Compound Finance is a leading decentralised finance (DeFi) protocol which allows users to deposit and borrow cryptocurrencies, and earn interest whilst doing so. How Compound does this is by creating liquid money markets for cryptocurrencies by setting interest rates with the use of algorithms. They are popular mainly because they are cryptocurrency exchange Coinbase‘s first ever investment into a crypto project and prices for their $COMP token had more than doubled in the past week. In this Compound guide we cover topics such as what is Compound, how to use the platform profitably and how to earn more of their $COMP token.

For an overview, check out our explainer video on DeFi and Compound:

What is Decentralised Finance (DeFi)?

Decentralised Finance (DeFi) was designed to “cut out the middle man” i.e. banks and reduce the cost of traditional financial operations such as taking out a loan or buying property. The aim of DeFi is so that people, particularly the unbanked can have open access to every financial service on the internet with their smartphones, without needing the banking system. Smart contract platforms such as Ethereum opened the door to DeFi, whereby programs running on the blockchain can self-execute when certain conditions are met. Developers can make use of these smart contract platforms to build decentralised apps (Dapps) with various functions. Developers brought the concepts of Dapps and DeFi together by bringing functions traditionally served by banks onto smart contract platforms. Compound is an example of a DiFi app, it is a blockchain-based Dapp which allows deposits and taking out loans of cryptocurrencies on its platform.

How does Compound work?

Compound operates similar to a bank. You can deposit various cryptocurrencies and earn an annual interest on your deposits, similar to depositing your money into the bank. However, Compound’s main difference is that it does not have custody of your cryptocurrency deposits. Instead, you are actually sending your crypto to and interact with a smart contract, rather than another company or user. This feature is important because it means that no person or authority can control or take your funds.

What makes all of this so interesting is that since Compound is a DeFi platform, it does not have to follow the Federal Funds Rate. It can do something completely different and cannot be shut down since there is no central authority.

How to supply (deposit) cryptocurrencies onto Compound and earn interest

On Compound’s website you can earn interest when you deposit (Compound refers to this as “supply”) cryptocurrencies onto their platform. To do this, first load an Ethereum account with any of the cryptocurrencies supported by Compound. Then on the Dashboard, choose which cryptocurrency you wish to supply to the platform by clicking on it.

