Crypto: The Power of Memes

On Feb 24, on the same date Anton Drexler founded what would become the Nazi Party, Russian President Vladimir Putin ordered a full-scale invasion of Ukraine. As Moscow’s bombs dropped on the country’s major cities, the nation’s Minister of Digital Transformation Alex Bornyakov fled its capital city of Kyiv.

Check our our video discussing the implications of the invasion of Ukraine on cryptocurrency:

Two days later, Bornyakov’s boss, Ukrainian vice premier Mykhalio Federov posted Bitcoin and Ethereum wallet addresses over Twitter, requesting crowdsourced crypto donations.

“We start to accept donations in meme coin. Now even meme can support our army and save lives from Russian invaders,” said Fedorov on March 2.

According to data tracked by the blockchain analytics firm, Elliptic, the majority of donations to Ukraine have been paid in Ether and Bitcoin, but donors have also sent the PolkaDot cryptocurrency as well as stablecoins like Tether.

“We’re watching history being made in real-time here,” says Braintrust Network co-founder Adam Jackson.

According to Crypto for Ukraine, over US$100 million in cryptocurrencies have been donated to Ukraine. The number is currently growing. Of the donations, nearly 40% were in Ethereum, followed by 31.51% in Bitcoin.

A report by Yahoo! Finance states that the split of funds starts at 69% going to military support, 19% for humanitarian aid, and 12% for general aid as of the time of the report on March 8.

Bornyakov thinks that in times like the current crisis, response time is crucial.

“The National Bank of Ukraine created a fiat fund, but with the time and speed of a regular banking system, it was impossible to finance important things for the army. Crypto plays a role to get this flexibility when we really needed to respond quickly to deliver the army with its required supply,” Bornyakov said.

Cryptocurrencies offer much faster transaction times, but not all businesses accept them as payment, according to Bornyakov. Currently, the government converts the donated crypto assets into dollars or euros through Ukrainian exchange Kuna, which it has partnered with to also custody the funds.

This helps reduce the friction arising when crypto donation funds are used to acquire goods for the military in order to fight off Russian forces.

Some firms do in fact accept crypto, but for those who do not, cryptocurrencies are sent via the exchange into the conventional banking system for payment.

Ettore Rosetti, the digital, marketing and innovation lead advisor for NGO Save the Children said that the group is seeing millions of USD in pledges in crypto projects. The humanitarian group has accepted crypto contributions since 2014, but the range is more varied now, accounting for the expansion of the crypto world.

“You’re crowd-sourcing a humanitarian effort in real-time,” said Jackson.

