What is Thundercore?

ThunderCore (TT) is a high-performance smart contract platform which allows for the running of decentralized applications (Dapps) and Decentralized Finance (DeFi). Thundercore promises low fees and compatibility with any app written for the popular Ethereum Platform. The underlying currency on Thundercore Network is TT, which is used as a transfer of value and for related gas fees on the platform.

Thundercore attempts to Solve Scalability, allowing For Under One Second Confirmations. In the last couple of years, many blockchain projects have been working on scaling and improving network speeds. Until recently, it seemed nearly impossible to scale blockchains with big projects like Ethereum failing to do so. ThunderCore seems to have cracked it and may be on track to beating giants like Ethereum in scaling their platform.

What is the aim of ThunderCore?

ThunderCore aims to be a high-performance blockchain that enables mass adoption of dApps. It promises comparatively lesser transaction fees (low gas cost), compatibility, security and speed.

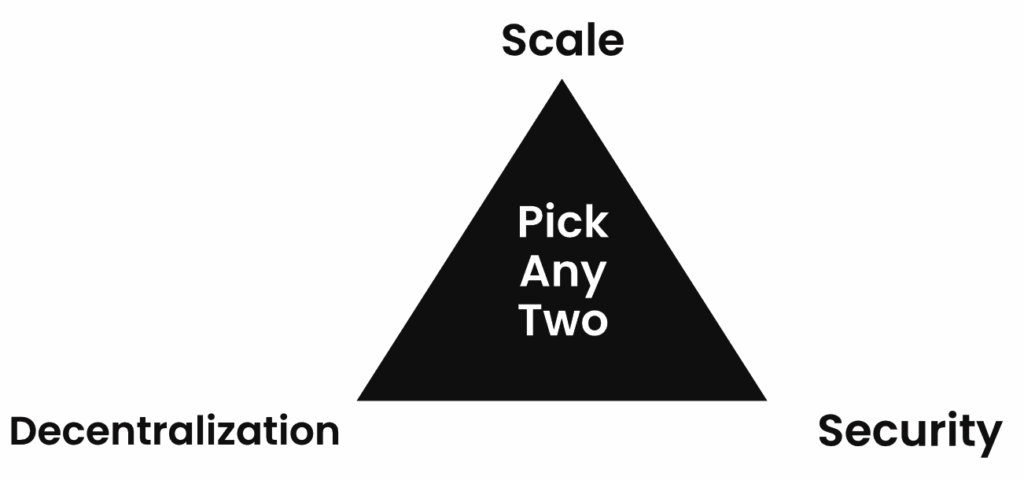

Currently, transactions on the blockchain are very slow. This is because of the “Blockchain Trilemma” a term coined by Vitalik Buterin, the founder of Ethereum.

Solving the Blockchain Trilemma

According to the “Blockchain Trilemma“, a blockchain has three major features: decentralization, scalability and security.

However, the blockchain trilemma proposes that it is very hard for a project to have all three features to a satisfactory condition. A network that is decentralized and has a tough security would not be scalable. Similarly, a blockchain that is decentralized and scalable will have little security etc.

Buterin believes at a fundamental level, a blockchain network can only achieve two of the three features at any time. The blockchain trilemma could be the source of scalability issues on most cryptocurrency blockchains. Most crypto projects cannot handle high numbers of transactions while ensuring network decentralization and security.

However, ThunderCore has found a solution for this problem.

How does ThunderCore solve the Blockchain Trilemma?

Many projects have tried and failed to continue their emphasis on decentralization and security while incorporating scalability. ThunderCore, however attempts to do this in a unique way. They do this by creating a Fast Path and a Slow Path. The Fast Path is for optimistic conditions. Whilst the Slow Path is for worst-case situations.

What is the Fast Path and the Slow Path?

The Fast Path is like a highway, allowing for instant confirmations on the network. However, if anything goes wrong on the Fast Path, ThunderCore users can resort to a Slow Path. The Slow Path is similar to a network of smaller roads. It isn’t very fast, but it will be reliable.

