Celestia is one of the hottest modular blockchain projects in 2023. Their first airdrop, known as the Genesis Drop, is currently LIVE! And their tokenomics suggests that there are more airdrops to come! In this article, we will explain what Celestia is and how to position yourself for their $TIA token airdrop.

Celestia Airdrop Step-by-Step Guide

Here’s a step-by-step guide on how to get a potential Celestia token airdrop:

- Set up a development environment.

- Install Celestia Node.

- Install Docker.

- Install Celestia App.

- Set up and run a node on the Celestia network.

See below for more details.

What is Celestia?

Celestia is a modular blockchain network that simplifies the process of deploying a blockchain. They achieve this by separating the consensus and application execution layer. In essence, Celestia provides a pluggable consensus layer, which is usually the hardest part of deploying a blockchain because of the massive computational overhead it requires. As a result, users can focus on deploying execution layers and building decentralized applications (DApps) with this feature.

How is it Different from Traditional Blockchains?

Celestia scales differently compared to traditional blockchains like Ethereum. Traditional blockchains have a monolithic architecture where all nodes perform execution, consensus, and data availability. These nodes, responsible for storing the entire blockchain history, become more costly to operate as the blockchain data grows over time.

On the other hand, Celestia has a modular architecture where the consensus and data availability layers are separated from the execution layer. This decoupling allows nodes to execute specific transactions, rather than all transactions, resulting in increased scalability.

Additionally, Celestia uses novel Data Availability Sampling (DAS) technology, which enables light nodes to prove consensus without downloading the entire blockchain and retaining security, thus allowing for bigger blocks and a larger number of transactions, resulting in further scalability improvement.

Who is the Team behind Celestia?

Celestia was co-founded in 2019 by Mustafa Al-Bassam (CEO), Ismail Khoffi (CTO), and John Adler (CRO). They have a large team of blockchain veterans who worked for large Web3 projects and organizations such as Ethereum, ConsenSys, Cosmos, Harmony, and Chainspace. In October 2022, Celestia successfully raised $55 million in a combined Series A and B round led by Bain Capital Crypto and Polychain Capital, putting the company’s valuation at $1 billion.

Does Celestia have a Token?

Yes, Celestia has its $TIA token that will be used to secure the network via proof-of-stake and pay transaction fees on the network. Additionally, the token will have a fee burn mechanism similar to EIP-1559 in Ethereum, so that burned fees will offset new token issuance as the network gains adoption. According to their documentation, 7.4% will be allocated to the public during their Genesis Drop & Incentivized Testnet, which is currently ongoing. 12.6% however will be allocated towards Future Initiatives which suggests they may do more airdrops in the future!

How to Receive Potential Celestia $TIA Token Airdrop?

The best chance to receive Celestia airdrop is to run a node on their testnet, similar to Aptos node validators. There are currently two testnets that are live: Arabica Devnet (for developers) and Mocha Testnet (for validators). According to their roadmap, we are approaching the “2023 Incentivized Testnet” phase on the road map, just before the mainnet launch. However, the incentivized testnet is not the same as the two live testnets. But it is worth a shot to try and set up a node as it could potentially include us in the snapshot. Here’s how to set up a node and get a potential Celestia token airdrop:

- Set up a development environment. Set up your development environment to run any Celestia software, which can be used for development, building binaries, and running nodes. Go to docs.celestia.org/nodes/environment for the complete guide.

- Install Celestia Node. Install the Celestia Node to be compatible with either the Mocha Testnet or Arabica Devnet. It is also another prerequisite before you can run a node. Go to docs.celestia.org/nodes/celestia-node for the complete guide.

- Install Docker. Docker is an open platform for developing, shipping, and running applications. You will need to run Celestia Node using Docker. Go to docs.celestia.org/nodes/docker-images for instructions.

- Install Celestia App. This is the last step of the prerequisites before running a node. You will need to install the Celestia App, which is a binary file that will be used to run the node. Go to docs.celestia.org/nodes/celestia-app for the steps.

- Set up and run a node on the Celestia network. There are several options for you to choose. If you are a beginner, we highly recommend getting started with running a Data-Availability Light Node.

