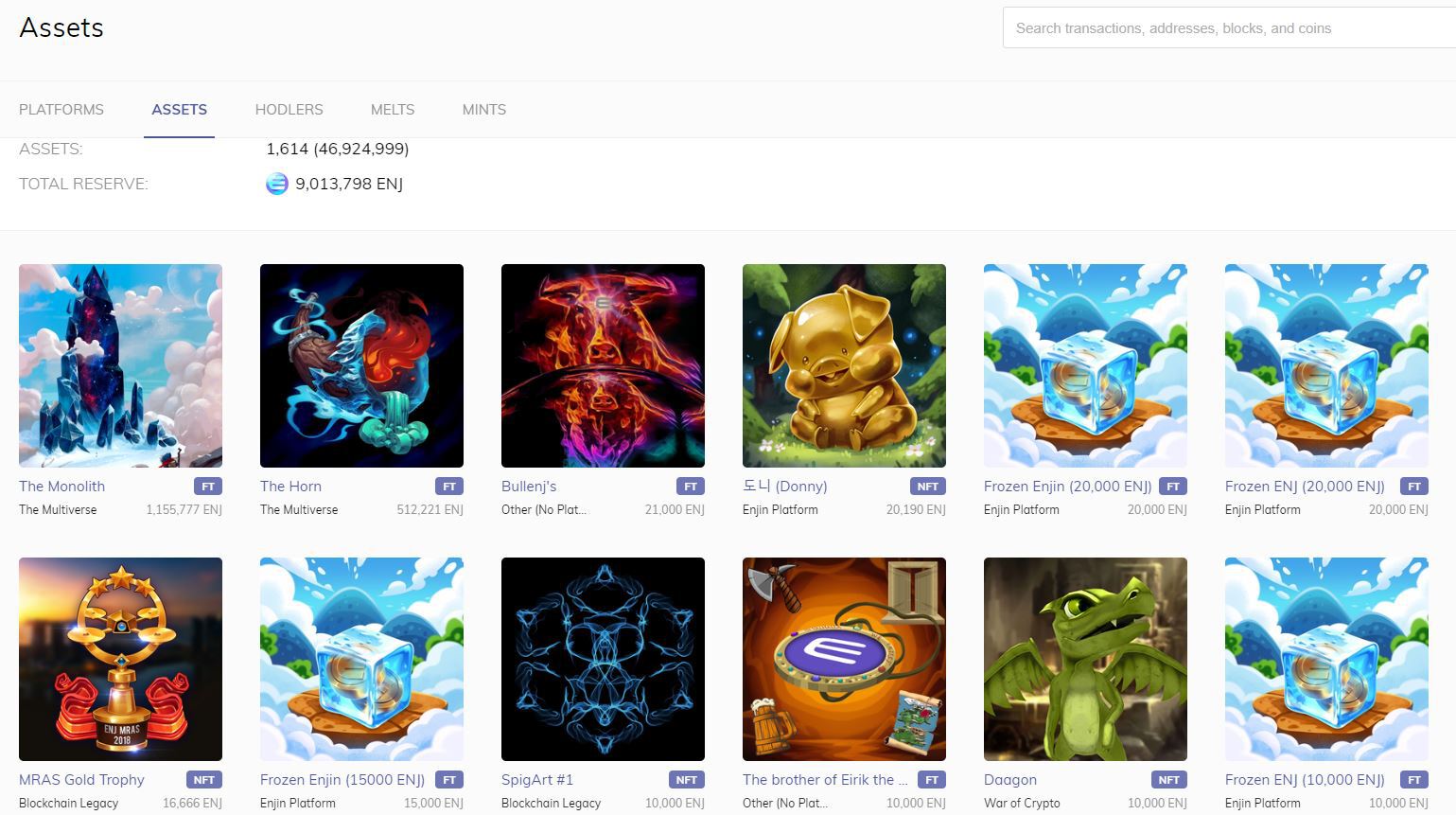

- Non-fungible token as reward

Deflationary Farming: “One-Side-Burn”

This is touted by the team as “Yield Farming 2.0,” which is designed to support a deflationary, unilateral burning of tokens. To understand how this works, we must first look at how the current yield farming mechanism works.

