ZK-rollups could be one of the strongest performing sectors in 2023, as demand for Ethereum scaling solutions is increasing. As such, Sovereign Labs is one of the most promising upcoming projects in the ZK-rollup space. The team is well-funded and the development is on track to be completed in Q2 2023. As such, Sovereign should definitely be on your watchlist for 2023.

Check out our zkSync article for another highly anticipated ZK-rollup project this year.

What is Sovereign?

Sovereign Labs, the team behind Sovereign, is creating an open, interconnected rollup ecosystem to make it easier for developers to deploy interoperable and scalable rollups on any blockchain. It’s been compared to Cosmos ($ATOM), but instead of layer-1 chains, Sovereign uses their software development kit (SDK) and inter-blockchain communication protocol (IBC) for ZK-rollups.

Current Problems of Blockchain Scaling Solutions

The current blockchain scaling solutions including application-specific layer-1s, optimistic rollups and ZK-rollups, all have their own drawbacks:

- Application-specific layer-1s are the easiest to design and implement, but require large amounts of capital from validators to secure the blockchain. This approach is only viable for a few well-funded blockchain apps.

- Optimistic rollups produce fraud proofs to prevent misbehavior. However, during an attack, fraud proofs can be censored, leading to long finality delays. This makes bridging out of optimistic rollups slow and costly.

- ZK-rollups share the advantages of optimistic rollups, but without the long finality delay. Large batches of transactions can be finalized with validity proof in a matter of seconds. However, ZK-rollups are incredibly difficult to build because it involves a very high level of cryptography and protocol engineering.

Out of the three blockchain scaling solutions, ZK-rollups prove to be the most promising scaling paradigm despite the massive undertaking it requires to build them. As such, Sovereign aims to make it easier for developers to create secure and interoperable ZK-rollups, just like the Cosmos SDK did for layer-1 chains. As a result, developers do not need to be experts in cryptography to write their apps, allowing them to focus on the business logic of their chain.

Who is the Team behind Sovereign?

Sovereign Labs is co-founded by Cem Özer (CEO) and Preston Evans (CTO). Özer had worked as a smart contract and protocol engineer in ConsenSys, the company behind MetaMask. On the other hand, Evans had worked as a software engineer in Amazon, and has years of experience in computer science and machine learning.

Sovereign aims to make scaling simple, supporting billions of blockchain users without sacrificing security. In late January 2023, Sovereign Labs raised $7.4 million in seed funding led by Huan Ventures with participation from Maven 11, 1KX, Robot Ventures and Plaintext Capital. According to CoinDesk, a spokesperson from Sovereign stated the fundraise puts the company’s valuation in the “eight-figure” range. The fund will be used to build the SDK and hire protocol and researchers with expertise in blockchains and cryptography.

Properties and Key Features of ZK-Rollup SDK

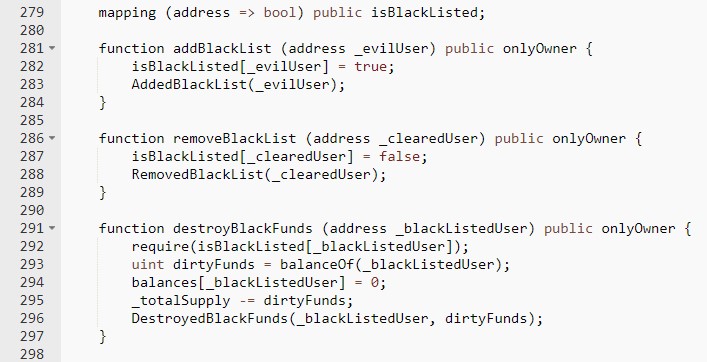

The Sovereign SDK will provide a set of default modules, a peer-to-peer network, a database, and an RPC node, and will abstract away the details of zero-knowledge. This way, developers can write their apps in Rust or C++, and the SDK will automatically compile it to an efficient zero-knowledge virtual machine.

It will also use a novel bridging technique based on proof aggregation to allow rollups on a shared L1 to bridge back and forth at minimal cost without a trusted third party. Off-chain relayers can combine the proofs of all the peer rollups into one proof, which can then be verified on the chain. As the state transitions are proven to be valid, there is no need to pay fees to a liquidity provider or wait a week for transactions to be completed. This means that bridging can be done immediately with no drawbacks.

The biggest feature here is that Sovereign SDK Rollups are able to be used on any blockchain, as the responsibility of verifying proofs is given to the user, not the original blockchain. This is what sets them apart from smart-contract rollups. As the data availability layer does not need to be able to check proofs, SDK rollups can be used on any blockchain without needing to be rewritten. This makes them incredibly versatile, creating an ecosystem of interoperable and scalable rollups that can run on any blockchain.

When is Sovereign Launching?

Sovereign is currently in the process of developing the SDK, which includes designing the default storage module, cryptoeconomics, and core APIs. They are also working on a research prototype which is currently integrating with modular blockchain Celestia for data availability and ZK virtual machine Risc0 for the proving system. This phase is expected to be complete around Q2 2023.

Initial implementation of the SDK will begin afterwards, which they will implement a peer-to-peer network, RPC node, core APIs, default storage and sequencing modules. Once this feature is complete, the SDK will be repeatedly stress tested and audited for about six months until it is ready to be deployed across all mainnet chains.