For the Fast Path, ThunderCore facilitates fast and easy confirmation by 2 ways. The “Committee”, which is executed by a committee of stakeholders. And the “Accelerator” to linearize transactions and data.

ThunderCore uses Ethereum as the Slow Path as it is one of the most stable networks in the industry. The slow path will take over when the network condition is bad and /or if there is an attack. It also acts as a check to see if the Accelerator is working.

How to Stake Thundercore?

Thundercore cannot be mined as a way to generate new TT or gain passive income, hence there is no thundercore mining. Instead to passively generate Thundercore, TT is staked by locking up TT in a particular wallet. The amount of rewards depends on the lockup duration, which can be 7 days, 30 days, 3 months, 6 months or 1 year. Staking Thundercore is easy, you can do this using the mobile wallet and joining a staking pool.

What is the ThunderCore (TT) used for?

The ThunderCore (also known was ThunderToken or TT) is the native cryptocurrency of the ThunderCore network. Analogous to ETH on the Ethereum network, ThunderToken is used for paying gas fees and value transfers.

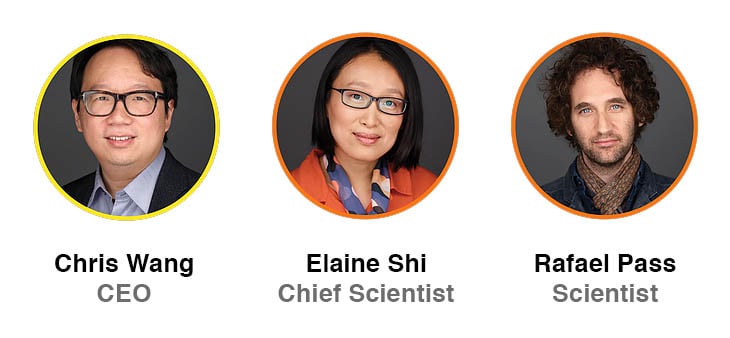

The ThunderCore Team

The team comprises of engineers, scientists and entrepreneurs. They previously worked in publishing academic papers relating to Bitcoin and smart contracts. They are also the founding members of the Initiative for Cryptocurrency and Contracts (IC3).

Update Aug 2019: Chief Scientist Elaine Shi has announced that she will be leaving the ThunderCore Project.

What is the Current Status of ThunderCore?

The first Thunder release will be fully EVM (Ethereum Virtual Machine) compatible. Thus, allowing for direct migration of dApps.

ThunderCore has already deployed its pre-release main-net. Therefore, developers can already start building on ThunderCore. Users can also start deploying smart contracts.

