OIN Finance ($OIN) devised a way to build a Decentralised Finance (DeFi) project that seeks to deliver what most Ethereum products can too, but on a different blockchain — the Ontology network. This can potentially solve issues of blockchain congestion and rising gas fees which recently is a cause for concern and a real obstacle to mass adoption.

As the first DeFi project running on Ontology, it is interesting to know what they have done and what they have in store in the space in the months to come.

Check out our explainer video on OIN Finance:

Background

Renard Zhang, CEO of OIN Finance and his team began the project with a three-pronged mission of promoting DeFi, becoming a gateway for DeFi, and helping it grow into a more mature market. The team helped recreate the developments of the decentralized technology from the Ethereum ecosystem into the Ontology blockchain.

What is OIN Finance?

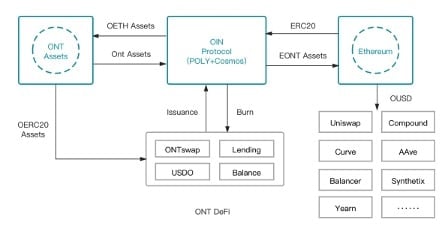

OIN Finance is a DeFi ecosystem focused on providing a liquidity pool lending platform on top of the Ontology network. Its purpose is to create a cross-chain interoperable platform for services like lending, borrowing, swapping, and minting of stablecoins.

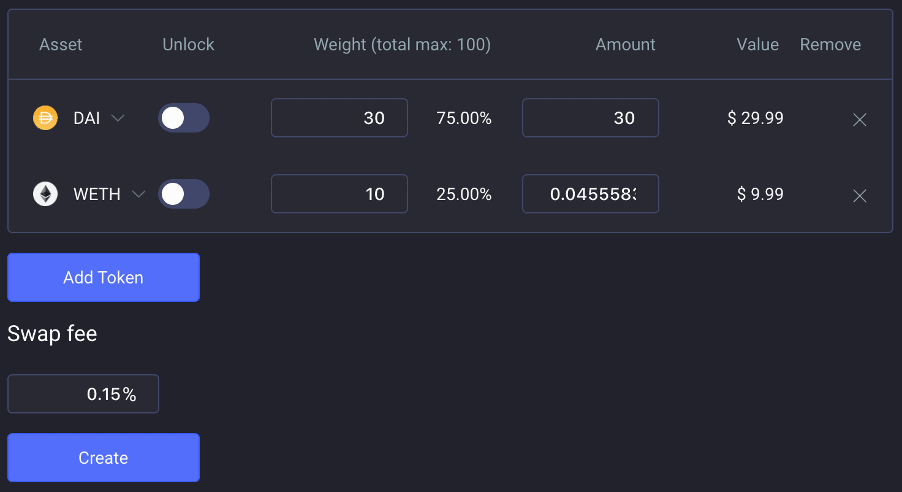

With OIN, users can add liquidity on their own decentralized exchanges (DEX) and build their own market makers through OINSwap. Another project inside the OIN ecosystem is OINLend, where users can make loans or borrow cryptocurrency assets.

Other services available in the ecosystem are OINWallet, OINDAO, and the USDO stablecoin. Through OIN’s bridge technology, these services built on the platform can be accessible to the Ethereum community, as well.

For now, OIN is focusing on building the Ontology network to provide low-cost services while avoiding the congestion problems that users experience in the Ethereum blockchain, more so recently. Once the project has a strong enough user base on the ONT DeFi platform, they can move to scale the project further.

The road ahead for OIN is to first build a community of early adopters and give them an opportunity to be a part of the initial pool of stakers. Then, it can be made available to the larger public.

Cross-chain interoperability

OIN’s architecture enables the growth of not only its own platform but also the whole DeFi space, by linking several blockchains together. Its cross-chain design opens up the platform to other existing networks to expand offerings to a vast number of users.