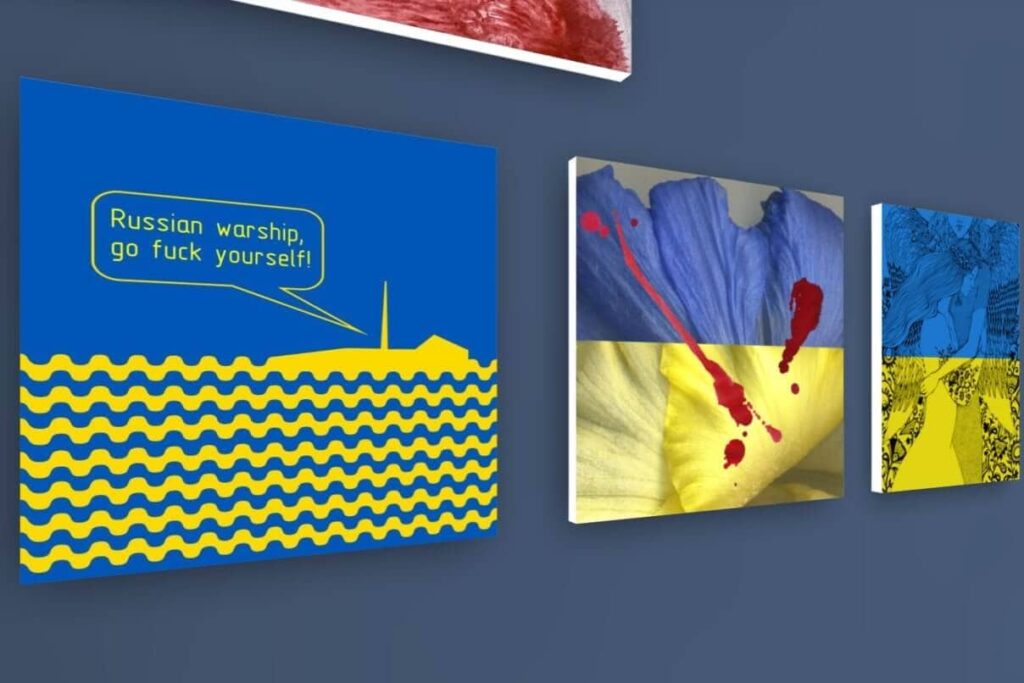

“What’s fascinating about the emerging currency types are NFTs. We’re getting inquiries from artists wanting to create an NFT to benefit Save The Children’s response in Ukraine,” said Rosetti.

Indeed, Crypto Punk NFTs worth USD200,000 form part of the contributions to Ukraine’s national crypto aid fund opened on Feb 26. And Russian protest punk band Pussy Riot’s co-founder Nadya Tolokonnikova organised an auction fundraiser to sell an NFT of the Ukrainian flag for USD7mil.

Amid the geopolitical and economic turmoil that has come about due to the Russia-Ukraine crisis, a sense of a real impact being made seems to stand out. Never in the history of the highly linked phenomena of war and economics have we seen the impact of ordinary citizens come about so quickly.

Days before the Russian invasion, Ukraine legalised cryptocurrency after 272 of its 450 parliament members voted for the move. Then, according to a Vox article by Emily Steward and Rebecca Heilweil, some Ukrainians also turned to crypto as an alternative to Ukrainian financial institutions, which had been limiting people’s access to bank accounts and foreign currency amid the crisis.

Now, Ukraine ranks 4th in the world in crypto adoption, according to research firm Chain Analysis.

In Putin’s Russia, Crypto Exchange You

Meanwhile in Russia, a report on ABC11 states that as Visa and Mastercard suspended their services and sanctions on the economy began to take effect, many are turning to cryptocurrency as well.

Ordinary Russians are now using crypto as a lifeline as their currency collapses under the brunt of geopolitical economic reprisal, according to Coinbase Global CEO Brian Armstrong.

“Many of them likely oppose what their country is doing, and a ban would hurt them, too,” wrote Armstrong over Twitter just before midnight on March 3.

“If the US government decides to impose a ban, we will, of course, follow those laws,” added Armstrong.

Binance CEO Changpeng Zhao, the world’s largest crypto exchange, mirrored Armstrong’s sentiment but was more ambivalent with his stance on the conflict.

“Should a coffee shop in Paris refuse to serve a Russian customer? Or take their wallet while they’re at it? The answer to that is no,” he wrote in a blog post. “We are not going to unilaterally freeze millions of innocent users’ accounts.”

One issue driving the push towards crypto sanctions on Russian users is that nations are wary of the nation’s oligarchs and Putin’s real resource of power might use it to evade sanctions. As it stands, steps had already been taken by these oligarchs to secure their wealth amid threats from the US and its allies, particularly a US task force created for this specific purpose announced by US leader Joe Biden on Feb 27.

On February 28, superyachts owned by Russian billionaires linked to President Vladimir Putin were on the move as the United States and its allies prepared further sanctions on their property following the invasion of Ukraine.

However, US Treasury deputy secretary counselor Todd Conklin has suggested crypto can’t be used to fully circumvent the sting of sanctions, given its practical limitations.

