WAX Protocol ($WAXP) stands for Worldwide Asset eXchange. They are one of the safest and most convenient ways to create, buy, sell and trade virtual items i.e. non-fungible tokens (NFTs) through an integrated DPoS blockchain platform designed to work hand-in-hand with a microservice layer to improve the digital goods market’s infrastructure. Obtaining WAX knowledge has enabled innovators to develop a highly-connected and sophisticated marketplace that has brought a lot of value in digital goods projects.

This information here will help you learn how to incorporate the WAX Protocol within the WAX Platform and how the two tools complement each other. It’s worth noting that the WAX Platform is composed of the WAX Protocol and a microservice layer.

Learn more about WAX with our interview with Evan Vandenberg, Director of Business Development at WAX.

Background

The WAX platform was founded by William Quigley and Jonathan Yantis, together they have vast experience in blockchain technology. Quigley is also the Managing Director of Cashel Enterprises, a cryptocurrency-focused investment vehicle which has incubated and invested in over 40 blockchain and cryptocurrency projects. Meanwhile, Yantis also works as WAX’s CEO.

The global growth of the digital goods marketplace has experienced enormous challenges for the past decade, but WAX technology has helped in finding solutions that spur the development of the sector. Although some users think that the technology has arrived late when challenges are already overwhelming, it’s actually the perfect time since blockchain has matured enough to satisfy the requirements for the WAX system to succeed.

As the digital goods market continues to expand, it’s essential to acknowledge that tokenized consumer products and virtual items have played an instrumental role in blockchain growth. Virtual items like in video games alone have generated more than USD$140 billion for the market. On the other hand, tokenized consumer products have realized over USD$1.8 trillion.

Considering that WAX attempts to offer remedies for a marketplace with a combined market value of over USD$2 trillion, it’s easy to realize the magnitude of the problem. The first year of incorporating WAX Protocol operations on major players like VGO and dApps has realized over USD$150 million worth of trading volume.

What is WAX?

Wax is a marketplace for digital assets, serving more than 400 million online players that sell, buy, and collect in-game items. Their suite of blockchain-based tools allows people to trade digital or physical items instantly and securely to anyone in the world. WAX’s platform brings together a community of collectors and traders, buyers and sellers, creators and gamers, merchants, creators of dApps and even game developers.

Examples of what WAX can do include buying and selling gift cards to people across the globe, or building your own online store using the B2B tools created by WAX. WAX also allows people to create NFTs and send them to others.

WAX Blockchain

The WAX network works on a consensus model that relies on various WAX Guilds to enhance blockchain production. WAX utilizes Delegated Proof of Stake (DPoS), which depends heavily on WAX Guilds to ensure success in blockchain generation.

The WAX ecosystem has witnessed considerable growth due to the incorporation of the WAX Token Model, which is designed to ensure success in various aspects such as voting, staking, and rewards. The Wax Staking Reward is a feature that has encouraged community participation because it allows users to vote and access rewards.

With WAX tokens, users have immense options to explore. For instance, if staked WAX tokens haven’t been placed, a token holder will require platforms such as Scatter and Lynx to automate the process.

WAX Tokens ($WAXP)

WAX tokens ($WAXP) power the entire WAX ecosystem. They are used to reward participants in the chain and enable contributors to receive ten times the number of tokens purchased. This strategy makes it easier to calculate all microtransactions on the platform.

One benefit of owning WAX tokens is that you get to earn even more tokens by voting for WAX guilds. This is called the WAX staking reward. This process is hassle-free and takes just a minute or two to join. Furthermore, you can unstake your tokens at any time.

