Bitfinex is a veteran cryptocurrency trading platform with a long history, but its past is not without controversy, leaving many to question its legitimacy. But for those looking for a secure and feature-rich cryptocurrency exchange, Bitfinex is worth checking out, offering users a range of security and other features that rival those of Coinbase and Binance.

Sign up here to get started

What is Bitfinex?

Bitfinex is a premier destination for experienced traders from around the world. It is one of the top exchanges in terms of recognition and trading volume, serving all but a few countries. It supports both fiat-to-crypto and crypto-to-crypto trades, allowing users to buy and sell cryptocurrencies with ease. Finex is a secure platform with advanced features such as margin trading, lending, and order types. It also offers a mobile app for trading on the go. With its user-friendly interface and low fees, Bitinex is an ideal choice for traders of all levels.

Bitfinex is a cryptocurrency exchange platform that offers a wide range of features, including margin trading, limit and stop orders, and over-the-counter (OTC) trades. It has an intuitive interface with easy-to-navigate dashboards and menus, and robust security measures. Despite this, Bitfinex has been hacked twice (in 2015 and 2016). Since then, it has improved its security and compensated lost funds to every user. Bitfinex is a reliable and secure platform for trading cryptocurrencies, offering a wide range of features and tools to help users make informed decisions.

Key Features of Bitfinex

Bitfinex is known for its core features such as:

Exchange Trading: Central limit order books that let users to deposit, trade, and withdraw digital tokens.

Margin Trading: By receiving funding from the margin funding platform, qualified customers can trade with up to 10x leverage.

Margin Funding: The P2P financing market in which users can earn interest by lending funds to other users who trade with leverage.

OTC Desk: Trades can be conducted directly between parties using Bitfinex instead of going through open order books.

Ability to Purchase Cryptocurrency Using Debit or Credit Cards: OWNR and Mercuryo, third paty payment processors, are accepted by Bitfinex for cryptocurrency purchases.

High Liquidity: As one of the leading exchanges in terms of daily BTC/USD trading volume, Bitfinex ensures price stability and trader confidence.

Good Customer Support: For 24/7 support and a comprehensive knowledge base, users of Bitfinex can rely on email support with responses within 12 hours.

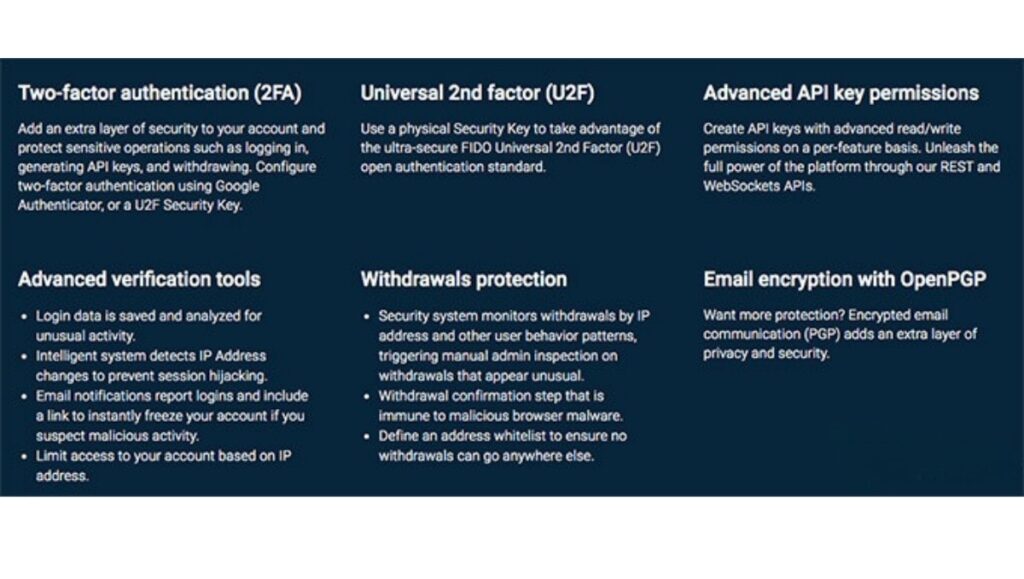

Security: Bitfinex is a secure cryptocurrency exchange that takes extra precautions to protect user funds, such as cold storage, DDoS protection, encryption, and regular backups, as well as additional security measures like whitelisting, 2FA, U2F, and suspicious activity analysis.

Variety of Trading Options: Trading participants have access to limit, market, stop, trailing stop, fill or kill, iceberg, OCO, hidden, and post-only limit orders in addition to funding and leverage trading.

Market Pairs: About 100 market pairs are available on the platform, including those for well-known coins like Bitcoin, Ethereum, Ripple, and EOS as well as well-liked alternative coins like TRON, Stellar, NEO, 0x, QTUM, and many others.

