Flamingo Finance aims to provide everything a DeFi user needs in one swipe. The project is also built on the NEO blockchain, enabling it to evade the high cost and congestion of Ethereum. Here, we take a deeper look at Flamingo, why it chose NEO, its native token, and what it has to offer to DeFi enthusiasts.

Background

The protocol is a NEO Foundation project brought to life through the NEO Global Development (NGD) team and is meant to expand NEO’s vision of a smart economy. Flamingo offers an all-round service to its users by taking care of back end and front end issues under one platform.

What is Flamingo Finance

Flamingo is a full-stack DeFi protocol that is interoperable and powered by the NEO blockchain. Operations on the network are divided into distinct components to enable a smooth operation for the platform. (Modafinil) Currently, the system supports access using the NeoLine wallet for NEO assets, Metamask wallet for Ether (ETH) holders, and Cyano plugin wallet for ONT token holders.

Flamingo’s 5 Key Components

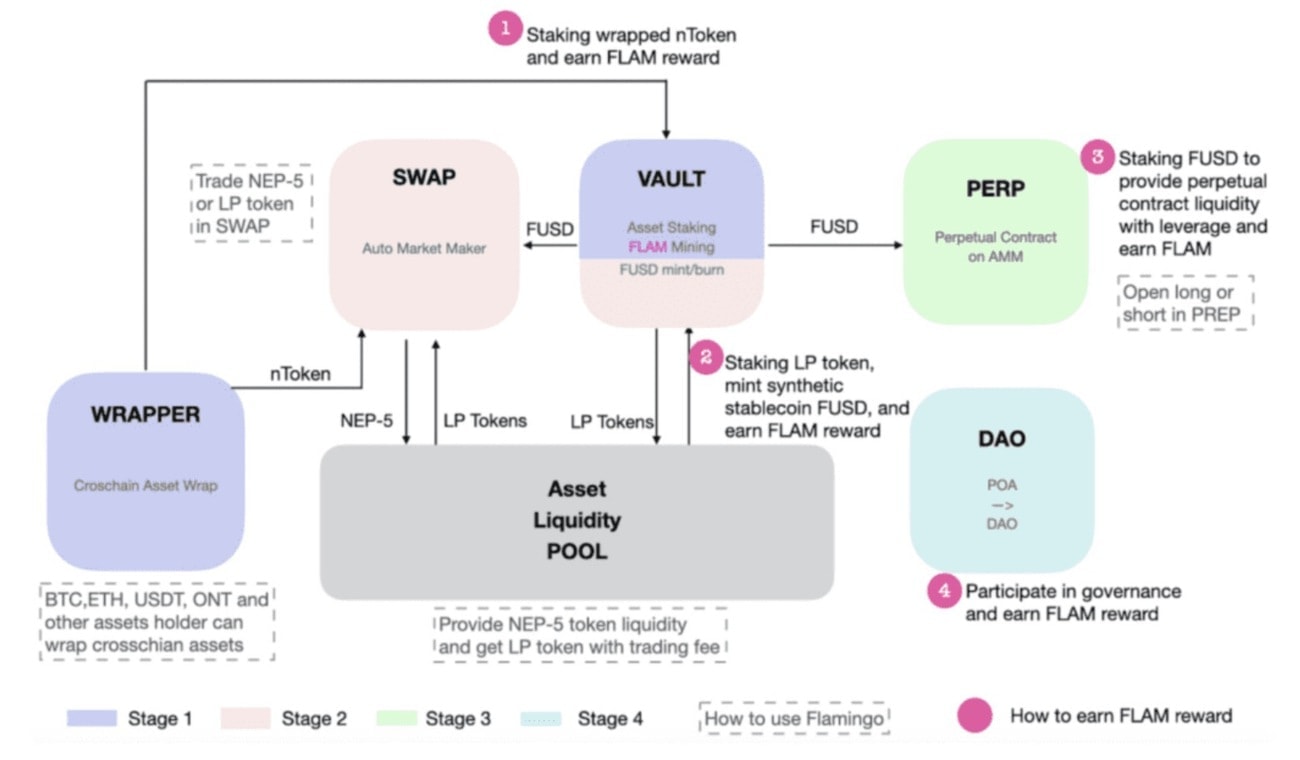

Swap

This handles automatic on-chain market making. The module interacts with wrapped tokens on the parent blockchain to provide liquidity. Uniswap, a leading DeFi platform, inspires its approach to automated market making. Liquidity Providers (LPs) converge on a pool by providing tokens with NEO’s standard, NEP-5.

