The decentralized finance (DeFi) space has grown to include platforms in various sectors such as spot trading, derivatives, and futures. Interestingly, some networks such as Yearn Finance support yield farmers and liquidity providers through an aggregation service.

Instead of offering spot trading, lending, or borrowing functionalities, it allows users to deposit funds, then it distributes it based on projected returns and the risks involved.

However, this isn’t enough to drive meaningful DeFi adoption. Therefore, Yearn followed the partnership route to expand its ecosystem and to improve interoperability between DeFi systems.

In this article, we look at the most impactful partnerships in the Yearn ecosystem:

Yearn + SushiSwap

On November 3, 2020, Yearn’s creator, Andre Cronje, took to Medium to announce the coming together of his platform and Sushiswap. The connection between the two platforms meets as Sushi improves its automated market-making (AMM) outlooks while Yearn digs deeper into aggregating formulas. These qualities brought a need for cooperation between them, leading to:

- A combination of development resources.

- A rise in the total value locked (TVL) on each platform.

- Working together to develop and launch Deriswap, a platform bringing together spot trading, derivatives, and futures trading.

- Introducing Keep3r Network, an on-chain price oracle on the second iteration of Sushswap.

- Additionally, liquidity providers on Sushi provide collateral for the Sushi money market.

Partnership with Cream Protocol

The DeFi aggregator platform partnered with Cream, a lending network similar to Aave, in developing the system’s second version. With the partnership, the Yearn and Cream team created Cream V2, which introduced or enhanced leverage and lending features. Notably, the new platform enables yield farming using leverage.

Additionally, Cream V2 acts as a springboard to power stable credit and yet-to-be-built lending functionalities. Apart from merging resources allocated towards development and seeing a rise in individual TVL, the partnership saw shares in Yearn Vaults qualify to provide collateral in Cream.

One feature added to Cream’s new version includes rotating multi-signature keys in order to improve deployment, iteration, and testing. Unchanged features include those that touch on governance and native tokens.

Akropolis and Yearn

The partnership is rather a unique one. Why? It aims to bring out the best in each platform’s team. Therefore, each team continues with their previous journey but leans on the other if they need help.

Furthermore, Akropolis users can access Yearn and a host of other networks such as Cream and Pickle. In return, Yearn investors benefit from Akropolis’s investment strategies and a pool of institutional networks. The partnership between the two platforms brought with it improvements on Akropolis.

For instance, there was a development of new vaults, an institutional application, some strategies, and a rotation of multi-signature. In addition, Akropolis’s native token was upgraded to be able to track losses.

The PowerPool Partnership

PowerPool is a decentralized protocol accumulating governance strengths in systems built on the Ethereum blockchain. In short, it brings together governance tokens from a wide range of DeFi protocols, such as Compound and Balancer.

The partnership with Yearn Finance connected YFI, the governance token on Yearn, with PowerPool’s PowerIndex. PowerIndex provides a DeFi index inspired by distributed exchange-traded funds (ETFs). The index exudes meta-governance functionalities and contains eight tokens, including YFI.

Note that the meta-governance aspect rides on concentrating user tokens from different DeFi platforms into a single contract. Next, the tokens’ voting weight is delegated to a group consensus. Notably, the contract generates a token that its holders can use to decide the other tokens’ fate in the pool.

So, what does the partnership bring to Yearn?

- Having a share of the index gives DeFi lovers a share in Yearn.

- It increases participation in YFI governance issues.

- PowerIndex supports swapping. Thus, anyone can exchange another platform’s token with YFI and vice versa.

- In return, Yearn benefits from more liquidity. Additionally, pooling YFI helps stabilize its price.

