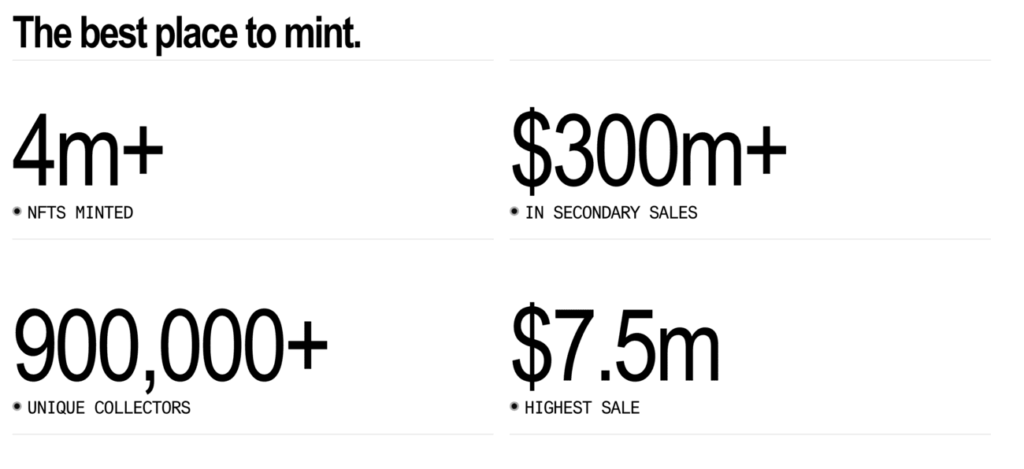

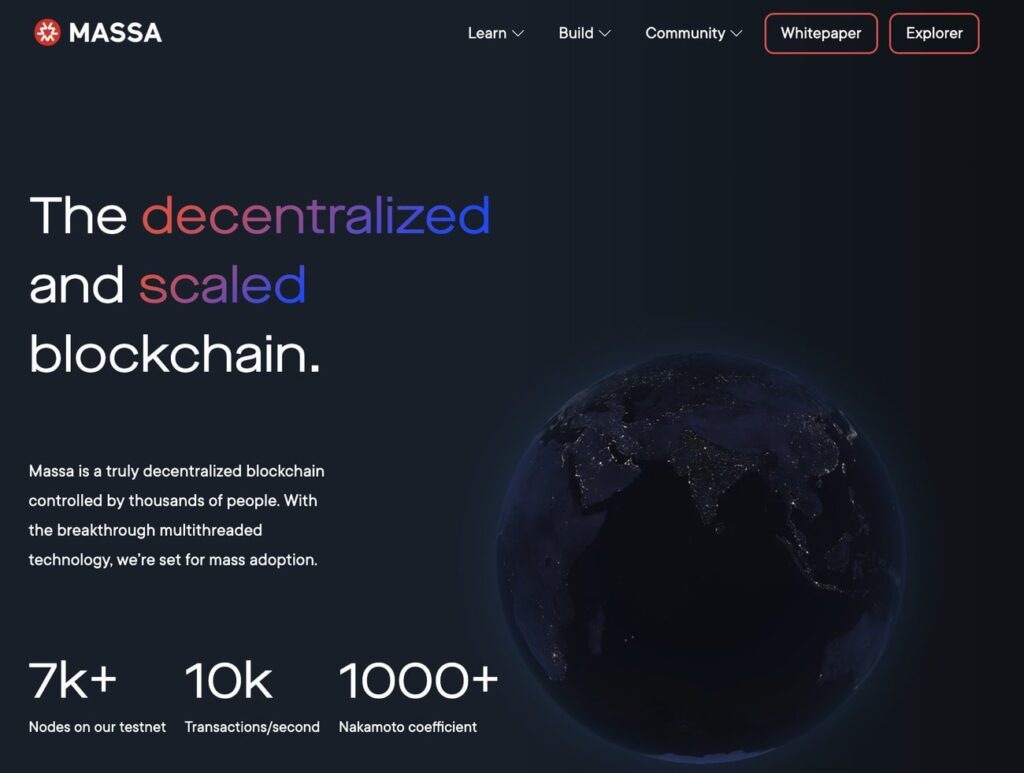

Massa Labs calls itself the first truly decentralized blockchain. Their vision is to build a high-capacity infrastructure that provides dApps with a censorship-resistant environment thanks to its true decentralization. Also, to offer a secure way for protocols to continue thriving on the blockchain even in case the project shuts down. This is possible because Massa’s smart contracts are hosted on-chain and remain serverless forever. Massa Labs has recently raised over US$5 million in funding and has reserved 8% of its initial token supply for the community via an “incentivized testnet”. As a result, there is speculation that they may do an airdrop for those who use their testnet. Here’s a guide on how you can get a potential Massa Labs token airdrop.

Massa Labs Airdrop Step-by-step Guide

- Check if you have met the minimum requirements.

- Set up a node.

- Complete the tasks on Massa Labs Galxe page.

- Complete quests on Massa Labs dashboard.

Click here for more details.

What is Massa Labs?

Sébastien Forestier, Damir Vodenicarevic and Adrien Laversanne-Finot created Massa to fulfil the vision of a decentralized internet, where everyone can participate and benefit from the network. Massa is made up of highly-accomplished engineers, researchers and builders, with experience in crpyography, finance, gaming and more. All joining their forces to bring decentralization to everyone.

