What is Composability in DeFi?

Decentralized finance (DeFi) has revolutionized financial services, creating new possibilities unlike anything that exists in traditional banking. DeFi protocols allow you to transfer value, exchange tokens, take out loans, provide liquidity, earn yields and so much more. As the market expands, it is likely that even more innovations will surface.

This is because of how smart contracts work. The open-source and permissionless nature of blockchains allows anyone to code their own contracts or even integrate a component of another protocol in their own application. As a result, the applications built on a smart-contract network can run interchangeably.

This is known as “composability” — the interoperability of DeFi protocols resulting in efficient and creative financial services and products for users. It is the core basis of DeFi and is what helped the ecosystem grow so quickly.

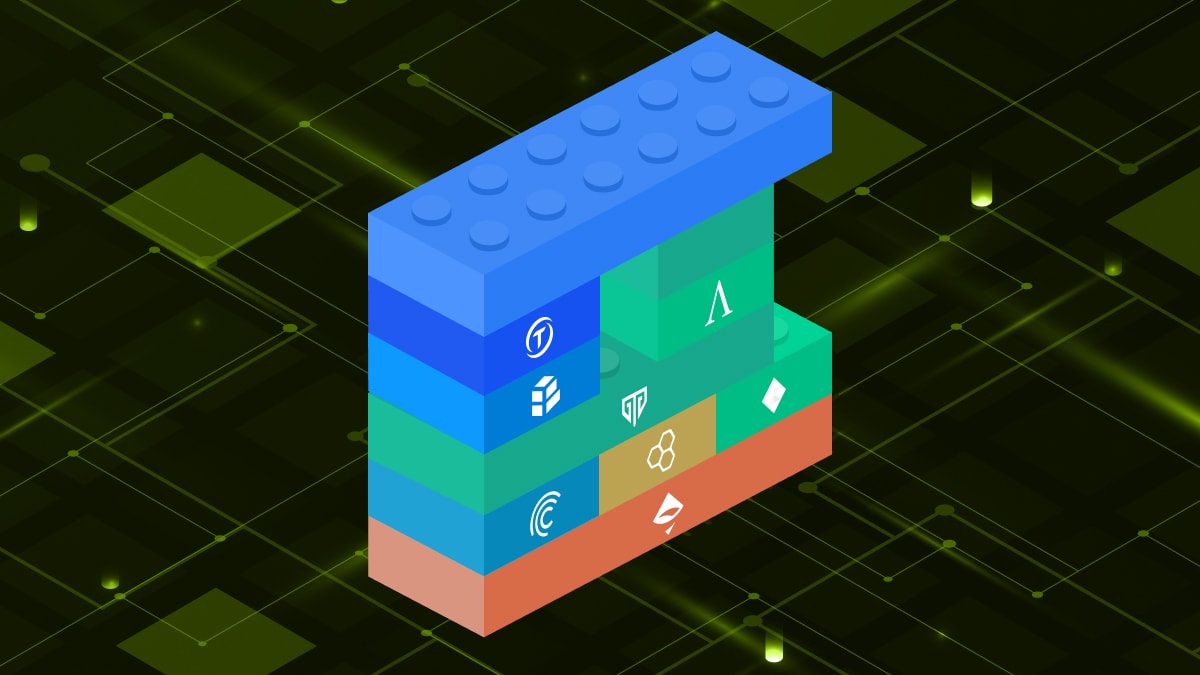

What are “Money Legos” in DeFi?

To understand how composability works in DeFi, we can view components of DeFi protocols as Lego blocks, giving rise to the term “money legos.” Each building block has its own functionality such as borrowing, lending or staking assets, just to name a few. Developers can stack multiple protocols together like Aave, Compound, Yearn, Curve or Synthetix to create a new DeFi protocol, just as you would a Lego set.

For developers, money legos save a lot of time and complications around building a new decentralized application (DApp). They do not need to start from scratch as they can simply integrate existing money legos into their own. What money blocks provide are solutions to more complex processes which require more steps than usual.

Moreover, developers can build smart contracts that can operate the legos in any order, be it one before or after the other, or in parallel. For example, by joining the money legos together and then specifying the order of events through a smart contract, users could

- Put up collateral for a loan on Aave

- Stake half of the loaned amount on Curve

- Trade half of the loaned amount on Uniswap

- Pull out both amounts simultaneously and take profit

- Pay off the loan on Aave

This is just one type of scenario. As you can see, there are infinite possibilities with money legos. It is up to your creativity how much use you can make of the combination of their functions to optimize your crypto. Furucombo is a great platform to experiment different possibilities of DeFi money legos.

