FTX EXCHANGE (INCLUDING FTX INTERNATIONAL AND FTX.US) ARE NO LONGER IN OPERATION

Both exchanges have filed for bankruptcy. Subsequently, the exchange was “hacked” and more than US$600 million worth of cryptocurrencies drained. The hacker is strongly rumoured to be a former FTX employee. For more about how this story unfolded and the latest news, check out these articles:

Derivatives Trading is a lucrative market, it is estimated to be worth more than $1 quadrillion all over the world according to Investopedia. This insane valuation is possible because derivatives are available for every type of asset in the world, you have derivatives for stocks, commodities, physical assets, and even cryptocurrency.

According to Investopedia, the size is almost 10 times that of the gross domestic product of the entire world. It is important to understand that the notional value and the actual value of the derivatives market are two different things, which can explain such a high valuation.

What is Derivatives Trading?

Diving into the cryptocurrency world can be overwhelming. You are immediately faced with an insurmountable wall of options and information on different types of trades. Each trade may or may not eventually make you money, however, each type of trade has its learning curve, complexities, and barriers to entry.

Newcomers may have heard about derivatives trading as a very good way of making money, and they might be curious about derivatives trading as an option to do this. However, as with anything, it is important to make sure you understand the basics first and ensure you have appropriate risk mitigation strategies in place if you do decide to invest.

This article aims to set out how to learn about derivatives trading, and provides derivatives on FTX Exchange as an example.

What are Derivatives?

Derivatives, simply put, is a contract between two parties, the contract is based on an underlying asset which can be anything but. In the traditional sense, it is either a stock or a commodity. Derivatives are popular in the crypto market as well, as more and more traders emerge themselves in all that the flourishing market has to offer.

A derivative is not a type of trade rather it is a collection of a few trades. For example future contracts, swaps, options, and warrants, all of which are based upon a contract of an underlying asset. In derivatives trading, the contract is really important, and it is widely used by traders all around the world to hedge risk and commensurate rewards.

Further details about derivatives

You can think of derivatives as a secondary asset that represents a contract on the primary asset, so it is directly linked to the value of the primary asset which is called the underlying asset.

This may sound jumbled up and complex, however, derivatives are an advanced investing option usually used by experienced traders.

Derivatives have two main classes, namely: lock and options. The lock class is made up of swaps, futures, and forward contracts, these contracts are called lock contracts because the parties are locked in the contract up until the life of the contract expires.

For example, if a person specifies they will buy or sell a futures contract they have to buy it or sell it at the end of the expiration period. In the options class the holder has the right to buy or sell the asset as specified in the contract, but he is not obligated to do so. Meaning the buyer can hold off on buying the asset and only give the money that he is owed and the seller can also opt to not sell the underlying asset.

Futures contracts

Futures contracts are a type of derivatives trade in which the price of the underlying asset affects the contract. It is a contract, as the name suggests, in which the seller and the buyer sign a contract to exchange the asset at a predetermined date with a predetermined price that is set somewhere in the future.

Future contracts are based on the expiration date generally, for example, in stocks, future contracts are known based on the month they expire in. Futures contracts are also available for stocks, cryptos, and commodities.

Equity options

Equity options derive their value from the underlying stock, the equity options work on two types of trades: calls and puts. Call options are the type of trade in which the holder of the option has the right to buy the asset at a strike price (preset price) and also a time both of which are preset in the contract. In the Put option, the seller has the right to sell the asset on a price and date that is specified in the contract.

Example of equity options

It is really easy to understand how options work. For example, a trader anticipates a fall in the price of bitcoin so what he does is that he sells ‘put’ options for the asset to be sold at a certain price, which may be the price before the fall.

The trader now has a hedge against the fall of the price, if at the time of expiration of the contract the price of the asset has dwindled further he does not lose money, thus creating a very comfortable space for him.

Differences between options and futures contracts

For people who are new to futures, it is important to understand there is a difference between futures and options. An options contract does not put an obligation on the buyer or the seller. In the American way of doing business, it gives them the right to execute the trade before the expiration time, while in Europe the right is given after the expiration time.

In a futures contract, the buyer has to take possession of the underlying asset, and subsequently, the seller has to sell him that asset, they can settle for the cash equivalent. However, the trade has to take place.

The buyer also has the option of loading off their position any time before the trade expires to get rid of their obligation. This is one thing that is common in options as well as futures trading giving an advantage to the buyer to benefit from the leverage holder’s position before expiration.

FTX Exchange

There are more than 1,000 crypto exchanges globally, each trying hard to break in and flip the market over its head and acquire a lot of customers. Yet only a select few have succeeded in the endeavor.

FTX has been one of the most promising exchanges, the exchange has in a very short time become the ‘go-to’ for professional traders, as it offers options other exchanges cannot.

As a result, it is one of the biggest derivative trading platforms for crypto in the world. It is highly recommended by crypto traders that have been working for a long time in the field.

FTX was founded by Sam Bankman-Fried in 2019. He is also the founder of Alameda Research, a cryptocurrency, and blockchain research company that creates specialized algorithms for trading cryptocurrency.

Learn how to get started with our FTX Exchange Guide.

