Despite the apparent growth of the crypto ecosystem, one major problem faced by traders is the cost. Many retail traders often fall victim to exchanges that quote unfair asset prices. Unfortunately, these shortcomings can lead to distortions in the market. This is where FinxFlo comes in to provide a solution.

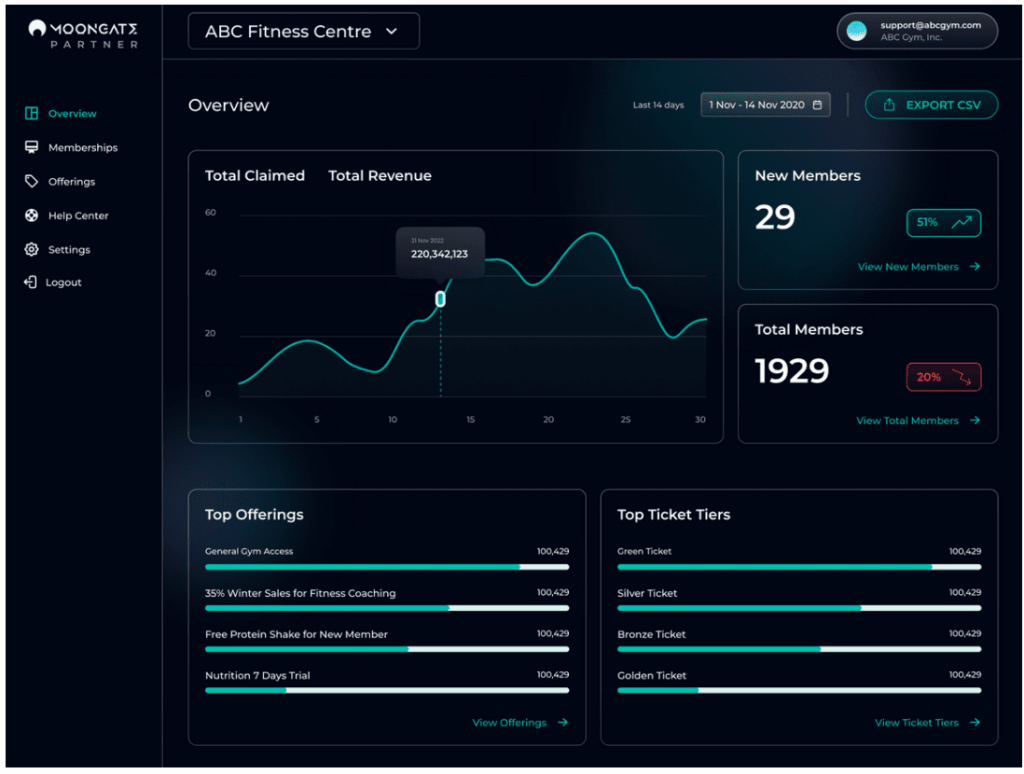

FinxFlo is a platform that seeks to allow its users to trade with 25+ exchanges (DeFi and CeFi based) from a single interface, with a one-time KYC verification process. Therefore, traders on FXF can access the best price for the asset to be traded. With just one account and one KYC process, traders can maximize the prices and rates provided by the platform.

Furthermore, the brokerage also enables traders to make informed decisions by providing them with accurate and real-time information and ensuring transparency.

Background

Founded in 2019, Finxflo comprises a multi-cultural team of individuals with successful stints in various industries such as Law, Finance, Fintech, etc.

The CEO and Co-founder, James Gillingham, is a household name in the world of investments, who has once owned a trade algorithm platform, which he sold off later at the tender age of 23 in a big deal.

Along with Thomas Plaskocinski, he is channeling all that experience towards creating a simple yet effective solution to most traders’ problems, namely, market volatility.

FinxFlo operates under an exemption granted by the Monetary Authority of Singapore (MAS) within the Payment Services Act 2019. Meanwhile, further regulatory approvals in other jurisdictions are underway.

What is FinxFlo?

FinxFlo is a crypto brokerage platform that aggregates offers from the top exchanges to create a fair market environment and provide more liquidity.

Using Decentralized Finance (DeFi) model and concepts, FinxFlo doubles as a price aggregator platform with brokerage services to help traders and investors identify the best buy and sell positions for digital assets.

That way, they can avoid the risks that exist within the crypto markets. But not only that, FinxFlo offers its users the privilege to trade at a low fee.

