NFTs (non-fungible tokens) have become very popular amongst cryptocurrency traders and are drawing a lot of attention from several industries. The world of art has greatly benefitted from the sector, more than other industries (so far) because it opens creators and potential buyers to an ever-expanding marketplace. Generally, this stems from NFTs’ non-fungible nature, meaning that each one is unique.

What makes NFTs special?

Anyone can trade one Bitcoin (BTC) or Ether (ETH) for another and end up with the same asset they traded in terms of value and usability. However, non-fungibility means that no two assets are alike. If you trade one NFT for another, the newly-received asset will be fundamentally different. In the art sector, this allows people to buy directly from the creator, with the assurance that there is no duplicate anywhere. NFTs have also created a whole asset class and industry of NFT speculators which buy, sell and trade them for profit. There are estimates that in 2021 alone, there were over US$23 billion worth of trades in NFTs. In fact, the most expensive NFT sold in 2021 was Beeple’s The First 5,000 Days, which sold for US$69.3 million.

Some Common NFT Scams

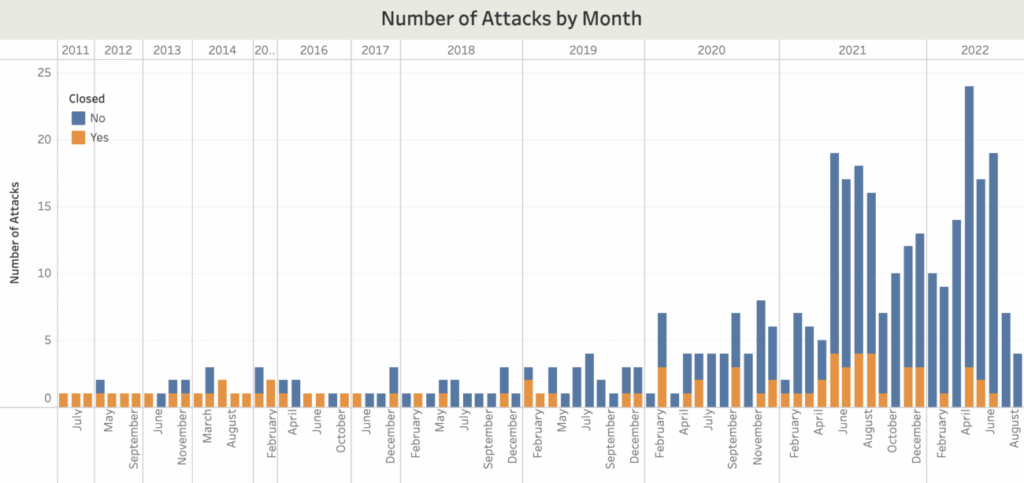

However, as with most up-and-coming industries, the NFT space is rife with its fair share of scams. Malicious players find ways to take advantage of buyers pumping money into the industry. Scammers are also becoming more sophisticated with their methods and will go to any lengths to swindle NFT holders, especially since some NFTs are worth millions. Here are some common NFT scams.

Fake offers

Scammers frequently entice NFT holders with false offers. Known methods include phishing emails, fake links, and service offers that require people to sign malicious contracts. Sometimes, people willingly give up their signatures for seemingly legitimate reasons, such as a paid offer to help animate your NFT. Tokens and NFTs may get stolen after you sign the transaction. In December 2021, scammers hacked the NFT marketplace Fractal, pushing a link to prospective buyers through the platform’s official Discord. Within 10 minutes, around 370 users lost 862 SOL, worth more than US$150,000 at the time.

False NFT projects

The NFT space has seen several rug pull scams where a known or unknown creator publishes an NFT for sale. For many reasons, including the possibility of high returns, people may skip adequate due diligence and quickly sink money into a new NFT with growing popularity. In many cases, these projects eventually lose their value and can’t be sold for a profit or the initial capital. The unknown creators then take all the money and are almost always unreachable. A popular example is the Frosties rug pull and scam. In January, buyers who purchased pieces of the cartoon ice cream digital collection lost a total of . (https://inboundrem.com) 3 million after the creators and funds disappeared from OpenSea.

Counterfeit NFTs

Scammers can create fake NFTs that resemble originals, especially when the original is not very popular. The forger would then list the fake NFT on a marketplace where an unsuspecting buyer may purchase what they think is the authentic version. Since no one wants a plagiarized or counterfeit NFT, the buyer is left with a worthless asset.

Pump and dump scams

Here, a group of scammers artificially pump a worthless NFT collection which eventually drives price and demand from speculators. Within a short period, the collection garners enough attention that people consider it valuable and start buying. However, the group will pull the plug and disappear as soon as they make enough money from the sale. The price of the NFT eventually tanks, leaving holders unable to resell their worthless NFTs. A relevant example of a pump-and-dump scam is the Squid Game token. Last year, unknown creators launched a token that exploited the popularity of Netflix’s Squid Game series. The SQUID token pumped past $2,800 and eventually crashed to $0. The scammers made away with more than $3 million in total and have still not been found.