WAX and DeFi? WAX’s new tokenomic model explained

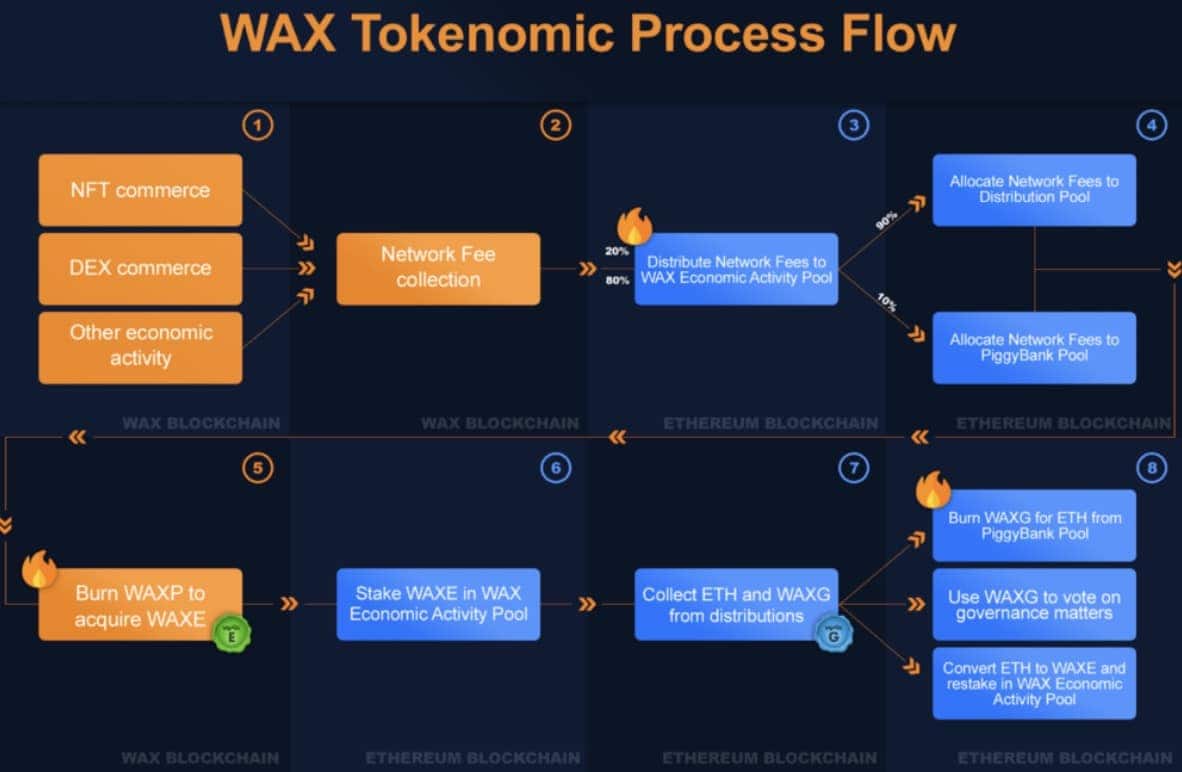

In a recent announcement, WAX mentioned they will have a new tokenomic model hoping to capitalise on the rapid growth and popularity of NFTs and decentralised finance (DeFi). Their plan is to link the value generated from creating, selling and trading NFTs to Ethereum. WAX considers it different from other DeFi platforms because they consider these activities to be able to provide a sustainable source of value to stakers.

How the new WAX inter-blockchain tokenomic model would work is that the operational functions of NFTs would still be done on the WAX blockchain, whilst Ethereum will become, “…the capital vault of the WAX NFT empire”. There are 4 components to this new tokenomic model, namely:

- WAXP to Ethereum bridge: this new bridge will enable WAXP token holders to convert their tokens into WAXE.

- WAXE: WAXE is a new Ethereum ERC20 utility token. Participants of the WAX tokenomics will need to burn their WAXP tokens to get WAXE tokens via the Ethereum bridge. They would then stake the WAXE in the Ethereum Distribution Contract.

- WAXG: WAXG is a new Ethereum ERC20 governance token which will be distributed to WAXE stakers based on a set timetable and proportionate to their percentage of the WAX Economic Activity Pool. Token holders will be able to govern the allocation and distribution of economic value on the platform.

- WAX Economic Activity Pool: This is a smart contract which will accumulate a percentage of generated WAX fees to be converted to ETH for distribution to WAXE stakers or given to WAXG token holders that decide to burn their tokens.

For full details of WAX’s new tokenomic model, check out their article on Medium.

WAX Guilds and Rewards

A WAX blockchain contains 21 WAX Guilds that qualify to earn a reward. Remember, blocks can only be produced after the chain meets the threshold to earn rewards. The rewards are awarded depending on the number of blocks that every WAX Guild can produce. Standby Guilds are considered as backup operators that help to generate a chain on request.

WAX Performance Metrics

WAX has been configured in such a way that it releases two blocks per second. It’s worth noting that each WAX Guild can only produce one block at a time. If a block fails to come out at a specific time, other blocks will jump the queue to ensure a continuous process.

A block that has been skipped will contend for a space in the memory pool to compete for guilds’ inclusion in the next turn. More than 3000 blockchains are usually transacted each second in the WAX system. The transaction rate is two times swifter than the VISA system can procure in the same period.

The Future of WAX technology

WAX Platform doesn’t only work to offer remedy for the current problems but also offers a roadmap for future operations. WAX Developer Hive is tasked with the duty of technical service provision, tutorials, and other simulations. Besides, WAX developers equally provide vital resources that make implementations successful.

The technology has also incorporated features that will make it convenient to evaluate whether the system passes the transparency test among communities.

Also, there’s room to allow interoperation with other chains to enhance performance. NFTs are among the candidates that need microservices and can thrive with the WAX Platform.

Conclusion

Gamers from across the world can substantially benefit from its secure and decentralized digital items marketplace. As WAX Platform continues to provide more improvements, developers will find several ways to create features that would better serve gamers in terms of digital goods trading.

The platform is also expected to play an instrumental role with digital media and is set to welcome over three billion users in the coming five years.

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.