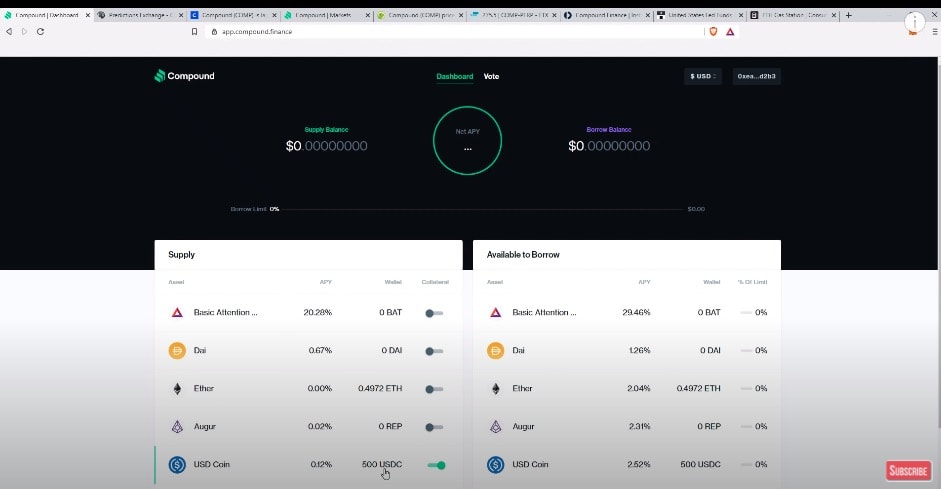

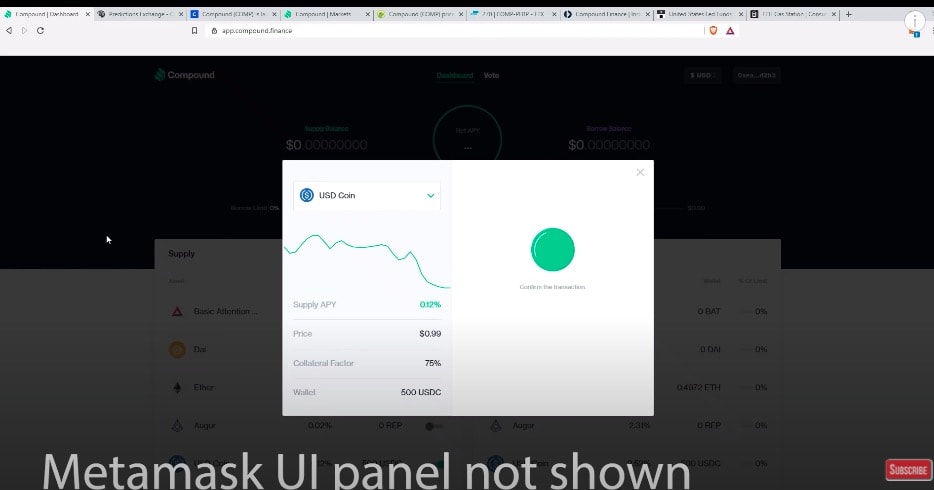

In the below image you can see that we will be depositing USD Coin (USDC) which generates an Annual Percentage Yield (APY) of 0.12%. So you can earn 0.12% per year if you supply USDC to the platform. Input the amount you wish to supply and confirm by clicking “SUPPLY”. A metamask window will pop up where you will interact with the smart contract and confirm the transaction. You will be charged gas fees for interacting with the smart contract. In our case we were charged USD$1.

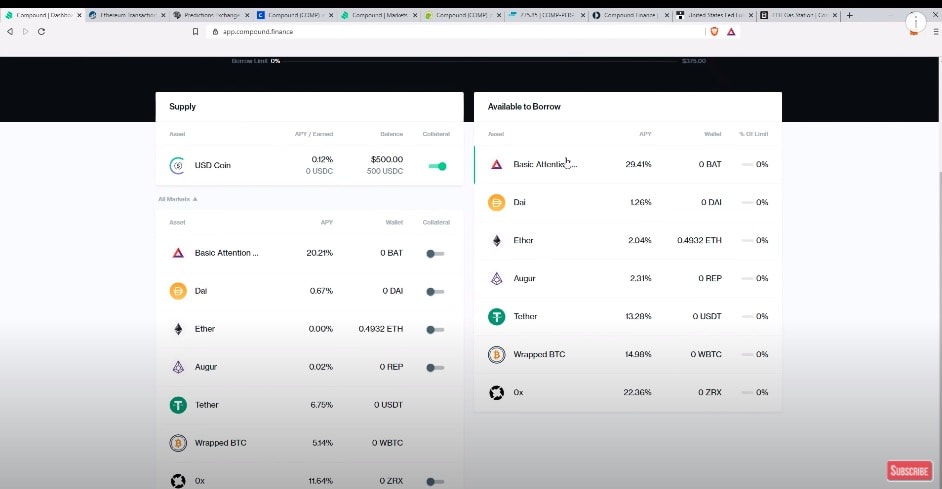

Once you have supplied cryptocurrencies onto the platform, you would be able to use Compound’s other features such as using these supplied cryptocurrencies as collateral to take out loans.

An important point to note is that Compound has floating interest rates which are subject to change. How Compound determines the interest rate is similar to the Federal Reserve, Compound would analyse the supply and demand for a particular cryptocurrency and then set a floating interest rate that will adjust based on market conditions. Compound also takes a 10% cut off your earned interest. Users can take back their cryptocurrencies at any time with a 15 second lag between executing the instruction and receiving their crypto.

How do I take out loans/ borrow cryptocurrencies on Compound?

You can use your deposited cryptocurrencies as collateral to borrow other cryptocurrencies. Compound requires users to put up 100% of the value of your intended loan. There are risks of doing this though which will be explained below where we look at Compound’s liquidation clause.

