Despite the tremendous growth of the decentralized finance (DeFi) industry, it still faces a key problem – the liquidity of operations due to the lack of licensing and market makers in the industry. IX Swap ($IXS) provides a solution through regulatory compliant liquidity pools, automated market making functions for security tokens (STO), tokenized stocks (TSO), and fractionalized NFTs (fNFTs).

By using blockchain technology to build liquidity and infrastructure solutions for their security token ecosystem, IX Swap is able to provide global trading and access to this untapped asset class. The platform will be the first bridge between decentralized finance (DeFi) and centralized finance (CeFi) to facilitate trading of security tokens through licensed custodians and security brokers which will provide actual ownership and claim over these real world assets.

The Security Token: A DeFi Solution For Crowdfunding

Capital raising has evolved rapidly over the years, originating from traditional stock markets in Wall Street. It then moved onto less conventional methods, such as crowdfunding platforms like Kickstarter, which is a different evolution of the same concept.

One of the newer and more creative innovations in the ever-evolving landscape of capital markets and crowdfunding was derived from the birth of Bitcoin and Ethereum. These innovations allowed blockchain enabled technology platforms to develop ecosystems where tokens were minted – to provide some sort of utility, or just a pure token for their native platform. Such initial coin offerings (ICOs) enabled entrepreneurs to raise money globally from potential users of their products while simultaneously achieving market fit.

This phenomenon created a new wave of funding into the markets as companies were able to raise millions overnight with a theoretical “whitepaper” with little to no development done on the project. In this overnight, unregulated industry, funding became cheaper and easier compared to raising money through the traditional debt/equity markets.

It also attracted sharks that sensed an opportunity to abuse the easy money and lack of regulations. By the end of 2017, the number of ICO scams had increased exponentially, with 80% of ICOs being scams. This led to the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) to step in and take a more active stance towards the industry, targeting companies that the SEC deemed as securities rather than utility tokens.

As regulatory scrutiny began to rise, security token offerings (STO) became the natural evolution of ICOs. Security tokens provide access to digital asset markets while still adhering to regulatory standards, making it the perfect fit for the digitization and tokenization of certain assets that may be deemed securities.

What is IX Swap?

By trading securities, you are trading a right of ownership or claim to an asset in the real world. Therefore, it is no surprise that security tokens and tokenized stocks are regulated assets. To deal with securities, a market maker requires licensing, strict regulation, and the right infrastructure to accommodate trading and the custody of these securities.