Key Advantages of Bitfinex

Bitfinex is a popular cryptocurrency exchange that has been providing users with a secure and reliable trading platform for over five years, earning positive reviews from users along the way.

A Cryptocurrency Exchange Targeted Toward Professional Traders

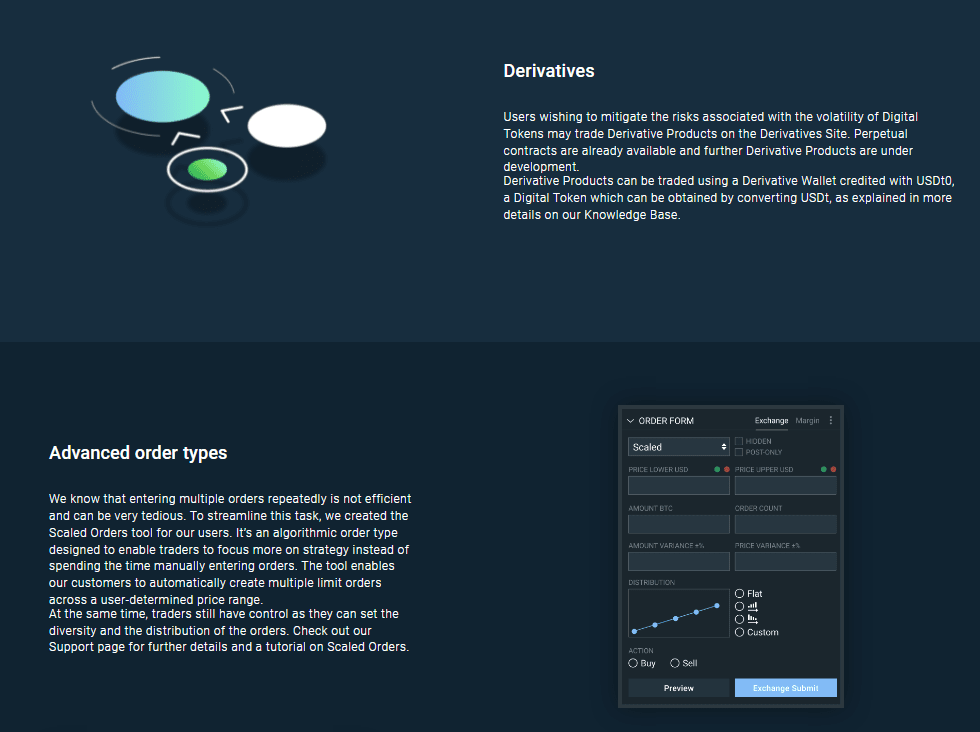

Bitfinex is a cryptocurrency exchange platform that is mostly aimed at crypto trading professionals. It offers advanced order types such as limit, stop-limit, stop, fill or kill, and scaled, as well as the ability to customize the interface. Advanced crypto traders can also view more-informative charts. This makes Bitfinex a great option for professional traders, as evidenced by the many user Bitfinex reviews.

Plenty of Trading Pairs (400+)

Crypto trading pairs are an important factor for professional cryptocurrency traders. Bitfinex offers over 400 different trading pairs, including both fiat-to-crypto and crypto-to-crypto options. This wide selection of trading pairs allows traders to find the best option for their needs, and potentially make more profits. With Bitfinex, users can take advantage of low fees, taxes, and account limits to maximize their profits. With so many options available, traders can find the perfect crypto trading pair for their needs.

High-Level Security Features

Bitfinex is a popular cryptocurrency exchange platform that offers a wide range of features and services. It has suffered some security issues in the past, but the platform has taken steps to ensure that its users are protected. It has implemented two-factor authentication, cold storage, and other measures to ensure the safety of user funds. Additionally, it has a dedicated security team that monitors the platform 24/7 and responds quickly to any potential threats. With these measures in place, users can rest assured that their funds are safe and secure on the Bitfinex platform.

Bitfinex is a secure cryptocurrency exchange that pays close attention to IP addresses and user information. It also offers additional security measures such as allowing withdrawals from a single, set IP address and cold cryptocurrency storage. Cold storage refers to keeping crypto coins in hardware devices that are not connected to the internet, making them virtually impossible to access. (caldwell.edu) With these security measures in place, users can rest assured that their funds are safe and secure on the Bitfinex platform.

The exchange keeps 99.5% of its users’ crypto assets in cold storage devices, which is one of the best security features that it employs. Many users of the exchange agree that Bitfinex has learned from past controversies and that the current security measures in place are both reliable and adequate. This ensures that users’ funds are kept safe and secure, giving them peace of mind when trading on the platform.

Derivative Trading Option

Bitfinex is a popular cryptocurrency exchange that offers its users a variety of trading options, including derivatives. Derivatives are contracts that are tied to the asset being traded, such as Ethereum. This allows users to invest in an asset without actually purchasing it, allowing them to take advantage of market opportunities quickly and easily. Bitfinex reviews are positive, with users appreciating the convenience and flexibility of the platform.

