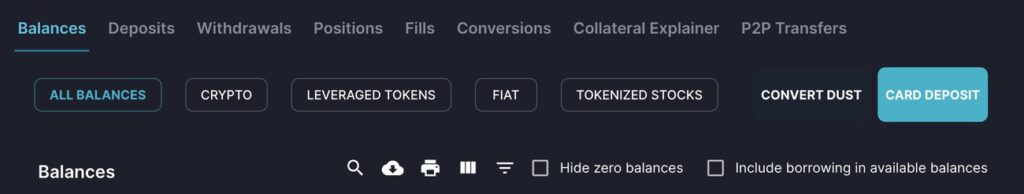

Were BlockFi’s assets held on FTX exchange, which is now bankrupt, and its funds hacked?BlockFi provides lending services to clients across the globe. In our previous article, we reported that BlockFi has paused its client withdrawals since 11th November 2022 due to lack of clarity” on the status of FTX.com, FTX US and Alameda.

Does BlockFi have exposure to FTX?

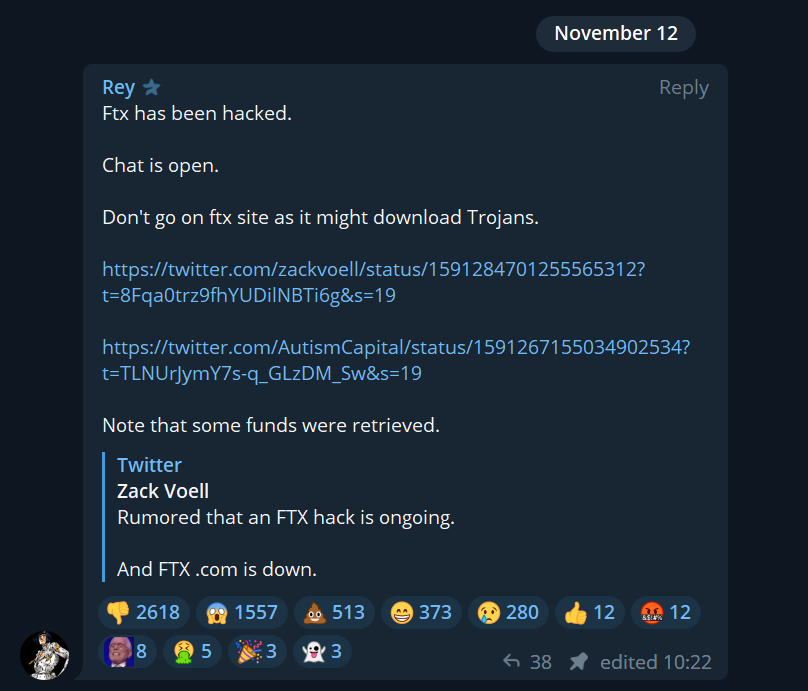

Shortly after BlockFi halted client withdrawals, the FTX Group filed for bankruptcy. Worse, FTX had been hacked and over US$600 million in funds were stolen. A lot of these funds belonged to FTX exchange users such as retail investors and even blockchain companies. Therefore, rumours have been swirling that BlockFi has substantial assets held in FTX.

On 14th November 2022, BlockFi issued an update addressing the rumours that a majority of its assets were held on FTX. Admitting they have “significant exposure” to FTX and their associated corporate entities.

On 28th November 2022, and during BlockFi’s bankruptcy hearing, the company revealed it has US$355 million stuck on FTX. On the other hand, Further, Alameda Research, an associated company of FTX, owes US$680 million to BlockFi.

On 28th November 2022, BlockFi also sued Emergent Fidelity Technologies, a company owned by FTX’s Sam Bankman-Fried (SBF). The lawsuit seeks SBF’s shares in Robinhood that were used as collateral as part of a pledge agreement.

Will BlockFi be able to recover any funds from FTX?

According to BlockFi’s 14th November 2022 update, BlockFi “…will continue to work on recovering all obligations owed to BlockFi.” BlockFi, however, expects there will be delays in the recovery of assets from FTX. This is because FTX, FTX.US and Alameda have filed for bankruptcy.

However, with the news that BlockFi has also filed for bankruptcy, it is starting to become uncertain whether BlockFi will be able to recover everything it has stuck on FTX.

