Gate.io, an esteemed cryptocurrency exchange platform launched in 2013, maybe the most prominent choice at first glance. Nevertheless, this review intends to examine the platform’s strengths and assess whether it is a viable option for cryptocurrency traders.

Sign up here to get started

What is Gate.io?

Gate.io is one of the oldest and fastest-growing crypto exchanges in China, operating since 2013 and rebranded to Gate.io in 2017. It offers a wide range of services, including an Initial Exchange Offering (IEO) platform, numerous cryptocurrencies, margin trading with leverage, and other advanced financial services such as margin lending or borrowing. Despite having a powerful trading engine, the platform interface may feel cluttered and is not the best starting place for inexperienced investors.

It offers a wide range of features, including spot trading, margin trading, and futures trading. While it has had some issues in the past, many users have praised its user-friendly interface, low fees, and wide selection of coins. However, some users have complained about slow customer service, lack of fiat currency support, and occasional technical glitches. Ultimately, Gate.io is a reliable and secure exchange platform that offers a wide range of features and coins, but it may not be the best choice for those looking for a platform with fiat currency support or fast customer service.

Key Features of Gate.io

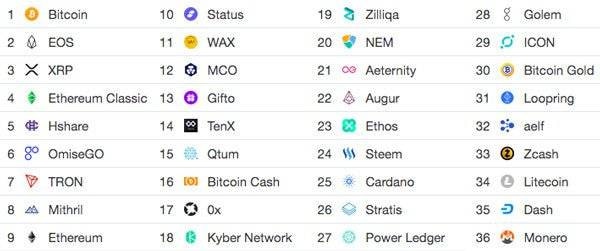

- Numerous cryptocurrencies. Gate.io is recognized as an altcoin exchange due to its offering of 180 diverse cryptocurrencies and almost 400 cryptocurrency markets, but it exclusively deals with cryptocurrencies and does not handle fiat.

- The platform’s functionality. Gate.io offers a wealth of features including trading in cryptocurrency markets, 10x leverage margin trading, margin lending or borrowing, participation in investment plans, investment in IEO’s through Gate.io Startup platform, perpetual swap contracts, and other functionalities.

- Fees are reasonable. Gate.io, like most altcoin exchanges, charges a minimal fee. It is not the cheapest service on the market, but there are various discounts. Trade on the platform costs 0.2% of the entire order amount.

- Security. The Gate.io team is security-savvy; CER ranked it as one of the top exchanges in terms of cybersecurity. Users can encrypt their accounts in a variety of ways, and the platform has a number of built-in security features.

- Customer service. Aside from the 24/7 live chat available to all users, it also provides a large help database including a FAQ section and a New Use Guide. You can also file support tickets for more complex issues.

Key Advantages of Gate.io

Despite any negative aspects, let’s begin by highlighting the positive features of Gate.io. The exchange’s most significant advantage is its extensive support for various cryptocurrencies.

More than 200 Cryptocurrencies are Supported

Gate.io stands out from other exchanges by offering over 200 different cryptocurrencies for trading, which is highly valued by crypto enthusiasts interested in niche coins. As the crypto market continues to grow and attract more investors, exchanges have started to diversify their offerings to meet demand. Since Gate.io is one of the oldest exchanges in the industry, it’s not surprising that it has a broad selection of coins to choose from. Multiple customer reviews also highlight this as one of the exchange’s top features.

Effective Security Measures

When evaluating a crypto exchange, security should be your top priority, and Gate.io appears to be on the more secure side according to user reviews. They use both hot and cold wallets, with the latter being hardware devices that keep private keys and cryptocurrencies offline. (Tramadol) In addition, the exchange offers two-factor authentication and specific notifications to keep users informed about account activity.

Fees are Quite Low

After perusing some user reviews of the Gate.io exchange, it’s apparent that their fees are one of the main reasons people choose to trade there. To understand why this is, let’s first discuss the two terms that frequently come up in discussions of exchange-related fees: market “makers” and “takers.” Makers place an order to purchase crypto at a set price, while takers buy instantly at the current market price.

Typically, makers and takers are charged different fees, with takers paying higher fees since they don’t have to wait for a certain price. However, with Gate.io, things are different. They offer a flat fee model where both makers and takers pay the same set fee, regardless of the circumstances. This fee is quite reasonable at 0.2%, which falls within the industry standard. Although withdrawal fees are a different story, as they depend on the specific cryptocurrency being withdrawn, Gate.io’s withdrawal fees for Bitcoin are around 0.0005 BTC, which is below the industry average and puts them on par with some of the top exchanges out there.

Key Disadvantages of Gate.io

Despite the various features discussed in this review, it’s important to note that not all Gate.io customer reviews are positive, with some users expressing concerns about the exchange.

