MetaMask is a secure crypto wallet to store and manage your Ethereum (ETH) and other ERC-20 tokens. It is also a gateway to other decentralized applications. This is beneficial for people who frequently use ETH and its tokens as it provides a secure and fast way to access their funds. This guide is a MetaMask tutorial for complete beginners. We will learn how to:

- Set up a MetaMask account.

- Deposit to MetaMask.

- Send funds from MetaMask.

- Change and add networks in MetaMask.

- Use MyEtherWallet with MetaMask.

- Fiat on-ramps: Buy Crypto Using Debit or Credit Cards.

- Withdraw money or cryptocurrencies from MetaMask.

- Collect airdrops using MetaMask.

- Cash out your crypto to fiat using MetaMask.

You can also follow me as I walk through the steps in my video:

What’s more, there are rumors that MetaMask might also do a $MASK airdrop! Learn how to get some of that potential airdrop with our MetaMask ($MASK) Token Airdrop Guide!

How to set up a MetaMask account

Here’s how to set up a MetaMask account:

- Download and install MetaMask.

- Create a new wallet.

Download and install Metamask extension

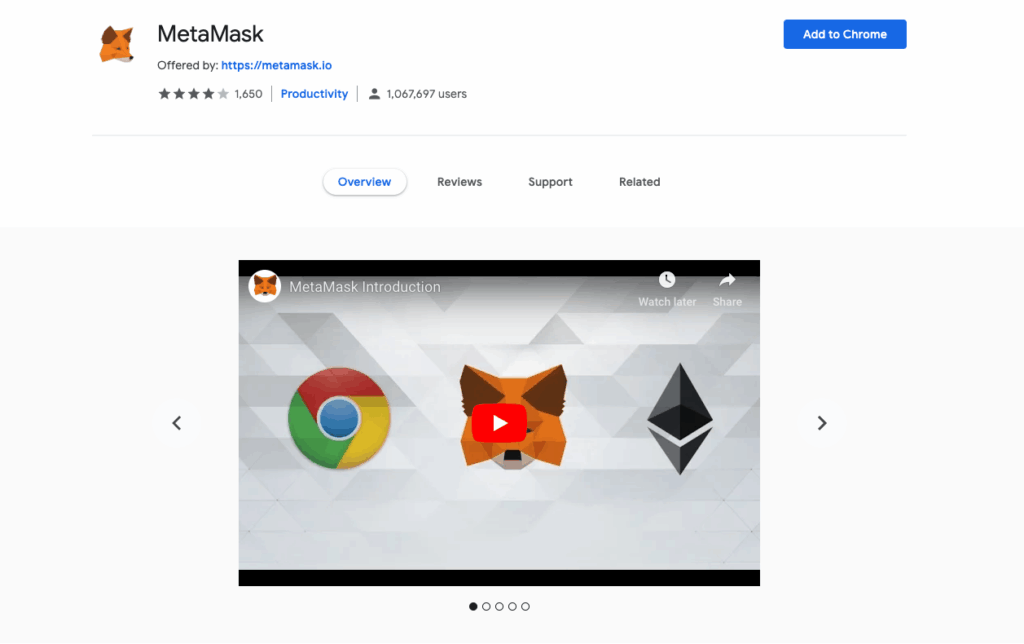

Download MetaMask. MetaMask has extensions for Chrome, Firefox, Opera and Brave browsers. At the extension store on these browsers, search for MetaMask and click “Add to” browser.

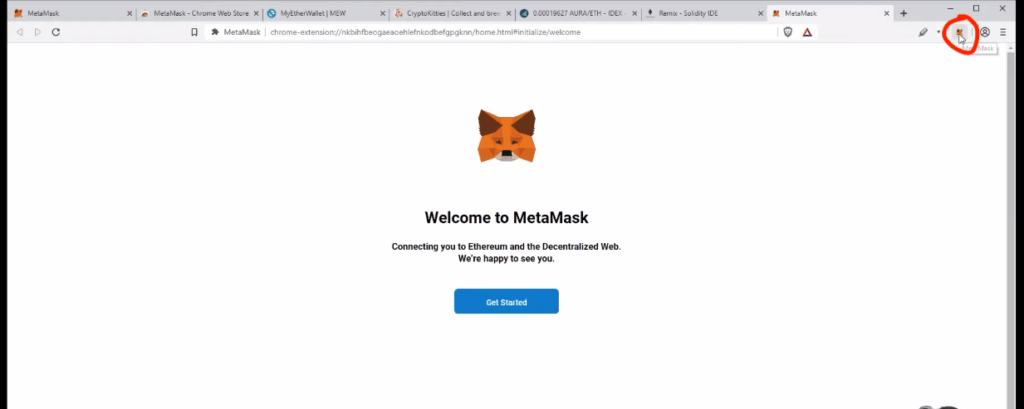

Once installed, the MetaMask icon will appear on the top right-hand corner.

