Cryptocurrency Exchanges are facing additional regulation and scrutiny around the world. Two key exchanges – OKEX and Huobi are under regulatory scrutiny in China. One of the reasons for the scrutiny is that both these exchanges had a huge footprint in China prior to the 2017 Exchange ban. To find out about top cryptocurrency exchanges, check out our Exchange Tier List. Here are the major changes to the exchange scene in November 2020.

OKEx Exchange withdraws suspended

It has been almost a month since Okex Exchange suspended all withdrawals from the platform. This was due to one of their private key holders (Star Xu) being detained for investigation by a “public security bureau”. OKEx has always claimed that Xu is not detained but only actively cooperating with the relevant authorities for something unrelated to the Exchange back in 2019.

No withdrawal has happened since 16 October 2020; in OKEx’s last Twitter post, dated 9 November 2020, they claim that the function is not yet active but funds are safe and unaffected.

Withdrawals reopened!

After more than a month since their suspension announcement, Okex exchange has finally reopened unrestricted withdrawals on November 27. In addition, there will be rewards for active users. Read all the details in our developing article.

KuCoin recovers around 84% of funds in hack

As covered in our previous Newsletter, KuCoin had confirmed on 26th September 2020 that they had been hacked, resulting in around USD $236m worth of funds being lost.

On 11th November 2020, CEO and Co-founder Johnny Lyu confirmed that around 84% of affected assets have been recovered. Several means were utilised to do this, for example on-chain tracking, contract upgrade and through the judicial system.

Currently, 176 of their listed tokens have resumed full services, and it is expected that the remaining listed tokens will all be re-opened before 22nd November 2020.

Huobi Rumors go wild

On 2 November 2020 a few big transactions worth hundreds of millions into Huobi Exchange have been spotted; although this could be routine for a big Exchange like this, users were worried since the issues with OKEx exchange were still ongoing.

There were also rumours that, similar to OKEx, key executives of Huobi were detained for investigations.

This created an escalated FUD that ended up with a massive drop in value for $HT (Huobi Token), as well as worried users quickly withdrawing their cryptocurrencies from the Exchange.

Huobi official account subsequently tweeted denying all rumours and classifying them as false.

For now, everything seems to be back to normal and no more news have emerged since.

See our ongoing coverage of the Huobi rumours.

Binance Exchanges news

Binance Uganda merges with Binance.com

A few weeks after Binance Jersey announced that the Exchange, launched in January 2019, will be fully closed by 30th November 2020 (no explanation was given but it’s presumed that it wasn’t necessary anymore, after deposits in EUR and GBP have been enabled directly on Binance.com), Binance Uganda will cease to exist as well.

Binance Uganda was launched in June 2018 and has been the first fiat-to-crypto Binance platform, even though it had been stated more than once that it was a separate entity capable of independent decisions.

An explanation was provided by the Chief Executive Officer (CEO) Changpeng Zhao:

“All the features that Binance Uganda provides [are] now covered by Binance.com together with our fiat channel partners. There’s a very minimal number of users on there, so it doesn’t make sense for us to maintain two platforms”.

The process will consist of three different phases: Closure of Deposits and New Registrations; Closure of all Trading Services, and final Hard Shutdown on the 28 November 2020.

Users are strongly recommended to transfer their funds out of the Exchange before 00:00 UTC on 28/11/2020.

Is Binance blocking US-based users?

Reports are emerging that Binance has started to block users based in the US from accessing the Exchange. According to The Block, emails were circulated to US-based users who were told to withdraw their funds within 90 days.

This is in any event in line with their announcement back in September 2019 that they will no longer serve customers from the US. They are also likely doing this now considering the ongoing legal actions against BitMEX and its key personnel.

Binance.com is now giving a 14 days notice to US customers

As a consequence to what we reported a few weeks ago, it appears that some US customers who are still using the “.com” version of the exchange are receiving a 14 days notice letter. In the email, as they reported, Binance is informing that due to their “periodic sweeps”, US residents are being asked to withdraw all their funds within 14 days or their funds will be blocked.

It is not clear whether the identification process is only based on KYCs or on IP addresses as well; in the first case, it could be possible that US customers who skip the KYC process accepting lower deposits/withdrawals limits could still use the platform.

Binance.com has been trying to remove its US customers for a while as the exchange doesn’t have any regulatory standing in America. US customers can use Binance.US, an exchange with far less pairs that is therefore not as attractive to traders as the classic “.com” version.

Coinbase Pro is disabling Margin Trading

In a blog post on Nov 24, the Chief Legal Officer Paul Grewal announced that customers wouldn’t have been able to place margin trades after November 25, 2PM PT time. The existing positions will remain effective until the last one will have expired; at that moment the product will go offline.

The decision comes as a consequence to the finalized “Interpretive guidance on actual delivery of Digital Assets” by the CFTC (Commodity Futures Trading Commission) in March. You can read more here. In the letter we can read:

“We believe clear, common sense regulations for margin lending products are needed to protect and provide peace of mind to U.S customers. We look forward to working closely with regulators to achieve this goal”.