Wrapper

Flamingo uses this component to power inter-chain interaction of blockchain assets. Wrapper works with Bitcoin, Ethereum, NEO, and Ontology, where tokens from these platforms can be ‘wrapped’ by being converted to NEP-5 tokens and used on the NEO network.

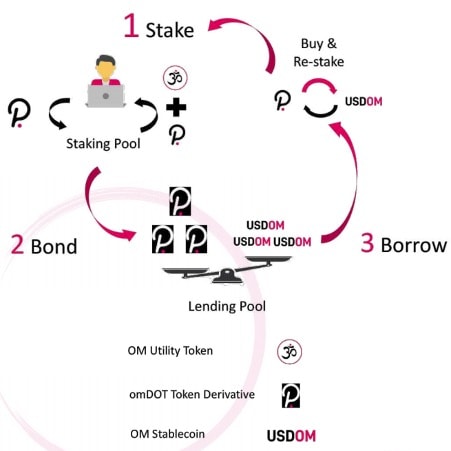

Vault

The Vault module provides an interface for managing, mining, and staking assets. Also, it handles the issuance of collateralized stablecoins. Vault stakers earn rewards in the form of the platform’s native token, FLM (more on the token later).

Vault is projected to go live anytime between September 25 and 29 in 2020.

Perp

Perp is derived from the word perpetual and is designed with perpetual contracts in mind. It uses automatic market-making to power a perpetual contract exchange that deals with a host of assets. The exchange has a leverage of up to 10X for both long and short positions.

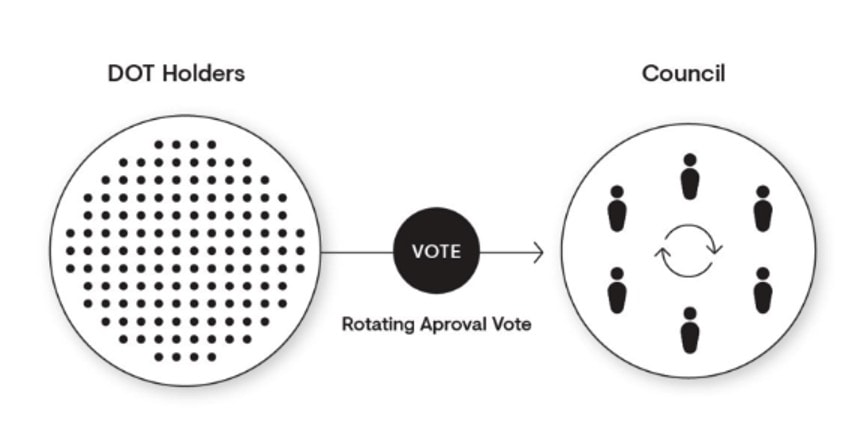

Decentralized Autonomous Organization (DAO)

In the decentralized world, everything should be distributed, including governance. Flamingo uses DAO to allow for optimum community involvement in the running of the platform. Issues that fall under DAO include token economics, functionality changes, and parameter configuration.

Generally, DAO has a say in things happening on the Wrapper, Swap, Perp, and Vault modules.

Flamingo Finance Token (FLM) and Flamingo USD (FUSD)

FLM is Flamingo’s native currency dedicated to governance. It’s built using NEO’s NEP-5 standard. Interestingly, the token does not have a cap on its maximum supply.

FLM coins are distributed to the community with regards to participation on the network. For example, the token will be given for staking cross-chain assets, staking LP tokens, minting FUSD, depositing stablecoins to provide a margin when interacting with perpetual contracts, and contributing to governance proposals.

Note that before DAO takes over the governance, the Flamingo team will address governance issues through proof-of-authority (POA). FLM can be held by anyone wishing to join the NEO DeFi ecosystem. Furthermore, FLM holders are entitled to submit proposals to the DAO and also be able to vote for submitted proposals.

Flamingo supports FIP and FCCP proposals.

Flamingo Improvement Proposal (FIP) involves anything related to system design features such as risk control, liquidation, and liquidity improvement. Flamingo Configuration Change Proposal (FCCP), on the other hand, contains proposals directed towards the FLM release schedule, staking, fee structure, FLM distribution mechanism on the Perp module, etc.

FUSD is a stablecoin on the platform that is pegged to the US dollar (USD). Staking LP tokens allows one to mint the stablecoin. However, to unlock their collaterals, the minted FUSD has to be burnt.