Create a new wallet

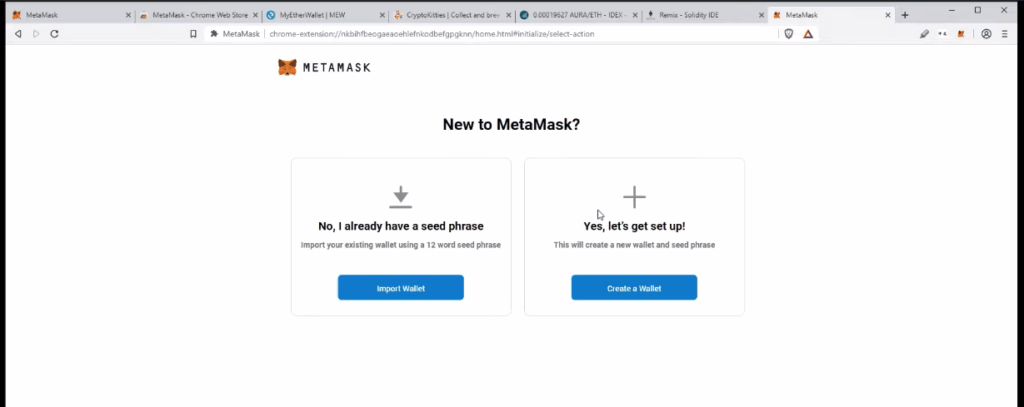

Click the “Get Started” button on the webpage and choose the option to make a new wallet. Afterward, you will be asked to come up with a password for your account. It is best to make a strong password that other people can’t easily guess, like your birthday. This means that your password should have numbers and letters arranged in a unique way.

Back up your wallet with the special 12-word code. It is best to write this code down on a piece of paper and store it in a secure place. Do not let hackers access the code by saving it on your computer. Instead, to keep your money safe, write the code on paper instaMask account address, click on the extension and then copy the address at the top. You can also click “…” and “Account details” to get your full deposit address and a QR code. Make sure you’re on the same network on MetaMask as the wallet or exchange you’re sending tokens from. To deposit tokens, either copy the address onto the “send” address on the wallet or exchange you’re sending from, or scan the QR code.

To check if you have received tokens, open the MetaMask window and look for the token you added. If it is there, you can see your balance. If it is not there, you need to manually import the token contract. To do this, go to CoinGecko or CoinMarketCap, find the token you want, click on “Contract” and the MetaMask logo. On the MetaMask window, click “Add token”. Once the token is added, you can see your balance in the MetaMask wallet. Change “The balance was seen in the MetaMask wallet” to “You can see your balance in the MetaMask wallet.”

How to send crypto from MetaMask?