5 Different Fiat Currencies are Supported

It is a cryptocurrency exchange that allows users to make deposits with five different fiat currencies – USD, EUR, GBP, JPY, and CNH – via wire transfer. This makes it easier for users to purchase cryptocurrencies without having to go through the tedious process of transferring other coins from their wallet. Bitfinex also offers a wide range of trading options, making it a great choice for both experienced and novice traders. With its user-friendly interface and secure platform, Bitfinex is a great choice for those looking to buy and sell cryptocurrencies.

Key Disadvantages of Bitfinex

Despite its many features and benefits, Bitfinex has had a controversial past which may raise questions about its legitimacy.

Conflicting History

Bitfinex, one of the world’s leading cryptocurrency exchanges, experienced two major break-ins in 2015 and 2016, resulting in the loss of user funds. In response, the exchange reimbursed all affected users in full. The hacks had a major impact on the crypto community, and served as a warning to other exchanges to strengthen their security. Since then, Bitfinex has taken steps to ensure their platform is as secure as possible, and have received positive reviews from users.

Perhaps Not Appropriate for New Traders

It is an exchange built for professional traders. It offers a wide range of features, but these may be difficult to understand for beginners. If you are new to crypto trading and want an easy-to-use platform, Coinbase may be a better option. Bitfinex is known for its security, but users should be aware that it may not be suitable for those with little knowledge of financial markets and investments.

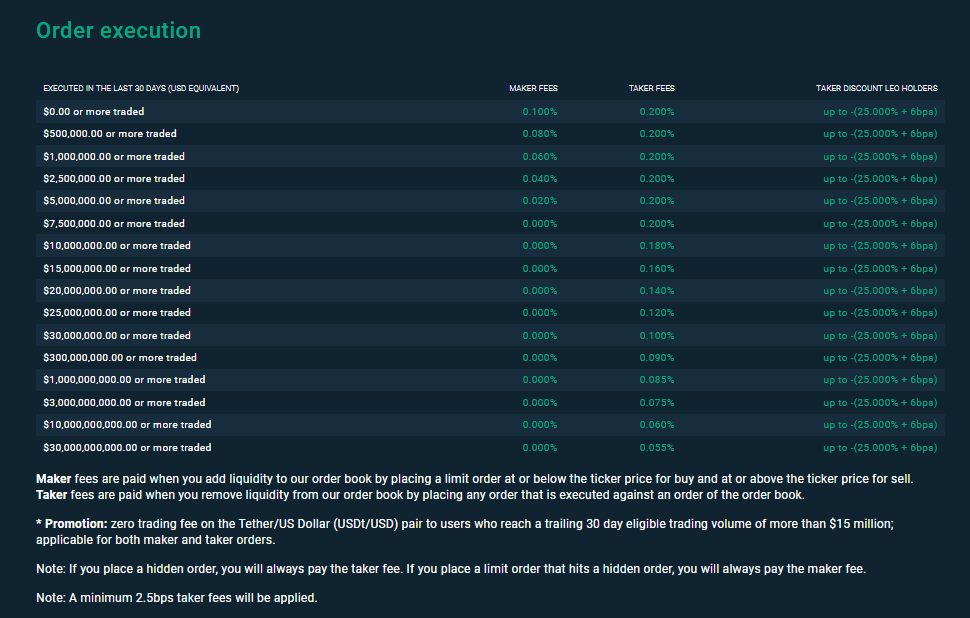

Fees

It has a “maker” and “taker” fee model, with taker fees ranging up to 0.2%. Deposits are free, and withdrawals cost a bit depending on the cryptocurrency. Bitfinex is a great choice for traders looking to save money on fees while trading cryptocurrencies.

How to use Bitfinex?

Bitfinex is a popular cryptocurrency exchange that offers users a secure and easy way to buy and sell digital assets. Let’s take a look at how the actual registration process on the site works.

Step 1: Go to the official Bitfinex website.

Step 2: On the upper-right part of the screen, press Sign Up.

Step 3: In order to open up an account, you’ll have to do the usual – create a username and password, and provide Bitfinex with your email address.

Step 4: Now, you’ll be asked to confirm your email address.

Step 5: You will now need to re-log into your account. And, that’s it – you’re in!

Registering with Bitfinex is fast and easy, with two-factor authentication and identity verification available for added security.

Conclusion

Bitfinex is a popular cryptocurrency exchange that offers a wide range of financial and analytical tools. It is secure and has low fees, making it a great option for experienced traders with a varied portfolio of crypto assets. However, if you’re just starting out, there are better options out there, such as Binance or Coinbase. Before trading on Bitfinex, make sure to read up on the platform and understand the risks involved.

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.