Massa Labs aims to provide a high-capacity, censorship-resistant, and serverless infrastructure for dApps and protocols using AssemblyScript as its smart contract language. They also offer a unique feature of web3-on-chain, which allows web developers to deploy their web applications on the blockchain and keep them running even if the project shuts down.

Messa released the first version of its testnet on July 16th, 2021. Currently, they are focusing on improving the stability of their nodes, verifying the security of the full codebase, and adding other minor fixes and improvements. They have also started a security audit in April 2023. Messa plans to launch its mainnet in October 2023.

Will there be a Massa Labs token airdrop?

Massa Labs has recently secured over $5 million in funding and according to its blog post, an allocation of 8% of the total initial supply of 1,000,000,000 Massa has been allocated for node runners, which is 80,000,000 Massa. These tokens will be airdropped to node runners who registered to the testnet incentive program, depending on the number of points they obtained.

How to be eligible for the Massa Labs token airdrop?

Massa Labs have announced the criteria for the token airdrop, here’s how to be eligible for the 80 million Massa token airdrop:

- Collect a minimum of 200 points by the end of testnet 24.

- Are not from ineligible countries i.e. USA, China, Iran, Syria. However this list is subject to change.

- Pass the KYC procedures by 25th September 2023.

- Provide their Massa wallet address by 25th September 2023.

How to get Massa Labs token airdrop

Time needed: 3 hours

Here’s how to get the potential Massa Labs token airdrop:

- Meet the minimum requirements

You will need: A validated Discord account, virtual or dedicated server with minimum 4 cores and 8 GB RAM, SHH or Telnet Client.

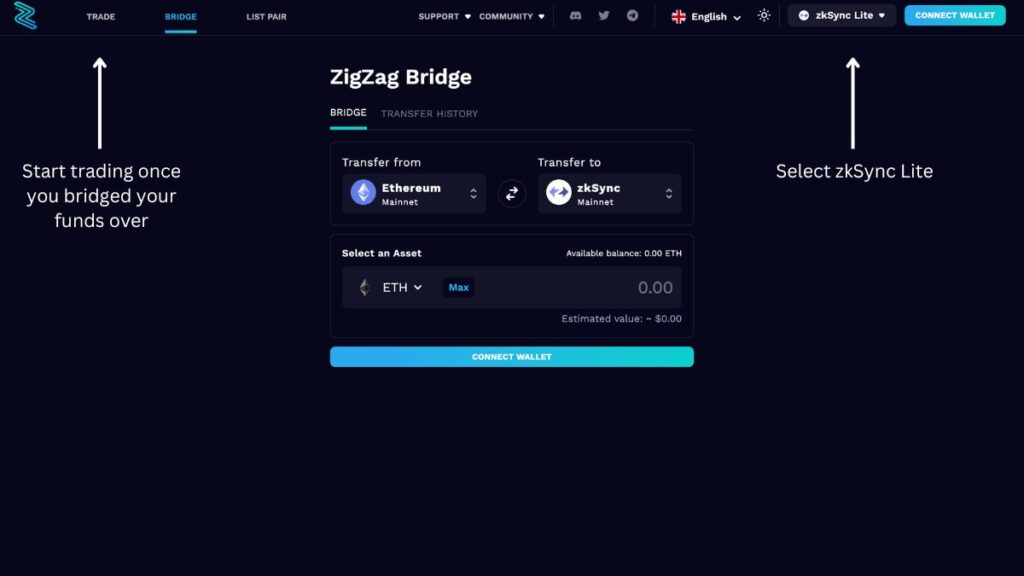

- Set up a node

Follow the tutorial to set up a node. In the tutorial, they will be using PuTTY to instal a node on Ubuntu. However, it is also possible to use Windows, Mac or Linux.

- Complete tasks on Massa Labs Galxe page

Connect your wallet to Massa Labs Galxe page. Tasks include following and interacting with their social media accounts and completing their quizzes.

- Complete quests on Massa Labs dashboard

Join the Massa Labs Discord, then connect to the Massa Labs dashboard. Afterwards, click on “Quests” on the top left-hand corner and complete the tasks. Tasks include downloading a Bearby wallet and minting their NFTs.

Airdrop Review

When reviewing an airdrop, there are several factors to consider. First, the likelihood the project will even do an airdrop in the first place. Then, to look at how many tokens the project intends to allocate towards airdrop campaigns, as well as the difficulty in participating in their airdrop. It is also important to look at the utility of the token so that there will be an actual use and purpose in participating in the airdrop in the first place. Finally, a factor to consider when reviewing an airdrop is whether the airdropped tokens are subject to any lockup period.

Likelihood of Airdrop: Massa Labs has not officially confirmed details of an airdrop, but they revealed in their whitepaper that they will reserve 8% of its initial token supply for the community via an “incentivized testnet”.

Airdropped Token Allocation: 8% of the initial token supply will be allocated to the community by way of an “incentivized testnet”.

Airdrop Difficulty: The most likely way to get any potential airdrop is to set up a node in their testnet. However this requires a lot of technical knowledge. Here’s hoping they will have more beginner-friendly tasks later!

Token Utility: The Massa Labs token utility is unknown.

Token Lockup: Of the airdropped tokens, 30% will be unlocked on mainnet launch, and the 70% remaining will be vested linearly over 24 months.