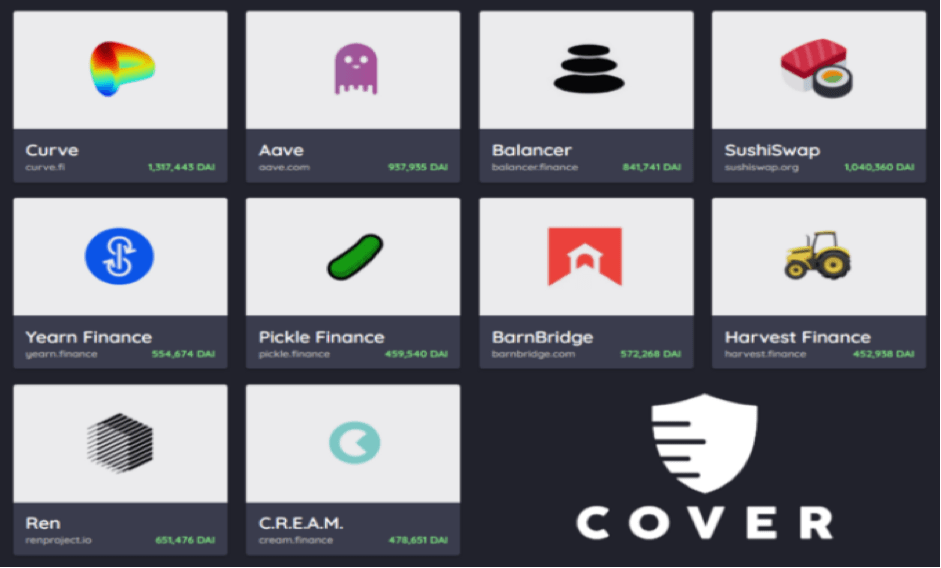

The Cover Merger

Although Cronje formally announced the partnership on November 28, 2020, the two platforms have been collaborating since Cover’s launch. The marriage between the two opens doors to advanced features targeting optimization, among other aspects.

The partnership allows Curve to provide backstop coverage to products built on Yearn. Their coming together allows Cronje’s network to enjoy Cover’s range of coverage known for supporting multiple collaterals. Yearn can mitigate risks for users through vault coverage. That’s not all. Underwriting coverage on Yearn becomes more profitable.

Fortunately, the benefits aren’t one way. For Cover, it’s hoisted to expand its wings to unchartered money markets. Additionally, it’s empowered to seek a bigger share of perpetual coverage and other products in the market. However, components such as the native COVER currency remain intact.

Pickle and Yearn

This is another key partnership in the Yearn ecosystem. Its uniqueness emanates from the fact that it’s supposed to eradicate duplicate works among the two teams. Doing so lets each team and individuals within a team work on what they’re extremely good at.

As a result, Pickle will launch new features such as reward Gauges. Governing members on the Pickle ecosystem receive DILL tokens when they lock their tokens for governance-related purposes. DILL holders share Gauge performance, withdrawal, and deposit fees.

On the other hand, Yearn users, especially Vault depositors, are incentivized to interact with Gauges through Vault shares. The depositors also receive more rewards by setting aside Pickle tokens to receive DILL. (www.chronicpainpartners.com)

Others benefits originating from the partnership include:

- A merger of the platforms’ TVL.

- Pickle finds its way into the Yearn ecosystem.

- Pickle enjoys Yearn’s security, among other features.

- Pickle’s reward Gauges rake in incentives from Yearn depositors.

- The two protocols’ teams work together on strategy creation and split profits from the strategies.

- There’s an overall increase in rewards for users in both circles.

Conclusion

By expanding the Yearn ecosystem, Cronje and his team seek to build an inter-connected DeFi world. With everything connected to everything, DeFi adoption naturally sets in.

Apart from interconnection and adoption, the partnerships focus on, for example, reducing the duplication of roles within teams working on DeFi projects. This encourages the birth of new products and features to help drive growth in the space.

In the process, DeFi enthusiasts benefit from enhanced products and yields, which further encourage interaction with DeFi-focused systems.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

- MetaMask Guide: How to set up an account? PLUS tips and hacks for advanced users

- Uniswap review and tutorial: Beginners guide and advanced tips and tricks

- Serum DEX guide and review

- SushiSwap ($SUSHI) explained

- 1inch Exchange, Mooniswap and Chi GasToken: The ultimate review and guide

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.