Hedget is conquering one area that decentralised finance (DeFi) projects have yet to fully explore- options trading. DeFi is in all honesty still in its infancy, and there is still plenty of infrastructures which could be built to solve problems relating to contract security, liquidation risks, and speed and cost of transactions. Hedget in collaboration with Chromia aims to become the default options trading platform for DeFi tokens.

Background

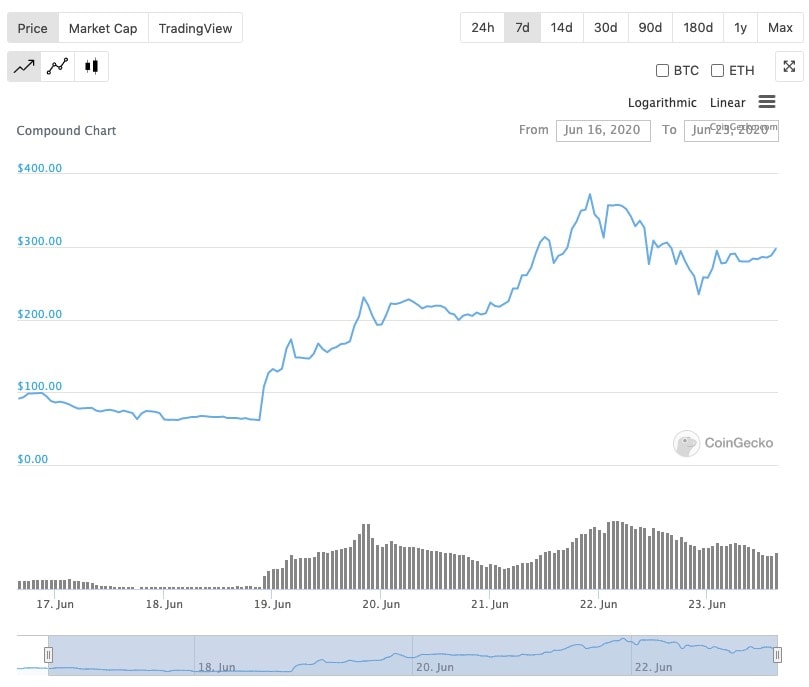

Hedget rides on the background of DeFi applications. With DeFi assets growing parabolically and reaching $8.77 billion as of August 2020, it is, without doubt, an area that is rapidly on its way to dominating the crypto market.

Unfortunately, the volatility of cryptocurrency prices is likely to curtail further growth. On the flip side, the risks involved can be minimized by embracing options trading.

The project is headed by Malcolm Lerider, a former Research & Development Manager for NEO blockchain. Others include Serge Lubkin, Ex-marketing lead at Chromia, and Riccardo Sibani, who, among other things, developed concepts and proof of works in Ethereum and has a double degree in Cloud Computing. The protocol’s advisors are Roger Lim, NGC Ventures’ founding partner, and Alex Mizrahi, the founder of several academic papers about Bitcoin. The protocol’s partners include NGC Ventures, FBG Capital, and Chromia.

What is Hedget?

Hedget is a blockchain-based platform focusing on options trading, with a specific focus on safeguarding users from the fluctuating prices of digital currencies. Options are a unique trading venue since they allow traders to interface with the underlying asset without owning them.

Trading involves buying and selling assets at a predetermined future date and price. Options can either be a call or put. Call options enable the user to buy while put options give users the right to sell. Options traders can bet on the price either going up or down.

The bets can be spread over a period of time, with each having different prices, commonly known as strikes.

Three things are needed when creating an option: (1) the asset being tracked; (2) option type; and (3) maturity/expiry date. The options maturity date on the platform is every Friday at 8:00 UTC+5. A major point to note is that the system applies European options rules. With these rules, an option’s settlement can only be done at expiry and not in-between strikes regardless of whether the price is favorable.

The protocol works with Ethereum smart contracts, Chromia-based decentralized apps (dapps), and client-side wallets.

Hedget options protocol

Other aspects of the Hedget protocol include collateral and settlement mode.

