Binance, the world’s largest cryptocurrency exchange by trading volume, has joined the Chamber of Digital Commerce, an American lobbying group, to help establish crypto regulation in the United States. The Chamber of Digital Commerce is a leading blockchain and crypto trade association with members such as Citi, Visa, MasterCard, Dapper Labs, Ripple, and Circle.

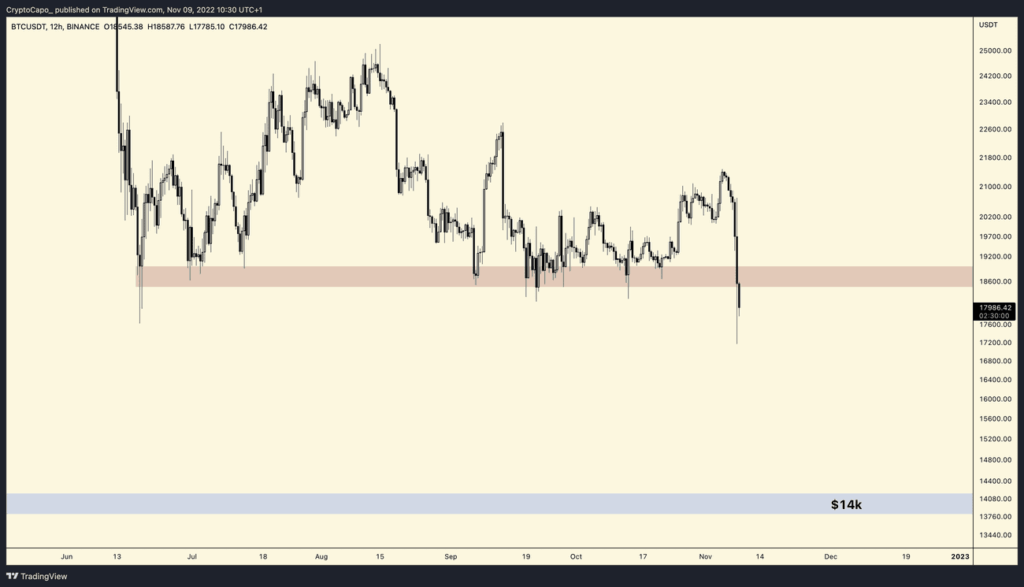

This move comes as U.S. lawmakers are moving aggressively towards regulating the crypto space as result of FTX’s collapse in November as well as the Terra Luna collapse in May. Billions of dollars’ worth of crypto assets were stolen and lost, prompting politicians and regulators in the U.S. to take strict action.

It is without a doubt that Binance also played a key part in the collapse of FTX. After Binance CEO Changpeng Zhao (CZ) learned of the unethical flywheel scheme that Alameda Research and FTX were taking part in, he announced on Twitter that he would liquidate all of Binance’s FTT holdings, FTX’s native token.

Shortly afterwards, as investors got hold of the news, they quickly rushed to withdraw their assets, leading to a liquidity crunch in FTX. CZ then announced that Binance had signed a non-binding letter of intent to acquire FTX to help and protect customers, but pulled out the next day after realizing the massive hole in FTX’s balance sheets.

Despite CZ’s efforts to protect the crypto industry, some believed that Binance is to blame. Former FTX spokesman Kevin O’Leary testified at the Senate Banking Committee hearing, saying that Binance “intentionally put FTX out of business”, even though FTX was already engaging in illegal activities. Regardless, lawmakers and regulators began diverting their attention to Binance.

According to Reuters, U.S. authorities are currently considering filing criminal charges against top executives of Binance including CZ, relating to money laundering allegations in 2018. However, Binance defended against Reuters, saying that they are attacking Binance’s law enforcement team who have strictly complied with anti-money laundering policies.

As of now, the U.S. Department of Justice is still divided over whether to prosecute Binance. It is unclear whether they will pursue this four-year long case. Given the circumstances, Binance’s decision to join the Chamber of Digital Commerce is an effort to help establish policies that benefit and protect users, and to provide education and advocacy on the use of digital assets and blockchain-based technologies.

Binance’s Vice President of Public Affairs Joanne Kubba said that “working hand in glove with policymakers, regulatory bodies, and industry groups like the Chamber is imperative for Binance.”