Key strengths of Flamingo Finance

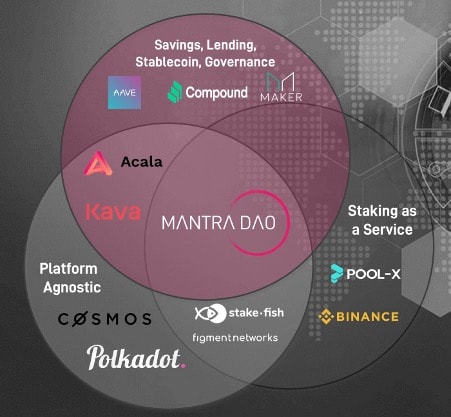

Interoperability

Flamingo is part of an ecosystem made up of NEO and the Poly network. Poly is a protocol developed on NEO in conjunction with Switcheo Network and Ontology. The protocol connects to other blockchain platforms such as Cosmos, Bitcoin, Ontology, and Ethereum.

To bring the interoperability factor, Flamingo connects to NEO, NEO connects to Poly, and Poly connects to other decentralized networks.

Capital Efficiency

Popular decentralized exchanges (DEXs) using an automatic market maker model underutilize capital from LPs. Flamingo provides capital efficiency by clustering individual aspects such as a liquidity pool (LP) and a collateral pool.

For instance, Swap handles the LP while Vault provides the collateral pool. Therefore, LPs can provide liquidity in Swap and still stake their tokens in Vault.

Fair Launch

To enable a fair launch for all, the platform does not support a pre-mine. Neither does it allocate coins to its founding team. Instead, all FLM tokens are distributed to the community.

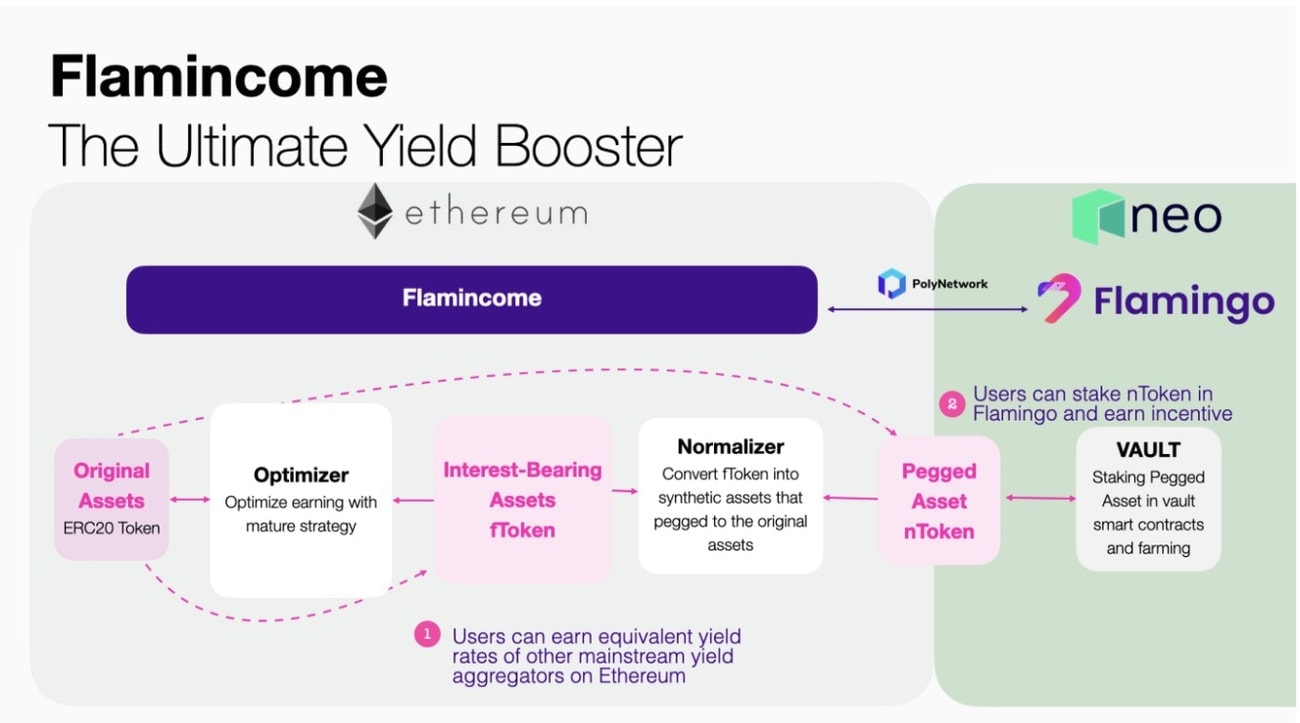

What is Flamincome?