The Usual Scenario for Most Liquidity Pools

Commonly, yield farming pools in the DeFi space look very advanced for the average trader. Not only does this create a psychological barrier to entry, but it also makes profit-making a little more difficult for someone new to yield farming.

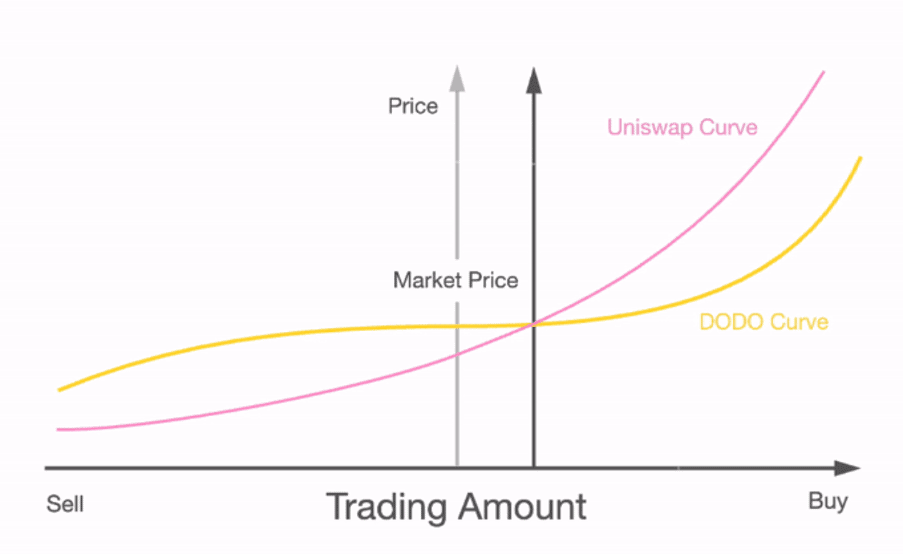

Another issue that traders face is the inflationary structure of the incentive mechanism in most liquidity pools. This is because, in order to provide rewards to yield farmers, mined tokens have to be released into the market. This model isn’t designed for long-term effectiveness since with more reward tokens in supply over time, we can expect its value to depreciate as well.

Duck’s Unilateral Burn

$DUCK, on the other hand, is designed to support long-term yield farming strategies. Even beginners on liquidity pools can just stake and earn a part of the profit that DuckDAO’s market maker gets.

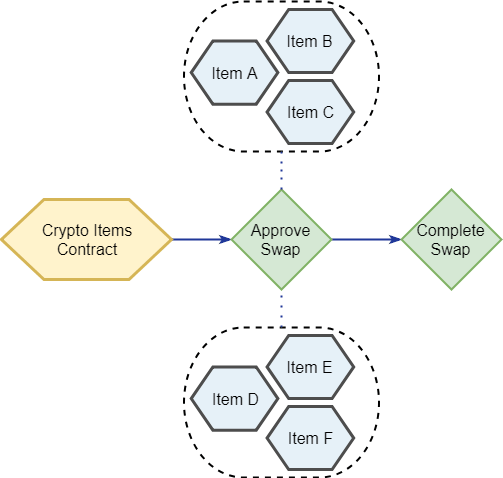

One-Side-Burn is a deflationary model that is designed to burn 50% of the carry pair as soon as the liquidity provider decides to cash in a portion of his stake.

What happens in such a situation is that users lose one side of their liquidity as the tokens are burned. And when someone decides to exit the pool completely, his entire liquidity is also burned and further lowers the DUCK tokens in supply.

While this model may seem counterintuitive for profit-earning at first, over-time, the value of the tokens is going to be greater than what it was when a user has staked in the pool. That is why DLP’s design appears to be much better in the long run.