Australian Exchange BTC Markets exposed users’ data

On December 1st during a routine marketing round of emails to their users, Australian exchange BTC Markets, one of the most famous in the continent, accidentally exposed their users’ data. Names and emails where all together displayed in the “to” field and sent in batches of 1000 at a time, exposing each personal user’s data to 99 other email addresses.

Caroline Bowler, the CEO, immediately confirmed the data exposure adding that nothing more than names and emails were exposed, while funds and passwords remained safe. Nonetheless, we know this type of exposure can (and probably will) lead to unwanted campaigns or phishing emails, therefore users should always doublecheck the sender of the emails before clicking anything suspicious.

The exchange is now working on additional measures and has advised their clients to change email passwords and set up 2 factor authentication on their accounts.

Final reminder

Centralised cryptocurrency exchanges do have custody of the cryptocurrencies in your account trading wallets. Therefore if anything happens to the exchanges, your funds can be affected!

So don’t keep more funds in exchanges than you need for day to day use or trading! Keep your cryptocurrencies safe and under your OWN custody, ideally in a hardware wallet.

We recommend the Ledger Nano X. Check out our review and set up and installation guide.

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.

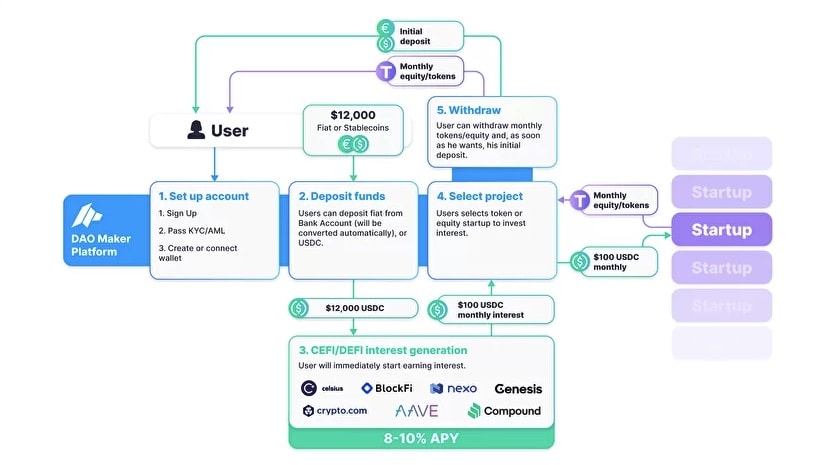

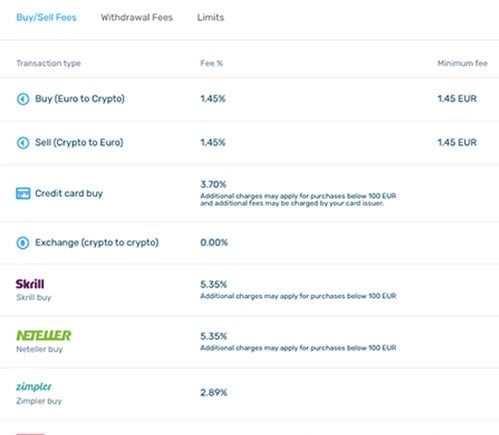

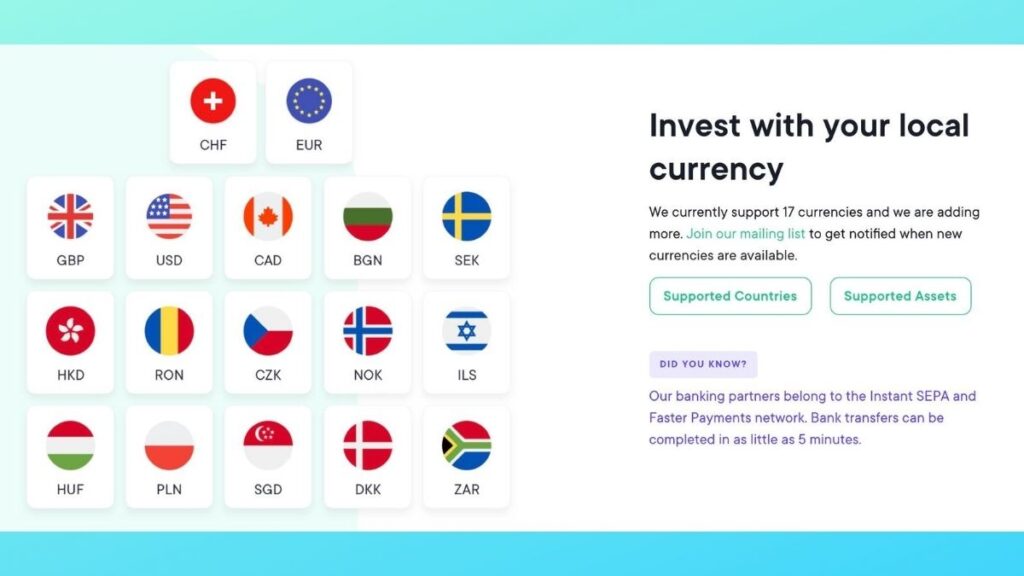

SwissBorg Network Token ($CHSB)

SwissBorg Network Token ($CHSB)