Decentralization

By adopting Tendermint’s consensus algorithm, nodes can function without any problem whilst trying to achieve consensus. And through its own stablecoin, there are enough incentives for nodes to continue securing and maintaining the health of the network.

Data Security

OIN uses Merkle proof to secure the data of its users. In such a set-up, any information on actions initiated on top of the Ethereum blockchain will be kept in a secure line of codes so they cannot be written back to.

OIN Finance’s Services

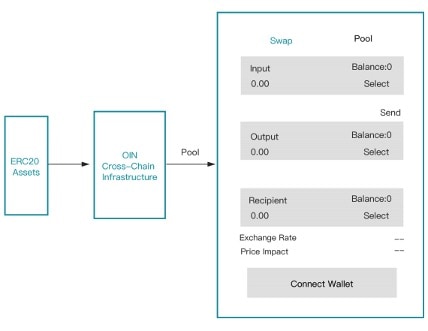

OINSwap V1 Pool

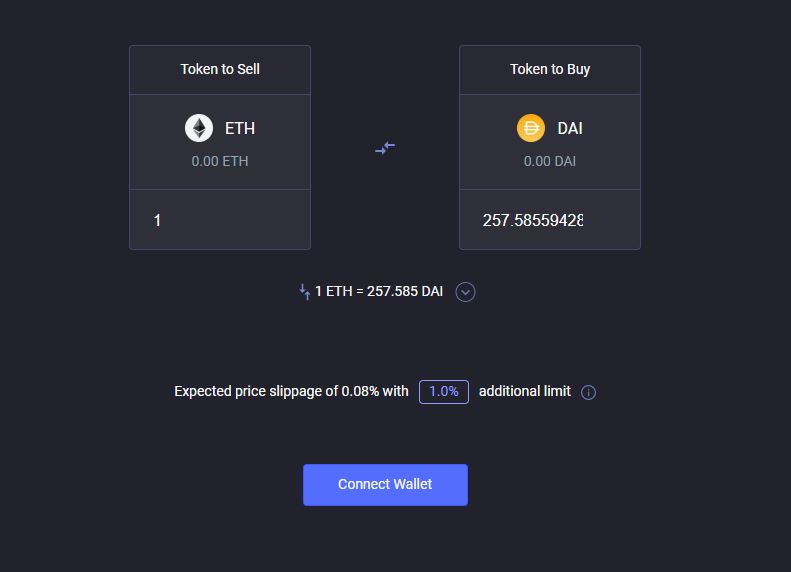

OIN will launch the first DEX on Ontology, enabling Ontology users to conveniently trade their ONT tokens with the tokens supported by OIN. The swap pool powers the whole DEX while its prices are determined by prevailing market conditions. V1 and V2 pools are currently in the works and there is no official launch date yet.

OINSwap V2 Pool

As soon as the cross-chain bridge is successful, and ERC-20 assets can run to and from the Ontology network, they can begin the operation of OIN Swap’s V2 pool. In here, OIN tokens are used to reflect the value of some tokens into OIN Swap.

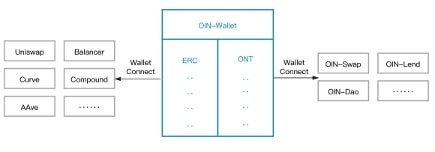

OIN Wallet

OIN Wallet can be used to store tokens supported by the Ontology and Ethereum network. As soon as the second phase of the project is completed, which is to successfully run the Ontology-Ethereum bridge, OIN wallet can be able to access other Ethereum-based DeFi projects. These are protocols such as Curve, Balancer, or Compound.

USDO

USDO is the stablecoin of the network, pegged to the US Dollar. It is the first decentralized stable token built on top of Ontology. USDO is backed by Ontology’s native token, ONT.

The stablecoin can be used to deposit into OIN Swap or OIN Lend pool to gain profits from staking and liquidity mining.

$OIN Token

OIN token is the native asset of OIN Finance. It will be utilized as the governance token, as well as for collateral rewards and clearing compensation.