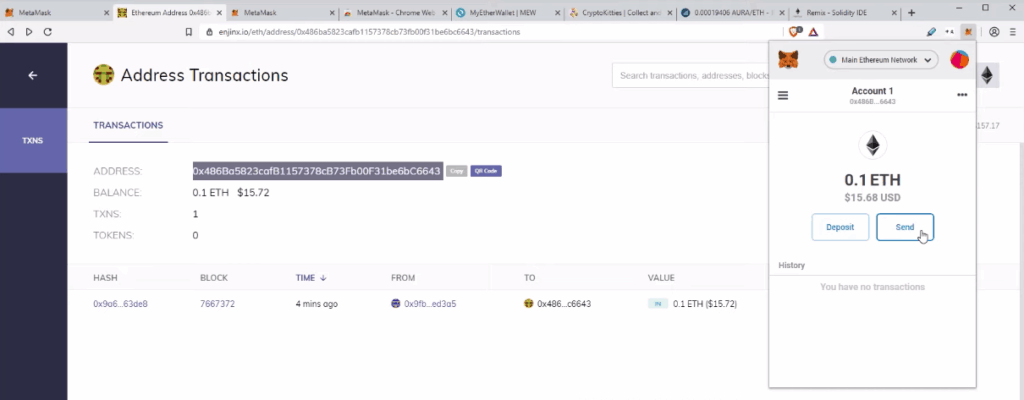

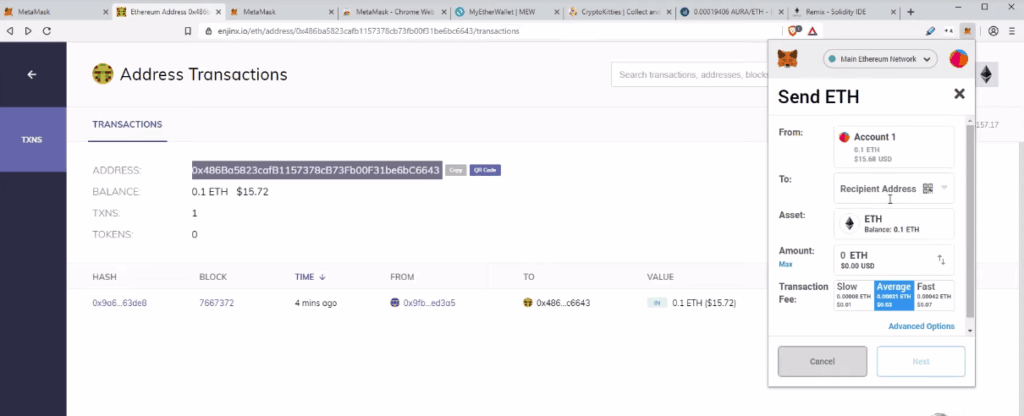

You can send cryptocurrencies in your MetaMask to other wallets, and exchanges, or make purchases. Click on the extension and “Send” on the pop up window.

Once you have filled in the address of the person you are sending the cryptocurrency to, the type of cryptocurrency (e.g. ETH) and the amount, double-check that the address, type and network are all the same. Confirm the amount to be sent, the gas fee and the total amount including the fee, then click “Next”. When the cryptocurrency has been sent, you will get a notification saying “Confirmed Transaction” on your web browser.

