Introduction

This report provides an overview of the crypto project funding landscape as of Q2 2025, with a focus on venture capital investment trends. The cryptocurrency market has seen significant shifts, and understanding the flow of capital is crucial for assessing its health and future direction.

Q2 2025 Funding Overview

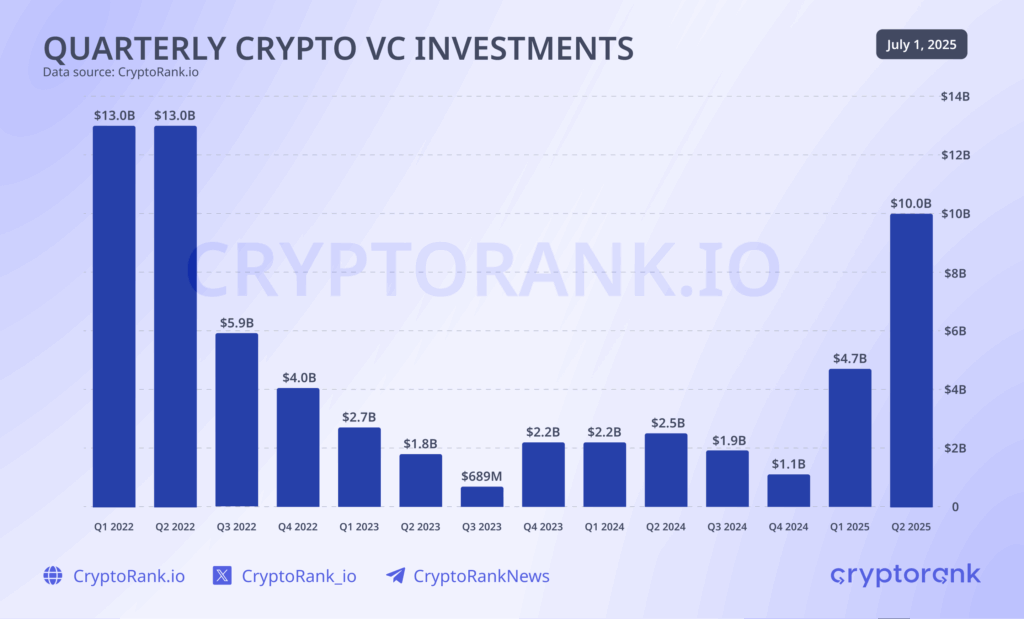

According to CryptoRank’s Q2 2025 report, crypto fundraising experienced a significant surge, reaching levels not seen since the bull market of the previous cycle. For the first time in three years, quarterly crypto VC investments exceeded $10 billion. This sharp increase began at the start of 2025, following the arrival of a new White House administration and a more crypto-friendly policy agenda.

It’s important to note that rising Bitcoin prices alone do not appear to drive venture investments in crypto. Instead, investors seem to prioritize clear and supportive regulations for Web3 projects. The real surge in venture funding commenced after the White House signaled a more positive approach towards cryptocurrencies.

Late-Stage Deals and Market Maturity

Late-stage deals played a significant role in driving the growth of crypto fundraising in Q2 2025, including IPOs, mergers and acquisitions, and post-IPO debt. These transactions indicate a more mature phase of the crypto market, where high valuations are increasingly supported by revenues and business metrics rather than solely on future potential. The largest share of late-stage funding is observed at the intersection of Web2 and Web3, encompassing centralized exchanges, CeFi protocols, stablecoin issuers, investment funds, and mining companies.

There were 31 deals in Q2 with funding rounds exceeding $50 million, while the smallest number of deals involved check sizes below $1 million. This highlights a rising entry threshold as the market matures and becomes more saturated. More than half of the deals were either undisclosed or classified as strategic, reflecting a shift away from traditional VC models towards a more flexible fundraising approach, driven by the rapid pace of change in the crypto market.