Collateral

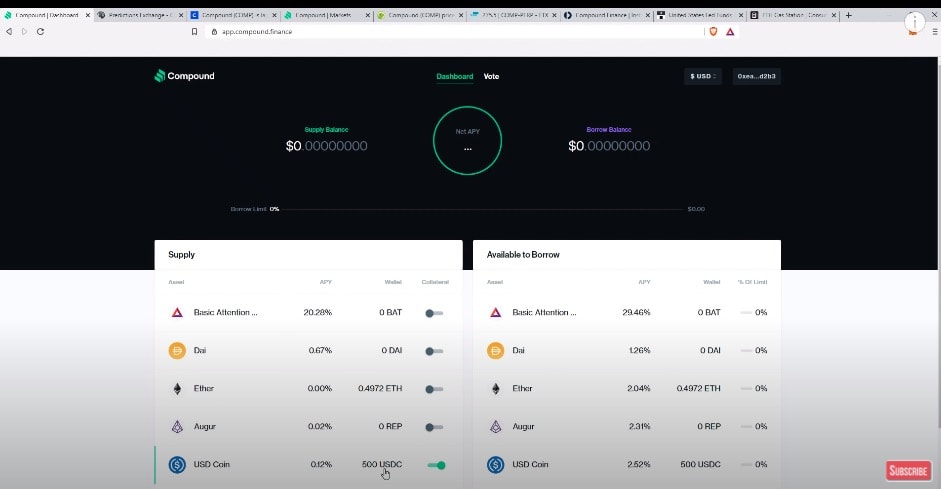

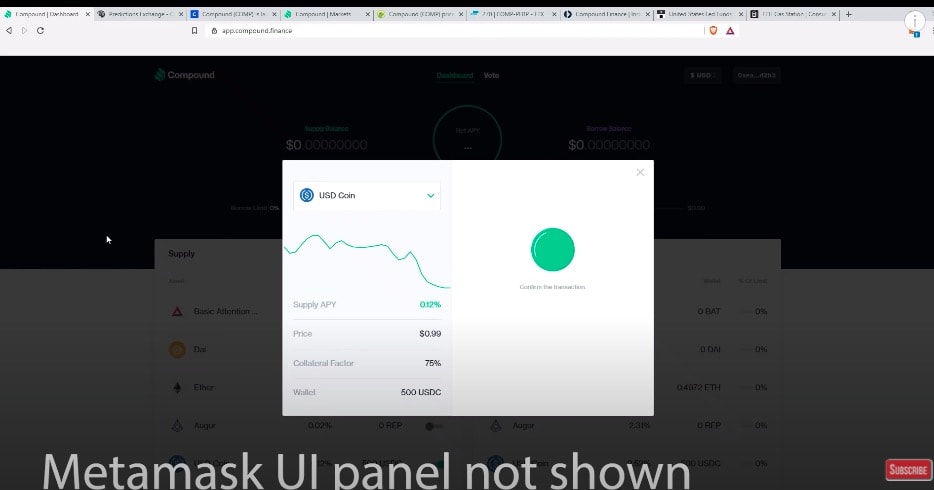

Here, users have to provide the full collateral for both call and put options. For example, those creating a call option for 20 ETH will be required to provide 20 ETH as collateral while those placing a put option will need to provide an equivalent amount of USDC (USD Coin), or any other supported stable coin.

Settlement mode

The network supports options settlement in either cash or physical. For physical settlement, the underlying asset, e.g., ETH, is converted to its fiat equivalent at the maturity date. In an ETH call option, the writer swaps ETH for USDC from the holder.

Cash settlements allow the writer to calculate the profit and transfer it to the holder. Settling in cash is advantageous since it can save on transaction fees.

Use cases of Hedget

The Hedget network is an excellent addition to the world of DeFi, from guarding options traders against the fluctuating prices of cryptocurrencies to increasing capital efficiency for both customers and businesses to hedging lending risks.

Furthermore, the platform can be used:

As a non-centralized price hedge

Here, users can use the network to hedge against their virtual currency holdings in a decentralized way. They can do this by buying a put option that protects them against reducing the underlying asset prices.

