Decentralized finance (DeFi) projects have seen an enormous boost in recent years. While there has been an increase in its total value locked, especially in protocols that support yield farming, liquidity mining, and leveraged trading, there is still a need to design these platforms in a way that makes the experience easier for users, especially non-crypto people. This is what Oddz aims to do.

Oddz Finance ($ODDZ) is offering an on-chain options trading product on their platform without significant costs on the part of the user, lowered barrier to entry, zero gas fees, and reliable data feed. These are features that are not completely embraced in most projects we see in the DeFi space.

Background

According to the team behind Oddz, while the boom of DeFi introduced new trading opportunities for cryptocurrency holders, it still has its problems. Most trading platforms that offer derivatives to their users are not as user-friendly as they are supposed to be. This is a concern if adoption is the end goal.

Moreover, most platforms suffer from slow trade execution and a lack of transparency, which makes it difficult for traders to establish the positions they want given these limitations. Oddz protocol is designed to solve these issues on its own on-chain option trading and derivatives platform.

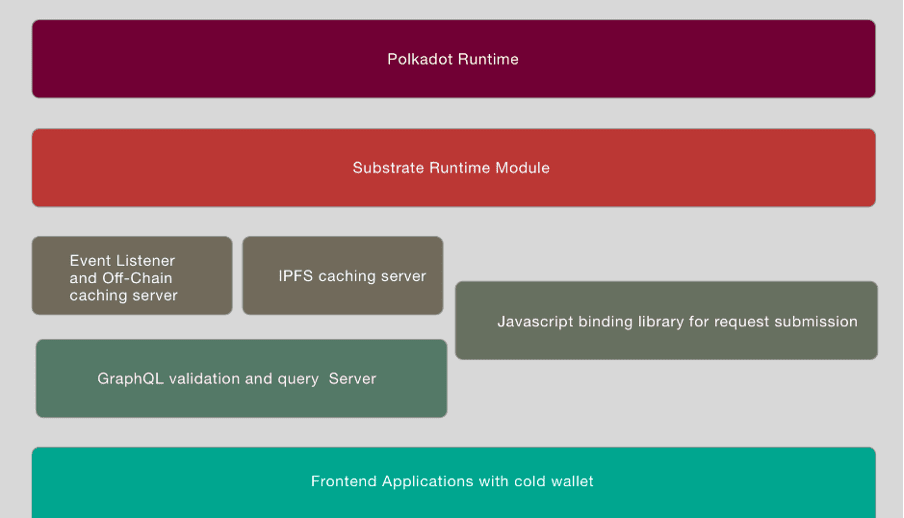

As of this writing, the next step for the team is to work on the integration of the protocol to the Polkadot network. There is also a plan for the team to launch its oracle, options on wallet applications, and futures platform by the second quarter of 2021. Conditional and perpetual markets will be introduced by the third quarter of 2021.

What is Oddz Finance?

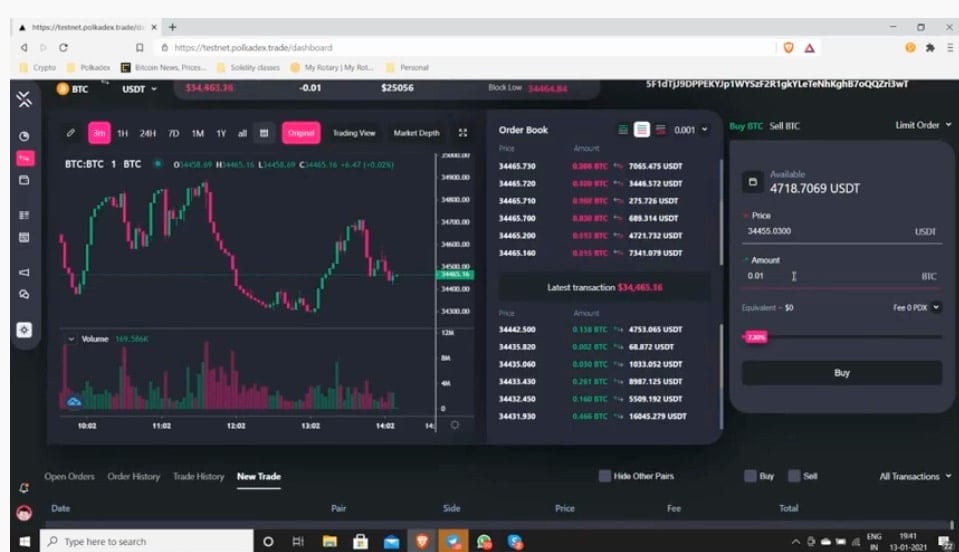

Oddz Finance is a decentralized, cross-chain, options trading platform that runs on Binance Smart Chain, Ethereum, and Polkadot. It offers a simplified approach for users to engage in derivatives trading. Through the platform, they can easily create positions, settle options contracts, and enter futures contracts, among others.

