Welcome to the second part of our crypto trading guide series for beginners! In this article, we’ll tackle two critical pillars of successful trading: risk management and trader psychology. Mastering these skills ensures you can trade with consistency, avoid emotional pitfalls, and protect your capital for the long term. We’ll break down how to manage risk effectively, maintain emotional discipline, and understand the psychological journey of a trader.

Understanding Risk Management and Psychology

Risk management is about protecting your capital by controlling how much you’re willing to lose on each trade, while trader psychology focuses on managing your emotions to stay disciplined and consistent. Together, they form the backbone of profitable trading.

Without proper risk management, even the best setups can wipe out your account, and without psychological discipline, fear or greed can derail your strategy. For beginners, we’ll focus on the following concepts:

- 1% Risk Rule

- Risk-to-Reward Ratios (RR)

- Win Rates

The 1% Risk Rule and Position Sizing

The cornerstone of risk management is the 1% risk rule: never risk more than 1% of your portfolio on a single trade. This keeps losses small, allowing you to survive losing streaks and stay in the game long enough to profit. Let’s see how to apply this with an example.

Example: BTC Trade Setup (May 8 2025)

Let’s say we have a $10,000 portfolio, so our 1% risk is $100. On May 8, BTC has broken above previous Friday High and we’re looking to take a long at the retest of that key level at $97,868 while placing our stop-loss at previous Friday Low at $96,306.9 (1.6% drop from our entry).

The first thing we should do is to calculate our position size.

- Position Size = Risk Amount ÷ Stop-Loss Percentage

In our example, that would be $100 ÷ 0.016 = $6,250. Our position size is $6,250, meaning we can buy $6,250 worth of BTC at $97,868.

If the stop-loss hits at $96,306.9, we lose $100. If the take-profit hits at $100,000, we make $136.59. You can use TradingView or Bybit to calculate this!

Different trading tools and exchanges will likely have different names for “portfolio” and “position size” on their interface. Just so that you are not confused with the terminologies:

- “Account Size” on TradingView and “Available Balance” on Bybit refers to your portfolio.

- “Lot Size” on TradingView and “Order Value” on Bybit refers to your position size.

Using Leverage for Trading

When your calculated position size exceeds your portfolio, leverage becomes a tool to bridge that gap, enabling you to take the trade without risking more than your 1% rule allows.

In other words, if your account size is smaller than the position size needed for a trade, leverage lets you borrow funds to meet that position size. Let’s see how to use leverage effectively by determining the right leverage amount based on your account size and position size.

Let’s say we have a $10,000 portfolio, so our 1% risk is $100. We’re looking to go long on SOL at $162.34 while placing our stop-loss at $161.34 (0.62% drop from our entry). This means our position size is $100 ÷ 0.0062 = $16,129.03. Since our position size is larger than our account size ($16,129.03 > $10,000), we will need leverage to take this trade.

To determine the leverage needed, divide the position size by the account size: $16,129.03 ÷ $10,000 = 1.61x leverage.

This means we can use 1.61x leverage on our $10,000 to achieve the $16,129.03 position size. Bybit is a strong choice for leveraged trades, as the platform allows you to customize your leverage settings with precise adjustments, such as 3.5x or 8.33x, helping you achieve your position size with accuracy.

Alternatively, we could use a smaller portion of our account, say $5,000 (half of our portfolio), at a higher leverage to achieve the same position size: $16,129.03 ÷ $5,000 = 3.23x leverage. Either way, any leverage setting we use would still result in a $100 loss if our stop-loss at $161.34 is hit. This also means the profit would be the same in any leverage setting.

This is the correct way to use leverage for trading. At the end of the day, it does not matter how high or low the leverage setting is as long as our risk is managed properly!

Using Risk-to-Reward Ratio (RR)

The risk-to-reward ratio (RR) measures the potential profit of a trade relative to its potential loss, expressed as a ratio. For example, a 2R trade (or 2:1) means you’re risking 1 unit of loss to potentially gain 2 units of profit—such as risking $100 to make $200. In the BTC trade example above, you can see that it was a 1.37R trade where we are risking $100 to make around $137 and in the SOL leveraged trade example as well where it was a 4.87R trade, risking $100 to make $487.

In this guide, we use R to represent 1% of your portfolio, so a 2R setup risks 1% to gain 2%, and a 3R setup risks 1% to gain 3%.

The rule of thumb in trading is to aim at least for a 1R setup. Focus on higher RR setups.This ensures that even with a lower win rate, your winners outweigh your losers. However, there are different strategies to go about this which we will discuss in the next section.