“Crypto is traceable, transparent. If someone is sending Putin Bitcoin from outside of Russia to evade US sanctions, then chances are they had to buy that bitcoin at an exchange and that exchange has their name,” added Jackson.

“While technically it could be used to avoid sanctions, it’s not a great way to do it,” he adds.

And as every transaction of the blockchain is transparent and public, cryptocurrency exchanges can use the information to trace the source of the funds to see if it is coming from blacklisted or sanctioned sources. In turn, the exchanges can also identify and block sanctioned persons from even opening an account.

US Financial Crimes Enforcement Network acting director Him Das said in a statement on Monday that the agency had “not seen widespread evasion of our sanctions” via cryptocurrency.

As it stands, analysts say wealthy and well-connected Russians often have a web of front companies through which they sift funds and crypto might not form a large part of this web.

According to The Washington Post, Trump-era Treasury Department assistant secretary Marshall Billingslea said that “the oligarchs have so many well-heeled accountants and complicit bankers around the world, they don’t really need to go that way. And if they’re investing in sound sanctions advisers, they’re being warned that some of these blockchain currencies like Bitcoin are not nearly as opaque as they might have thought,” somewhat reflecting what Jackson said above.

Large-scale avoidance of sanctions by say, turning fiat into cryptocurrency would prove difficult. For example, if an oligarch wanted to convert $1 billion dollars into cryptocurrency, they would find it very difficult since there is insufficient liquidity in the market to convert such a large sum. The oligarch would have to use multiple exchanges which would make the process extremely inefficient.

But avoiding sanctions using crypto could happen at a smaller scale over a longer period of time. As Investors.com states, Iran and North Korea offer some shady guidance to the world of discreet digital asset fundraising.

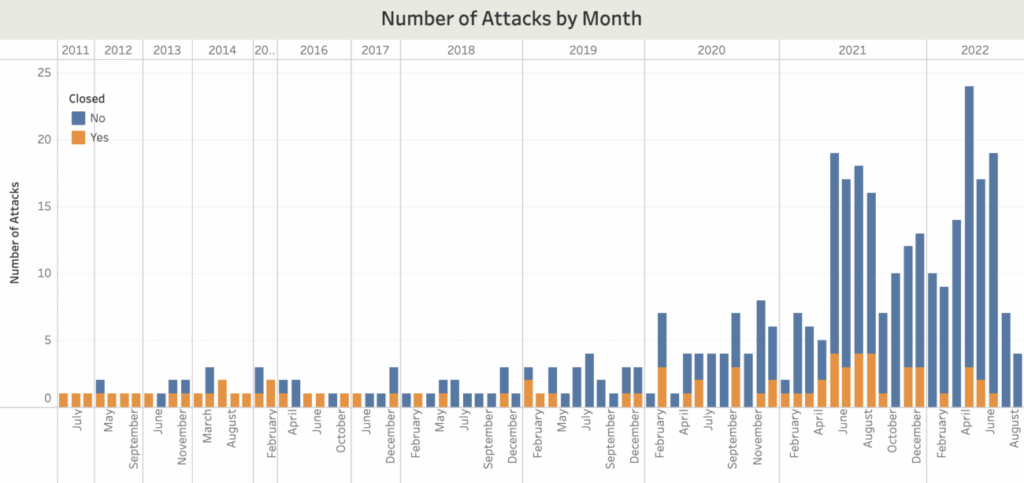

Crypto and blockchain analysis firm Elliptic found that Iran has used Bitcoin mining to bypass US embargoes, using Bitcoins their computers mined to pay for imports that would have otherwise been sanctioned. North Korea meanwhile employed hackers to steal some USD400mil in assets from cryptocurrency platforms last year, according to the research firm Chainalysis.

Russia’s embargoed but wealthy persons of interest could also channel divert money through smaller crypto exchanges that seem legitimate but have dubious compliance protocols under closer scrutiny. These exchanges might even be cooperating with the person of interest or their group’s money-laundering or ransomware schemes. The US last year sanctioned two exchanges on allegations of facilitating ransomware transactions.