How to trade Derivatives on FTX Exchange

As have previously published guides on how to add cryptocurrency in your wallet on FTX exchange, you can check it out over here. You would need cryptocurrency in your wallet to post collateral for futures so make sure you add some cryptocurrency to your wallet.

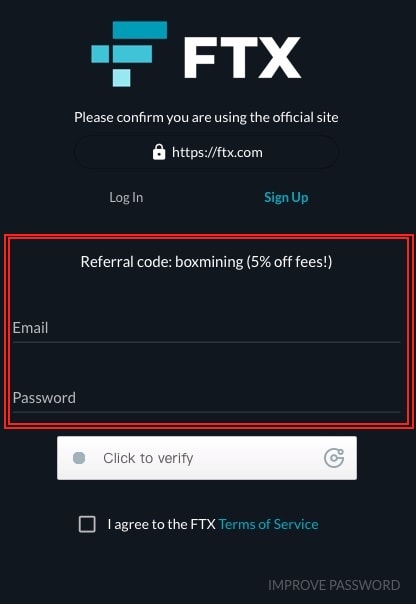

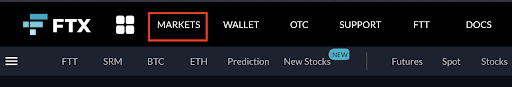

To trade futures on FTX you would first need to go to the markets tab at the top of the platform’s home page.

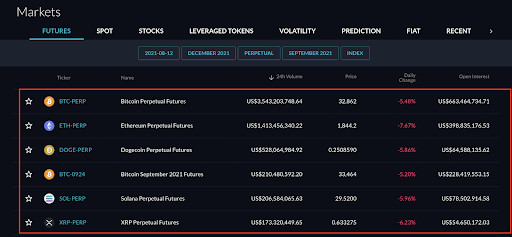

Once you have reached there you would be able to see the futures section, where several contracts would already be listed.

In the section, you would be able to see almost all kinds of details about the futures, their expiration, price, trading volume, and the change in their value over the day as well. Along with crypto, you can also deal in futures contracts of US-based stocks and also some commodities as well.

Once you choose the type of future you want to trade, you are taken to the console which has almost all the information one needs to trade the future.

In the middle of the console, you can look at the trading window which has the graphs displayed.

The top right corner shows you the index details as well as the price of the futures contract, along with its expiration. The bottom right shows you details of the collateral you have available, and the leverage can also be set from there as well.

Coming down from the console you can come to the order book as well as the order execution tab and the market trades tab:

Futures are a type of trade that is very complex thus requiring a lot of information on the console screen for traders to make a decision. Thus while the console may look clustered it is functional.

At the bottom of the console is the history book, where you can take a look at different positions you have had and the ones currently you are in. The data gives you a summary of the performance over time.

The futures trades can be made through the console easily by keeping the collateral in your wallets. Once you have the collateral you can start trading futures through the exchange easily.

Trading options

Options are traded just like futures on the exchange, a topic that has already been covered on the website. You can either go long or short on a particular contract and the settlement is made at the end equal to the expiration price.

Expiration of Contract

FTX’s options are usually settled in USD, it is important to note that on FTX the price of a particular cryptocurrency is based on the FTX crypto index’s average at any time one hour before expiration. This is a common practice to beat volatility in the market.

Let’s just assume you short sell two options of BTC each priced at around $300, now the BTC expiration price according to the contract is $35,200. That means that your option is worth $200.

Your option gives you the right to buy BTC at $35,000. Now, if the contract expires as such, after expiration you will have essentially a profit of $400 based on your holdings, which means that the $200 above the price of the BTC translates to the $400 profit that you will get at the end.

Buying and selling options on FTX

To trade options on FTX exchange you first need to go to the Options section of the platform. The options can be curated based on the requirements you set.

You can create an option based on your requirements and request a quote on the platform which is the most common way of buying options.

There are many people on the platform checking the requests and within 10 seconds you might find a responder to your bid. Then it is up to you to accept, as soon as you accept the quote the contract starts.

You can look at the requests you have opened in the ‘My Requests’ section.

Quoting Options on FTX

Quoting is also really simple, you can look at the requests for quotes posted by people on the platform, you can take a look at the requirements set by them and give them a quote. Whichever quote is a better deal would be shown to the person who makes the request.

It is important to note that you have no idea if the person posting the request is buying or selling, you have to provide a quotation for both scenarios.

You can see the requests for quotes in the ‘All Requests’ section.

Conclusion

As discussed, FTX was founded as a tool for crypto traders who didn’t have a lot of options to start trading with. Over time the exchange has developed a curated set of options for its customers.

The platform is very stable with a focus on simplicity and minimalism, nothing on the platform is without a purpose. The simplicity makes it very easier for people to start trading on FTX.

However, it should be pointed out that futures and options trading are advanced levels of investing and require lots of research, reading, and learning before starting to invest.

It is a good way of hedging your risks in the market, however, you should only trade at the start with the money you can afford to lose, reckless investing is not the way to go about it. Hopefully, this guide will help you get started on your crypto trading journey.

Check out our other FTX guides

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.

SwissBorg Network Token ($CHSB)

SwissBorg Network Token ($CHSB)