LATOKEN is an Estonia-based cryptocurrency exchange offering users a multi-asset crypto trading platform, financial services, FinTech, cryptocurrency wallet, and a neobank. In this LATOKEN review, we’ll take a look at the company behind the platform, exploring the platform’s features, supported cryptocurrencies, customer service, and more.

Sign up here to get started.

What is LATOKEN?

LATOKEN, a cryptocurrency exchange based in Estonia, was founded in 2017 by CEO Valentin Preobrazhensky and three other experts. With a current staff of around 270 employees, LATOKEN has experienced rapid growth since its inception.

LATOKEN offers users the ability to trade digital assets. It has evolved from its original goal of creating a multi-asset crypto trading platform to become a regular platform for trading digital assets with additional features.

In addition to crypto trading, the company also offers users a range of financial services, FinTech solutions, a cryptocurrency wallet, and a neobank – an online-only banking service.

LATOKEN is currently ranked 111th on CoinMarketCap based on its exchange score, but its daily trading volume places it much higher at around 60th position. CoinMarketCap’s Top-20 rankings in March 2019 saw HitBTC enter the list, showing that the exchange is a worthy competitor in the cryptocurrency exchange space.

Key Features and Advantages of LATOKEN

Additional Services

LATOKEN is a cryptocurrency trading platform that offers more than just an exchange. It also provides users with digital wallets for their cryptocurrencies, loans, and other services. LATOKEN’s official website offers investors the chance to invest in startups on the world’s largest IEO Launchpad. Before investing, it is important to understand the risks and do thorough research to avoid potential losses.

You can refer your friends to the platform and get rewarded. When someone signs up using your referral link, you’ll get a $50 credit that can be used to pay 25% of fees. Plus, you’ll get money when those people start trading.

You can list your project on the LATOKEN exchange and take advantage of the referral program to attract organic traders, as well as improve the performance of your digital asset. Additionally, you can access more than 500k LATOKEN users worldwide via Data Room or Online Video Pitch and pitch to thousands of investors from the LATOKEN network. Furthermore, you can perform various tasks and earn crypto rewards for doing that.

VCTV (Venture Capital Television) is the perfect platform to pitch your startup to investors. With its focus on technology and entrepreneurship, VCTV provides feedback and valuable contacts that can help you in the future. Currently, LATOKEN has 25 major investors.

Wide Range of Assets to Choose From

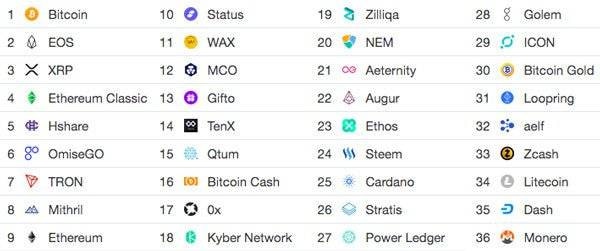

LATOKEN offers an extensive selection of cryptocurrencies, with more than 250 supported coins, including:

- Bitcoin

- Ethereum

- Cardano

- Dogecoin

- Ripple

- USD Coin

- EOS

- Litecoin

- and 250 more

LATOKEN supports a wide range of cryptocurrencies, including the most popular ones such as Bitcoin, Ethereum, and Litecoin, as well as lesser-known tokens. However, it is important to note that some of these tokens may not be as reputable as the more popular ones, so it is important to do your own research before investing.

Easy to Start Trading

Usability is an important factor to consider when choosing a cryptocurrency exchange. If you are a beginner and have never used a similar platform before, you should pay attention to the platform’s user interface and how easy it is to use. After all, if you plan to use it regularly, it is essential to make sure that the platform is user-friendly.

LATOKEN is a user-friendly platform that provides a range of services, including a trading platform, crypto wallet, IEO Launchpad, LADEX, and LA airdrop. The platform’s landing page makes it easy to find and access all of these services.

This platform offers support for multiple languages, including English, Spanish, Chinese, Vietnamese, Portuguese, German, and Italian. You can easily select your preferred language from the drop-down menu at the top-right of the page. If you have any questions, the company’s customer service team is available to provide assistance.

LATOKEN offers four levels of verification, each of which is required for different withdrawal limits:

- Tier 0 – 1,000 USD/24h withdrawal limit.

- Tier 1 – 10,000 USD/24h withdrawal limit.

- Tier 2 – 100,000 USD/24h withdrawal limit.

- Tier 3 – 100,000 USD/24h withdrawal limit and access to alternative tokens.

For Tier 3 verification, you need to provide your contact information. From email, full name, phone number, and date of birth, as well as proof of your citizenship, residence, and identity. Additionally, you must submit a photograph and complete the corresponding questionnaire to complete the verification process.

Focus on Security

When selecting a cryptocurrency exchange, security should always be the top priority. Look for a provider that takes your privacy and security seriously, so you can be sure your account is safe and secure.

LATOKEN is a secure cryptocurrency exchange that provides users with:

- Encrypted keys

- Password security

- Secure storage

- Data transmission

- DDOS protection

- 2FA verification

LATOKEN provides an online wallet for storing your cryptocurrencies. However, it is recommended to use a hardware wallet for added security as it does not store your private keys online. It encrypts your private keys with AES-256 encryption for added security.

LATOKEN is renowned for its security measures, with 99.95% of users’ funds stored in cold storage using multi-signature technology and AES-256 encryption with a 256-bit key, which is considered virtually unbreakable. It ensures user security by using Salted SHA-256 encryption to protect passwords. This encryption method is enhanced with a random data addition, known as a salt, to make passwords more secure. Although SHA-256 is less secure than BCRYPT, SCRYPT, or Argon2, it still provides a reliable layer of protection.