Through its native token, FXF, users can earn rewards by engaging themselves in various activities available on the platform (more details in the subsequent sections).

In short, the platform combines the best of Defi and CeFi into a single product.

The Advantages of FinxFlo

Smart Order Routing

It’s the proprietary concept at the heart of the FinxFlo trade algorithm. Whenever a user enters an order, the platform automatically compares available prices on different exchanges and selects the user’s overall best option.

With it, users are ensured to derive maximum returns on their investment without having to swap platforms.

Dark Pool Trading

Front running, which closely resembles the popular pump and dump strategy, occurs when, as in most cases, a whale investor moves to cause a sudden change in the price of assets by creating a large transaction.

Cryptocurrencies are not immune to such manipulation. But this is where the Dark Pool feature comes in. The function protects users from unsuspected market movements by enabling users to exit a trade in the case of such events swiftly. At the same time, if the user can pull profits with his position, the trade will be allowed to continue.

A Unitary portal

In trying to keep pace with this fast-evolving industry, most crypto traders end up owning even more than five accounts with different exchanges to access the extra privileges offered on each.

But thanks to FinxFlo’s one account, one KYC, one wallet, and one interface policy, users can have all their needs met on a single portal without losing any of the benefits that come with having multiple accounts.

Furthermore, FinxFlo’s combination of the Ethereum and Tron blockchain network means, for the first time, traders can access different asset pairs not available elsewhere.

Token Mining

On other exchange platforms, traders’ rewards are the profits they make with successful orders. On Finxflo, even the list performing traders get rewarded for their activities.

This process is also referred to as Trade Mining.

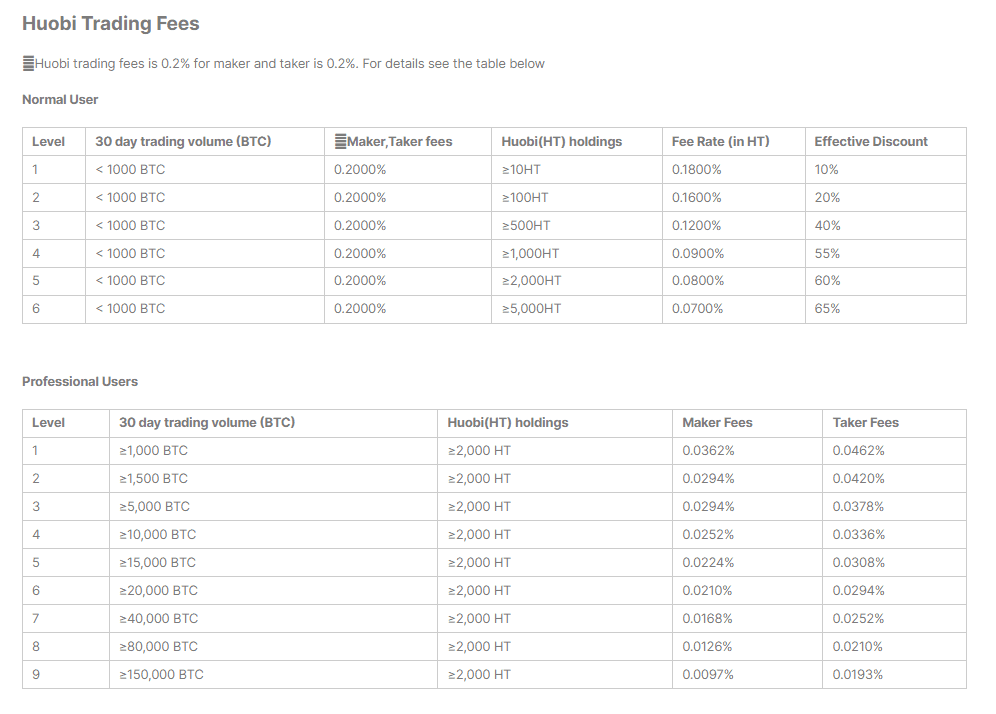

FinxFlo Fees

On FinxFlo, a trading fee of 0.1% (for each buy or sell order) is deducted at the execution point. In addition, fund withdrawals are completely free.