Why “Money Legos” Matter?

“DeFi” is a buzzword that gets thrown around a lot. People often associate DeFi with low fees and yield farming, but do not exactly know how the underlying infrastructure works. Therefore, it is important to learn about money legos as they are the building blocks for programmable money, hence its name. While developers can compare and choose specific DeFi protocols to cut down on fees when building new applications, investors can better optimize and manage their crypto by having a better understanding of money legos.

As savvy investors, we know that key performance indicators (KPI) of a healthy market and ecosystem are trading volume and activities. As such, money legos are powerful tools that can expand the potential possibilities of the ecosystem. They add to the utility of each existing protocol, while improving the blockchain’s network effect.

In other words, each time a new protocol is created in the DeFi space, a new money lego is born that can also be used to offer more new services within the sector. These new protocols will offer faster and more efficient services, giving investors more ways to generate profit. For each new money lego, hundreds or thousands of new combinations become possible.

However, as of now, composability mostly favors protocols of the same blockchain. For example, DeFi protocols on Ethereum can only interact with other protocols on Ethereum. Same goes for Solana or Cardano. Perhaps in the future, true multi-chain interoperability will allow protocols on one blockchain interact with a protocol on another blockchain. This means that crypto will become more accessible, further increasing their adoption.

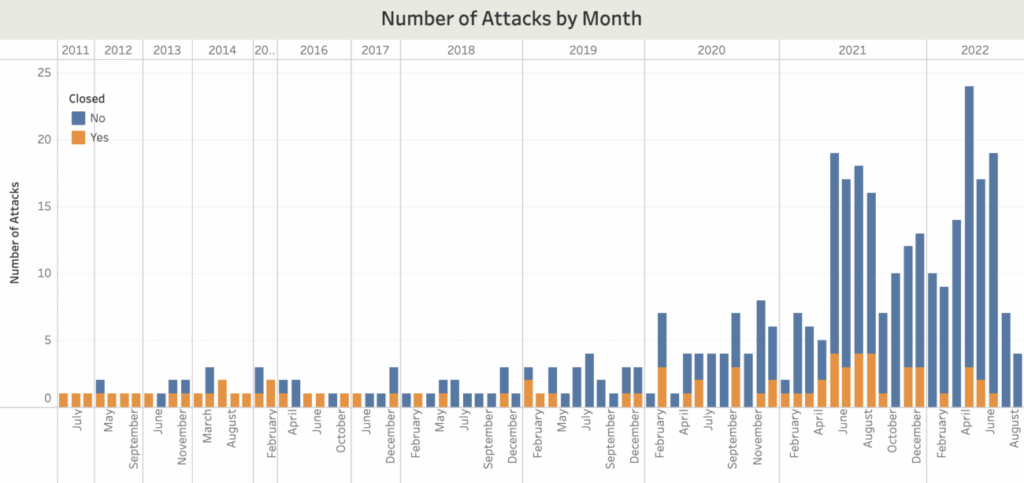

Risks of “Money Legos” Composability

Since DeFi protocols can seamlessly integrate with each other, this means that the entire ecosystem hinges on each of its money legos. If one of the core money legos is compromised, it could lead to a chain reaction, potentially affecting other integrated applications.

This is possible because of the interoperability between the DeFi protocols. For example, you can carry out complex strategies like borrowing Synthetix (SNX) from Aave, depositing SNX into Synthetix to mint sUSD, then swap sUSD for DAI on Curve. Now if any one of these protocols is attacked, then all of their liquidity pools will be severely affected.

Moreover, certain protocols also have wrapped crypto tokens (e.g. WBTC, renBTC, wETH) that are pegged to the value of another crypto. This means that you not only have to trust the protocol you deposit your funds to but all the others it may be reliant upon.

Key Takeaway

It is important to understand money legos as they are the building blocks of the DeFi ecosystem. Money legos help developers create new protocols, offering faster and more efficient financial services for DeFi end-users. It also helps investors get the best trades and the best yields when it comes to earning from DeFi protocols. That is the whole concept behind the idea of composability. Seamless interoperability among components helps to build the best and most creative solutions.