Through OIN token, the platform implements a community governance model to manage operations. Elaborately, the token can be used to pay for transaction fees, staking, or community voting.

OIN token is hugely popular. The public sale of the token was around 50 times oversubscribed and was launched on Uniswap and Bitmax and BiBox on 3rd September 2020. Those lucky few that were able to get into the public sale, purchased their OIN tokens at USD$0.08, and considering prices of OIN at the time of writing is almost USD$1, these holders have every reason to be ecstatic.

OIN DAO

OIN DAO also has the ability to issue USDO. Since USDO is collateralized by ONT, it has its own pool in the Ontology platform. Those who have ONT can mint USDO at an initial collateralization rate of 300%.

The clearing mechanism (similar to how liquidations work in MakerDAO) kicks in if the collateralization of the USDO drops below 180%. But if users do not wish to borrow or lend USDO, they can send them over to OIN Swap or OIN Lend to do liquidity mining.

OIN Lend

Lending is decentralized on the OIN platform. Through smart contracts, both lenders and borrowers can safely deposit tokens to become underlying assets on the platform. Then, OIN chooses between different tokens supported by the Ethereum and Ontology network to mint OIN tokens at a specific exchange rate.

A minimum over-collateralization of 150% is required for loans, similar to other DeFi lending protocols. The interest fees are determined automatically by smart contracts based on different market factors such as supply and demand.

Interests are accumulated per block and a portion of it is kept in the reserves. This is to allow lenders the option of withdrawing their token deposits should they wish to do so.

OIN Chain

OIN Chain is a layer built on top of the OIN platform designed to support the cross-chain interoperability feature of the protocol. This will help integrate Ethereum’s DeFi projects to also supply more assets in the Ontology network. (nelsongreerpainting)

It will be a multi-functional adaptor that will bridge both Ethereum and Ontology, as well as more public chains in other developments ahead.

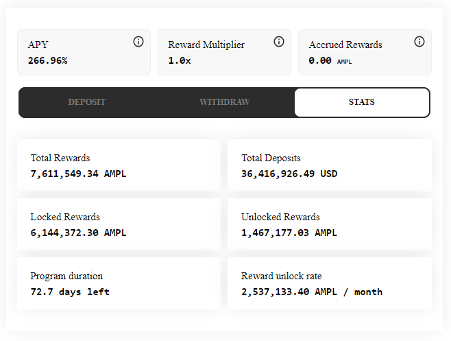

Liquidity Mining and Staking

Half of all the OIN token supply is generated from liquidity mining and staking. The supply created via stakers will be derived from USDO collateral pools collected in the OIN DAO and OIN Lend platforms.

OIN tokens that are created by way of liquidity mining will be injected in the OIN Swap pools. Once the OIN Lend pool is made available with its cross-chain architecture in place, ERC-20 compliant tokens can be staked too.

Exactly 40% of all minted tokens are distributed every day via staking rewards, while the remaining 60% will be distributed as liquidity mining rewards. Through OIN DAO, the community can decide how to shift the ratio of the daily reward allocation for the network.

Conclusion

As one of the pioneers of DeFi on the Ontology network, the outlook for OIN Finance appears increasingly positive, especially with Ethereum’s rising gas fees. While the number of DeFi projects launched on the Ethereum blockchain increases daily, whether they can continue to sustain their operations continues to be a prevailing concern.

Establishing a successful proof of concept on top of other platforms for DeFi projects can be helpful for the community and whole crypto space at large. After all, it only adds more options for users to explore the services that fit their needs best.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

- MetaMask Guide: How to set up an account? PLUS tips and hacks for advanced users

- Uniswap review and tutorial: Beginners guide and advanced tips and tricks

- Serum DEX guide and review

- SushiSwap ($SUSHI) explained

- 1inch Exchange, Mooniswap and Chi GasToken: The ultimate review and guide

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.