Consensus:

Validator Node: This type of node participates in consensus by producing and voting on blocks.

Consensus Full Node: A Celestia-App Full Node to sync blockchain history.

Data Availability:

Bridge Node: This node bridges blocks between the Data-Availability network and the Consensus network.

Full Storage Node: This node stores all the data but does not connect to Consensus.

Light Node: Light clients conduct data availability sampling on the Data Availability network.

What are the eligibility criteria for Celestia $TIA airdrop?

Celestia have just announced their airdrop eligibility criteria. The criteria are in 4 major categories as follows:

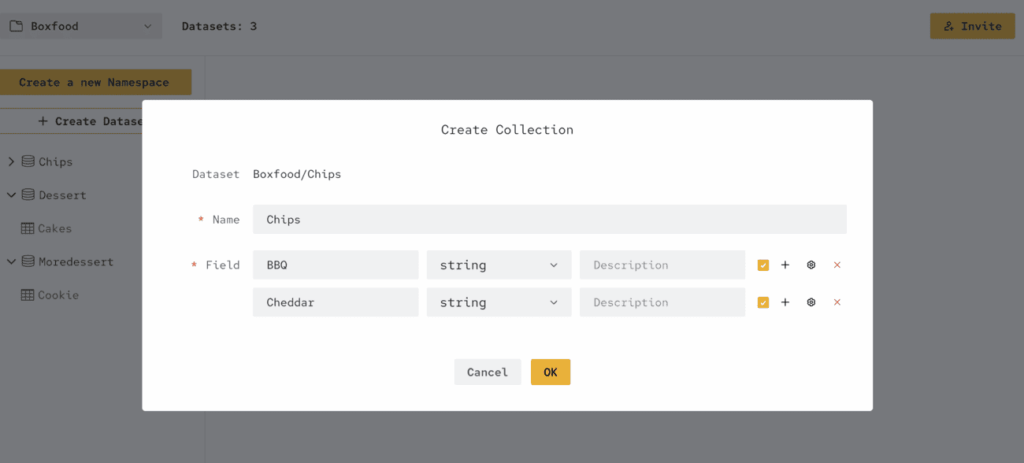

- Research and public goods: These are public GitHub contributors to key protocol infrastructure, public goods, and ETH Research.

- Early modular ecosystem: These are public GitHub contributors to rollups and key modular infrastructure.

- Early adopters, Ethereum rollups: These are the top 50% of active users of the top 10 rollups by TVL on L2 Beat as of 20th April 2023 with a balance of $50 during the snapshot taken on 1st January 2023.

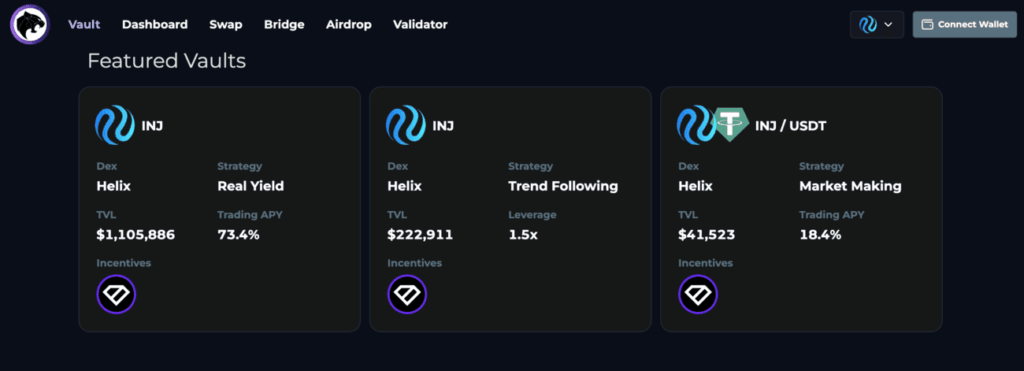

- Stakers & IBC Relayers, Cosmos Hub & Osmosis: These are stakers with at least $75 and IBC relayers on Cosmos Hub and Osmosis based on a snapshot taken on 1st January 2023.

