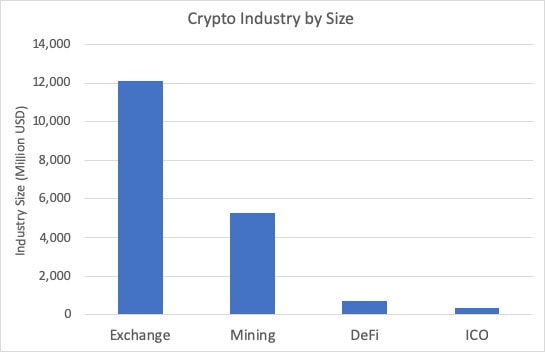

Bitmain, the world’s leading cryptocurrency mining company, has seen a huge $300 million profit in its first four months of 2020. This greatly alleviates fears of a “collapse” in the Bitcoin mining industry caused by the Bitcoin Halving – which effectively reduced miner’s revenue by half. Bitcoin mining is a multi-billion dollar industry and is set to be one of the most profitable sectors in the cryptocurrency space. Find out more about Bitcoin mining in our guide.

In an Industry blog, Wu Said Blockchain, first reported the news after Bitmain told their staff internally of the around $300 million profit. As a reward for their hard work, Bitmain employees received big Labour Day bonuses totaling 7,000 Yuan (around $9,900).

Quite what prompted these gains was not revealed but the reports suggested that a large part came from ventures not pertaining to cryptocurrency mining. The main area is in Artificial Intelligence (AI), a field they entered in 2018.

Since then, Bitmain’s AIs growth has been fast and they have launched chip designs that companies can use to power their AI systems and software. The blog post mentioned a large order of their AI chip BM1684 which was said to be worth “millions” and seemed to suggest it could account for the large profit windfall.

That is not to say that Bitcoin mining has taken a back seat. Bitmain has also opened four new mining farms and has seen a hash rate increase in its other pools. However, the headlines following Bitmain in recent times had painted a vastly different picture of life inside the company and its economic health.

Bitmain’s Losses and Internal Disputes

Earlier this year, reports came out claiming Bitmain was in serious strife and were set to lay off 50% of their staff amid concerns about Bitcoin’s May halving. The company had already cut staff in 2018 and with market share decline evident in 2019 many felt Bitmain would become a tragedy of the “crypto winter”. Performance problems from their mining rigs, like the Bitmain S17/T17 Antminer, only seemed to compound their issues.

The most notable problem though was Bitmain’s internal conflicts between the top tier staff. The two founders and CEOs of the company, Jihan Wu and Micree Ketuan Zhan have been at loggerheads for months.

Leaks in early 2019 had suggested Jihan Wu was set to give up his CEO position and take a limited role in the company. Yet, in October 2019 Wu made the shocking decision of ousting his longtime partner Zhan, who was Chairman of Bitmain at the time. In an email to staff, Wu told his employees to cease all contact with Zhan and that he was back to save the company.

Zhan has filed two lawsuits against Bitmain and the AI subsidiary, which is called Fujian Zhanhua Intelligence Technologies. The disgruntled former senior executive is looking for a way back into Bitmain and released a statement saying: “I will fight for her [Bitmain] till the end with legal weapons. I won’t allow those who want to plot against Bitmain to succeed. If someone wants a war, we will give them one.”

The case continues but for now it would seem that Wu has the upper hand, especially with business doing so well at Bitmain.