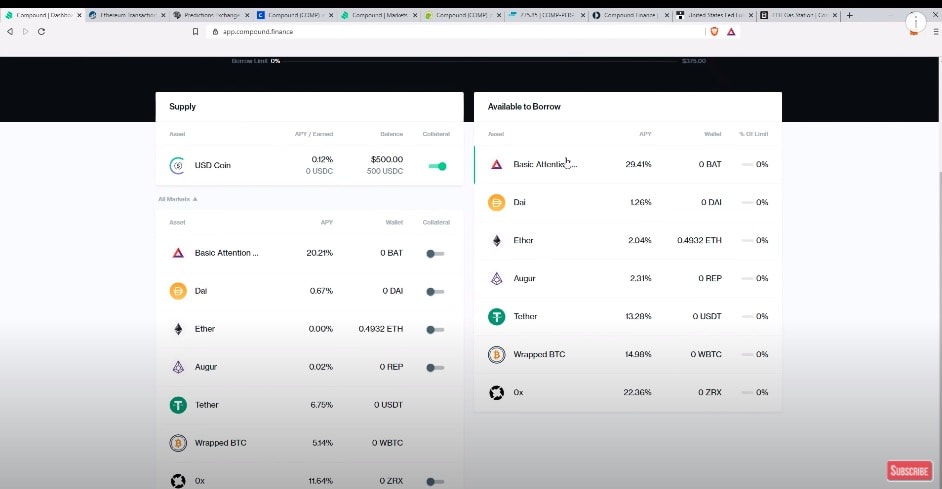

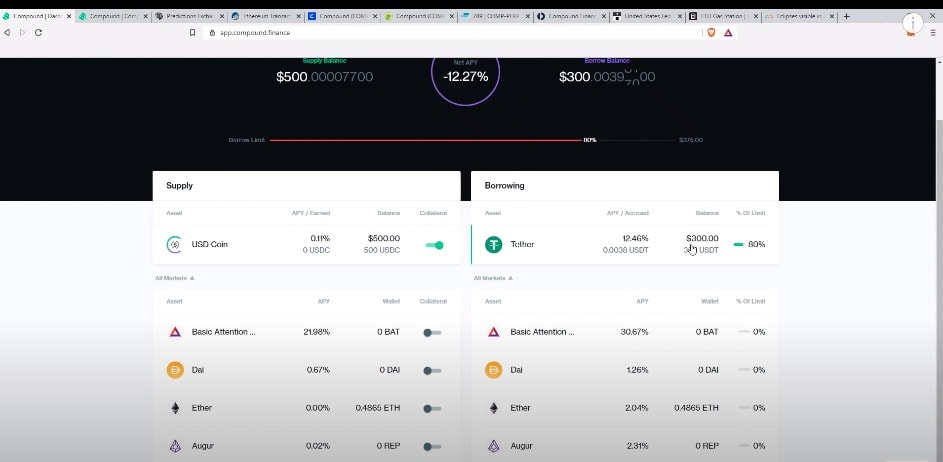

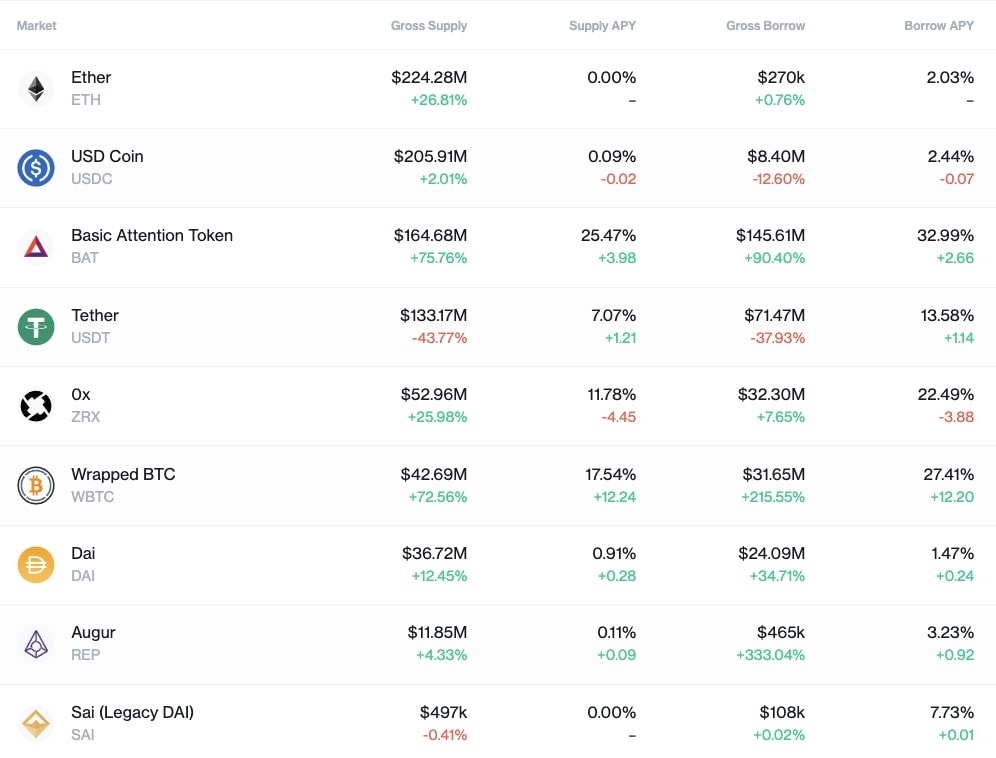

As protection on lending platforms

Hedget is primed for use by other lending networks to provide security against position liquidation by users. DeFi platforms champion for over-collateralized lending to cover losses in case they occur.

For example, on DeFi platforms such as MakerDAO, users need to put up collateral of 150% in order to borrow. During liquidation, more collateral is auctioned to stabilize DAI prices. Unfortunately, the loss is only reflected on users and not on the platform.

When Hedget is used in combination with MakerDAO, for example, users can select at a time that loans are generated to pay a premium for automatic liquidation.

To power leveraged trading

The protocol is ideal for traders who don’t flinch at the thought of leveraged trading. Using the protocol, leverage traders benefit from low prices associated with acquiring options compared to directly associating with the tracked asset.