Purchases of Fiat Cryptocurrency are Not Permitted

Gate.io is a popular crypto exchange, but it has one major drawback – it does not support fiat currency payments. This means that users can only purchase and trade cryptos on the platform with other cryptocurrencies. This can be especially frustrating for newcomers, as it requires them to purchase cryptocurrencies on another platform and then transfer it to Gate.io in order to trade. This can be a deal-breaker for many, as it adds an extra step and hassle to the process. The reason why Gate.io does not support fiat currency payments is that it is not a regulated exchange.

Not a Regulated Crypto Exchange

Gate.io is an anonymous cryptocurrency exchange, which means that the team behind it is unknown. While some crypto enthusiasts appreciate the decentralized nature of such exchanges, others are concerned about their lack of regulation and potential security risks. With no public team information available, it is difficult to know who is behind the exchange and whether they can be trusted.

Additionally, Gate.io does not support fiat currency payments, which can be frustrating for new traders. This means that you can only purchase and trade cryptocurrencies on the platform with other cryptocurrencies. While the flat fee of 0.2% for both makers and takers is reasonable, there are also withdrawal fees to consider, which can vary depending on the cryptocurrency.

Overall, the lack of transparency regarding the team and regulation status of Gate.io is a red flag for many traders. While the exchange may offer competitive fees and a user-friendly interface, the potential risks associated with unregulated exchanges cannot be ignored. As always, it’s essential to do your research and exercise caution when trading on any platform, particularly those with an unknown team and regulatory status.

Previous Security Breach and Insurance Deficiency

Gate.io experienced a security breach in early 2019, where a hacker stole hundreds of thousands of dollars worth of Ethereum Classic during a 51% hack. As expected, this kind of security breach is a major concern when choosing a cryptocurrency exchange. While it’s true that some exchanges have experienced hacking issues and have emerged relatively unscathed, it’s usually because they have some form of insurance. Unfortunately, Gate.io has no insurance whatsoever, as it is an unregulated exchange.

This is a major drawback for users, and it’s important to note that if your funds are stolen, there is no guarantee that you will get them back. Many Gate.io exchange reviews emphasize this point, and it’s something to keep in mind when deciding whether or not to use this platform.

The Interface Is A Little Clunky

While the Gate.io platform offers a variety of features, some users find the interface and trading layout quite complex and not user-friendly, according to user reviews. The overwhelming and cluttered user interface is a common complaint among new users who lack experience in trading on asset exchanges or brokerages.

This could be a significant concern for inexperienced users who are not accustomed to the trading environment. However, Gate.io does offer a mobile app version of the exchange that seems to be optimized better than the desktop site.

How to use Gate.io?

We have now discussed the major advantages and drawbacks of the Gate.io exchange. It’s evident that this particular platform is quite divisive – while some users have shared negative experiences, others consider its decentralized and unregulated nature to be a pro rather than a con.

Having said that, let’s take a more practical approach and assess how easy (or challenging) it is to register on the exchange. We’ll also discuss how to add funds to the exchange and purchase your preferred cryptocurrencies, and later sum things up.

How to Register on Gate.io?

First and foremost, here is the registration procedure.

- Step 1: Go to the Gate.io official website and click Sign Up.

- Step 2: On the next screen, enter your country, email, and establish a username and password.

- Step 3: You must now create a fund password.

- Step 4: You will now be prompted to confirm your email address.

- Step 5: Once you have verified your email, you can simply connect to the platform and begin trading!

When you first log in, you will be requested to input an email code for added security – this is a good thing!

How to Fund Gate.io?

Let’s get started with funding your account.

- Step 1: Once logged in, navigate to the top-right corner of the screen and select My Funds under Account Settings.

- Step 2: You will be automatically led to your Exchange Account at this point. The cryptocurrencies which you can deposit, withdraw, and trade will be displayed. As stated before in the Gate.io exchange review, you cannot deposit fiat money into your account or use it to purchase crypto coins.

- Step 3: A Bitcoin wallet address will be generated for you in a matter of seconds. You can either copy-paste it or scan the QR code; just make sure to double-check the address in the wallet or exchange where you are depositing your Bitcoin!

Now, the depositing process is actually pretty quick and simple, similar to the registration process stated before – this is something that is also agreed upon in most user Gate.io reviews.

Conclusion

In conclusion, the question remains – would I recommend trying out Gate.io? It’s a tough call, as there are better options available such as Binance and Coinbase. While Gate.io offers a vast range of niche cryptocurrencies, a mobile app, and reasonable fees, it has a shady past, lacks fiat payments, is unregulated, and has a clunky interface.

However, for those well-versed in crypto and interested in trading lesser-known assets, Gate.io might be worth considering, as it supports margin and leverage trading. It’s important to note that Gate.io is safe and requires some KYC verifications for withdrawing funds. I hope this review has been helpful in your decision-making process, and wish you the best of luck in your crypto endeavors.

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.