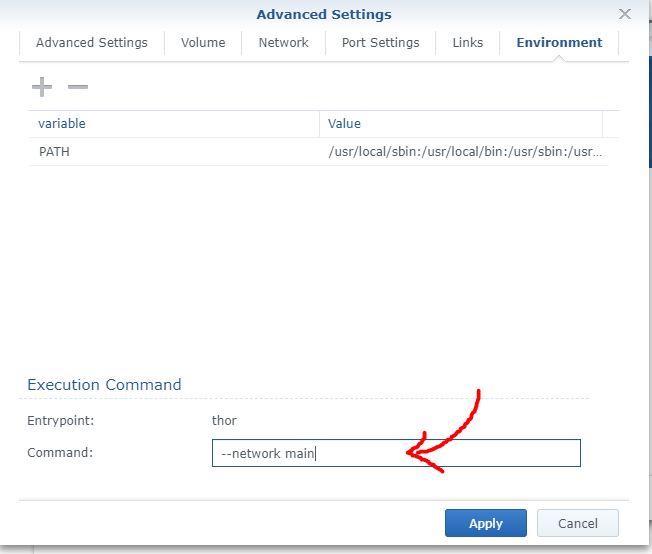

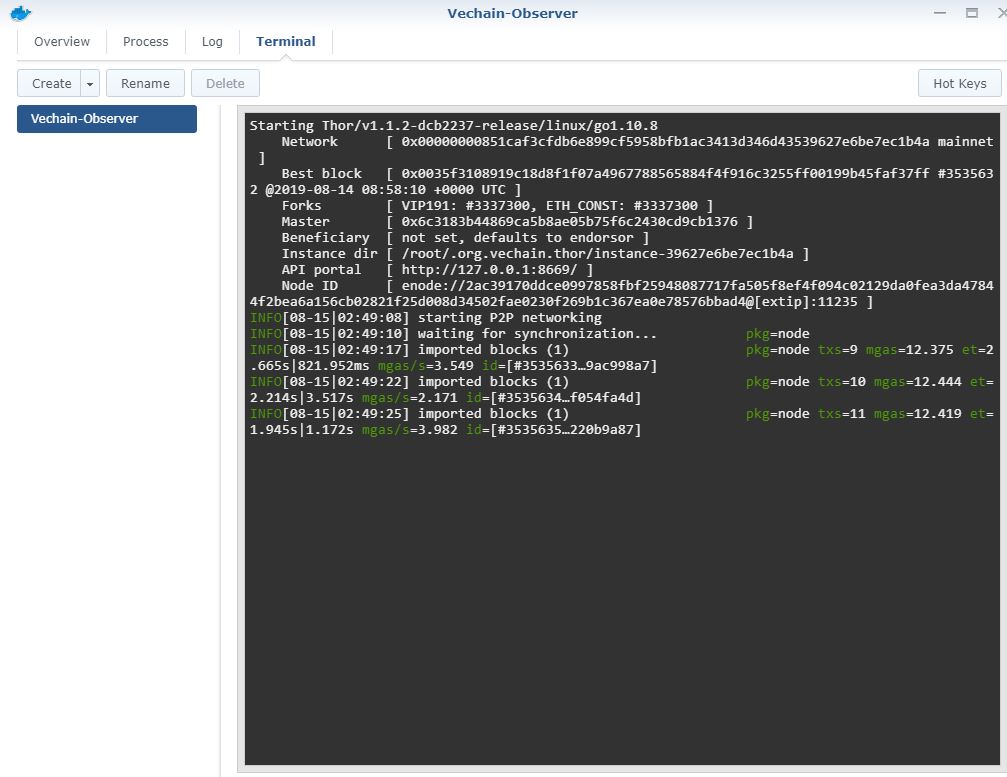

How do I connect to the ThunderCore Mainnet?