Change and add networks in MetaMask

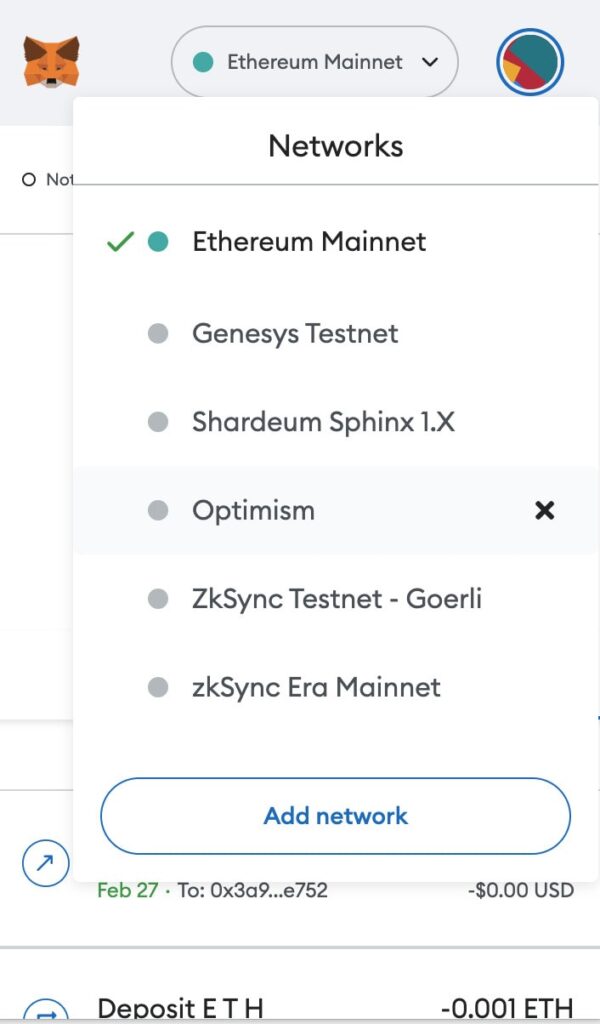

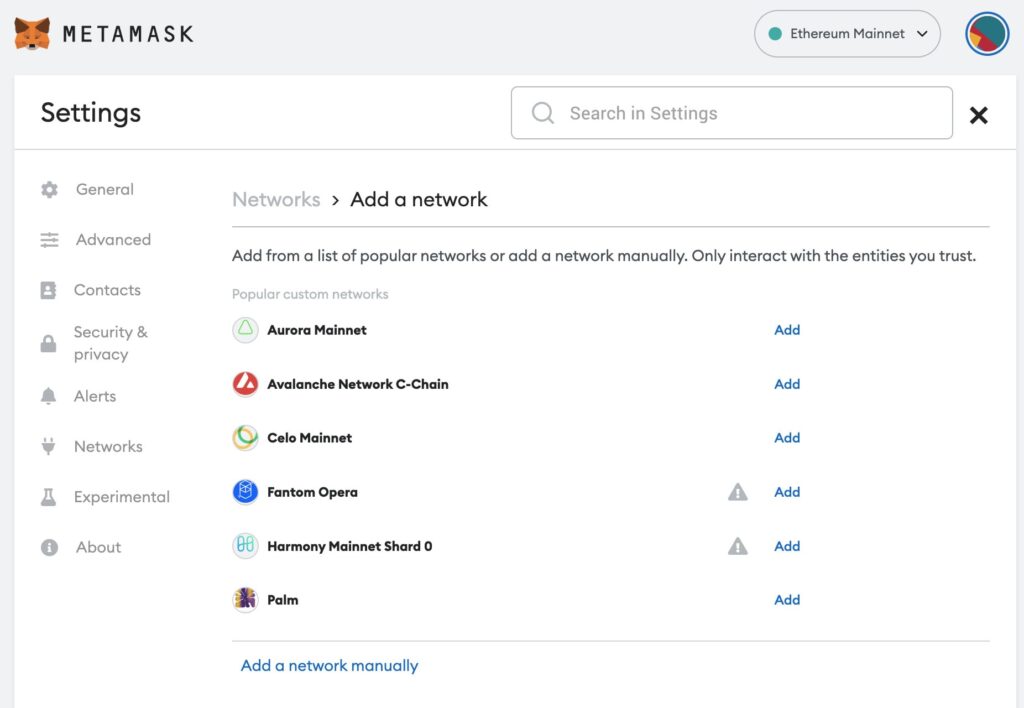

Ensure the correct network is selected on both the sending and receiving wallets to ensure funds are sent. To do this, click on the top bar of your wallet and select the network you want to use. This could be Ethereum, or Layer 2 blockchains such as Optimism, Arbitrum, or Polygon. Once you have chosen the right network, you can safely send and receive tokens.

For some newer or testnet networks, you may have to add them to MetaMask manually. To do this, click “Add network”, search for the network, and click “Add”.

If you can’t find your network, you can add it manually. Get the details from the project’s documentation and fill them in.

Learn more about Ethereum Layer 2 networks such as Arbitrum, Optimism, Polygon and Ethereum 2.0 here.

Adding a network using Chainlist

Here’s how to add a network to your MetaMask using Chainlist :

- Connect your MetaMask to Chainlist.

- Find the network you want to add and click “Add Chain”.

- On MetaMask, click “Approve”, then “Switch network”.

How to use MyEtherWallet with MetaMask?

MyEtherWallet is a free program that helps people make wallets and use smart contracts. On their website, click “Access my wallet” and “Browser extension”. On MetaMask, pick your wallet, then press “Next” and “Connect”. You’ll then be able to see the MyEtherWallet dashboard. Here, you can check your portfolio, manage your NFTs, send and receive cryptocurrency, and sign messages.

MetaMask Fiat On-Ramps: Buy Crypto Using Debit or Credit Cards!

MetaMask makes it easy to buy cryptocurrencies without ever leaving the app. It works with Coinbase Pay, Transak and MoonPay, so you can use your credit card or Google Pay to purchase different types of digital coins. Depending on the company, you’ll be able to buy a variety of cryptocurrencies. Here’s how to do it:

- On MetaMask, click “buy” and choose which company you wish to buy from.

- On the page, select how much crypto you want to buy, the payment method, and the type of cryptocurrency. Then click “Buy now”.

How to withdraw money or cryptocurrencies from MetaMask

To take out your money or digital currencies from MetaMask, you must first transfer them to an exchange that can turn them into fiat currency. To do this, look at our list of the Top Cryptocurrency Exchanges 2023. This will help you find a platform that can convert your crypto into the currency you need.

- Have a cryptocurrency exchange account set up. For recommendations, check out our Top Cryptocurrency Exchanges 2023.