How do I claim Celestia airdrop?

Celestia airdrop can be claimed from now until 17th October 2023 at 12:00 UTC. Those who are eligible can claim their Celestia airdrop by adding their address to the Celestia genesis block at https://genesis.celestia.org/. Tokens will then be automatically sent to the wallet.

How to get a potential season 2 airdrop?

The Celestia Genesis Drop saw 7.4% of the $TIA token supply being airdropped to the public. Their documentation however, states that 12.6% will be allocated towards Future Initiatives which suggests they may do more airdrops in the future! Here’s how you can get a potential season 2 airdrop:

- Donating on Gitcoin

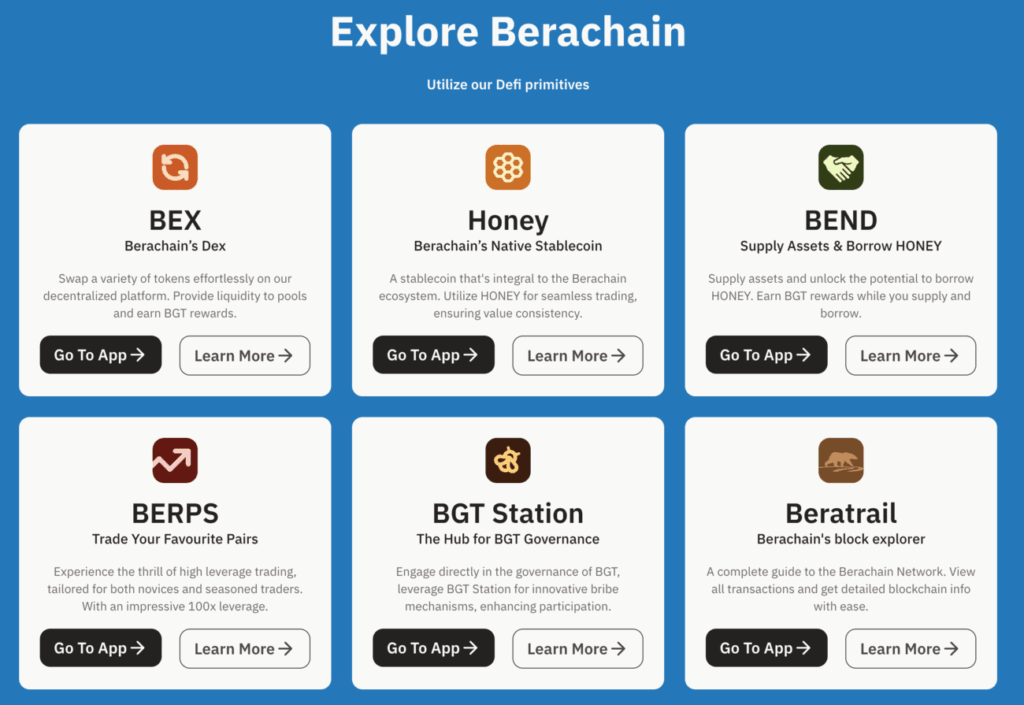

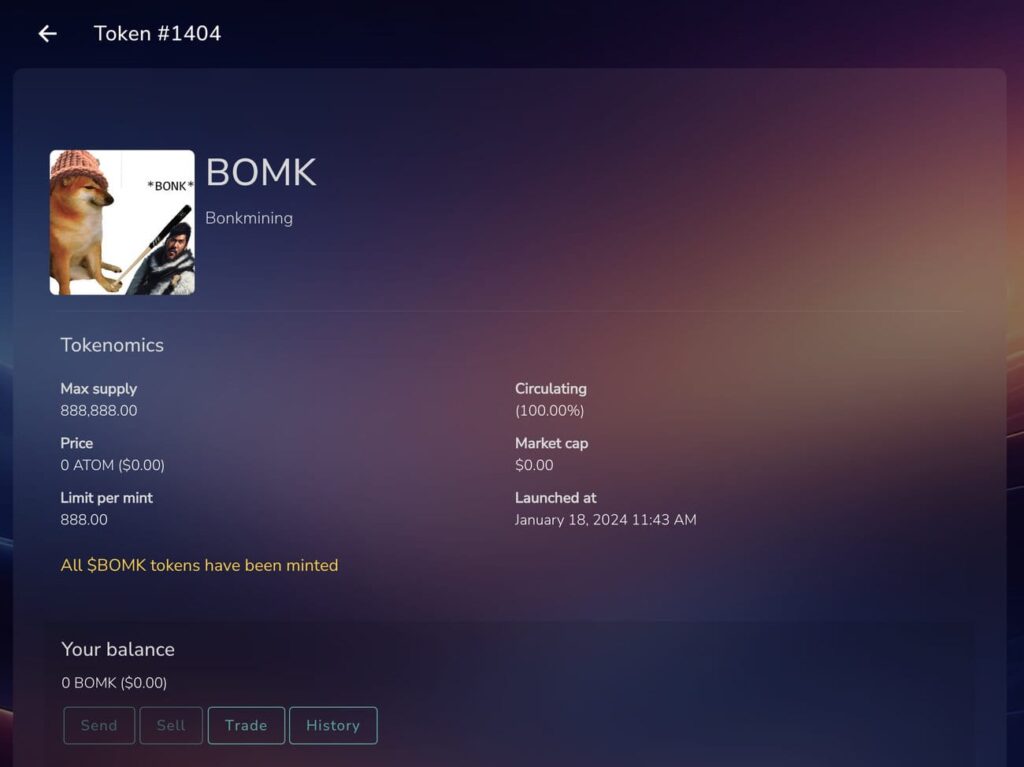

- Interacting with their protocol and ecosystem.

Where can I trade Celestia $TIA token?

Celestia $TIA token launched on 1st Novemeber 2023 and is available for trading (TIA/USDT trading pair) on the following exchanges: Bybit, Binance, OKX, Gate,io and Bitget. As at the time of writing, $TIA prices are up 22.2%!

EXCLUSIVE OFFER– 3 lucky winners that deposit 100 USDT and make 1 trade can join our iPhone 15 Pro Max 512 GB lucky draw! SIGN UP HERE

Start trading! Check out our Bybit Exchange Guide and Review

How to claim AltLayer airdrop for Celestia $TIA token stakers?

AltLayer announced details of their Airdrop Season 1. A total of 300 million $ALT tokens (i.e. 3% of the total supply) will be airdropped. The snapshot was taken at 12:00:11 on 17th January 2024 (UTC), and the AltLayer airdrop will be available to claim from 25th January to 25th February 2024. Of the $ALT tokens to be airdropped, 9.92% (i.e. 29.76 million) $ALT will be airdropped to Celestia Stakers.