Fake Holder Verification Bots

Scammers may create programs that impersonate authentic verification bots used with discord servers. Owners then allow approvals for these fake bots that transfer sensitive information to scammers who steal the NFTs.

How to Avoid NFT Scams

All players in the NFT marketplace should know how to avoid scams. Due diligence often does the trick, as fake projects or assets usually have features that stick out. Generally, avoiding scams requires a lot of caution from NFT holders. Owners looking to sell their NFTs must set approvals. The process requires the seller to set an approval so that the marketplace can transact on the owner’s behalf if, for example, someone else buys the asset. While popular marketplaces like OpenSea are relatively safe, there is still a significant risk with setting approvals.

Approvals give the receiving contract or address the authority needed to transfer tokens. If a malicious bot or contract has the approval, your funds are not safe. To avoid these scams, there are a few things to note.

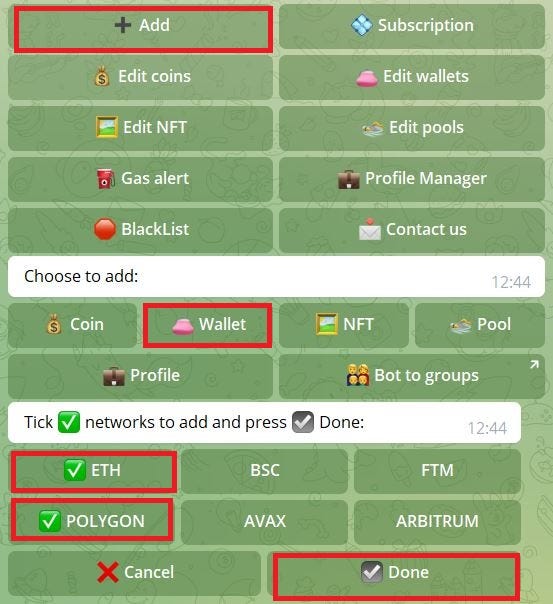

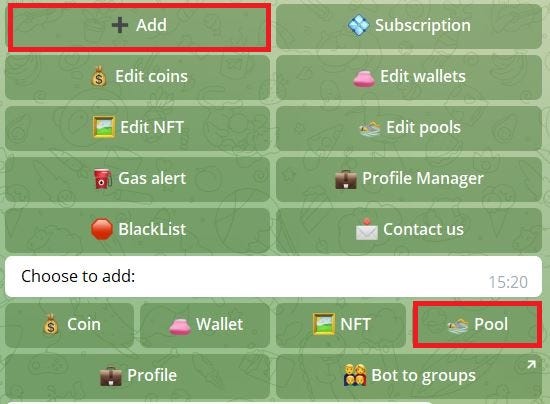

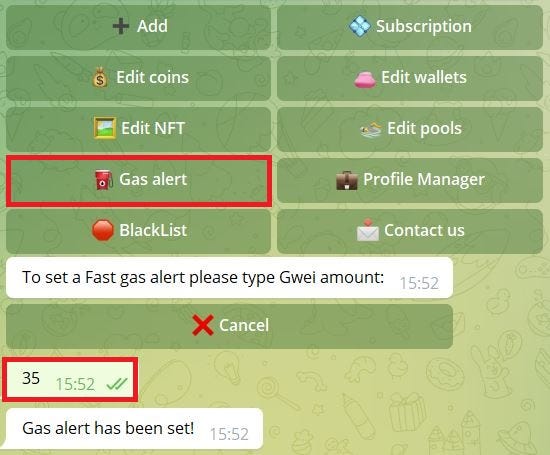

Setting approvals and verification

The blockchain is a public ledger and does not need permission for people to read stored information. However, executing transactions on the blockchain requires gas. When transacting with a third-party bot, marketplace, or address, any verification requiring gas fees is likely illicit. In the same way, setting approvals should cost some gas. There might be a serious problem if a transaction to set an approval is gasless.

Due diligence

It is important to do intensive research into an NFT collection or project before purchasing it. Trustworthy projects should have verifiable teams compromised of members without fraudulent histories. Depending on the project, a whitepaper might also be necessary. For phishing scams, buyers must double-check email addresses and links to ensure authenticity. Buyers must also do their due diligence to avoid plagiarized or counterfeit NFTs by confirming verification ticks on marketplaces or sticking to links posted on the project’s official Discord.

Discord Notes

Buyers using Collabland for management can attach specific notes to authentic bots in a server. This note will be available anywhere you see the bot, making it easy to avoid corrupt bots.

Personal Safety

All wallet credentials should only be in safe locations that are not easily accessible by third parties. It is inadvisable to keep this information on a mobile phone or with someone else. All owners should also consider unique passwords in addition to two-factor authentication (2FA).

Conclusion: Staying Safe

Avoiding NFT scams requires continuous effort. Buyers who have done their due diligence should consider taking further steps, including actions not listed above. Since the NFT space is still somewhat nascent, buyers should expect that scammers may come up with newer ways to steal NFTs or swindle unsuspecting users. Therefore, traders must take additional protective steps when buying, selling, or setting approvals for NFTs.