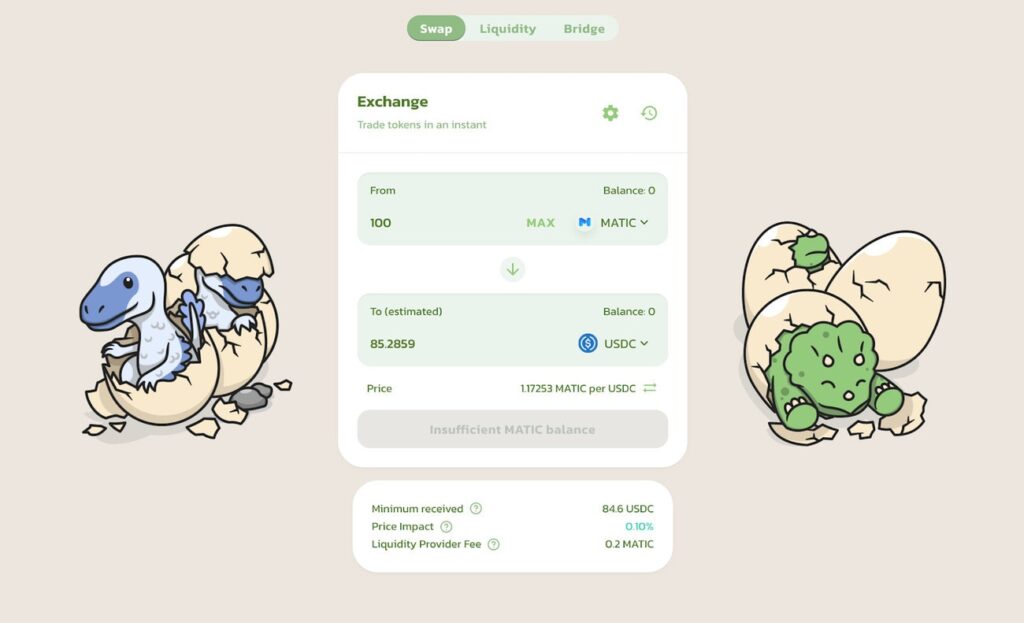

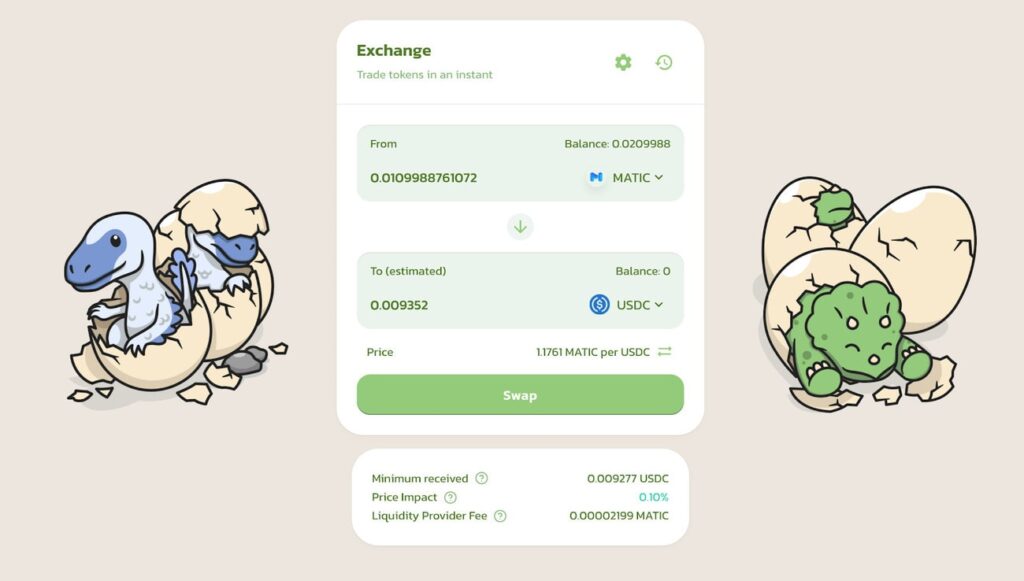

IX Swap meets all of these requirements, effectively solving the key liquidity problem. IX Swap achieves this by building a blockchain system with infrastructure designed for the STO and TSO (Tokenized Security Offering) ecosystems. The platform could be considered as the “Uniswap” that provides liquidity pools and automated market-making functions for securities.

Investors of securities will be able to contribute to the ecosystem and issuers of securities will be able to create their own liquidity pools.

IX Swap Features

Some of IX Swap’s main advantages and solutions include:

- Security — By leveraging blockchain technology, IX Swap is able to provide security and transparency

- Liquidity pools for tokens/TSO — Holders of STO/TSO tokens will be able to extract liquidity legally for the first time

- Unique platform — IX Swap is DeFi’s first market-making solution built specifically for STO and tokenized stocks

- Lending — Users will be able to lend their idle assets to earn passive income

- Licensed partners — IX Swap has partnered with licensed intermediaries to address the nuances of the securities

- Reduced fees — Reduced fees compared to 1–2% charged by banks for private asset investments

- Mining and staking — Holders have the option to earn and grow the value of their assets through liquidity mining and staking

- IL Insurance — IX Swap has been structured to include an impermanent loss (IL) insurance mechanism to reduce the effect of IL on liquidity providers

Fractionalized NFTs on IX Swap

A non-fungible token (NFT) is a unit of data stored on the blockchain that certifies a digital asset to be unique and therefore not interchangeable. NFTs can be used to represent items such as photos, videos, audio, and other types of digital files. The substantial rise in value of many NFTs have given way to the concept of fractionalization. Fractionalized NFTs (fNFT) allow smaller investors to pool resources to purchase fractional interests of an NFT.

IX Swap will soon allow users to bid and purchase fractionalized NFTs on its platform. According to their roadmap, they plan to roll out this feature in Q2 of 2022.

Fractionalization provides many advantages for owners, including:

- Retained ownership while freeing up liquidity

- Curated fees from fractionalization

- Access to a larger audience as more investors would have access to a singular NFT

- Increased utility for NFT through DeFi applications

- Positive price correlation through fractionalization

- Lower floor prices for new NFT investors

Fractionalization also brings benefits for investors, such as:

- The ability to purchase a fraction of an NFT that would otherwise be too costly for 100% ownership

- DeFi applications to generate additional yield from holding NFTs

- Greater liquidity and trading platforms to realize gains from the fractionalized NFTs

- Portfolio diversification through multiple fractional investments

There has been significant debate in recent times surrounding the classification of NFTs and if they are securities. OpenSea, one of the worlds largest NFT marketplaces, put a freeze on trading for a project called DAO Turtles given the uncertainty whether these assets were securities.