Hedget token ($HGET)

HGET is an ERC-20 token that Hedget that is used for governance and utility. As a governance token, it settles transaction fees and fund’s asset reserves and general functions. Also, it’s used to avert order book manipulation through order spamming. This, however, requires staking HGET tokens.

HGET tokens have a total supply of 10 million tokens. The usage of these tokens is controlled by the Hedget DAO (Decentralized Autonomous Organization).

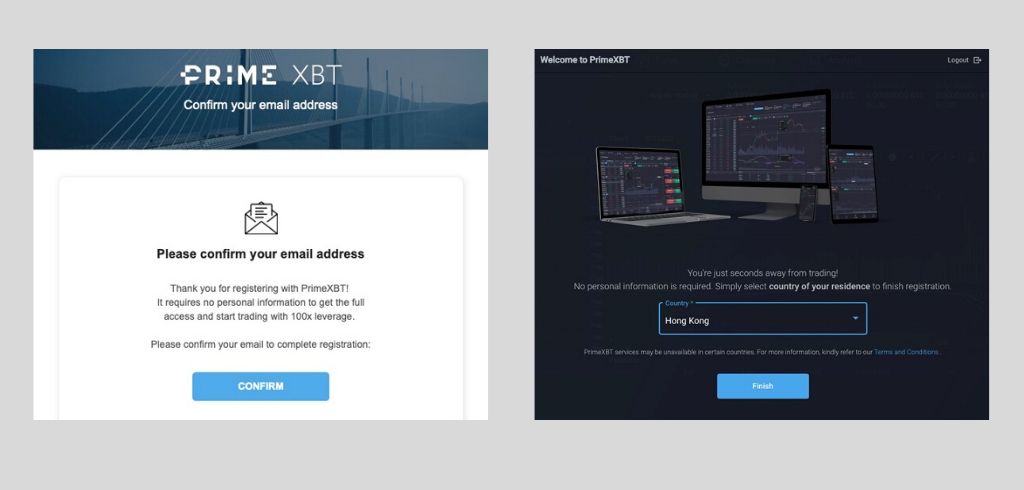

Hedget token auction

On 1st September 2020 at 13:00 UTC, Hedget will have their public auction for 423,000 HGET tokens (i.e. 4.23% of the total supply). There will be 2 separate auctions with 211,500 HGET in each auction, one auction will have all bids denominated in USDT (ERC20) and the other in Chromia’s CHR (ERC20) token.

Both auctions will have a starting price of USD$1 and run for 11 days in a Convergence Auction format. The Convergent Auction format requires participants to gradually disclose information about their pricing decisions.