Oddz abstracts several functions in derivatives trading such as accessing features like call and put options, conditional market, and swap contracts. There are different stakeholders unified by the platform, including arbitrageurs, hedgers, and speculators.

Products of Oddz Finance

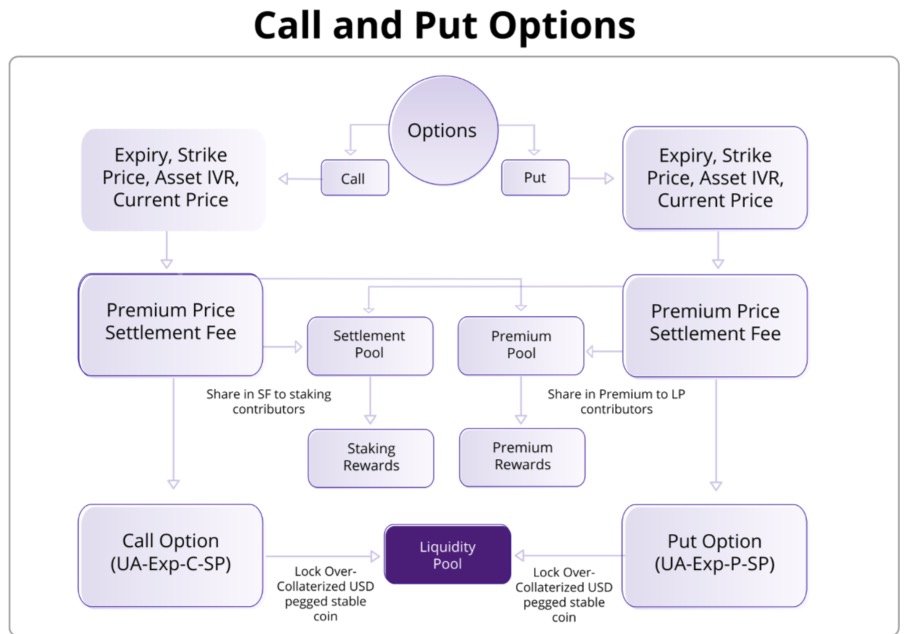

Leveraging and Hedging Options – Traders can make either call and put options on the protocol. In Call options, traders are given the ability to purchase underlying assets listed on the protocol based on a specified price within a particular time period. In Put options, traders can determine a specific price in selling a particular asset within a time period.

Conditional and Perpetual Tokens – Users can create and trade conditional tokens which can be valued based on any standard that is tied to it, say political, sporting, and other similar events. They can also trade either long or short through the protocol as supported by the platform’s high liquidity.

Attributes of Oddz Finance

- Blockchain Agnostic -The platform can facilitate user trades regardless of the blockchain that they belong to. Because the platform is also designed to be multi-chain, DeFi platforms from other networks can be easily deployed on Oddz.

- Customizable – Through the implementation of smart contracts, users can freely change the parameters covering their automated trading positions according to their own preferences.

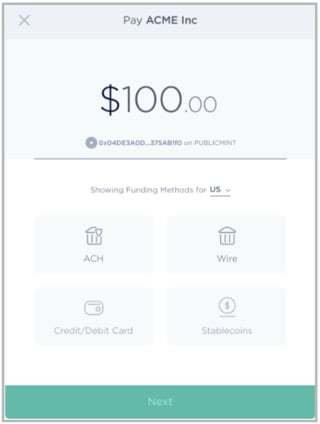

- Economical – Unlike most leveraging platforms, Oddz does not charge gas fees for each transaction made on the platform.

- Low Barrier – The platform allows users to leverage any amount in on-chain option trading products without the need for any authorization or third-party approval.