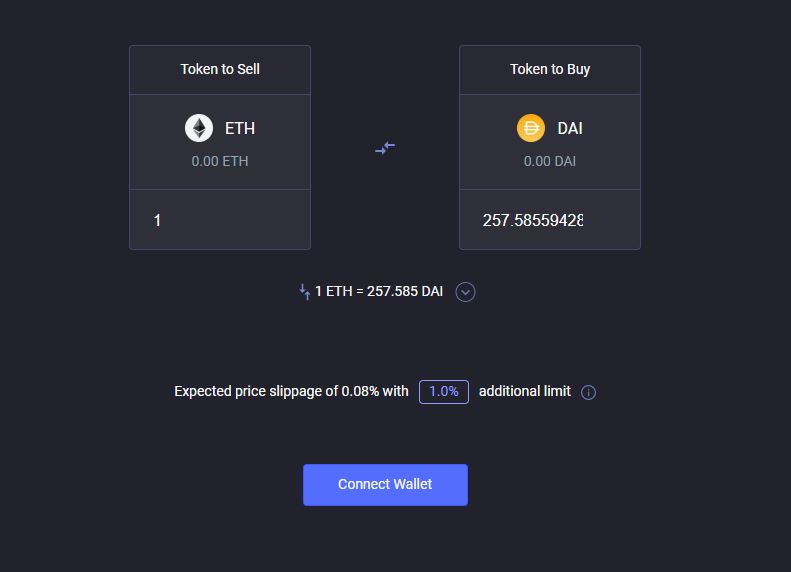

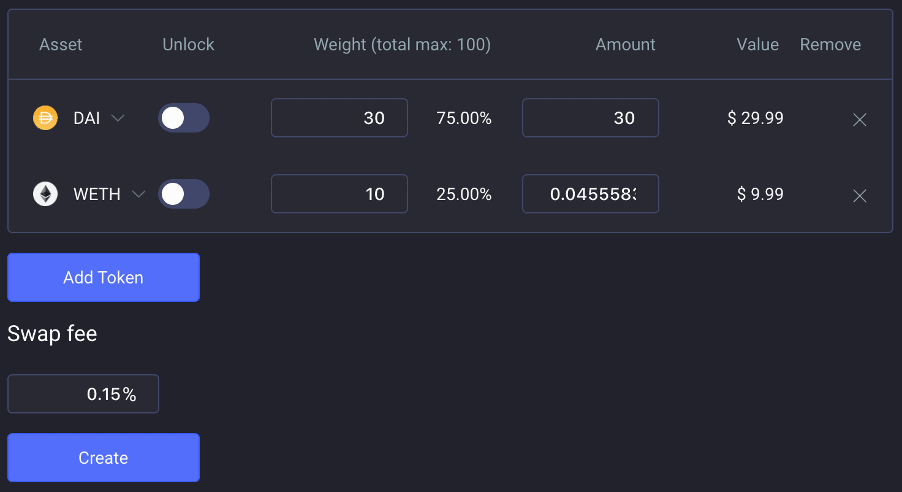

- To send your cryptocurrency from MetaMask to a crypto exchange, it’s best to first convert your cryptocurrencies into one of the more popular coins, like Bitcoin or Ethereum. This makes it simpler to send all your coins in one go, and also because these two coins are accepted by most exchanges.

- On the exchange, sell your cryptocurrency for fiat currency.

- Withdraw your fiat currencies (USD) to your bank account.

How to collect airdrops using MetaMask?

Airdrops are a great way for people to get free tokens, which is like getting FREE MONEY. To get the tokens, you will need to do certain tasks. After that, you will need to connect your MetaMask wallet to collect and sell the tokens. Here’s how to collect airdrops using MetaMask:

- Go to the airdrop site.

- Depending on the project, you may need to change your network. To do this, click on the top bar on MetaMask and select your network.

- Connect your MetaMask to the site. The button is usually at the top right-hand corner.

- Choose which wallet you want to connect to the site.

- Click the claim button on the website.

- Confirm the transaction on MetaMask and pay any gas fees.

- After you are done, disconnect from the airdrop site by clicking on the three dots on MetaMask. Then “Connected Sites” and disconnect.

Don’t know where to get airdrops? Check out Upcoming Crypto Airdrops.

