manafort.com) temp927.kinsta.cloud/what-is-ripple-and-xrp/”>Ripple has been booming lately as more and more financial institutions have started to use the service for its fast transactions and extremely low fees. As banks seek to move away from the somewhat outdated SWIFT system, the Ripple protocol and it’s token XRP has risen up as a viable alternative. Ripple is also a very controversial coin, with proponents talking about interest from banks and opponents worried about centralization and lack of real world adoption.

Will there be a demand for Ripple and XRP

Previously, there were concerns about the use of the token. In theory, it is possible to use the Ripple payment protocol without the XRP token and people were left to wonder about it’s worth. However, Ripple has recently tweeted that, “3 of the top 5 global money transfer companies plan to use XRP in payment flows in 2018”.

3 of the top 5 global money transfer companies plan to use XRP in payment flows in 2018. Even more in the pipeline. https://t.co/5JOlxe20Ur

— Ripple (@Ripple) January 5, 2018

Furthermore, the CEO of Ripple, Brad Garlinghouse, has also confirmed that banks and payment providers plan to use xRapid (the XRP liquidity product) in a serious way.

Future outlook for Ripple – serious challenger to bitcoin or scam?

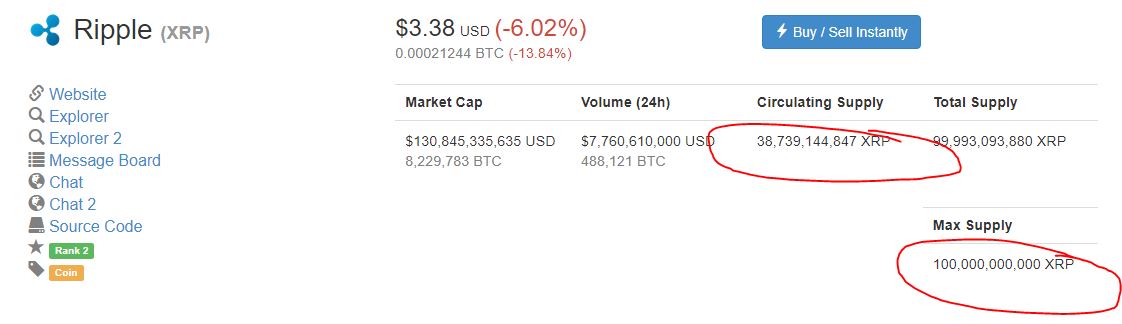

Ripple, currently second in market capitalization, has been continuing on an upward trend. At press time, the altcoin was trading at an average of $3.36. With a market cap of over $131 billion, it is over half that of bitcoin.

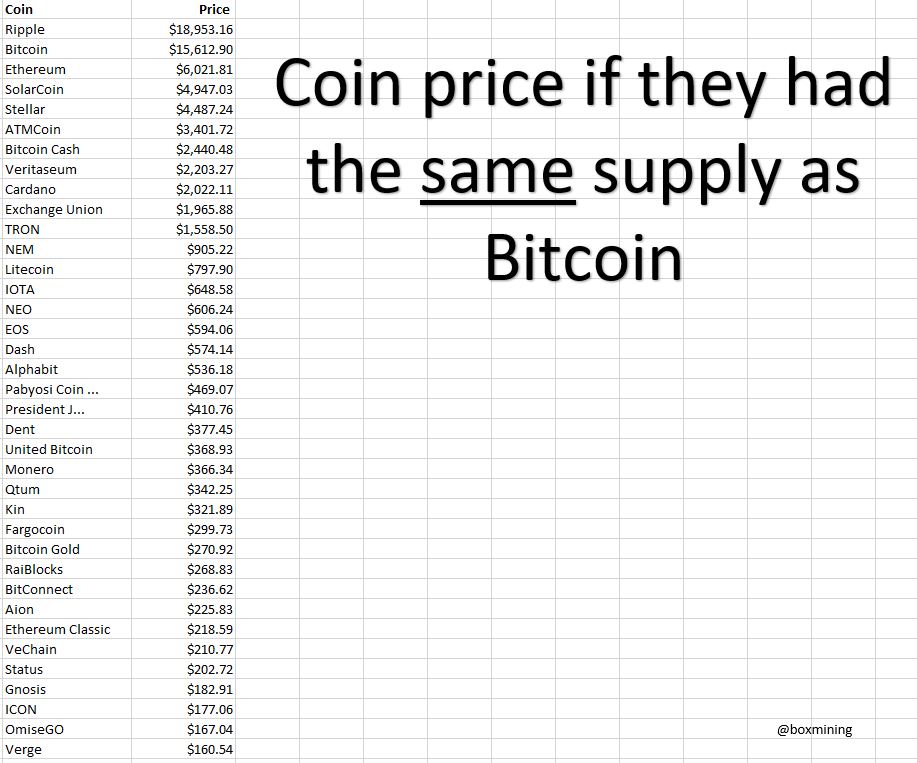

One thing to take note of though is the high supply of Ripple. Bitcoin will only ever have at most, 21 million coins in circulation. Ripple currently has over 38 billion XRP issued. If we set the supply of Ripple to 21 million, using its current market cap, each coin would be over $6,200. And looking at it that way might ward off potential investors.

The success of Ripple and other altcoins have led to an all time low for bitcoin dominance at 33.3 percent. With this recent news, will we finally be seeing a challenger to bitcoin for the top of the crypto throne or is just another flash in pan? One thing for certain is that 2018 is sure to bring much more exciting news for crypto.

https://www.youtube.com/watch?v=Y1GshH0F9Ic

Ripple Total supply vs Circulating Supply

The XRP token was created with a significant portion of it reserved for development of the coin. Unlike mining, these coins can be issued out by the owners (either the founders of ripple or Ripple Labs). This is a large difference between the circulating supply and the total supply as well, with almost 60% of XRP left to be distributed.

If XRP had the same supply as Bitcoin the Price would be walloping $18,953!