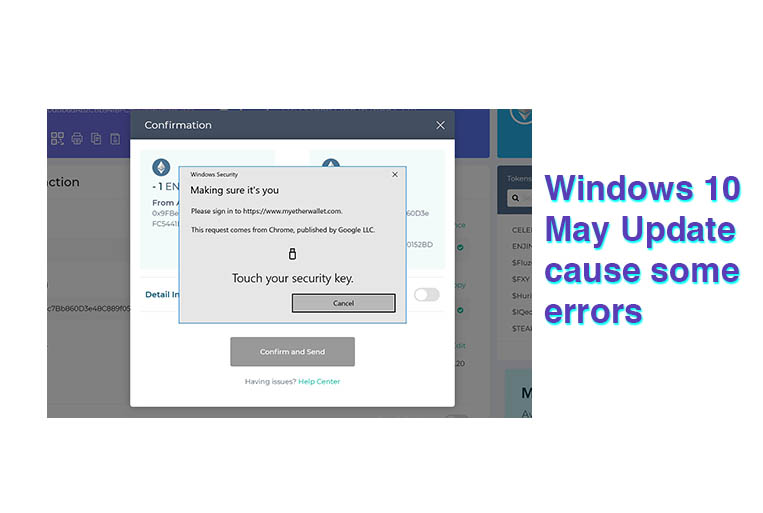

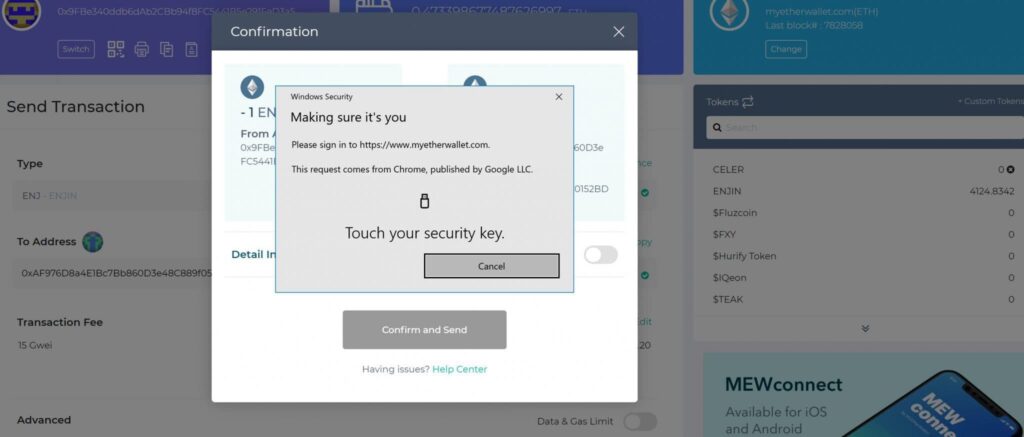

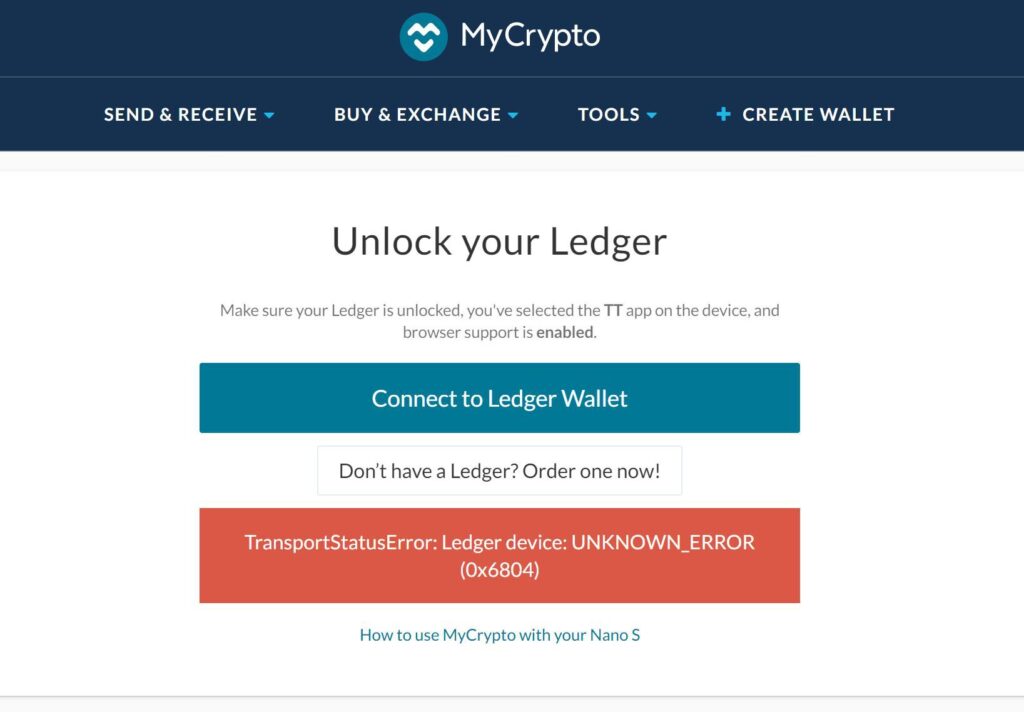

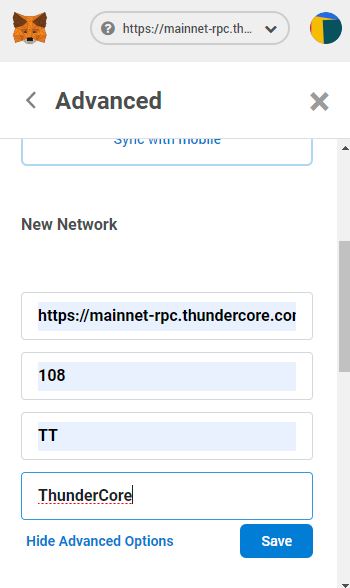

You can directly connect to Thundercore by changing the RPC settings on Metamask or changing the server on MyEtherWallet.

- Install MetaMask: you can install the MetaMask browser extension on your browser. Create an account on the Metamask website and set up the security protocols (for a full guide check out our Metamask Tutorial);

- Get ThunderToken (TT): You can get tokens from the Metamask browser extension. Click on the drop down menu and select “custom RPC”. Go to “new network section” and select “advanced option”.

- Mainnet RPC URL: https://mainnet-rpc.thundercore.com

- Chain ID: 108

- Symbol: TT

- The TT symbol will appear on your Metamask. You can get 50 free tokens on the ThunderCore website by copying and pasting your Metamask TT address onto the appropriate field. You can also use this process to purchase tokens;

- Copy and paste the ERC20 contract: copy smart contract source code from Github; (use mine here: https://remix.ethereum.org/#version=soljson-v0.4.24+commit.e67f0147.js&optimize=false&gist=116b51b7e5bf2cd3f29f2136dac3f08f)

- Deploy through Remix ID; and

- Check on https://scan.thundercore.com/ .

Pros and Cons of ThunderCore

Pros

- ThunderCore is compatible with the Ethereum network;

- The network has a faster transaction speed compared to Ethereum;

- ERC20 smart contracts can be deployed on this network;

- The team are working on new features that would allow dApp interaction without gas;

- ThunderCore allows users and developers to utilize existing tools such as Metamask and Truffle etc.; and

- Developers can use familiar programming languages (e.g. Solidity) while carrying out smart contracts on the network.

Cons

