Deriswap is the latest and unreleased project by Andre Cronje, announced for the first time in a Medium post on 23rd November 2020. Andre is a well known developer in the Defi space (“the Father of Defi” as many define him) and famous is his interest in trying to simplify users’ lives when approaching protocols. For example Yearn Finance ($YFI), launched in July 2020, automatically distributes users’ funds to various swap-based DeFi protocols based on their returns, risks, and other factors. Keep3r Network (which came in October) on the other hand, is a platform for projects that need or wish to outsource their “jobs” (operations) to third parties.

How has Defi improved over time?

Only a year ago, decentralized finance (DeFi) sounded so foreign, attracting just a handful of die-hard crypto enthusiasts and supporters. Fast-forward to 2020, and the space has become some sort of a sub-sector of crypto, leading to the creation of networks which address various sectors. Most of these platforms concentrate on yield farming through swaps. Other options and futures-focused systems also came on board.

Unfortunately, while these systems brought solutions, they also complicated the space. For instance, new questions had arisen such as which one is the easiest to use, which one has the best yields, etc.

Luckily, yield aggregator platforms such as Yearn Finance, as we said, came to the rescue of liquidity providers (LPs).

However, the segmentation problem still isn’t solved. This is where Deriswap comes in. The protocol ensures capital efficiency by aggregating services offered by other platforms such as Uniswap, Bancor, Deribit, Primitive, Compound, and Aave.

What is Deriswap? What problems is it trying to solve?

Deriswap is a decentralized platform combining swaps, options, futures, and loans into a single product.

Cronje wanted to, among other things, guard DeFi users against the high costs incurred when moving away from the money market, as is the case with options-focused networks such as Hegic. Additionally, Cronje’s vision is to shift from segregated to consolidated liquidity.

Some advantages of pooled liquidity include less price slippage and fees. Also, he wanted to strengthen asset-settled instead of cash-settled options.

Under the microscope, Deriswap is inspired by Uniswap. In an interview, Cronje noted that the platform was born after adding roughly 150-lines of code to the Uniswap protocol. However, things like math functions had to be developed from scratch to address unique computations on the new system.

What products will Deriswap offer?

- Swaps make use of Uniswap’s Automated Market Maker (AMM) formula “x * y = k” and allow LPs to provide liquidity as pairs of two coins such as Bitcoin (BTC)-Ethereum (ETH). Their incentives originate from trading costs.

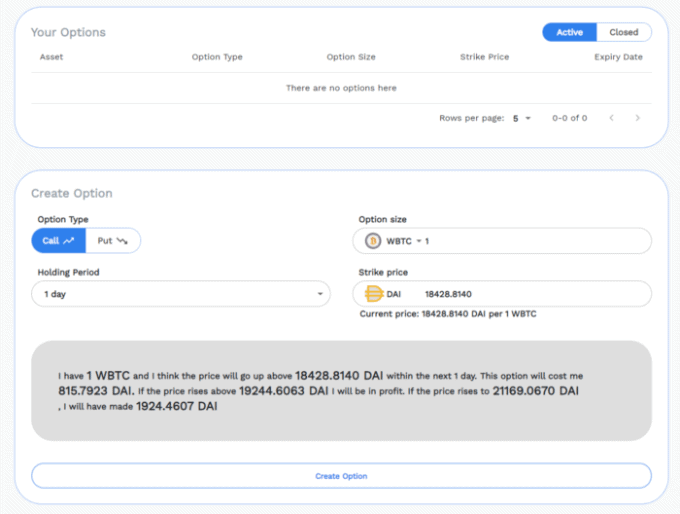

- Options – Options tap into swaps to hedge against volatility. For example, positive trading costs cancel losses from settled options. Deriswap makes use of TWAP (Time-Weighted Average Price) oracles to implement American-styled options that have no hard-coded settlement time.

Since settlement occurs in pairs, call and put functions have to exhaust assets from either side. That is, a call request buys the entire amount while a sell order auctions the absolute value.

Deriswap options allow users to maximize fees whether the market moves sideways or is too volatile. In case it moves sideways, for example, there are fewer trading fees but high options fees. When it’s unstable, vice versa, the trading costs increase while the options charges are reduced.

- Futures – Futures ride on the time element found on swaps. This, vice versa, is “just a normal trade” in Cronje’s words. It allows one party in a contract to pay a premium as well as the base asset.

- Loans – Loans are a natural evolution from futures. Interestingly, the deposited currencies pair back each other. For example, assuming you deposited BTC-ETH and want an ETH loan, BTC serves as collateral. This then determines the amount of ETH eligible for borrowing.

Once the ETH is returned, BTC is given back. Otherwise, BTC is forfeited. It is important to note that loans can be settled before their due date.

What are Deriswap’s advantages?

We could think of the platform as a Yearn replica which doesn’t only interact with swaps like Uniswap and Bancor. It deploys capitals to the entire ecosystem of options, loans, and futures. Therefore we can outline key points such as:

- users can deploy funds on selected platforms from a single interface. For instance, they could allocate 30 percent to Aave to power decentralized borrowing, 30 percent to Deribit for options, and 40 percent to Uniswap for trading.

- distributing capital to various unrelated platforms allows Liquidity Providers to use the same amount of money for different things.

- with different spheres of Deriswap complementing each other, LPs guarantee returns even when one market is dormant or unfavorable. For example, when the market has low volatility, they can quickly turn to options and loans. This while a highly-volatile market provides an opportunity to make a killing from trading and futures.

- Deriswap makes existing DeFi products functional and cheaper

- … and accommodates what Cronje calls “lazy liquidity”. This is liquidity from LPs who don’t have time to be active on a platform. Instead, they provide liquidity and come back after six months to check for yields.

When is Deriswap launching?

As of today, there is no official release date and not much info has been disclosed. Through a series of tweets, articles and community posts announcing Yearn Finance’s last collaborations, we came to know that Deriswap will be completed and launched together with the Sushiswap team. The partnership should biuld the next Sushiswap trading platform on top of Deriswap.

In this post, we can also read that the two teams will cooperate “in a stealth project following Deriswap release”.

To confirm this “aura of mystery” behind Deriswap and last Cronje’s announcements in general, “cryptomaniacs” are welcome to bet on what this fourth notorious project in his last tweet could be

Is there a Deriswap token?

Cronje is considered by the cryptocurrency community as having the “Midas touch”, where every project he touches turns into gold. Therefore, people are anxious to know if and when Deriswap will launch a token so that they can dive in early and buy it for a cheap price and sell it later. Most DeFi protocols have their own limited supply token, so it is expected that Deriswap will eventually also have a token. However, the Deriswap protocol is currently undergoing audit so there is no official Deriswap token yet. There is also no news on whether there will even be a token at all.

However, this has not stopped some people from issuing fake Deriswap tokens for unsuspecting crypto enthusiasts to buy. In one such scam, people deposited over 150 ETH in less than 15 minutes, which the scammer promptly took and absconded.

Conclusion

In an ecosystem where liquidity is thinly spread across multiple platforms, Deriswap acts as a consolidator in order to increase capital efficiency. As such, a DeFi enthusiast can deploy his capital into loans, options, swaps, and futures platforms. Consequently, they can receive incentives, even when one industry is stagnant. Moreover, the use of the TWAP oracles eliminate the risk of widespread price variance.

Since Deriswap is developed by a seasoned programmer, the platform is likely to turn out as another success, just like Yearn.

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.