The crypto market is volatile and unpredictable, but there are events outside of the crypto space that heavily influences the performance of the market. If you are unsure of how the market will react, it always helps to take a step back and look at the bigger picture, which in this case is the macroeconomic data.

Why Technical Analysis and Narratives are Not Enough

A lot of people use technical analysis and narratives to determine future price movements. For example, traders would use chart patterns, trading ranges, and technical indicators to determine bullish or bearish trends. On the other hand, investors with a more fundamental approach tend to capitalize on rising narratives in the crypto industry, such as the upcoming Ethereum Shanghai Upgrade causing liquid staking derivatives to pump or halving events for Bitcoin.

These can be effective strategies, but not always reliable because there are larger forces at play. When the Ethereum Merge came in September, everyone expected ETH to surge in price because of the hype. But the crypto market was under pressure from macroeconomic factors causing broader investment market volatility rather than negative reactions from investors. This was when inflation and interest rate was at its highest for the year, affecting not only the crypto market but other financial markets as well.

How Do Macro Data Influence the Crypto Market?

As we have seen in 2022, short term speculation has been significantly influenced by macroeconomics. Since crypto is not widely adopted yet, it is still treated as a speculative asset. As such, Bitcoin’s price movement tend to mirror Nasdaq tech stocks, despite its vision of decoupling from the stock market. It is important not to underestimate macro data as they affect all financial markets. These are some of the common macro data to look out for when analyzing the market.

U.S. Consumer Price Index (CPI)

Inflation is measured by the Consumer Price Index (CPI). It is a key economic metric based on prices that consumers pay for goods and services throughout the U.S. economy. When CPI is high, it means that prices for goods and services have risen, indicating inflation. Essentially, high inflation erodes the purchasing power of fiat currencies, meaning that individuals have less buying power for goods and services.

As a result, inflationary pressures can cause market volatility, as people are more likely to save money for daily necessities and reduce their exposure to risky investments such as crypto. But as shown in the image below, the inflation rate and CPI are cooling off in 2023, which means that the worst is already behind us.

Federal Interest Rate

The federal interest rate, also known as the federal funds rate, is the benchmark interest rate set by the Federal Reserve (the central bank of the United States) for overnight lending between banks. It is measured in basis points (bps), describing the percentage change in the interest rate. One basis point is equal to 0.01%. It is an important tool used by the Fed to influence the overall level of interest rates in the economy and to affect the supply of credit.

The fed rate goes hand-in-hand with CPI and inflation rate. If the Federal Reserve raises interest rates, it becomes more expensive to borrow money. This affects businesses in particular, and shifts the investment landscape from risk-on to risk-off, reducing the demand for stocks and crypto alike.

Although CPI and inflation has been cooling off in 2023, it is not guaranteed that the Fed will scale back to 25 bps. According to Bloomberg, broader analysis of economic and financial conditions would favor the Fed raising rates by 50 bps. This could result in a stock market dip, which also affects the crypto market.

Supply Chain

The supply chain refers to the series of industries involved in the production, delivery, and distribution of goods and services worldwide. They are key indicators of global economic activities. Strong economic growth can increase demand for cryptocurrencies, as investors seek alternative investments in a growing market. On the other hand, weak economic growth or disruptions in the supply chain can reduce demand for cryptocurrencies and impact their price.

As of 2023, the supply chain is slowly recovering as the COVID pandemic is dying down. With the rise of artificial intelligence (AI) tools such as ChatGPT, supply chain leaders are focusing on automation, robotics and sustainability to improve manufacturing and solve labor cost problems. As such, shipping costs and gas prices have gone down. But there are still some areas struggling with shortages and bottlenecks, leading to bankruptcies and unemployment. For more information, Forbes has published an article sharing their insight on supply chain trends in 2023.

US Gross Domestic Product (GDP)

Out of all countries, the US seems to have been the dominating narrative in what has affected the price action of the crypto market. This could be related to the US CPI and Fed interest rates. While the US GDP does not have a direct affect on crypto prices, it can indirectly impact crypto prices by affecting the overall economy, consumer confidence, and market sentiment.

