Stablecoins are under the microscope right now following the collapse of Luna and UST, the stablecoin of the Terra ecosystem.

In this article, we look at the history of stablecoins, its pros and cons, why they are needed, and what are the risks are of utilizing them.

What is a Stablecoin?

A stablecoin is a cryptocurrency that maintains a fixed value because it is backed by reserves of other assets such as fiat currencies, securities, gold or precious metals, property, or any other assets as collateral.

There are four main types of stablecoins:

- Fiat-Collateralized: Fiat-backed stablecoins are backed by real-world currencies such as US Dollars or British Pounds at a 1:1 ratio.

- Commodity-Backed: Backed by precious commodities like gold, platinum, or real estate.

- Crypto-Backed: Backed by other cryptocurrencies which are kept as a reserve to ensure price stability in the event of price fluctuations. Smart contracts can also be coded to ensure no trust is needed in third parties.

- Algorithmic: These involve adjustments in the algorithm for controlling the supply and demand of stablecoins, usually in the form of two tokens: one a stablecoin and the other a cryptocurrency that backs the stablecoin.

Cryptocurrencies are decentralized and not controlled by centralized entities such as governments or regulatory bodies. They operate on supply-and-demand principles in a free market and can be volatile in nature.

Simply put, stablecoins allow investors and traders to ‘cash out’ of risky investments into another crypto coin that will not fluctuate wildly in value during times of market volatility.

History of Stablecoins

Stablecoins actually have a very long history, having been around since 2014 with BitUSD. BitUSD was created in July 2014 backed by the $BTS token and created by Dan Larimer and Charles Hoskinson, both pioneers in the cryptocurrency who went on to create EOS and Cardano ($ADA), respectively.

However, even the world’s first stablecoin was not without its issues. In late 2018, BitUSD lost its peg to the US Dollar, resulting in huge criticism from the cryptocurrency community. BitUSD is no longer commonly used, and many cryptocurrency exchanges no longer support this stablecoin.

The next stablecoin to be launched was NuBits in September 2014 and was functional for 3 years. Eventually, this stablecoin also fell- suffering 2 major crashes during which the peg was broken for an extended period of time. The first of these crashes was in 2016 when NuBits was depegged from the US Dollar for 3 months. This was likely because holders of NuBits suddenly sold their substantial holdings for Bitcoin, resulting in NuBits being unable to handle the large volumes of sell-offs and losing its peg. Surprisingly, after the 2016 crash, the marketcap of NuBits shot up by 1,500%. This was caused by people buying millions worth of NuBits in late December 2017 owing to concerns about the stability of Bitcoin, whilst the NuBits team was unable to print new coins to keep up with the demand, thereby driving up prices.

The second, and final major crash suffered by NuBits was in March 2018 which was caused by insufficient reserves of the coin, meaning that the NuBits team were unable to protect the coin when there was a dip in demand. Of course, large cryptocurrency holders immediately noticed the drop in NuBits prices and panic sold their positions, causing an even greater slide in price.

After the second NuBits depeg, the stablecoin had lost credibility with cryptocurrency investors. Some holders even threatened legal action against the NuBits team or went into Tether ($USDT) and/or TrueUSD instead.

Tether $USDT however has also weathered a few storms of its own, facing legal battles with the Securities and Exchange Commission (SEC), which also shook the confidence of the market. The legal action was eventually settled in 2021 with the parent company of Tether paying nearly US$60 million.

Despite this, cryptocurrency keeps evolving with each passing year as new innovations that were once met with speculation and distrust eventually become trusted by the market. Today there are many other stablecoin options out there such as USD Coin (USDC), Binance USD (BUSD), MakerDAO (DAI), Paxos Standard (PAX), and Gemini Dollar (GUSD) that provide alternatives to USDT.

Pros of Stablecoins

There are several reasons and numerous benefits to using stablecoins. In general, they are simply faster, cheaper, transparent, borderless, and programmable compared to fiat currencies. Some more benefits are listed below.

- Stablecoins allow a quicker and easier way for investors to enter the crypto market by bridging fiat into stablecoins, which act like fiat currencies on exchanges.

- Stablecoins are more efficient than fiat because they have the digital properties of other crypto tokens and can be moved around quicker and more efficiently than fiat money.

- Stablecoins can be held as capital in non-custodial wallets such as Metamask, thus removing the need for third parties to intermediate.