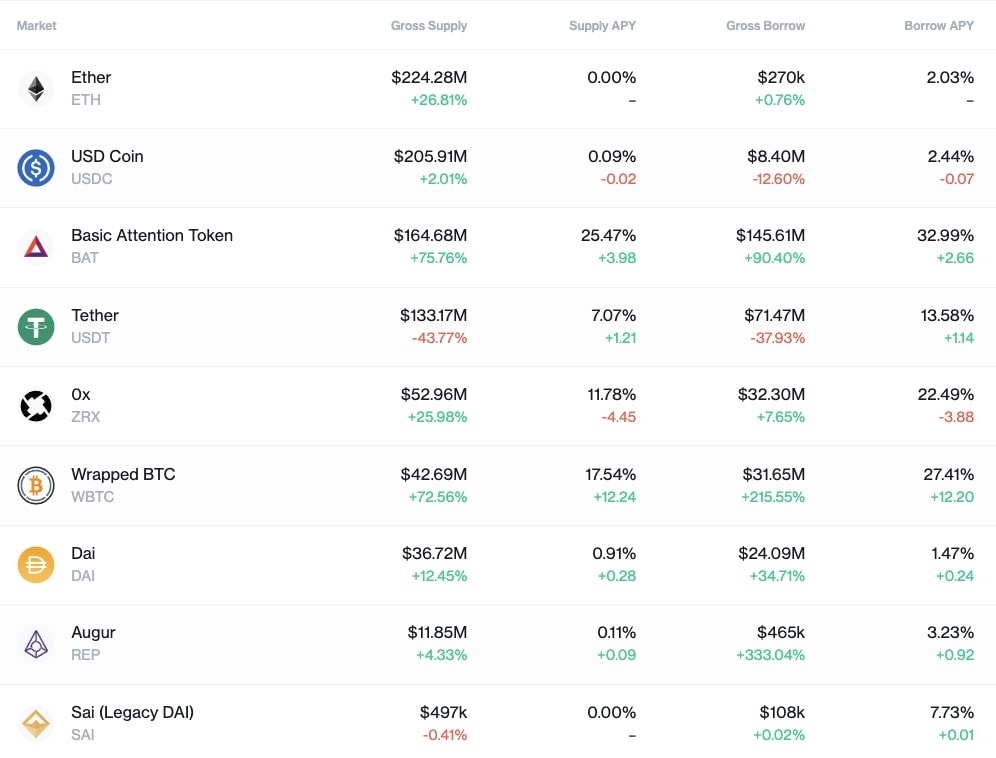

Borrowing cryptocurrencies does also require you to pay fees. For example in the below image you can see that taking out a loan of BAT will cost you a whopping 29.4% per year.

You can also see from the above image how Compound makes money, since there is a spread between the amount of interest generated from depositing, say BAT and the amount of fees you need to pay for borrowing the same.

What is $COMP token? How can I earn $COMP?

Since May 2020, Compound has transitioned to community governance. This means holders of Compound’s token, $COMP can make proposals and vote on decisions relating to how Compound is to be developed or run, e.g. what kind of collateral should Compound support, or what the interest rates should be.

There is a total supply of 10 million $COMP, of which 42.3% is reserved for distribution to users to earn when they use Compound e.g. by supplying or borrowing cryptocurrencies. For every Ethereum block, 0.5 $COMP is distributed across Compound’s 9 markets in proportion to the interest accrued in the market. And within each of these markets, the amount of distributed $COMP is divided 50:50 between suppliers and borrowers of that particular cryptocurrency. Hence the cryptocurrency which is earning the most COMP per day is always changing. Users should check Compound’s User Distribution page, where they can see the amount of interest paid per day as well as the amount of $COMP distributed to suppliers and borrowers.

You can also earn $COMP by voting on various governance proposals concerning how Compound should be run.

