Cardano is a decentralized smart contract platform which would be driven by peer reviewed academic research and capable of running both financial applications and decentralised applications. Established by a former co-founder of Ethereum, Cardano aims to improve on Ethereum by offering low-cost, secure and scalable transactions. To improve smart contract security, Cardano uses the programming language Haskell which has been proven to be easier to audit and formally verify. In addition, Cardano openly addresses the need for regulatory oversight whilst maintaining consumer privacy and protections through an innovative software architecture.

Check out our explainer video on Cardano ($ADA)

What is the ADA token and its uses?

ADA is Cardano’s native cryptocurrency. It was launched on 1st January 2018 through an initial coin offering as a utility token and will have 45 billion total supply. It is currently the 8th most popular cryptocurrency based on market capitalisation according to CoinGecko.

Upon the opening of the Shelley Public testnet on 9th June 2020, and any operator can set up a Cardano stake pool in anticipation for staking and delegation on the mainnet to be released in Summer 2020.

Eventually, ADA will allow users to send value between two parties, pay for goods or services, deposit funds on an exchange, or enter an application. ADA will also be used to power the transactions on the Cardano network.

Founder: Charles Hoskinson

Charles Hoskinson is a co-founder of Ethereum and founder of Ethereum Classic, with extensive experience working with smart contracts and the programming language Haskell. He is an outspoken critic of Ethereum and parted ways with the Ethereum team in 2016. This was likely due to ideological differences arising from the team’s response to the DAO hack of 2016. Hoskinson is now the CEO of Input Output Hong Kong (IOHK), and they have devoted a large team of expert engineers and researchers to build Cardano from the ground up.

Cardano – development of the blockchain protocol

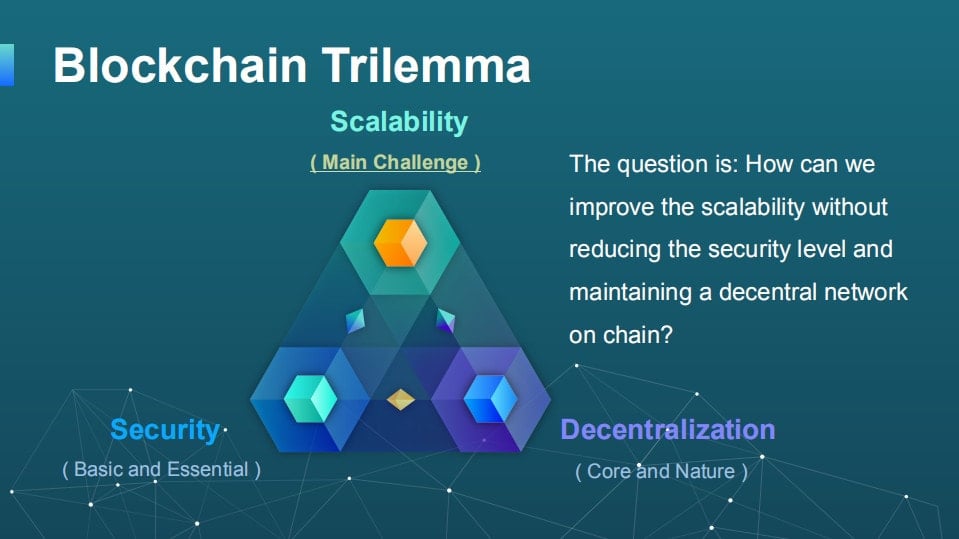

Cardano aims to become the third generation blockchain, overcoming issues with previous generations of blockchains namely lack of scalability, interoperability and sustainability. Cardano aims to develop its platform upon these 2 guiding principles:

- Peer-review: any science guiding the solutions to these issues goes through peer review.

- High assurance code: Cardano aims to bring the same level of scientific rigour for mission critical systems such as aerospace to the development of their project.

Cardano’s platform has the following key features:

- Cardano will be built in Haskell code. Haskell uses a math based approach that results in a much more secure and reliable protocol.

- A formally verified Proof of Stake consensus called Ouroboros. It is the first provably secure blockchain protocol developed by the IOHK team and peer reviewed. It has advantages over the traditional proof of work blockchains (e.g. as used by Bitcoin) by requiring less computation resources (there will be no mining) and is thus cheaper to run, yet being just as secure as the more popular Proof of Work algorithm. It also comes with a novel reward mechanism to prevent attacks like block withholding and selfish-mining.

