What is Ethereum?

Ethereum is a decentralized blockchain platform that allows developers to build and deploy smart contracts and decentralized applications (dApps). First proposed in 2013 by Vitalik Buterin, Ethereum has grown into one of the most influential technologies in the blockchain space, supporting a vast ecosystem of financial services, gaming platforms, social networks, and enterprise solutions.

Decentralization vs. Centralization

Most traditional systems—such as banks, tech companies, and social media platforms—operate under centralized control. Ethereum offers an alternative model where users interact directly through trustless protocols, eliminating intermediaries and enabling peer-to-peer collaboration.

Ethereum Network and Ether (ETH)

Ethereum provides the infrastructure for executing smart contracts, running dApps, and managing tokenized assets. Its native currency, Ether (ETH), is used to pay for transactions and computational services—commonly referred to as “gas.” ETH also functions as a store of value and is widely used across decentralized finance (DeFi) platforms.

Smart Contracts and dApps

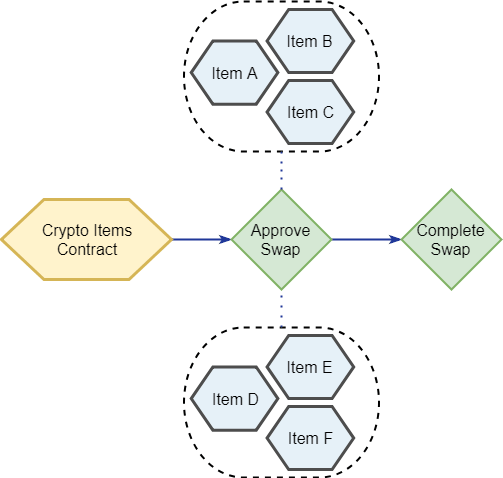

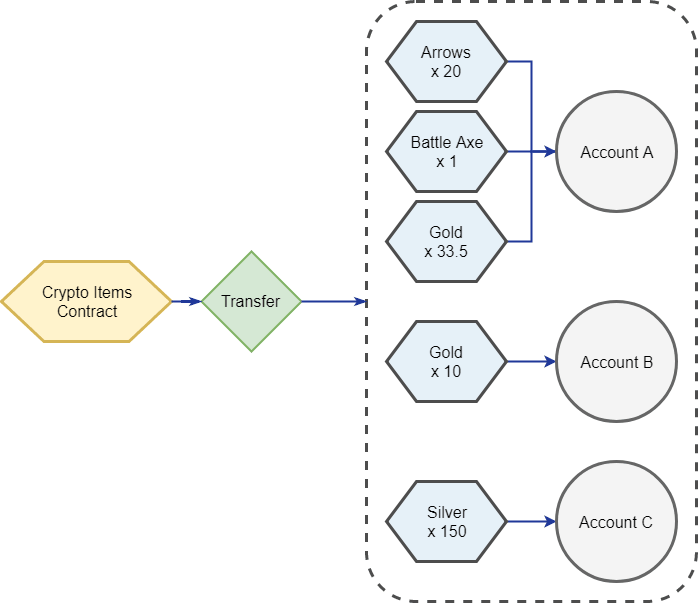

Smart contracts are self-executing programs that run exactly as coded, without human intervention. Developers use Ethereum’s programming language, Solidity, to create dApps that span industries such as finance, insurance, gaming, and identity verification.

Key characteristics of dApps include:

- Open Source: Code is publicly accessible and governed by community consensus.

- Decentralized: Data is stored on the blockchain and not controlled by any single entity.

- Incentivized: Users are rewarded with tokens for participation.

- Protocol-Based: Operates on cryptographic algorithms agreed upon by the community.