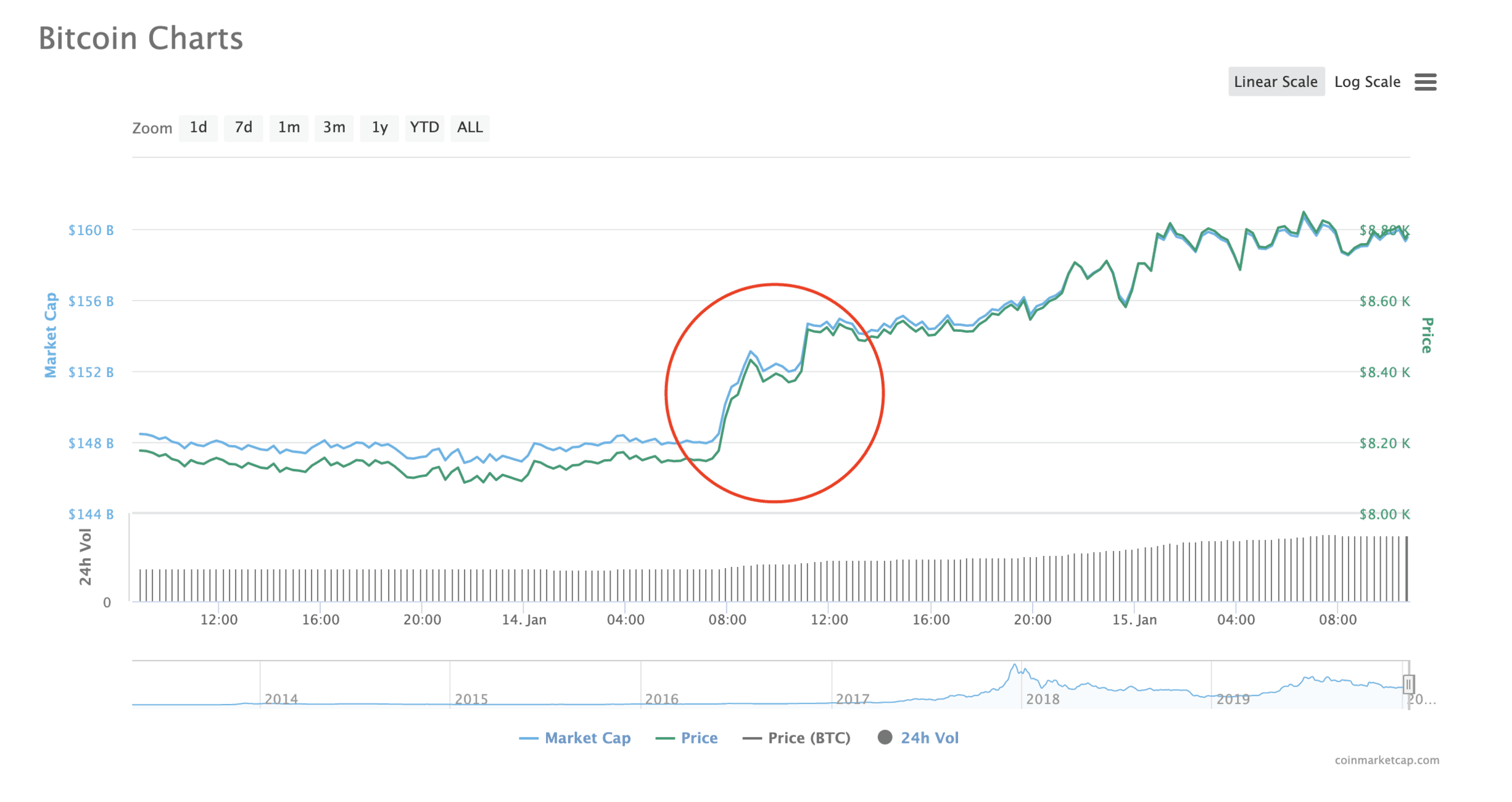

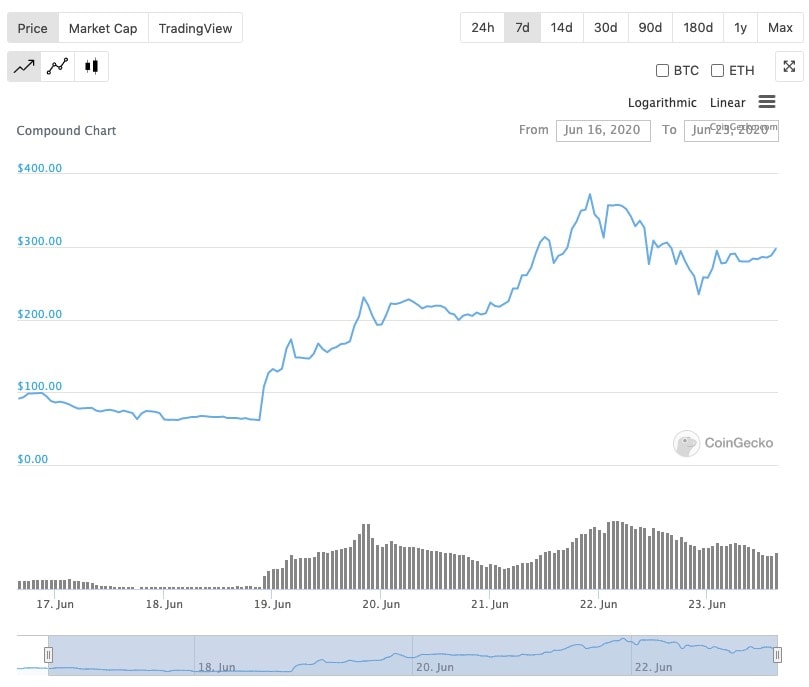

$COMP can be traded on various exchanges, such as Coinbase or FTX Exchange. And there was certainly a lot of attention focused on $COMP since prices for the token recently shot up from USD$60 to over USD$300 in a matter of days.

How are people using the Compound platform to earn 100%+ APR?