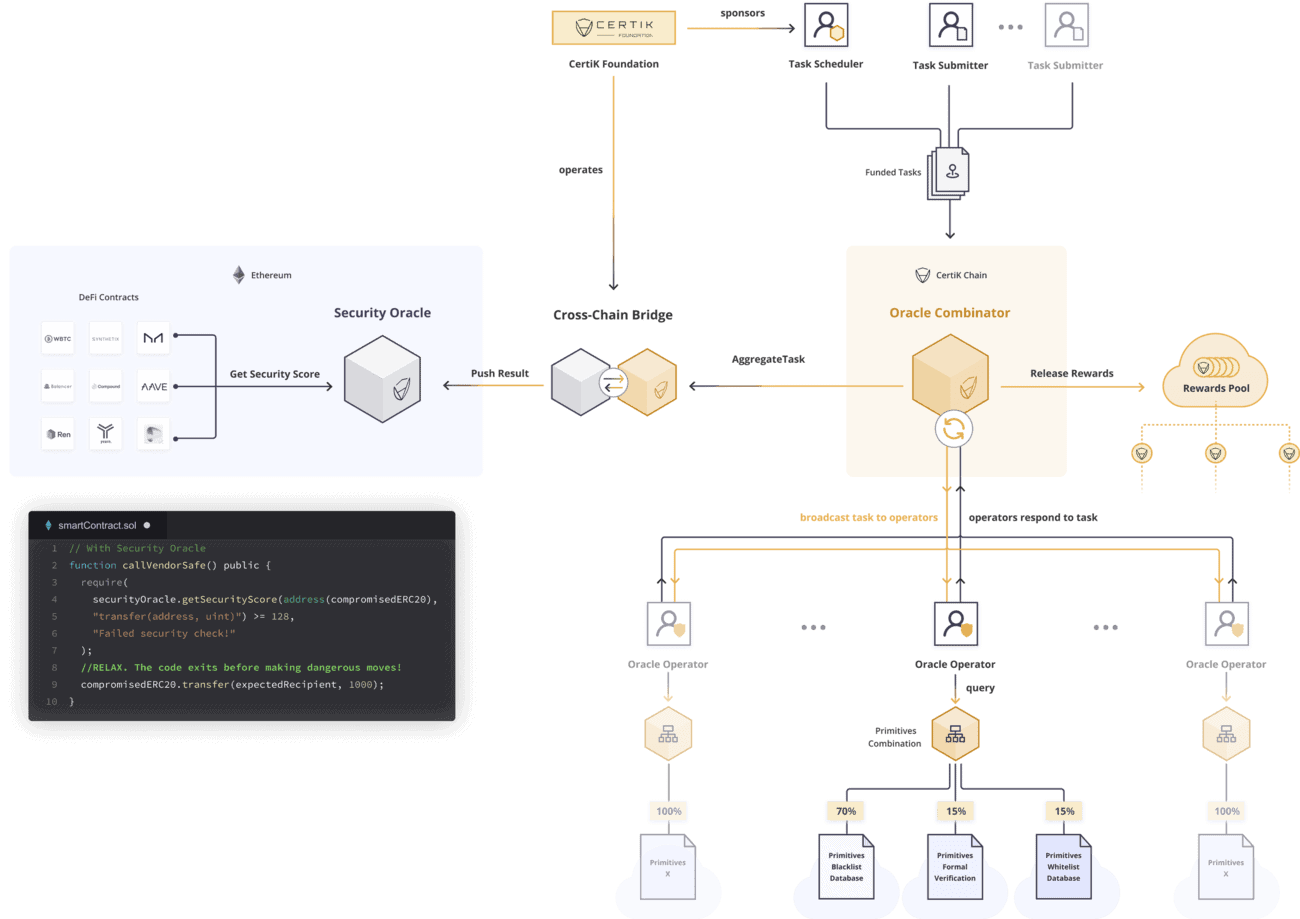

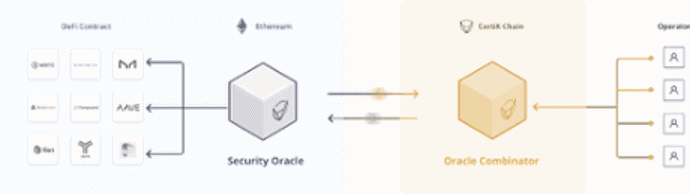

- Reliable – To help traders establish informed positions on the market, the platform has integrated a built-in oracle which feeds real-time blockchain data to the network.