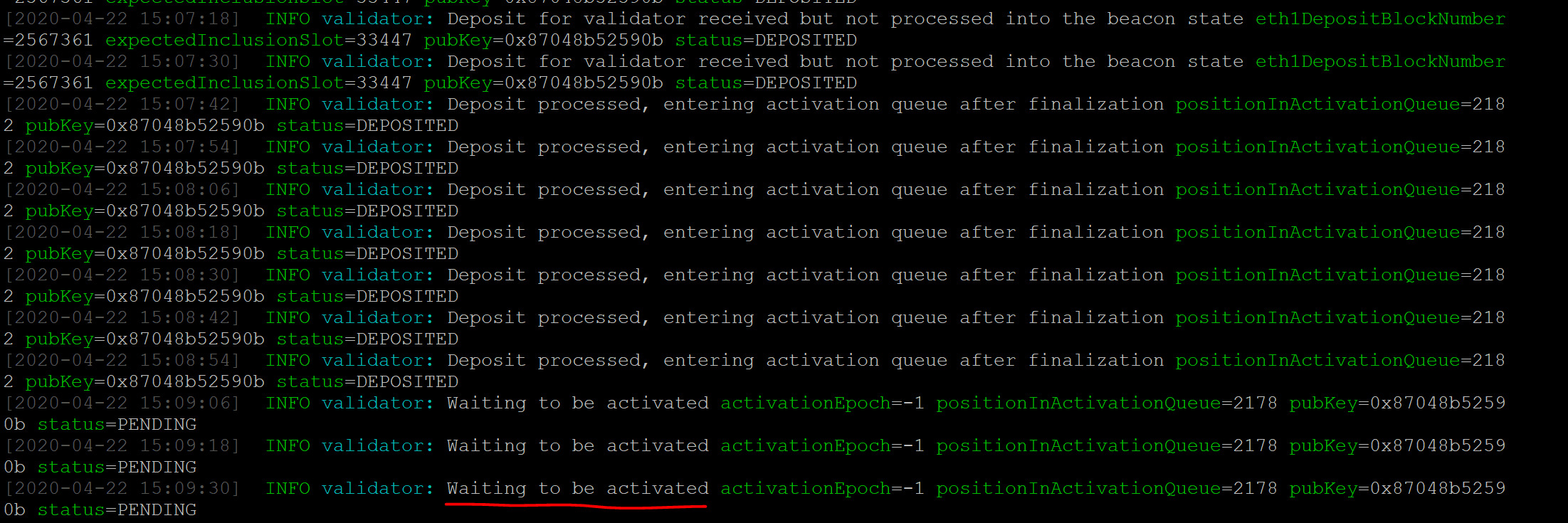

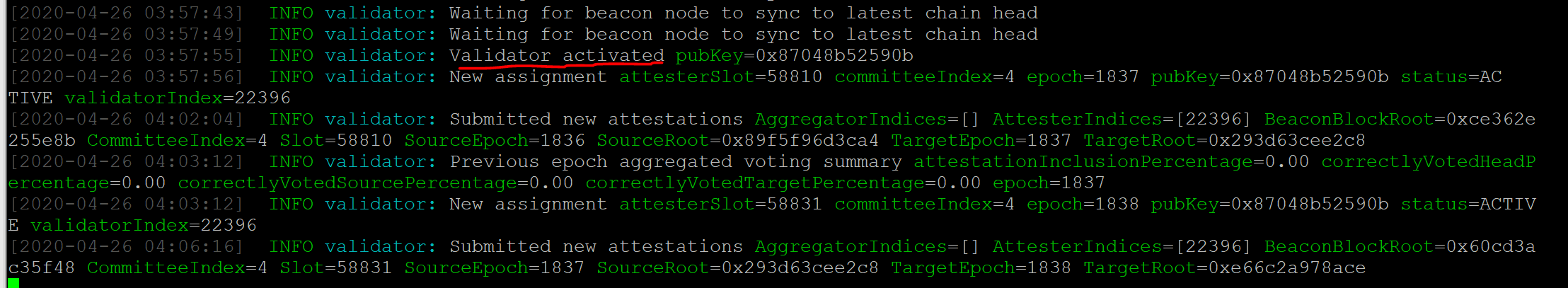

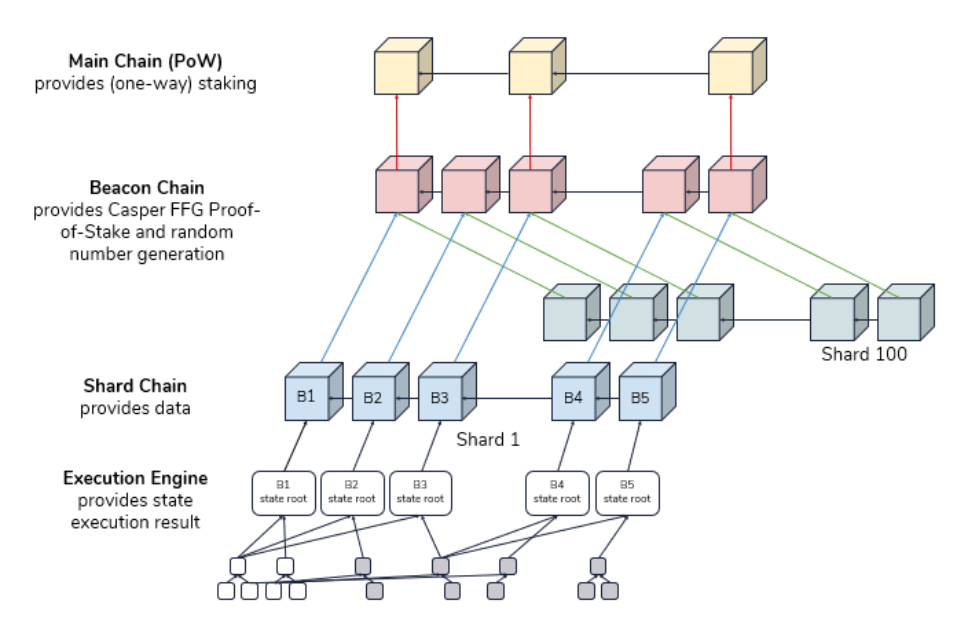

Ethereum 2.0 and Recent Developments

Ethereum completed its transition to Proof of Stake (PoS) in 2022, replacing the energy-intensive Proof of Work (PoW) model. This shift significantly reduced Ethereum’s energy consumption and introduced staking, allowing users to lock up ETH to help secure the network and earn rewards.

Recent upgrades include:

- Danksharding: Enhances scalability and reduces transaction costs by improving data availability.

- Verkle Trees: Introduces a new data structure that optimizes storage and makes Ethereum nodes more efficient.

- Account Abstraction: Simplifies wallet interactions and enables programmable accounts.

As of mid-2025, Ethereum supports over one million active dApps and secures more than $500 billion in value across DeFi, NFTs, and enterprise applications.

What is Decentralization

Decentralization distributes control across a network, removing reliance on central authorities. Ethereum leads this shift by running smart contracts and dApps on a global node network, secured by Proof of Stake. Upgrades like Danksharding, Verkle Trees, and Account Abstraction have made it more scalable and user-friendly. By 2025, decentralization powers not just finance but also identity, governance, and digital platforms.

Ethereum Network

Ethereum is a decentralized smart contract platform that enables developers to build dApps and financial protocols without relying on central authorities. As of 2025, it runs on Proof of Stake, with major upgrades like Danksharding, Verkle Trees, and Account Abstraction improving scalability, efficiency, and user experience. Ether (ETH) remains the native currency, used for transactions and powering smart contracts across a diverse ecosystem spanning finance, gaming, identity, and more.

Decentralized Platform

Ethereum is a decentralized smart contract platform that enables developers to build dApps and financial protocols without relying on central authorities. As of 2025, it runs on Proof of Stake, with major upgrades like Danksharding, Verkle Trees, and Account Abstraction improving scalability, efficiency, and user experience. Ether (ETH) remains the native currency, used for transactions and powering smart contracts across a diverse ecosystem spanning finance, gaming, identity, and more.