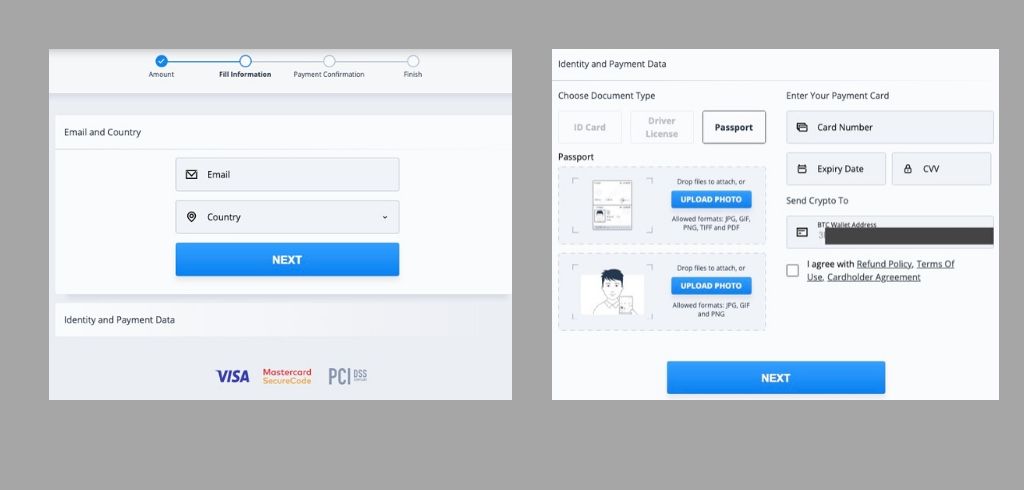

The auction timeline will be as follows:

Registry phase (6 days): Apply for the auction on their website, go through the KYC process and register your wallet for the token sale. Then, signal your initial bid price and desired amount of HGET you want to purchase. Participants can change their bid price and quantity for an unlimited number of times though this will incur transaction fees.

Main phase (5 days): Participants can only raise their bid prices or lower the desired token quantity. Note that updating your bid will incur transaction fees and you may be required to deposit additional collateral to support your updated quantity. For an increase in bid prices, they can only increase a specified percentage each day during this phase: Day 1- 90%, Day 2- 70%, Day 3- 50%, Day 4- 30%, Day 5- 10%. During this phase, Hedget will calculate and update participants on the temporary threshold price for the HGET tokens. This is the lowest price where bids which are equal to or above this price are sufficient to buy all the tokens in the sale. So participants can refer to this price and decide if they want to update their bids.

Fulfilment phase (immediately after end of auction): Hedget will finalise the threshold price. For successful bidders, HGET tokens will be sent to them accordingly. If a participants’ bid was below the threshold price or only part of the bid was fulfilled, the collateral/ remaining collateral (as the case may be) will be returned.

For more details on the auction see the guide published by Hedget.

Hedget and Chromia partnership

Chromia is a blockchain network meant to power a new breed of dapps that would scale beyond what’s currently available. The network brings together blockchain and traditional databases to create a “relational blockchain.”

Hedget exists as a layer on top of Chromia. The “relational blockchain” acts as a second layer on top of the popular blockchain system, Ethereum. A combination of the two platforms leads to Hedget performing settlements on Ethereum, while the trading is done on Chromia.

For example, suppose a user sells call options on Ethereum using Hedget. In that case, Chromia will require the user to deposit and lock funds. After this, they can create several options with varying expiry dates and strikes. However, this will appear as a single transaction on the ETH blockchain.

Read more about Chromia in their White Paper.

Hedget and Alameda Research

Hedget has formed a strategic partnership with quantitative trading firm Alameda Research, who is also the team behind FTX exchange and Serum decentralised exchange. Alameda Research made a strategic investment of USD $500,000 for 100,000 $HGET out of Hedget’s “Reserve” tokens.

This strategic partnership obviously caused a lot of hype, especially with Alameda’s strong background and the success of FTX Exchange. This in turn boosted people’s positive perceptions on Hedget and is causing a lot of people to fear that they will miss out on getting themselves some HGET tokens.