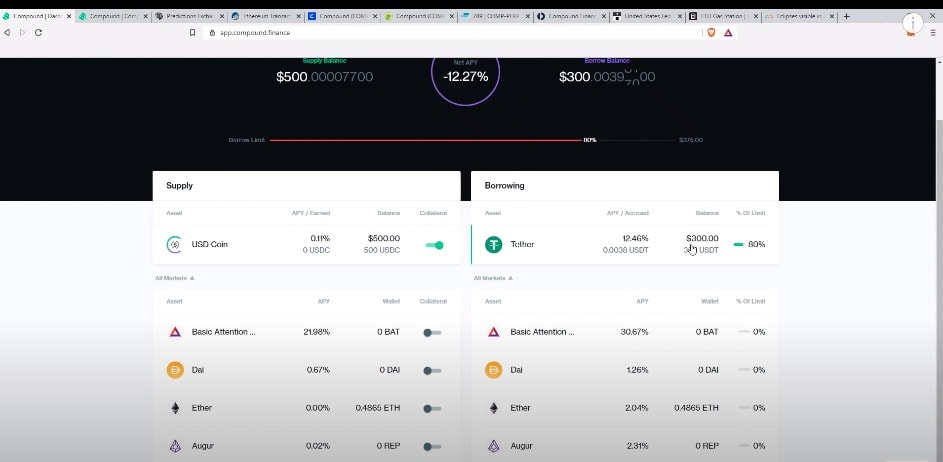

Users earn COMP when they supply or borrow cryptocurrencies on the platform. So in the below image we deposited 500 USDC and borrowed 300 USDT to get a net effective interest of -12.27% which on the face of it does not look profitable.

BUT at the same time we are also earning $COMP. This calculator shows you how much $COMP would be distributed depending on the type and amount of tokens supplied or borrowed. So as seen in the below image, whilst the net interest was -12.27% per annum, we EARNED 13.94% APY of $COMP. Basically, you are being PAID to take out a loan.

$COMP mining: Another way to potentially earn more $COMP

$COMP mining goes beyond simply supplying cryptocurrencies and profiting off the interest rates on Compound. Rather it is about getting as much $COMP rewards as possible in the shortest amount of time. Some methods even allow you to multiply your earnings by folding your position 4x.

In a nutshell, people have have been finding ways to do this by first depositing USDC, borrowing USDT and then converting the USDT to USDC. Then depositing the USDC onto the platform, leveraging it, withdrawing USDT and depositing it onto the Compound platform several times over.

What cryptocurrencies does Compound support?

Compound currently supports 9 cryptocurrencies, namely: Ether (ETH), USD Coin (USDC), Basic Attention Token (BAT), Tether (USDT), 0x (ZRX), Wrapped BTC (WBTC), Dai (DAI), Augur (Rep) and Sai (Legacy DAI) (SAI).

What are the risks of DeFi platforms?

DeFi, and any such platforms such as Compound has the main feature of being decentralised. Yet, it is decentralisation that brings associated risks. This is because instead of trusting a central authority to supervise the transactions, we are trusting the code which the smart platform was built upon. If there is a mistake in the smart contract e.g. the conditions for release of funds are set incorrectly, there is no overriding body which can correct this mistake or any customer service representative that can help. And the biggest risk of all is if the developer did not code the contract correctly making it vulnerable to hackers. An example of this was the dForce hack where hackers exploited a well-known exploit of an Ethereum token, resulting in losses of USD $25 million worth of customers’ cryptocurrencies.

Risks of using Compound: Compound’s liquidation clause

For Compound, there are risks associated with trying to earn $COMP through borrowing on the platform. Compound has a liquidation clause that kicks in when borrowing on the platform. For instance if the cryptocurrency you are borrowing increases in value and exceeds the value of your collateral, your borrowing account will become insolvent. In such case, other users can step in and repay a portion of your outstanding loan in exchange for a portion of your collateral at a liquidation incentive. This liquidation incentive is the discount at which other users can receive your collateral. So if the liquidation incentive at the time is 8% (subject to change through voting on Compound’s governance system), then other users can receive your collateral at 8% off the market price when they help repay your loan. Hence there are serious incentives for users on Compound to liquidate others and this will result in the person being liquidated to potentially suffer huge losses.

What is Compound’s aim for the future?

Currently, Compound only deals in cryptocurrencies on the Ethereum blockchain. However the Company eventually wants to expand and move into carrying tokenised versions of real-world assets, for example the US Dollar, Japanese Yen or stocks in companies such as Google.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

- MetaMask Guide: How to set up an account? PLUS tips and hacks for advanced users

- Uniswap review and tutorial: Beginners guide and advanced tips and tricks

- Serum DEX guide and review

- SushiSwap ($SUSHI) explained

- 1inch Exchange, Mooniswap and Chi GasToken: The ultimate review and guide

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.