Ironically, the failure to prevent Russian oligarchs from using crypto to squirrel away their millions around the world might force tighter regulations on cryptocurrencies themselves, putting proponents of crypto as a fair and balanced force for economic good, particularly during the Ukrainian conflict, in a bit of a moral dilemma.

As Forex.com global head Matt Weller was quoted at Investors.com said: “Those are the main two competing factors: The ideological-utilitarian perspective on the benefits of crypto assets versus the financialized investment component. Those are sort of pushing in opposite directions.”

One situation that really highlights a potential irony in this dilemma is Pussy Riot co-founder Nadya Tolokonnikova. That she is trying to help Ukraine as a protest against Putin seems to fit in the current zeitgeist of the conflict. But as Russian, imposing sanctions against Russian crypto to help Ukraine would stop her from raising money for Ukraine.

As the saying goes, the road to hell is paved with good intentions.

Those Are Blood Money

For Ukraine, they don’t have a choice in deciding how to balance the scales of this dilemma between economic fairness and moral-geopolitical good. As far as they are concerned, blind-but-fair adherence to crypto’s anonymous invisible hand of the market means their people will die.

Bornyakov’s ministry has started to reach out to major exchanges to not work with Russia for the time being because as he puts it: “They use this money to kill civilian people, to invade a free country without any reason. We inform those exchanges with official letters, with calls, where we can reach to stop work with Russia. Because those are blood money and in many cases come from corruption.”

According to the minister, some exchanges have stopped while others have limited their activity with Russia, and some working with Russia have been blocked, indicated by their complaints on social media.

Outside of the US raising sanctions, the most likely situation to happen in the next few months is that certain high-risk exchanges that don’t comply with regulations, at least in the United States, will be sanctioned by the Treasury Department in the near future, according to digital asset risk assessment firm TRM Labs’ legal and government department leader Ari Redbord.

“Because there is no central controller who can impose their morals on its user, crypto can be used to crowdfund for the Ukrainian army or help Russia evade sanctions,” said Elliptic’s chief scientist and co-founder Tom Robinson to The Washington Post.

“No one can really prevent it from being used in either way.”

According to Investors.com, TRM Labs recently identified 340 crypto businesses with strong Russian connections that it considers high risk such as lesser-known over-the-counter trading desks.

World’s First Cryptowar

Since Sun Tzu wrote the Art of War, the economics of defence has been widely discussed by both governments and private businesses alike. That it is now crypto’s turn to take up arms or rescue the helpless should surprise nobody.

But for a virtual asset so decentralised and antithetical to concerns of the state, the speed at which it has been applied to wartime has to a degree taken many state actors by surprise.

Both The Washington Post and Vox agree to some degree that war has pushed the utility of crypto to such a degree that the unique circumstances of war have made crypto itself a part of it.

According to the Vox article, “What we do know is that bitcoin and other cryptocurrencies are now a real factor in global economies and in conflicts.” Meanwhile, The Washington Post has straight-up dubbed the Russia-Ukraine conflict “the world’s first crypto war”.

What this conflict will do for the futures of individual cryptocurrencies is frankly anybody’s guess. But one thing we do know is that due to its unique attributes of speed and stealth, some of the most desirable attributes for any other tool or weapon, crypto’s role in the war is here to stay.

Crypto becomes an invaluable asset to Ukrainian refugees

Cryptocurrencies have been immensely valuable to Ukrainian refugees. As Russian attacks have destroyed critical infrastructure, many Ukrainians are finding it hard to withdraw cash from ATM machines. Therefore, many Ukrainian refugees are relying on digital currencies sent from relatives abroad in order to purchase goods and services. All that is needed for them to access their cryptocurrency wallets is a mobile phone and internet access, which is being provided by the thousands of Starlink satellite internet dishes provided by Elon Musk’s SpaceX.