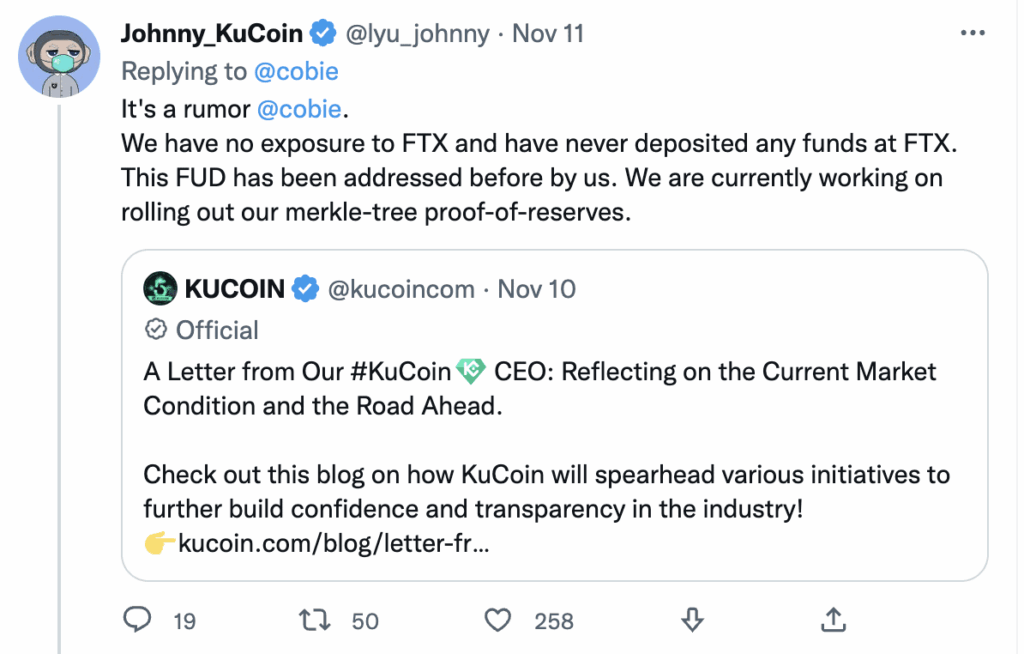

BlockFi assured users they were independent of FTX

Previously, BlockFi Founder and COO Flori Marquez have assured users via Twitter that it is an independent business entity from FTX. Although, BlockFi does have a US$400 million line of credit from FTX.US (and not FTX.com). To learn more about the difference between FTX.com and FTX.us, check out our article- Key Similarities and Differences Between FTX.com and FTX.us

What’s next for BlockFi?

On 28th November 2022, BlockFi filed for bankruptcy. During its first hearing, BlockFi expressed it intends to seek approval to restore withdrawals from BlockFi wallets. However, no Court application has been made yet and the Court has not decided whether customers will be allowed to make withdrawals.

BlockFi’s next bankruptcy hearing is presently scheduled for 9th January 2023 at 10:00 EST.

To learn more, check out our other article- What will happen to BlockFi?

FTX EXCHANGE (INCLUDING FTX INTERNATIONAL AND FTX.US) ARE NO LONGER IN OPERATION

Both exchanges have filed for bankruptcy. Subsequently, the exchange was “hacked” and more than US$600 million worth of cryptocurrencies drained. The hacker is strongly rumoured to be a former FTX employee. For more about how this story unfolded and the latest news, check out these articles:

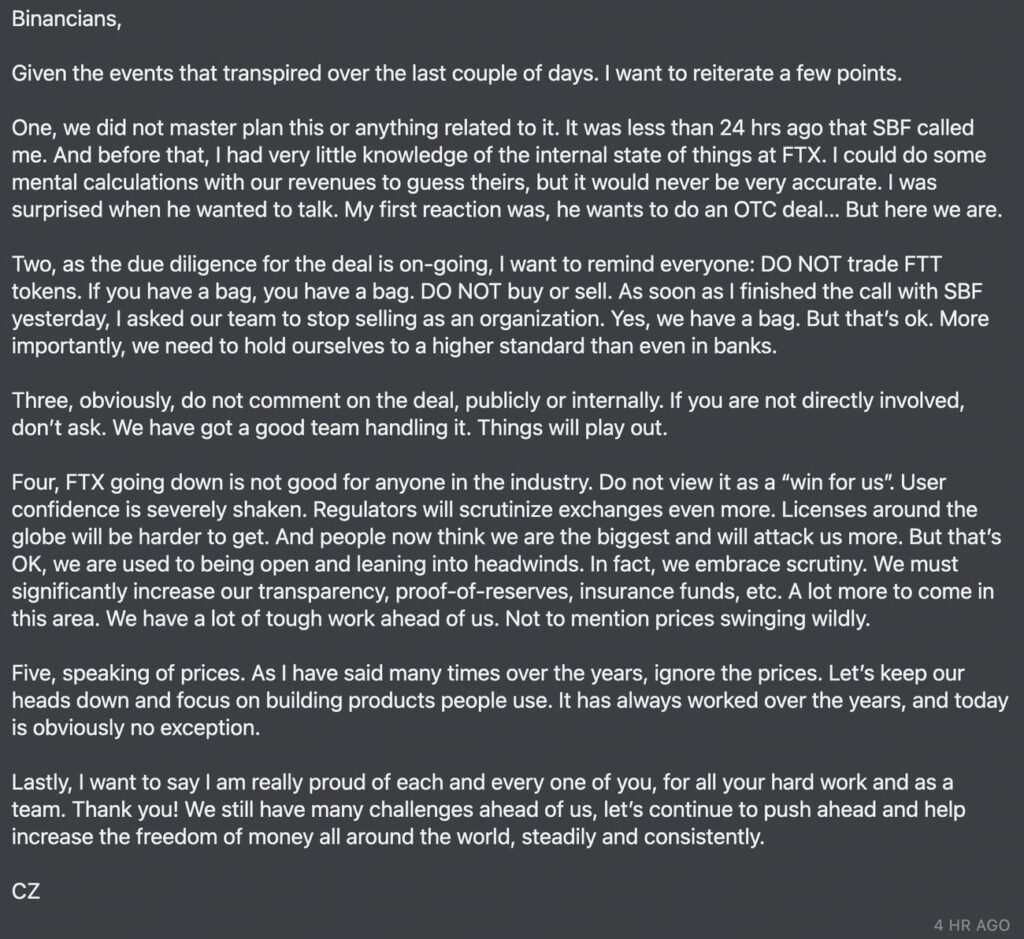

- SBF vs CZ War: What’s happening with FTX and Binance?

- Binance to Acquire FTX: What This Means for All Investors

- Binance Will NOT Acquire FTX: What is Next?

- BlockFi suspends withdrawals over unclear status of FTX

- FTX, FTX US and Alameda File for Bankruptcy

- FTX Hacked: Hacker Identity Revealed by Kraken

- What will happen to BlockFi?

- Were BlockFi’s assets held on FTX?