Cash out your crypto to fiat using MetaMask

MetaMask has launched it’s long-awaited Sell feature, allowing users to finally cash out their crypto to fiat on MetaMask. Currently, MetaMask allows you to cash out your crypto to fiat currencies such as USD, EUR and GBP. Your converted currencies can also be directly deposited to your bank account or PayPal. Note however that MetaMask’s Sell feature is only available in some states in the US, UK, and parts of Europe. Also for the time being, MetaMask Sell only supports ETH on Ethereum Mainnet. However, more layer 2 networks will be supported soon.

Here’s how to sell or cash out crypto to fiat using MetaMask

- Connect your wallet

Go to. https://portfolio.metamask.io/ and connect your wallet.

- Go to Sell page

Click on “Sell” on the left hand menu bar.

- Select region

Select your region. Note that MetaMask Sell is only available in some states in the US, UK, and parts of Europe.

- Select token and network

Select the token and network you want to sell from. For example, ETH on the Ethereum Mainnet network.

- Select destination account

Select where you want your cashed out fiat to be deposited (e.g. bank account or PayPal balance).

- Enter sell amount

Enter the amount of crypto you want to sell. Note MetaMask Sell currently only supports ETH.

- Select quotation

MetaMask will provide a range of quotations from different providers. Select your preferred quote to continue.

- Link fiat account

You will then be redirected to your selected provider’s website to sign up and link your fiat account. Afterwards, you will be directed back to MetaMask Portfolio.

- Send crypto and confirm transaction

Click “Send ETH to [Provider]” to send your crypto from your wallet to your fiat account. Then, confirm the transaction.

- Track your transaction

Go to the “Sell” tab to track your transaction. Please note that transaction speeds may vary and your fiat currencies may take a few days before it appears in your bank account or Paypal balance.

MetaMask tips, tricks, and hacks for ADVANCED users

Congratulations on setting up your account! Now you are ready for ADVANCED tips and tricks such as:

- How to reduce transaction fees;

- how to cancel incorrect transactions;

- how to use your Ledger cryptocurrency hardware wallet with MetaMask;

- how to save your frequently used contacts (addresses) to MetaMask;

- how to speed up stuck transactions….and more!

Check out our video which will walk you through the process step by step:

Frequently Asked Questions (FAQs)

MetaMask is absolutely suitable for beginners, if not essential for every cryptocurrency trader. MetaMask also has a clean and straightforward interface. The fact that it is an extension of your browser also makes it very easy to use.

MetaMask has not suffered any major hacks. However, there are ongoing phishing attacks by outside parties against MetaMask users.

Halborn, a cybersecurity firm, discovered a case in June 2022 where a compromised computer had unencrypted private keys on its disk. MetaMask has since fixed this vulnerability in its extension versions 10.11.3 and later.

Halborn, a cybersecurity company, has cautioned MetaMask users about active phishing scams. These scammers send emails with the MetaMask header and logo, asking people to verify their wallets by following KYC regulations. If the recipient clicks on the call to action button, they are taken to a fake website. This website then requests the user to enter their seed phrases, which the scammers can use to steal their crypto funds.

These MetaMask scam emails can usually be identified by spelling mistakes in the email e.g. “metamaks.auction”. Another red flag in the email is that it is not personalised.

For everyday transactions, MetaMask is a great choice. However, for larger amounts of money, it is best to use a hardware wallet. The Ledger Nano S, Ledger Nano X and Trezor are all secure options.

MetaMask can have transactions stuck when too many people are trying to process them on the network. To fix this, you can speed up the transaction. To do this, click “speed up” on MetaMask, then select the options available. Choose “Fast” and click “save”. This will create a new transaction with higher gas fees, but it will make the transaction go through faster.

Buying Ethereum on MetaMask is easy. MetaMask has partnered with Coinbase Pay, Transak, or MoonPay (depending on the country) to make it simple. All you have to do is click “Buy” on MetaMask, then pick which company you want to buy ETH from. You can compare each company’s rates and payment methods to decide which one you like best. After that, in the pop-up window, select the amount you want to buy and your payment method, then click “Buy Now”

To undo a transaction on MetaMask, press the “Cancel” button on the MetaMask window. If you chose a lower fee option, it will take longer for the transaction to go through, but it will also give you more time to cancel it

MetaMask is available for both iOS and Android mobile devices. And can be downloaded on the Google Play Store or the Apple App Store.

MetaMask is available as a web browser extension for Chrome, Firefox, Brave, Edge and Opera. You can download the extension on their website and install it.

You can download MetaMask for Android from the Google Play Store.

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.