Being a DeFi-focused platform, it has a dedicated platform for yield farming or liquidity mining; Flamincome. The system provides yield farming functionalities identical to those offered by Yearn.Finance (YFI).

Flamincome comprises an optimizer and a normalizer. An optimizer converts staked assets into interest-focused assets, while a normalizer changes interest-based assets into synthetic assets with a 1:1 peg ratio to the underlying asset. Synthetic assets can be transferred to other DeFi networks for additional liquidity mining.

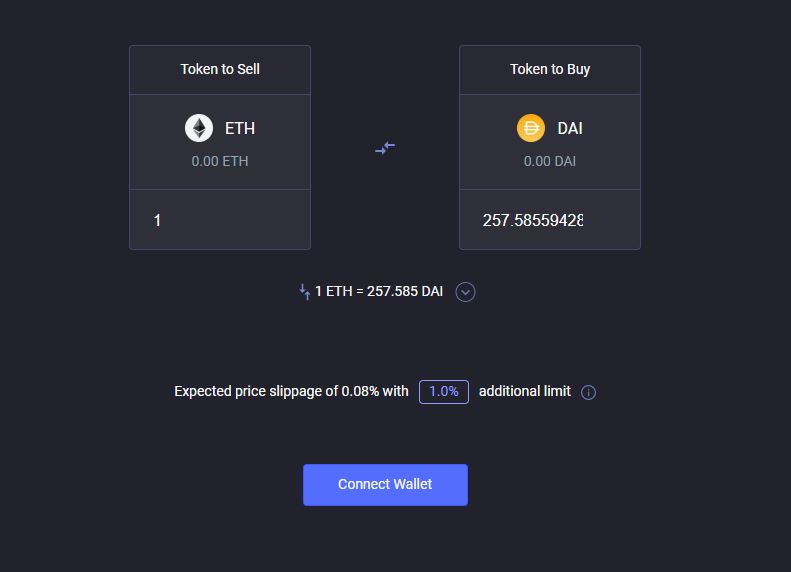

Flamingo Swap: What is it?

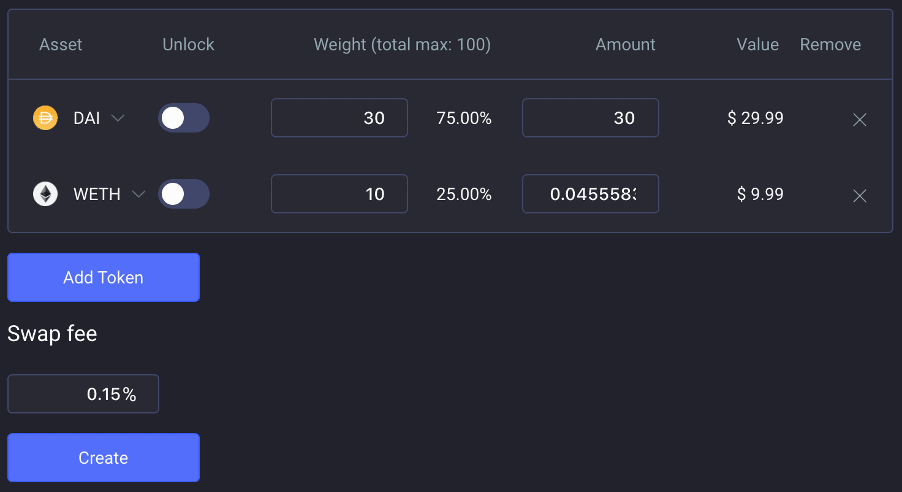

Flamingo Swap is one of the modules on Flamingo Finance’s DeFi platform. It is an on-chain automated market maker powered exchange that allows users to swap one token from another. Similar to other swapping platforms, Flamingo Swap needs users to add token pairs into these pools which in turn creates a supply for traders to come in and exchange tokens. Users i.e. LPs who add tokens to specified pools are rewarded for their contribution as they receive a distribution of the trading fees (currently 0.3% per swap) and LP Tokens. The LPs can then stake these LP Tokens in the Vault and get FLM in return.