- There is currently only one “Accelerator” on this network. This raises questions over how much power will be centralized. (Note the accelerator cannot freeze accounts or pause transactions indefinitely as this would lead to a re-election)

Token metrics & Circulating supply

The Thundercore is currently listed and trading on Huobi. The coin is listed as Thunder Token on CoinMarketCap.

Huobi has released the Token metrics of ThunderToken (TT):

Total Raised: $50M USD

Angel round: $0.01 USD/token (2 years lock- till March 2020)

Seed round: $0.02 USD/token (1 year lock – till Apr-May 2019)

Final round: $0.10 USD/token(20% released on Feb 28, 40% to be released on May 28, 40% on Aug 28)

Huobi Lite round: $0.015 USD/token, only $500,000 USD worth of tokens sold

What we can deduce from this is that ThunderCore valuation dropped from the final Private sale time – from $0.1 to $0.15. Admittedly, the Huobi Lite tokens could also be considered to be sold at a discount to encourage more players to get in. There is controversy over the Huobi Lite sale of TT, as the token price was much lower than the Final Round – upsetting a lot of the initial investors and supporters (such as ThunderFans).

ThunderCore Hub (Games and Thundercore Giveaways)

Currently ThunderCore Hub is doing a 150 TT giveaway to test out their new Android app. To quality, visit the ThunderCore Hub website and install the beta APK, register for an account and play dApp games to get the free TT.

Conclusion

ThunderCore is different because it scales both transactions and smart contracts. This could mean that blockchains can have thousands of transactions per second without compromising on security and decentralization.

Update (May 1 2019): Mainnet RCP address and Team members & Linkedin Profiles

Update (May 10 2019): Added listing information on Huobi

Update (May 14 2019): Added ThunderCore Hub and TT Giveaway