HMX is a decentralized perpetual exchange on Arbitrum that offers leveraged trading and market making with cross-margin and multi-asset collateral. The project will be launching 5 tokens- $HMX, $HLP, $esHMX, Dragon Points ($DP), and Trader’s Loyalty Credits ($TLC). HMX have also confirmed they will do an airdrop of its $esHMX tokens. Here is our guide on how to get the $esHMX airdrop.

Learn more about the Arbitrum airdrop!

What is HMX?

HMX is a decentralized perpetual exchange that offers leveraged trading, leveraged market making, and rewarding incentive programs on Arbitrum. Here are some key features of HMX:

- Leveraged trading: HMX offers leveraged trading on many asset classes with up to 1,000x leverage and cross-margin & multi-asset collateral support.

- Leveraged Market Making (HLP Vault): Users can become market makers on HMX by depositing assets into HLP, a unique vault built on top of GMX’s $GLP token. As at July 2023, the HLP APR is at 38%, and GLP is at 15%. Also, the yields for HLP will never be lower than GLP because HLD also accrues yields from GLP.

- Incentive programs: HMX offers rewards for its platform users. For example, Traders’ Loyalty Credit where for every $1 of trading volume, users will receive 1 $TLC. $TLC can then be staked to earn $HMX. HMX also offers rewards in $esHMX for keeping open leveraged positions and liquidity providers. The project also offers a referral program.

What are HMX tokens?

$HMX token is the Governance token of HMX Protocol, it also accrues value from platform revenue. It has a total fixed supply of 10,000,000 tokens, of this, 40% is allocated towards community incentives. Community incentives however, will be distributed in the form of $esHMX (i.e. escrowed HMX). $esEMX cannot be traded unless it is first vested, but it does possess the same utilities as $HMX tokens.

Meanwhile, users receive $HLP tokens by depositing their assets into the HLP vault, which provides liquidity for leveraged traders at HMX. Each HLP token represents a share of the ownership of assets within the HLP vault. Dragon Points ($DP) is designed to reward long-term supporters of HMX without creating inflation on the HMX tokens. $DP owners can stake them to earn a share of protocol revenue, which is split among staked $esHMX and $HMX. Finally, HMX users will receive 1 $TLC token for every $1 of trading volume. HMX rewards are distributed pro-rata to traders based on their TLC amount each week.

Will there be an HMX token airdrop?

HMX have announced 2 ways to qualify for the HMX token airdrop, either by completing campaigns on Zealy or to become a beta tester. The airdrop will run from 21st June 2023 to around mid to late July 2023. Note that HMX will be airdropping $esHMX tokens i.e. an escrowed version of $HMX. So users will need to vest $esHMX to convert the tokens into $HMX. Here’s how to qualify for the HMX token airdrop.

Time needed: 25 minutes

- Complete airdrop campaigns on Zealy

Go to HMX’s Zealy Questboard and complete the tasks. Tasks include social tasks, interacting with the HMX platform and answering quizzes. Note that the team will continuously update the tasks so it is a good idea to check back often for new ones.

- Become a beta tester on HMX

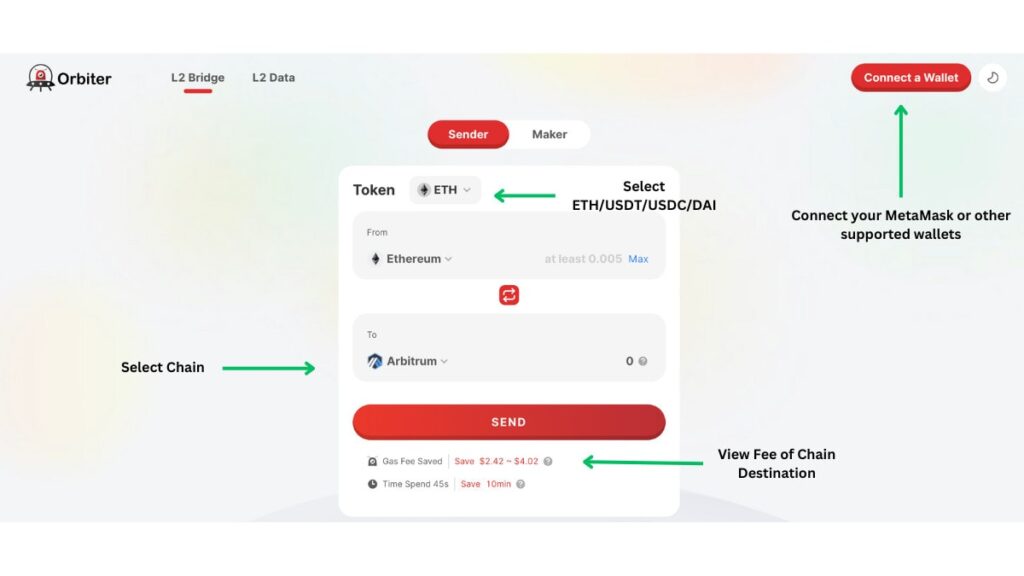

Complete the following tasks on HMX to earn points, which will give you a larger share of the airdrop. Firstly, open a leveraged position on a (1) cryptocurrency market; (2) equity market; (3) FX market; and (4) commodity market. Secondly, make a deposit into the HLP liquidity pool.

The total number of points earned will be calculated based on the combination of your transaction value and number of transactions.

Airdrop review

When reviewing an airdrop, there are several factors to consider. First, the likelihood the project will even do an airdrop in the first place. Then, to look at how many tokens the project intends to allocate towards airdrop campaigns, as well as the difficulty in participating in their airdrop. It is also important to look at the utility of the token so that there will be an actual use and purpose in participating in the airdrop in the first place. Finally, a factor to consider when reviewing an airdrop is whether the airdropped tokens are subject to any lockup period.

Likelihood of Airdrop: HMX have confirmed they will do an airdrop, which is now live!

Airdropped Token Allocation: The allocation of $esHMX tokens to eligible participants (i.e. early Perp88 users, beta testers, and participants of Zealy campaigns) will be based on the cumulative trading volume of HMX achieved from now until one month after the Public Open Beta of HMX ends. The Public Open Beta is expected to end around mid-August.

Airdrop Difficulty: HMX airdrop tasks are not difficult as they are mostly social tasks and opening positions in various markets. However, as it is an open beta, you will need to use real funds when trading.

Token Utility: $esHMX tokens will be airdropped to qualifying participants. These will then need to be vested in order to become $HMX. Meanwhile, $HMX is the governance token of the HMX Protocol.

Token Lockup: There will not be any lockup period for $HMX tokens.