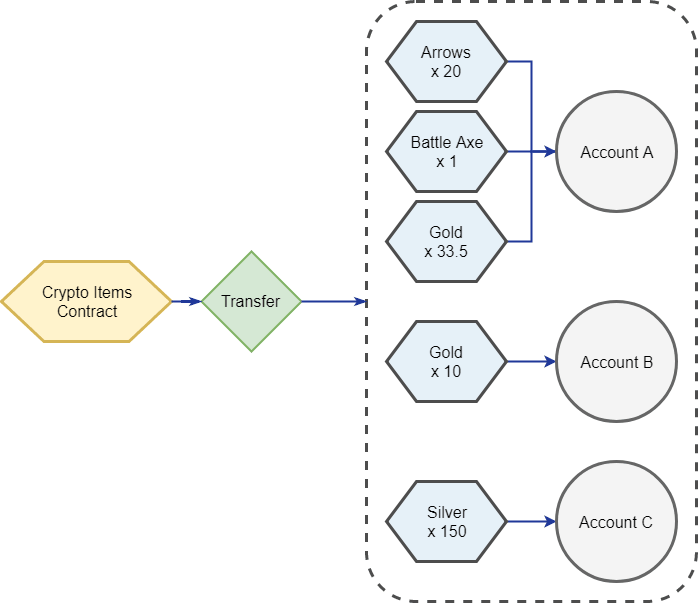

Duck Liquidity Pool Market-Maker Models

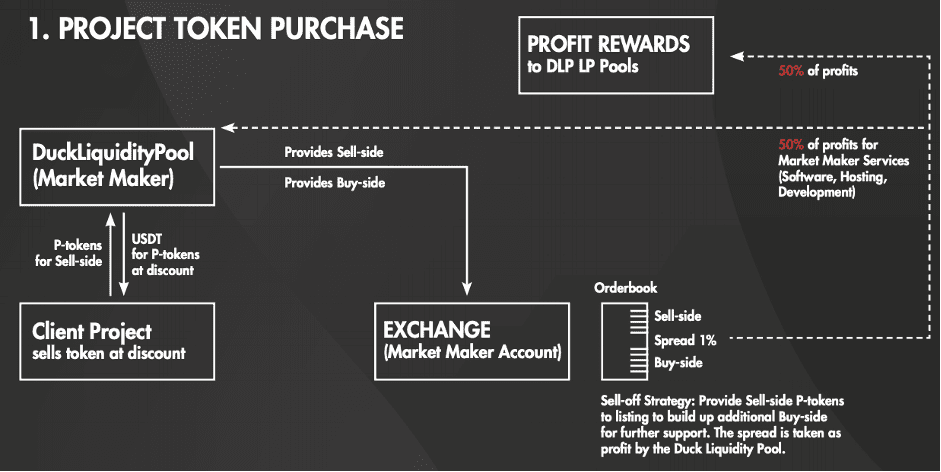

Project Token Purchase

DLP purchases tokens in order to facilitate buy and sell liquidity.