- Recursive InterNetwork Architecture (RINA): Cardano is looking towards building RINA in order to reduce the bandwidth which is required for communicating and disseminating data. The idea is that RINA has fewer protocols but is able to work faster, yet still providing transparency, privacy and scalability.

- The protocol is geared towards protecting users’ privacy rights while taking into account the needs of regulators. In doing so, Cardano is the first protocol to balance these requirements in a nuanced and effective way, pioneering a new approach for cryptocurrencies.

- Cardano will also be completely open source and patent-free.

Cardano’s platform is being constructed in 2 layers- a settlement layer and a computational layer. This gives the system flexibility during maintenance and allow for upgrades by way of soft forks.

After completion of the settlement layer that will run ADA, the separate computing layer will be built to handle smart contracts. Cardano will also run decentralised applications, or dapps, services not controlled by any single party but instead operate on a blockchain.

Advantages and Disadvantages of Cardano?

Advantages of Cardano

Many smart contract users believe that Cardano holds the key for long term secure development. This because of the numerous hacks and vulnerabilities in platforms such as Ethereum. Cardano founder Charles Hoskinson has criticized Ethereum as a “rushed product” with vulnerabilities which led to famous hacks such as The DAO. This could be viewed as a symptom of the flaws in Ethereum’s programming language, Solidity. Cardano improves on this by allowing for development using Haskell which can be formally verified.

Cardano’s use of the proof of stake model in itself brings lots of advantages such as less susceptibility to interference because the nodes will be responsible for throughput and thus eliminating the need for extra machines. In turn less energy will be consumed which is better for the environment.

Rewards are given out based on the number of tokens held rather than the amount of computational power contributed, which is fairer.

The platform’s 2 layered system allows for each layer to be responsible for a complete set of tasks. This means more potential for interoperability with different cryptocurrency platforms and is therefore more scalable compared to Ethereum.

Disadvantages of Cardano

Critics of Cardano have pointed to the slow development and overly ideal goals of the project. This can be risky for Cardano because it could be overtaken by more aggressive competitors, or the regulatory environment can change meanwhile.

Many features promised by the Cardano team are still not yet available. So a lot of what is said about how its cryptocurrency ADA would work is still theoretical.

What is the Daedalus wallet?

In order to store and use ADA, you must install Cardano’s Daedalus wallet. With the wallet you can send and receive ADA as well as view your transaction history.

The Daedalus wallet will also offer the following features:

- Unlimited Accounting – Manage any number of wallets with Cardano’s innovative hierarchical deterministic wallet implementation. This will give you more control over how your funds are organised. It also has powerful backup features to help recover your funds anytime.

- Advanced Security – Cardano will not hold your keys. They use the most advanced cryptography in the world to ensure safety from attack and offer spending passwords and seeds for all your accounts.

- Export to paper certificates- Wallets can be exported to paper certificates giving users the option of placing funds in cold storage.

- Built with Web Technologies – Daedalus is built on top of Electron, a battle-proven open source development platform to build cross-platform desktop apps using Javascript, HTML and CSS.

The Daedalus wallet is still a work in progress, features which are expected to be coming soon include:

- Support for Bitcoin and Ethereum Classic.

- Staking features which allow ADA holders to earn more ADA tokens.

- A mobile wallet for both iOS and Android.

What is the Goguen Era of Smart Contracts?

On 12 September 2021, Cardano’s Alonzo hard fork upgrade went live on mainnet. Therefore, users can now create and deploy smart contracts on the Cardano blockchain.

To learn more about what the Gouguen Era and Alonzo Hard Fork means for the development of Cardano, check out our detailed article here.

Cardano enters DeFi with Occam Finance ($OCC)

Occam Finance ($OCC) is a suite of DeFi (Decentralized Finance) solutions tailored for Cardano and managed and maintained by the Occam Association, a blockchain entity based in Switzerland. Currently, Occam offers 3 major products: OccamRazer, OccamX and OccamDAO.

Resources:

Website https://cardanofoundation.org/

IOHK website https://iohk.io/

Ouroboros whitepaper https://iohk.io/research/papers/#9BKRHCSI

Blog https://cardanofoundation.org/blog/