A strong US economy may increase consumer confidence and investment, potentially leading to an increase in crypto prices. Conversely, a weak economy may lead to a decrease in consumer confidence and investment, potentially leading to a decrease in crypto prices.

Housing Market

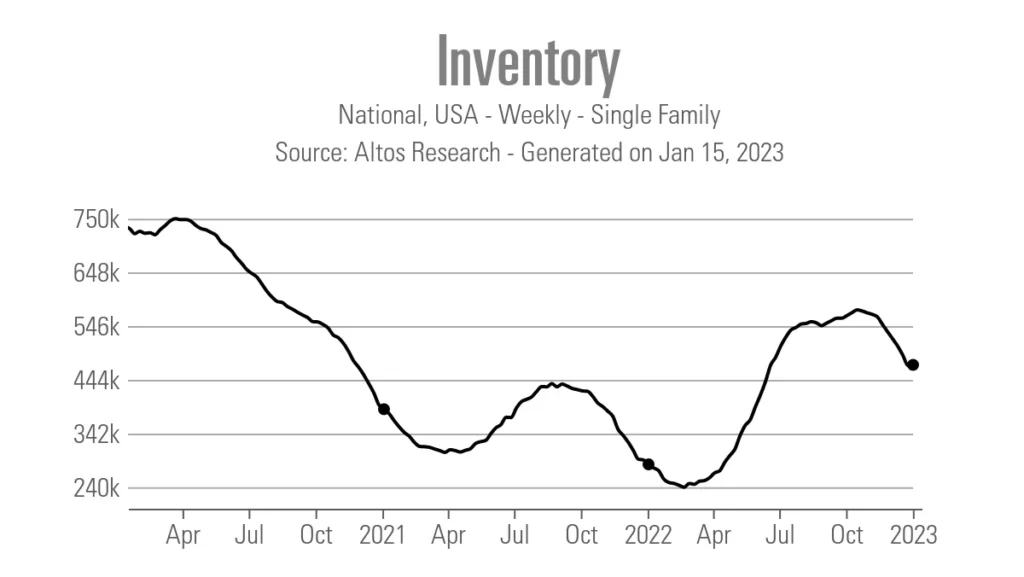

The housing market can affect crypto prices indirectly, as changes in the housing market can impact the overall economy and consumer confidence. A strong housing market can boost consumer confidence and lead to an increase in investment, potentially resulting in an increase in crypto prices.

On the other hand, a weak housing market can dampen consumer confidence and lead to a decrease in investment, potentially leading to a decrease in crypto prices. However, it is important to note that the relationship between the housing market and crypto prices is not direct and can vary depending on various other factors such as interest rates, economic policy, and global events.

As of 2023, the supply chain recovery has helped bring back inventory of single family homes on the market, and has increased the supply side as well. But with mortgage rates increasing, it is unlikely there will be an increase in demand for housing any time soon. Therefore, it is highly likely there will be a housing market correction, but we do not know if it is going to small or big.

Oil Prices

Energy has been a critical factor in the economic turmoil and increased inflation in the past year, and it has mainly come from oil prices. With the ongoing war in Ukraine, many people were fearful of a major worldwide energy crisis this winter. Although there was an energy crisis in Europe, it was not as bad as predicted. Meanwhile, oil prices dropped from $120 to $80 as a result of CPI and inflation rate cooling off.

Key Takeaway

Macroeconomic data is important for crypto prices because it can provide insight into the health and stability of the overall economy, which can impact investor confidence and market sentiment. This, in turn, can affect demand for cryptocurrencies and ultimately their prices. Macroeconomic data such as GDP, inflation, interest rates, employment figures, and trade balances can all provide a broader understanding of the economic environment, helping traders and investors make informed decisions about the crypto market. Additionally, changes in macroeconomic conditions can also impact the supply and demand of cryptocurrencies, affecting their prices.