Win Rate Strategies

Win rates determine your long-term profitability, but they’re often misunderstood, especially by beginners who think a high win-rate means success. While a high win rate (e.g., 70%–80%) might seem like the key to profitability, it’s not the only factor. Your risk-to-reward ratio (RR) plays a crucial role in balancing your strategy.

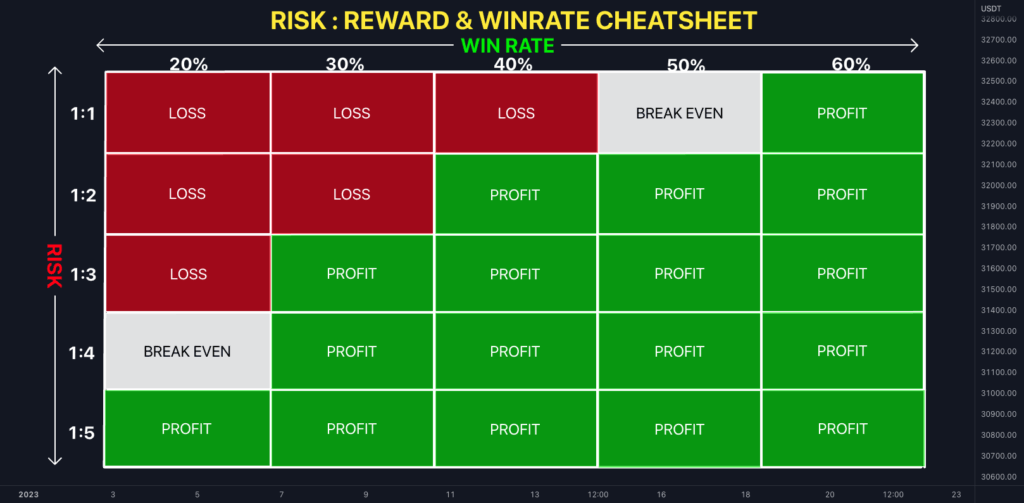

A high win rate with a low RR (e.g., 1R) can lead to smaller gains that don’t cover losses over time, while a lower win rate with a high RR (e.g., 3R or higher) can make you profitable even if you lose more trades. Refer to figure 5, if you are targeting for 1R setups only, you will need more than 50% win-rate to be profitable. On the other hand, if you are targeting for 3R setups only, you only need a 30% win rate.

Different traders prefer different strategies based on their risk tolerance and trading style: some aim for a high win rate with 1R setups, focusing on consistency and frequent small wins, while others target 3R or higher setups with a lower win rate, prioritizing larger gains per trade to offset more frequent losses.

The Psychological Journey: Loss Aversion

Trader psychology is a rollercoaster, and for beginners, one of the biggest challenges is dealing with losing streaks, especially when trading live. Loss aversion—a powerful cognitive bias—makes the pain of losing feel twice as intense as the joy of winning, according to behavioral finance research by Daniel Kahneman and Amos Tversky in their Prospect Theory. This bias can lead beginners to hold onto losing trades too long, hoping for a reversal, or to exit winning trades too early out of fear of losing gains, resulting in poor risk-reward outcomes.

Imagine you’re a beginner with a $5,000 portfolio, following the 1% risk rule, risking $50 per trade. You take 10 trades, but hit a losing streak of five trades in a row. After the first loss, your account drops to $4,950, and the sting of that $50 loss hits hard—emotionally, it feels much worse than a $50 gain would feel good. By the fifth loss, your account is down to $4,754.95, a total loss of $245.05. Despite the 1% rule keeping your financial risk small, the emotional toll of losing streak after losing streak can be overwhelming.

Research shows that 70%–80% of traders experience heightened emotions during market volatility, often leading 40% of retail traders to exit trades prematurely due to fear, according to a 2025 study on forex trading psychology. This stress can cause beginners to question their strategy, even when it’s statistically sound, and may push them toward impulsive decisions like revenge trading—taking larger positions to “make back” losses—or quitting altogether.

In live trading, even with good risk management, the stress of a losing streak can test your mental fortitude. The key question is: do you have the mental fortitude to continue trading through the inevitable losses, trusting your strategy’s edge over time, or will loss aversion derail your journey?

Conclusion

Risk management and psychology are about consistency, not perfection. The most important principle is to always risk the least to make the most, using the 1% rule, high RRR setups, and hedging to keep losses small and profits significant. Psychologically, accept that you’ll go through cycles—losing streaks will test your mental fortitude, but with discipline, you can become a full-time trader. Start with small risks, like $50 on a $5,000 portfolio, and focus on learning through real trades. Stay tuned for the next part of our series on confirmation vs. deviation!