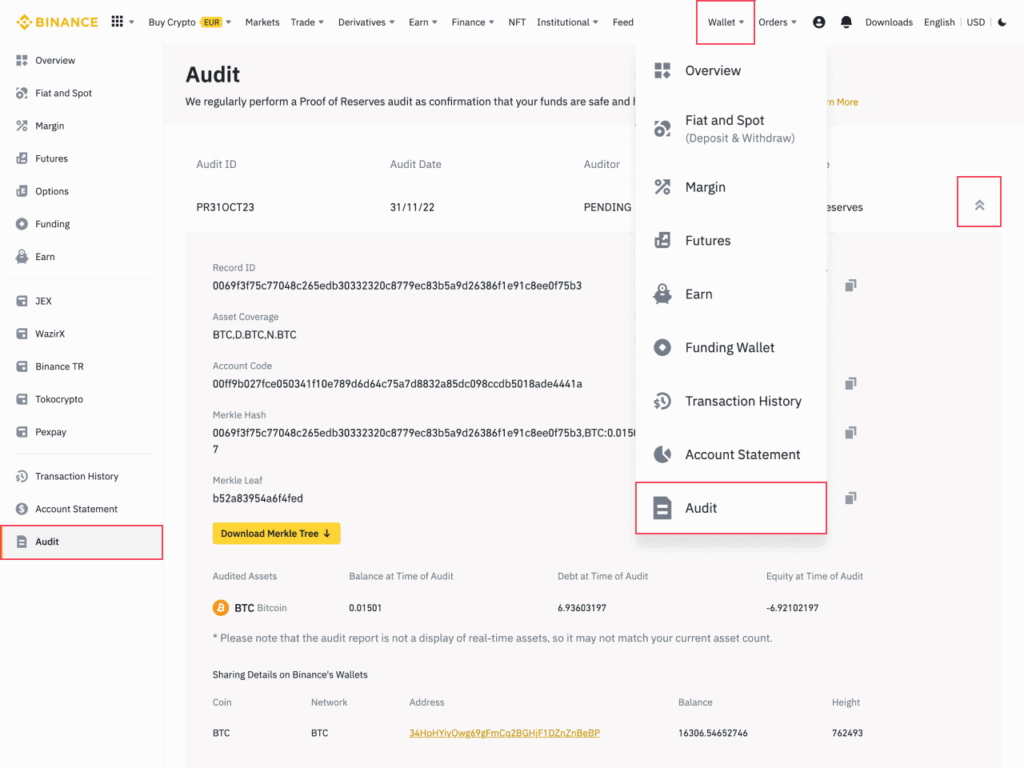

Exchange Security

Security and safety are arguably the most sensitive issues users worry about when selecting a good crypto exchange. For several years, various protocols and upgrades have been developed to address this issue but theft and hacks are still on the rise.

For this reason, FinxFlo has partnered with Fireblock to insure users’ assets and also provide top-level security based on the latest cybersecurity technology.

FinxFlo token (FXF)

FXF is the utility token of the platform, which is built as a blockchain 3.0 asset to facilitate interoperability between two separate networks, Ethereum (as an ERC20 coin) and Tron (as a TRC20 coin).

To enjoy some of the most exciting benefits of the ecosystem, users must hold the FXF coins. Aside from that, there are other lucrative benefits that come with having an FXF token in one’s FinxFlo account such as staking and yield farming.

FXF token is available for trading on Uniswap, Gate.io and Bilaxy.

Staking

Trading fees accumulated over time are distributed to users through a reward pool system. To be eligible, token holders would need to stake their FXF holdings on the network. Users would have their rewards distributed via a smart contract relative to their staked coins.

Yield Farming

Similar to other DeFi platforms, FinxFlo offers a yield farming program. But unlike how it is being provided on other exchanges, FXF token holders are automatically listed as Liquidity Providers (LPs).

These locked tokens are used to create funds, which serve as margins for FinxFlo exchange partners. In return, LPs get additional FXF assets as rewards. Most crypto investors utilize this process (called Liquidity Mining) to create additional income streams for themselves.

Conclusion

With all the recent hype centered around crypto such as the Gamestop and Dogecoin debacle, major corporations like Tesla buying into Bitcoin, etc., many newcomers are now eager to join the blockchain movement, which also exposes them to massive risk.

Fortunately, Finxflo’s vision to mitigate the risks of trading overhyped digital assets. Therefore, if the project becomes widely adopted, the crypto universe will see an even bigger influx of new individuals who will actively participate in trading, liquidity mining, as well as other crypto activities.

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.