Lamina1 is a layer-1 blockchain based on a fork of Avalanche, built for the metaverse. It is co-founded by Peter Vessenes (co-founder of Bitcoin Foundation) and Neal Stephenson (award-winning author, coined the term “Metaverse”). Lamina1 has hinted on Discord at conducting a token airdrop for the community. In this article, we will briefly explain what Lamina1 is what you can do to position for the airdrop.

Lamina1 ($L1) Token Airdrop Step-by-Step Guide

Here’s how to get the Lamina1 ($L1) token airdrop:

- Create a Lamina1 Wallet

- Add Lamina1 Testnet to MetaMask

- Claim Testnet $L1 Tokens on MetaMask

- Claim Testnet $L1 Tokens on C-Chain Address

- Complete Tasks on Crew3

- Set Up a Node

See below for more in-depth details!

What is Lamina1?

Lamina1 is a layer-1 blockchain optimized for the Open Metaverse. It is based on a fork of the Avalanche blockchain, providing builders a flexible framework to create digital assets. The network uses a high-speed proof-of-stake (PoS) consensus algorithm, customized to support the needs of content creators.

Project Team and Funding

Lamina1 was co-founded by Peter Vessenes (co-founder of Bitcoin Foundation) and Neal Stephenson (award-winning author, coined the term “metaverse”). The project has set up the Lamina1 Ecosystem Fund (L1EF), the world’s first publicly accessible ecosystem fund for layer-1 blockchains. It is designed to provide broad economic access to accredited investors interested in championing the Open Metaverse.

Does Lamina1 Have a Token?

Yes, Lamina1 has a native token called $L1. It’s a hard-capped, scarce asset that is used to pay for fees, and secure the platform through proof-of-stake. It has a basic unit of account between the multiple Subnets created on the blockchain. One nL1 is equal to 0.000000001 L1.

How to Get the Lamina1 ($L1) Token Airdrop?

The best way to get the potential Lamina1 ($L1) token airdrop is to interact with their testnet and complete tasks on Zealy. Here’s a step-by-step guide:

- Create a Lamina1 Wallet

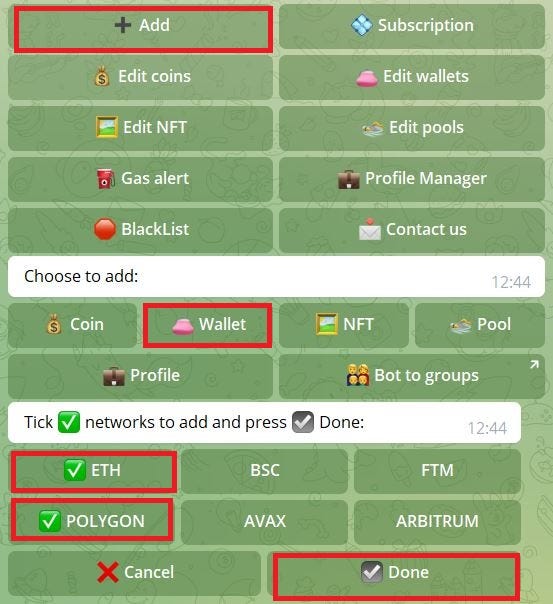

Go to the Lamina1 Web Portal and create a new L1 Wallet. Generate your key phrase and save them securely.

After your wallet is created, you’ll be redirected to your portfolio page. At the top right screen, you’ll see your X-Chain, P-Chain, and C-Chain wallet addresses and QR code.

X-Chain is for receiving funds, P-Chain is for receiving staking rewards and cross chain transfers, and C-Chain is for interacting with the Ethereum Virtual Machine (EVM). - Add Lamina1 Testnet to MetaMask

Go to the Faucet page. Click “Add Subnet to MetaMask” at the bottom, and you will automatically have the Lamina1 Testnet network on your MetaMask.

- Claim Testnet $L1 Tokens on MetaMask

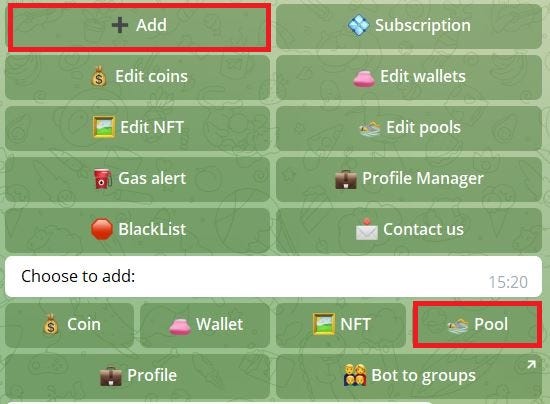

On the Faucet page, paste your MetaMask address and request 2 L1.

- Claim Testnet $L1 Tokens on C-Chain Address

Paste your Lamina1 C-Chain wallet address and request 2 L1.

The C-Chain can only be used to claim test tokens, because the faucet is only compatible with Ethereum-based wallet clients. - Complete Tasks on Zealy

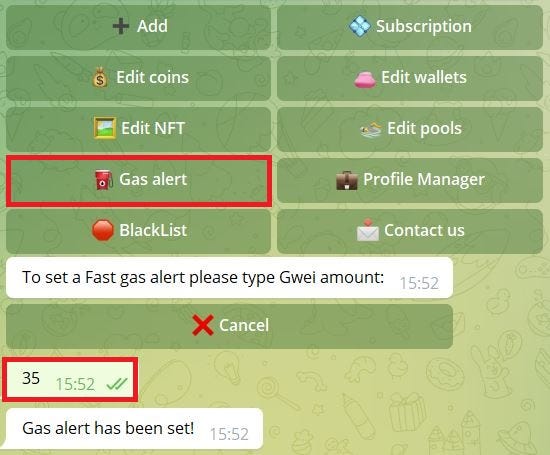

Complete the tasks on Zealy to get the “Testnet” role. This allows Lamina1 to keep track of your participation. Those who participated by accruing XP on Crew3 will receive an End-of-Testnet Giveaway!

- Set Up a Node

You can also set up a node and run it on the Lamina1 primary network. They have a complete guide on it.

Airdrop Review

When reviewing an airdrop, there are several factors to consider. First, the likelihood the project will even do an airdrop in the first place. Then, to look at how many tokens the project intends to allocate towards airdrop campaigns, as well as the difficulty in participating in their airdrop. It is also important to look at the utility of the token so that there will be an actual use and purpose in participating in the airdrop in the first place. Finally, a factor to consider when reviewing an airdrop is whether the airdropped tokens are subject to any lockup period.

Likelihood of Airdrop: Lamina1 has addressed the community on conducting a token airdrop. They will officially announce the details soon, so stay tuned for future updates!

Airdropped Token Allocation: The total token supply is yet to be revealed.

Airdrop Difficulty: For now, the tasks are simply claiming testnet tokens on Lamina1. More features will be released soon. You don’t have to set up a node if you simply want to be a user of the protocol.

Token Utility: $L1 will be used for transaction fees and staking to secure the network.

Token Lockup: There is no tokenomics yet.