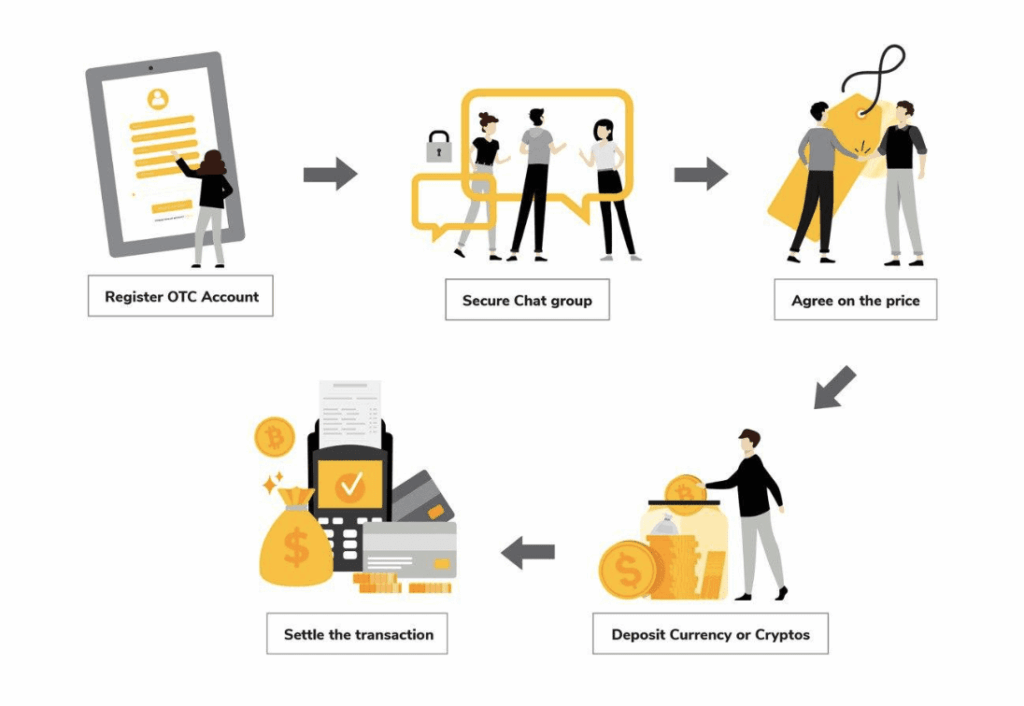

- Stablecoins allow for quicker, immediate peer-to-peer payments abroad that are semi-anonymous with much lower fees than fiat currencies.

- Stablecoins can be used for holding, trading, borrowing, and lending abroad. When fiat-related regulatory processes are involved, even better.

- Stablecoins can be staked to earn a higher yield than traditional finance in DeFi applications. When adding liquidity to protocols, they also minimize the risk of impermanent loss due to their price stability.

- Blockchain data and tracking allows for a more transparent view of the market, giving investors more information on liquidity flows and thus greater decision-making power.

- Many sectors of the economy and the unbanked population are benefiting from the use of stablecoins in remittance, escrow, payroll, settlement, and alternative banking that is self-custodial, cutting out intermediaries.

Cons of Stablecoins

Stablecoins used to be more controversial in the earlier days of crypto but have garnered more regulatory approval in recent years, minimizing many of the negative aspects.

- Stablecoins usually require trust in a third party to ensure the coins are backed by the stated assets, which also means external audits are needed to ensure assets are accounted for.

- There are lower yields on stablecoins in DeFi applications than on regular cryptos, however, these yields are still significantly higher than the interest rates offered by traditional banks.

- Stablecoins utilized in DeFi applications are subject to the usual risks involved with unregulated cryptocurrency projects. The TerraLuna disaster was a perfect example of an extreme worst-case scenario for an algorithmic stablecoin.

- Trial and error. Due to the relative infancy of stablecoins and the experimental nature of new technologies within crypto, there is still a risk when getting involved with newer projects or protocols.

- Regulatory scrutiny. As the stablecoin market keeps growing and adding billions of dollars in value to the crypto market, it will generate increased interest from authorities. This can also be seen as a positive.

Conclusion

Stablecoins and their rapid proliferation across all blockchain protocols have brought more flexibility and adoption to the cryptocurrency industry. They are now embedded in the fabric of the market and are here to stay.

The onus remains on the individual investor to do your own research (DYOR) when deciding which stablecoin to hold. Find out who created it, whether it’s a trusted centralized business or a decentralized protocol managed by smart contracts. All the options are open to you when it comes to the safer management of risk in the crypto market.