However, due to technical issues, the AltLayer airdrop to $TIA stakers will only be available to claim at a later time. The AltLayer and Celestia teams are currently working together on an airdrop portal for TIA stakers. So stay tuned to AltLayer’s social media channels for further updates.

Airdrop Review

When reviewing an airdrop, there are several factors to consider. First, the likelihood the project will even do an airdrop in the first place. Then, to look at how many tokens the project intends to allocate towards airdrop campaigns, as well as the difficulty in participating in their airdrop. It is also important to look at the utility of the token so that there will be an actual use and purpose in participating in the airdrop in the first place. Finally, a factor to consider when reviewing an airdrop is whether the airdropped tokens are subject to any lockup period.

Likelihood of Airdrop: Celestia’s first airdrop, known as their Genesis Drop is currently live. And with 12.6% of their token supply being allocated towards Future Incentives, there’s a good chance there will be more airdrops to come!

Airdropped Token Allocation: 7.4% of the $TIA token supply will be allocated to the public during their ongoing Genesis Drop & Incentivized Testnet. 12.6% however will be allocated towards Future Initiatives which suggests they may do more airdrops in the future!

Airdrop Difficulty: Since it is very likely that running a node can qualify you for an airdrop, the steps involved are quite technical and difficult.

Token Utility: The token will be used to secure the network via proof-of-stake and pay transaction fees on the network.

Token Lockup: $TIA tokens which will be distributed under the public allocation will be fully unlocked at launch.