Q1 2025 Funding Trends: Blockchain vs. AI

While Artificial Intelligence (AI) continues to dominate venture funding headlines, blockchain funding has evolved rather than disappeared. In Q1 2025, blockchain and crypto startups collectively raised $4.8 billion, marking the strongest quarter since late 2022. This figure alone represents 60% of the total VC capital invested in 2024.

A notable event in Q1 2025 was a $2 billion investment into Binance by MGX, setting a record for the single largest deal in VC history. This indicates a strategic focus by VCs on foundational blockchain technologies over speculative assets.

Key areas of investment within the blockchain sector include:

•Blockchain cybersecurity: Particularly for supply chain security and industrial IoT.

•Tokenization of real-world assets (RWAs): Including real estate and commodities, with predictions of significant CAGR.

•Decentralized finance (DeFi) protocols: These raised $763 million in Q1 2025.

Blockchain is not an alternative to AI but rather a parallel infrastructure supporting trust, ownership, and security. Major trends driving enterprise adoption in 2025 include the integration of AI in blockchain for model auditability and data provenance, the emergence of stablecoins as leading payment rails, and the shift of traditional financial (TradFi) firms towards blockchain technology for process optimization.

Smart VCs are diversifying their capital across both AI and blockchain, recognizing their complementary roles. New use cases are emerging from this convergence, such as AI models with on-chain auditability, smart contracts triggered by AI-driven decisions, and tokenized royalties for AI-generated content.

2025 VC Investment Projections

Venture capital investors are projected to back crypto startups to the tune of $25 billion in 2025. This optimistic forecast comes from Michael Martin, director at Ava Labs’ incubator Codebase, who attributes it to a ‘perfect storm of bullish signals.’ These signals include Circle’s successful public float, a booming crypto market, Stripe’s acquisition of Privy, increased Wall Street involvement in blockchain projects, and new regulatory clarity for digital assets.

As of August 2025, crypto projects have already raised $13.2 billion, with $121 million raised in a single week. This figure is 40% higher than the total investment in crypto for all of last year, putting it on track to surpass PitchBook analysts’ earlier projection of $18 billion.

Investor optimism is further fueled by the pro-industry stance of the current US administration, which has emboldened both sector players and larger financial institutions to engage more with digital assets. The recent rubberstamping of the Genius Act in July and upcoming crypto bills are expected to provide further regulatory clarity, driving increased adoption of blockchain technology by traditional financial institutions. This may also lead to more acquisitions of crypto companies by Wall Street and fintech firms, similar to Stripe’s move.

However, potential challenges remain, including macroeconomic uncertainties and the performance of public crypto companies like Circle and Coinbase. Underperformance in these areas could lead to investors tightening their capital flows.

Conclusion

The crypto project funding landscape in 2025 is characterized by a significant resurgence in venture capital investment, driven by a more favorable regulatory environment and increasing maturity of the market. While AI continues to attract substantial funding, blockchain technology is demonstrating its enduring value through real-world applications and strategic investments in foundational technologies. The convergence of AI and blockchain is also creating new opportunities and driving innovation.

Projections indicate a strong year for crypto investments, potentially reaching $25 billion, as regulatory clarity and successful public market entries build investor confidence. Despite potential macroeconomic headwinds, the overall outlook for crypto project funding remains positive, with a clear shift towards projects with sustainable business models and tangible utility.

References

•CryptoRank. (2025, July 16). State of Venture Capital in Crypto, Q2 2025. Retrieved from https://cryptorank.io/insights/reports/crypto-fundraising-report-Q2-25

•CV VC. (2025, May 9). Where VCs Are Investing in 2025: Blockchain vs. AI Funding Trends. Retrieved from https://www.cvvc.com/blogs/where-vcs-are-investing-in-2025-blockchain-vs-ai-funding-trends

•DL News. (2025, August 8). Why VC investments into crypto are seen to hit $25bn in 2025. Retrieved from https://finance.yahoo.com/news/why-vc-investments-crypto-seen-113944387.html