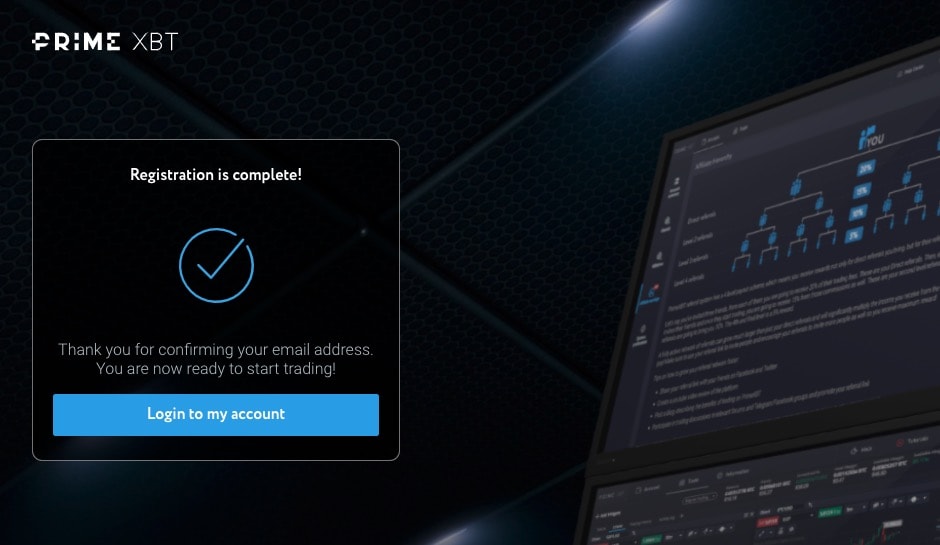

Hedget IEO on FTX Exchange

As part of the strategic partnership, Hedget will have an Initial Exchange Offering (IEO) listing on FTX Exchange on 4th September 2020 at 1:00pm (UTC) for 120,000 HGET tokens.

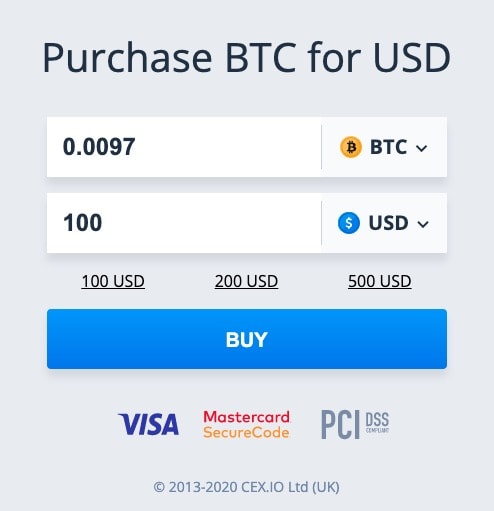

Participants must be at least KYC level 2 and hold tickets for the IEO. Each person has 1 ticket but those with higher average trading volume or FTT holdings may be entitled to more tickets. (manafort.com) Each ticket entitles you to bid for 100 HGET tokens with a minimum bid of $100 USDT ($1 per HGET) and a maximum bid of $500 USDT + 56 FTT ($5 per HGET +56 FTT).

There will be a total of 1,200 accepted tickets who will get the allocation of HGET tokens. If there are more than 1,200 tickets that made the maximum bid, FTX will allocate randomly between these bidders.

For more details check the participation guide.

Conclusion

With the volatility and the rigidity of current DeFi platforms, Hedget brings much-needed relief. And when used with blockchain-based lending systems, it can prevent automatic liquidation. Hedget’s application in leveraged trading, as well as its ability to hedge against price swings removes the need for trusted third parties. The fact that it is one of the projects Alameda Research had invested into also gives the public some confidence, considering Alameda’s history of success.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

- MetaMask Guide: How to set up an account? PLUS tips and hacks for advanced users

- Uniswap review and tutorial: Beginners guide and advanced tips and tricks

- Serum DEX guide and review

- SushiSwap ($SUSHI) explained

- 1inch Exchange, Mooniswap and Chi GasToken: The ultimate review and guide

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.

Decentralised Finance (DeFi) series: tutorials, guides and more

Decentralised Finance (DeFi) series: tutorials, guides and more