Main features of Ethereum

Ethereum is a decentralized, open-source platform designed for building and running smart contracts and dApps. Its key features include:

- Decentralized Infrastructure: No single entity controls the network; thousands of nodes maintain consensus globally.

- Proof of Stake (PoS): Since 2022, Ethereum uses PoS for energy-efficient validation and staking rewards.

- Smart Contract Automation: Programs execute automatically based on predefined conditions, without human intervention.

- Public Accessibility: Anyone with an internet connection can interact with the network and deploy applications.

- Native Currency (ETH): Ether is used to pay for gas fees, secure the network, and facilitate transactions.

- Scalability Enhancements: Danksharding and Verkle Trees improve data efficiency and reduce transaction costs.

- Account Abstraction: Introduced in 2024, it allows customizable wallet behavior and simplifies user interactions.

These features make Ethereum a foundational layer for decentralized finance, digital identity, gaming, and more.

What are dApps?

Users can build and run decentralized applications (dApps) on blockchain networks like Ethereum. These applications serve specific functions and operate without centralized control. As of 2025, dApps have expanded across industries including finance, gaming, identity, and social media. They typically share the following features:

- Open Source: The source code is publicly accessible. Updates require consensus from the community.

- Decentralized: Data and transaction history are stored on public blockchains, not controlled by any single entity.

- Incentivized: Users are rewarded with tokens or digital assets for participation and contributions.

- Protocol-Based: Operate on agreed-upon cryptographic algorithms. Ethereum now uses Proof of Stake (PoS) for consensus.

- Programmable Accounts: Thanks to Account Abstraction, dApps can offer flexible wallet behavior and enhanced user experience.

- Scalable Infrastructure: Upgrades like Danksharding and Verkle Trees have improved performance and reduced costs.