Note the below section titled “Flamingo swap launch and change of $FLM distribution: 5th Oct 2020” to see which Vaults are eligible for distribution of FLM rewards.

How to add liquidity to Flamingo Swap and what are my rewards?

By way of example, if you wanted to be a LP for the FLM/nNEO trading pair you would need to do the following steps:

- Go to the “Pool” tab on the Swap page;

- connect your NeoLine wallet;

- click “Add Liquidity” and choose FLM and nNEO. Note the the amount deposited must be of equal value based on the market price of the tokens but this will be calculated for you;

- check the respective exchange prices for the FLM and nNEO tokens and the share of the pool your liquidity will form after adding the same. If this is confirmed by you, click “Supply” and confirm; and

- the NeoLine wallet will pop up and you will be asked to adjust and agree to the GAS fee to be paid for this transaction.

For a full walkthrough on how to provide liquidity to Swap and withdraw your liquidity from the same, click here.

LPs will be rewarded with LP Tokens, in this illustration, the LP would get FLP-FLM-nNEO tokens. They will also get a share of the fees collected from traders equal to the proportion of their liquidity in a pool. So for example, if their deposited liquidity forms 2% of the FLM/nNEO pool they would get 2% of all the trading fees paid by traders, which is 0.3% per swap.

LPs can then stake their LP Tokens in specified trading pairs to get FLM. For a walkthrough on how to stake assets, claim FLM and remove your staked assets from the Vault, check out the detailed guide from Flamingo here.

LATEST NEWS

Are you eligible for refund of Flamincome withdrawal fees?

Due to an issue with the Flamincome interface, some users who withdraw USDT before 5:00am (UTC) on 26th September 2020 were charged 0.5% withdrawal fees without their knowledge. Flamingcome will refund the withdrawal fees to these users, which Founder Da Hongfei said on Twitter he will “personally subsidize”.

There is also a proposal being put forward to extend this refund period to any deposits that were made before 5:00am (UTC) on 26th September 2020 but “…withdrawn before 3 hours after the MintRush Resume.” Which from our understanding would be 4:00pm (UTC) on 25th September 2020.

Flamingo swap launch and change of $FLM distribution: 5th Oct 2020

At the initial launch of Flamingo Swap, only 6 trading pairs will be supported i.e. FLM/nNEO, pnWBTC/nNEO, pnWETH/nNEO pONT/nNEO, nNEO/pnUSDT and pnWBTC/pnUSDT.

As Mint Rush 2 has finished distribution of rewards, FLM tokens will no longer be distributed to single-asset stakers. Instead, only users who stake LP Tokens from specified trading pairs in the Vault will continue receiving FLM. From 1:00pm (UTC) on 5th October 2020 to 1:00pm (UTC) on 7th October 2020, 2,857,143 FLM will be distributed per day to these trading pairs in the following proportions:

- FLP-FLM-nNEO 20%

- FLP-pnWBTC-nNEO 20%

- FLP-pnWETH-nNEO 10%

- FLP-pONT-nNEO 5%

- FLP-nNEO-pnUSDT 20%

- FLP-pnWBTC-pnUSDT 25%

From 1:00pm (UTC) on 7th October 2020 to 1:00pm (UTC) on 14th October 2020, 1,071,429 FLM will be distributed per day in the same proportion as above.

SCAM ALERT: Flamingo airdrop

There is currently a Flamingo airdrop scam which asks participants to send their NEO tokens to a “designated contribution address” where you can get FLM tokens at a rate of 1 NEO=1,000 FLM.

The @FlamingoAirdrop as well as the FlamingoFinanceAirdop Telegram Channels are FAKE. Be careful!

I have all this FLM? What happens next?

FLM is currently listed on the following exchanges: Binance, FTX (FLM-PERP)

Conclusion

A full-stack DeFi protocol, like Flamingo, presents numerous advantages to DeFi users. And among them is capital efficiency, where LPs can provide liquidity and collateral at the same time.

The inclusion of a yield farming system gives DeFi enthusiasts a similar but improved network to YFI and SushiSwap.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

- MetaMask Guide: How to set up an account? PLUS tips and hacks for advanced users

- Uniswap review and tutorial: Beginners guide and advanced tips and tricks

- Serum DEX guide and review

- SushiSwap ($SUSHI) explained

- 1inch Exchange, Mooniswap and Chi GasToken: The ultimate review and guide

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.