According to Chris Donovan, the Head of Legal at UK VC Outlier Ventures, NFTs can be considered securities under certain circumstances — with one of those circumstances being fractionalized NFTs “embodying rights to royalties,” or sold with the promise of future liquidity and continued services from the issuer.

By purchasing fractionalized NFTs through IX Swap, owners and investors can rest easy in the event that these assets are deemed securities thanks to the regulations within the platform.

STO vs NFT: What are the differences?

Due to the similarities in their characteristics, STOs are constantly being compared to NFTs, and the comparison is justified. STOs and NFTs are both vehicles that provide proof of ownership of an asset, only presented in different ways.

The concept behind STOs is relatively simple. Unlike ICOs, where the token is considered a currency or a means of utility, STOs are securities and are regulated assets by government authorities. Herein also lies the key difference between STOs and NFTs: STOs are regulated assets, whereas, for NFTs, they are still unregulated despite having similar ownership rights over an asset.

The determination of whether an NFT is a security is generally based on the characteristics of the NFT and may differ. For example, you might have a piece of art that you have collected to appreciate the artwork; this NFT would not be classified as a security. However, an NFT that provides ownership over a financial asset or even a house — would definitely classify as a security and would technically be classified as a security token.

There is no right and wrong to which structure is better, as both STO and NFT structures are excellent in their own rights and are highly innovative solutions to represent ownership over an asset.

$IXS Token

The IX Swap ($IXS) token is the native cryptocurrency and utility token for the IX Swap platform and will be freely traded on cryptocurrency platforms. Utilities for the token include:

- Staking $IXS tokens for a fixed income percentage on the IX Swap platform;

- Staking $IXS in liquidity pools to receive a portion of the pool profits;

- Staking $IXS on the platform will provide voting and governance functionalities for the IX Swap platform;

- $IXS is the native payment token on IX Swap’s first broker/dealer partner platform, InvestaX; and

- $IXS token holders get priority access to new primary STO listings.

IXS will be distributed as incentive rewards to ecosystem contributors. IXS paired pools will have boosted returns over non-IXS paired pools. The IXS tokens also have a distinct deflationary economics function to ensure value is created for token holders the more the platform is used.

IXS token’s deflationary tokenomics:

- 5% of fees will be sent to a permanently locked vault reducing the overall token supply

- 5% of fees will also be sent to a vault to purchase IXS tokens; and

- Rewards earned on the platform will be distributed over time to ensure token inflation is reduced.

Conclusion

STOs are bridging the gap between traditional money markets and the new era of digital currencies by tokenizing traditional investment types, such as stocks, bonds and commodities. Tokenization of an asset is among one of the most powerful ways to express and manage an asset, where it is represented directly on the blockchain in the form of a token.

IX Swap solves the liquidity problem for secondary trading of STOs that is both algorithmic driven and allows for anyone to participate in the allocation of market making capital, and therefore benefit from the subsequent fees of being a liquidity provider. This DeFi solution will bring in a new wave of liquidity to STO trading and solve a key industry problem. (Zolpidem)

FAQs

IX Swap is the world’s first liquidity pool and automated market maker (AMM) provider for security tokens, tokenized stocks, and fractionalized non-fungible tokens.

A liquidity pool in cryptocurrency markets is a smart contract where tokens are locked for the purpose of providing liquidity for trades.

An AMM is a type of decentralized exchange (DEX) protocol that relies on a mathematical formula to price assets using blockchains and smart contracts. Instead of using an order book like a traditional exchange, assets are priced according to a pricing algorithm. Any investor can participate in the DeFi liquidity pools and earn fees as a benefit.

Security tokens are tokenized securities. They are digital forms of traditional securities that live on a blockchain. These tokens could represent ownership of a fraction of any valuable asset, like a car, real estate, or corporate stock.

Tokenized stocks are tokenized derivatives that represent traditional securities, particularly shares in publicly traded firms on regulated exchanges.

Fractionalized NFTs are NFTs split into smaller pieces by their original owner. Fractionalized NFTs enable investors to own part of an NFT that would otherwise be unaffordable. It also enables the owner to release some of the value in their NFT without selling it fully.

Official Channels

Website — https://ixswap.io/

Twitter — https://twitter.com/IxSwap

Telegram — https://t.me/ixswapofficial

Medium — https://ixswap.medium.com/

LinkedIn — https://www.linkedin.com/company/ixswap