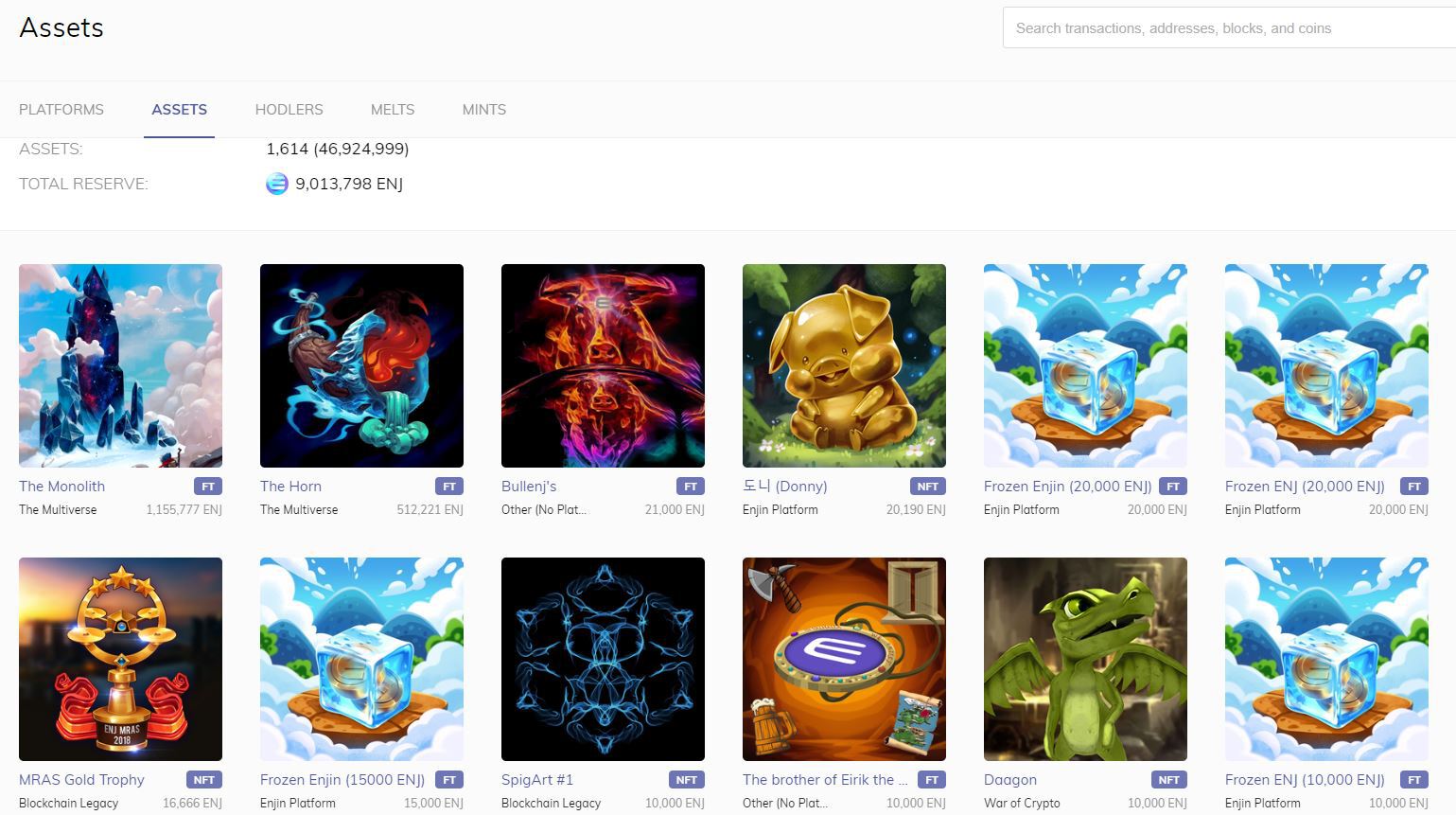

Examples of dApps in 2025 include:

- Aave: A decentralized lending and borrowing platform.

- OpenSea: A marketplace for NFTs and digital collectibles.

- Illuvium: A blockchain-based game with tokenized assets and play-to-earn mechanics.

Future of Ethereum

Ethereum’s future is increasingly defined by scalability, usability, and real-world integration. Since its full transition to Proof of Stake in 2022, Ethereum has undergone major upgrades including Danksharding, which significantly boosts transaction throughput, and Verkle Trees, which reduce node storage requirements and improve network efficiency. Account Abstraction, now widely adopted, allows for programmable wallets and more intuitive user experiences, making dApps accessible to mainstream users. Ethereum continues to serve as the backbone for decentralized finance, NFTs, and Web3 infrastructure, with growing adoption in enterprise and government sectors. As of 2025, Ethereum is preparing for further enhancements focused on privacy, modular execution environments, and cross-chain interoperability, positioning itself as a foundational layer for a decentralized internet.