LATOKEN ensures secure data transmission through the use of encrypted Transport Layer Security (TLS) connections (i.e., HTTPS). Additionally, Two-Factor Authentication (2FA) is required for any changes to your account or withdrawals, providing an extra layer of security for users. Their advanced distributed system architecture provides protection against DDoS attacks, ensuring that trading on the exchange is not disrupted by external threats.

Quite Average Trading and Withdrawal Fees

LATOKEN offers competitive trading fees, with lower fees for market makers than market takers. This allows users to benefit from the best prices available on the market, while still enjoying lower fees than their competitors.

LATOKEN prices for both market makers and traders:

LATOKEN offers traders the ability to trade Perpetual Futures, which are contracts that agree to buy or sell a specific cryptocurrency at a future date for a certain price. With LATOKEN, the more you trade, the lower your fees will be, as fees are based on your 30-day trading volume.

Futures trading offers the potential to capitalize on price volatility, but it can also be highly risky. Before making any decisions, it is important to ensure that you have a thorough understanding of the risks involved.

LATOKEN also offers some of the lowest Perpetual Futures trading fees in the market, with the same fees for both makers and takers.

LATOKEN regularly updates withdrawal fees based on market and blockchain conditions, and these fees are charged in the cryptocurrency you wish to withdraw. One example of LATOKEN fees are shown below:

LATOKEN’s trading fees are generally average, but their withdrawal fees may not be as user-friendly. Additionally, there have been many negative customer reviews regarding the withdrawal process.

Mobile Application

The LATOKEN mobile app is available for both Android and iOS, making it accessible to all mobile device users. It has an impressive 4.2-star rating on Google Play and has been installed by over 500,000 people. The app includes both a cryptocurrency exchange and a digital wallet that can be created in minutes with just an email address and phone number. For maximum security, it is recommended to store your cryptocurrencies in a hardware wallet, also known as a cold wallet.

If you’re looking for a secure way to store your digital assets, consider investing in a hardware wallet such as Ledger Nano X, Trezor Model T, or Ledger Nano S Plus. Alternatively, for an online wallet, Coinbase offers exceptional security measures.

The LATOKEN app provides users with the necessary tools and features to grow their crypto assets and start trading. Additionally, users can take advantage of price alerts to ensure they never miss out on buying or selling cryptocurrencies at their desired price. Stay up to date with the latest crypto and blockchain news with the LATOKEN mobile app. Track the latest industry developments and make informed decisions about price fluctuations.

The LATOKEN app update has introduced a new referral program that offers users a $50 credit on their accounts and daily cashback when people sign up with their referral link. This program provides users with an opportunity to generate extra income.

Most customer reviews of the LATOKEN app are positive, with users praising its ease of use and the wide selection of lesser-known tokens available on the exchange.

Multiple Support Options

For those new to crypto trading, having helpful customer service to guide you through the process can be invaluable. Crypto exchanges are becoming increasingly popular, and there are many resources available to help beginners get started. When it comes to LATOKEN customer service, reviews are mixed. Some customers report that the customer service is reliable and helpful, while others have experienced long wait times for a response. It is unclear what kind of service to expect from LATOKEN.

For instant assistance, LATOKEN customer service is available 24/7. You can contact their customer support team directly with your query. There’s also a live support widget on their platform for a more convenient experience. For any queries or issues, LATOKEN customers can easily submit a ticket via their ticket submission form. They can also join the official Telegram group for more answers. With multiple customer support options available, users can quickly and easily get their issues resolved.

Overall, LATOKEN’s customer support has been met with mostly positive reviews, with more customers expressing satisfaction than dissatisfaction.

Key Disadvantages of LATOKEN

Negative Customer Reviews

When selecting a product or service, it is important to read customer reviews. People who have been using the platform or service for a long time are the best source of information about its pros and cons. Upon researching Lotaken reviews, it has a low rating of 3.1 stars on Trustpilot. Almost half of the reviews being negative.

Many users have reported that they have been scammed by this platform. They are claiming that they only received a fraction of the value they were promised when selling cryptocurrencies. Furthermore, customers have been unable to contact customer support for assistance, leaving them feeling ignored and frustrated.

It is important to always keep your cryptocurrencies in secure hardware wallets to avoid any potential losses. Additionally, it is important to check the withdrawal fees of different assets applied by LATOKEN before making any transactions. Some users have reported paying high fees for their transactions.

Many customers have left reviews on Trustpilot about their experiences with LATOKEN. The most commonly heard phrase being ‘LATOKEN scam’. Unfortunately, some users have reported being unable to withdraw their cryptocurrencies when they had thousands of coins stored in their accounts.

How to Register on LATOKEN?

The following steps are quick and easy to follow:

- Create an account on LATOKEN’s official website by clicking the Sign up button.

- Provide an email address and password to create an account. This information will be used to access your account in the future.

- Verify your account by entering the code sent to your email address for confirmation.

After that, you’re done! It’s as simple as that to register and create an account on LATOKEN.

Conclusion

LATOKEN is a cryptocurrency exchange platform that supports more than 250 cryptocurrencies and focuses on security. However, there have been numerous customer complaints about the platform, with some claiming that it is a scam and that they have experienced issues when withdrawing money or that their assets have simply disappeared with no response from customer support.

Before making a decision on whether LATOKEN exchange is the right choice for you, it is important to consider all aspects of the platform.

Key Features of Binance

Key Features of Binance