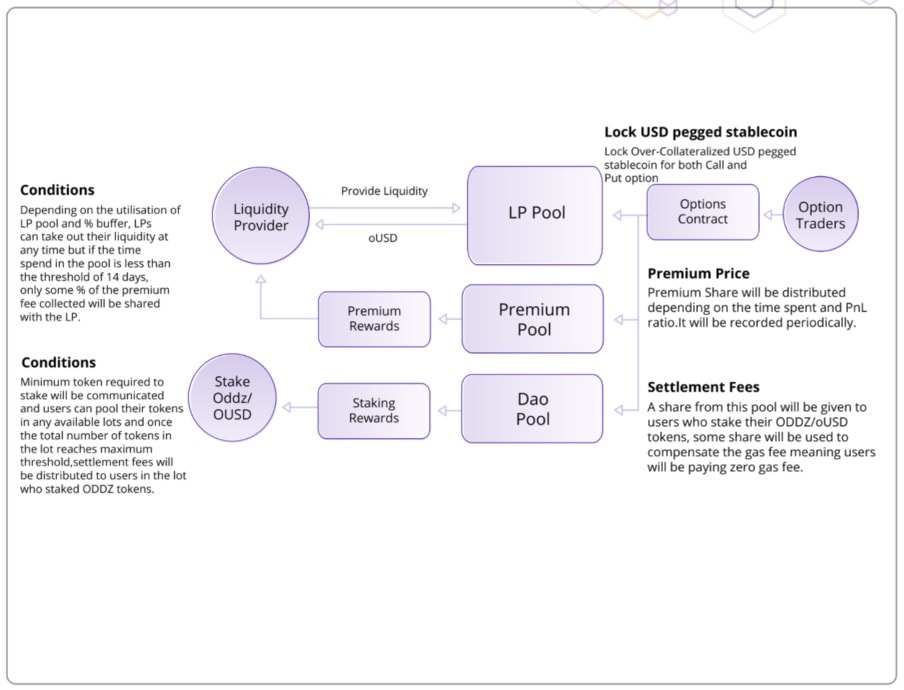

Liquidity Pool

In order to further support the liquidity of the platform in facilitating leveraged trading, users can also choose to lock a portion of their assets using Oddz’s USD-pegged stablecoin (oUSD). These will be used to supply liquidity for both call and put options.

Liquidity providers can withdraw their stake at any given time. However, a period of at least 14 days is required before they are given the opportunity to collect their share in the premium fees of the network.

There will be multiple liquidity pools for the protocol. It has a maximum threshold for staking and liquidity providers who staked ODDZ tokens will receive their portion of the platform’s collected settlement fees. However, there is a minimum stake requirement for users joining the pools.

Apart from the distribution of settlement fees to stakers of ODDZ or oUSD, there will be a portion of it that will be allocated to cover the gas fee for users to help keep its “zero gas fee” model.

ODDZ Token

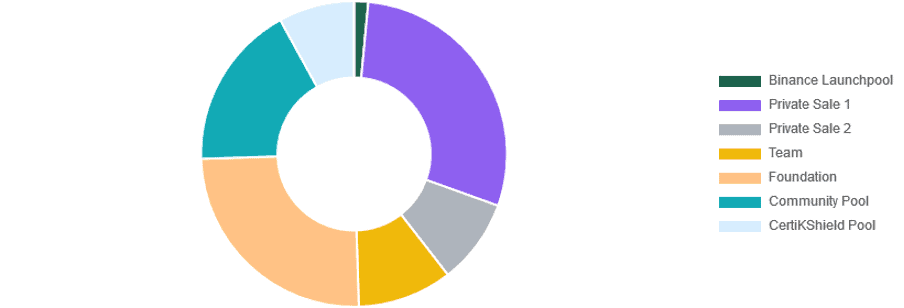

ODDZ token is the platform’s native utility token. They can be used as a medium of exchange and to support other platform features such as governance, staking, reward distribution, referral incentives, and liquidity pools, among others.

ODDZ will be mainly used to pay for transaction fees to help facilitate trades. They can also be staked in the liquidity pool to earn rewards.

Since the platform is decentralized, ODDZ holders are given the right to vote on important protocol upgrades, modifications, and other community-based proposals.

And if the users refer others to the platform, they are also entitled to earn rewards which are given out in ODDZ.

Conclusion

In order to take advantage of DeFi’s boom, the design of its protocols today must be aimed at lowering its barriers to entry and maximizing adoption. Here, the complexity and level of advanced understanding required to make transactions on a platform is worth considering. There are many projects that offer options trading to users but most of them still haven’t addressed these prevailing concerns so far.

Oddz Finance is a welcome development in the derivatives and options trading market. Since its platform is user-friendly and it minimizes the barrier to entry from required capitalization, more traders can finally tap leveraged trading in their own portfolio. Another advantage in using the platform is that if users wish not to participate in leveraged trading, they can just stake their holdings and still earn additional rewards in doing so.

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.