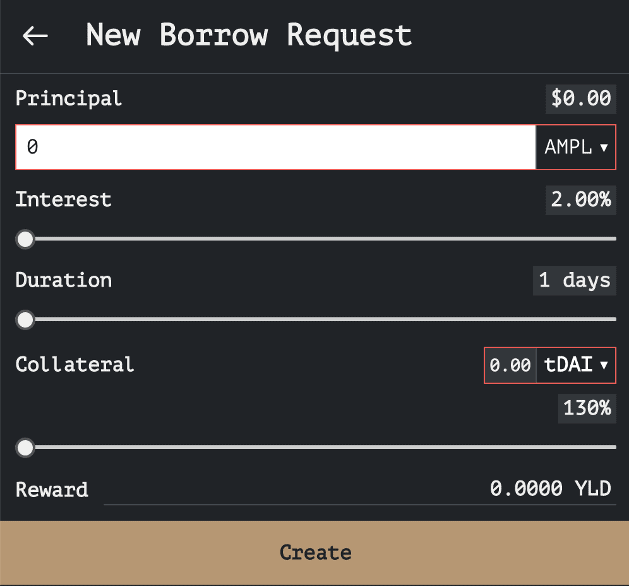

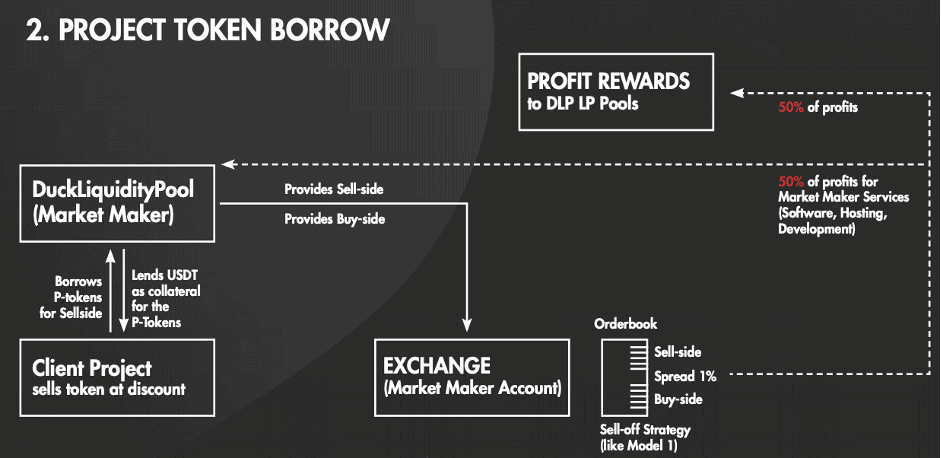

Project Token Borrow

DLP loans tokens against collateral in order to facilitate buy and sell liquidity.

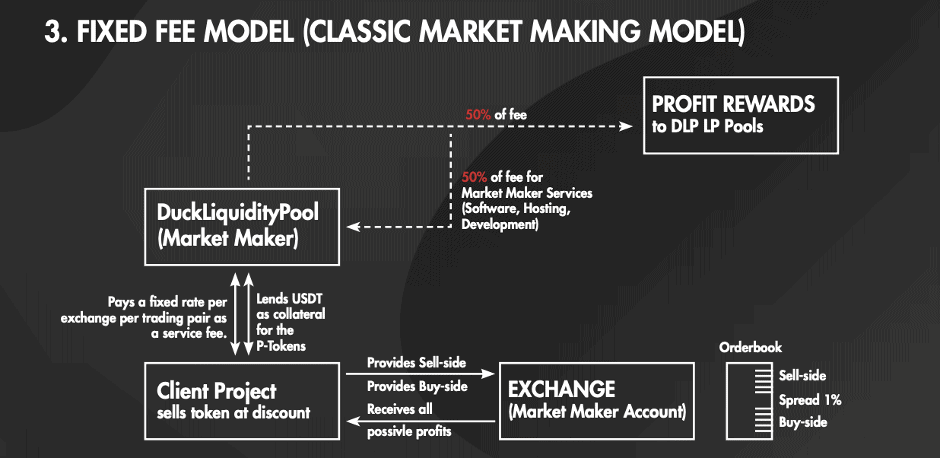

Fixed Fee Model

The protocol can charge a fixed service fee for listings that have decided to provide buy and sell liquidity on their own.

Conclusion

DeFi has enabled the birth of new profit-making strategies for traders in the space. However, whether existing liquidity pools can support long-term yield farming models is another question altogether. DLP’s model, which is powered by the ‘unilateral burn’ design, appears to be more promising.

To be fair, like many other pools, the profit it can generate for stakers is also influenced by the number of users joining the pool. This is why it is important to look into that as well before deciding to lock your tokens and supply liquidity to the pool.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

- MetaMask Guide: How to set up an account? PLUS tips and hacks for advanced users

- Uniswap review and tutorial: Beginners guide and advanced tips and tricks

- Serum DEX guide and review

- SushiSwap ($SUSHI) explained

- 1inch Exchange, Mooniswap and Chi GasToken: The ultimate review and guide

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.