The Trezor Model T is a cryptocurrency hardware wallet manufactuered by Satoshi Labs. It remains one of most trusted hardware wallets for securing cryptocurrency assets. With support for over 1,500 digital currencies and the latest Trezor Suite v25.6.2 update—including Stellar (XLM) support and WalletConnect integration—it remains a go-to option for secure crypto management. New offerings like Trezor Expert and the launch of the Trezor Safe 5 showcase SatoshiLabs’ ongoing commitment to innovation in crypto self-custody. This Trezor Model T review explores its features, updates, and whether it’s still worth buying in today’s fast-evolving crypto market.

BUY YOUR TREZOR MODEL T NOW!

If you want to learn how to set-up and install your Trezor Model T, check out our complete Setup Guide here.

Or check out my video review below.

Key Features of the Trezor Model T

- Screen: Bright color LCD – 240×240 pixels;

- Connectivity: USB-C connection with support for Android devices via the Trezor Suite mobile app;

- Crypto Compatibility: Supports over 1,500 cryptocurrencies and works with third-party wallets like MetaMask, Exodus, and MyEtherWallet;

- Security Enhancements: Features include Shamir Backup, microSD card encryption, wipe code for emergency data deletion, and passphrase protection;

- Mobile support: Android support via the Trezor Manager; and

- External wallet compatibility: supports MyEtherWallet and a few others.

Latest Updates: As of Trezor Suite v25.6.2, includes WalletConnect integration and experimental Stellar (XLM) support.

Security Features

Here are some of the security features of the Trezor Model T:

- Offline Private Key Storage: The Trezor Model T stores private keys entirely offline within the device, ensuring they are never exposed to internet-connected systems, significantly reducing the risk of remote attacks.

- Open-Source Firmware: Trezor’s firmware is fully open-source, allowing for community auditing and transparency. Regular updates from SatoshiLabs address emerging threats and maintain device integrity.

- Shamir Backup (SLIP-0039): Users can split their recovery seed into multiple shares, requiring a threshold number to restore access. This adds resilience against theft or accidental loss.

- Passphrase Protection: In addition to a PIN, users can enable a passphrase to create hidden wallets. This feature protects against coercion and phishing attempts.

- MicroSD Card Encryption: When enabled, a randomly generated secret is stored on a microSD card, which must be inserted to unlock the device. This adds an extra layer of protection against physical attacks.

- Tamper-Evident Design: While the Model T does not use a secure element chip, its hardware is designed to show signs of tampering, and it includes a wipe code feature that erases all data if triggered.

- Recent Security Updates: In response to phishing threats, Trezor has implemented enhanced safeguards across its communication channels and reaffirmed that it never requests sensitive information via email or support messages.

Can the Trezor be hacked?

The Trezor Model T remains vulnerable to certain physical attacks, though SatoshiLabs has taken steps to mitigate risks. The most notable exploit—first demonstrated by Kraken Security Labs—involves voltage glitching to extract the recovery seed from the device’s microcontroller. This attack still requires physical access and specialized equipment, and Trezor has emphasized that enabling the passphrase feature significantly reduces its effectiveness.

In reply, Trezor noted that the attack cannot work remotely and if users turn on the passphrase feature on the device. Trezor also reassured users that physical access is only a threat to 6-9% of cryptocurrency users.

However, Trezor has not redesigned the Model T hardware to eliminate this vulnerability, but it has introduced additional safeguards such as microSD card encryption, wipe codes, and firmware-level protections. In 2025, Trezor also responded to a phishing campaign that exploited its support contact form to send fake emails. While no internal systems were breached, the company urged users to remain vigilant and reiterated that it never asks for wallet backups or recovery seeds via email.

Trezor Model T 2.8.10 firmware update- does it fix the Kraken Security Labs hack?

The latest firmware version for the Trezor Model T is 2.8.10, released on 21st May 2025. Despite multiple updates since version 2.3.0, the core vulnerability identified by Kraken Security Labs—voltage glitching to extract the recovery seed—has not been fully resolved. This is because the exploit stems from a hardware-level flaw in the device’s microcontroller, which cannot be patched through firmware alone.

Trezor has introduced several mitigations over time, such as passphrase protection, microSD card encryption, and wipe codes, which make physical attacks more difficult. However, the fundamental vulnerability remains unless the hardware is redesigned. So while newer firmware versions improve overall security and usability, they do not eliminate the Kraken exploit.

Security 3/5

Multi-Currency Support

The Trezor Model T can hold over 1,500 different cryptocurrencies, including popular ones like Bitcoin, Ethereum, Cardano, Ripple, Litecoin, Stellar, and Dogecoin. In February 2025, Trezor announced it would stop supporting a few lesser-used coins—like Dash, Bitcoin Gold, DigiByte, Namecoin, and Vertcoin—in its Trezor Suite app. After July 2025, you won’t be able to access these coins through the app, but you can still manage them with other trusted wallets.

A big benefit of the Trezor Model T is that, unlike some other wallets like Ledger, you don’t have to install separate apps for each coin. It works smoothly with services like MetaMask, Exodus, MyEtherWallet, and Electrum, making it easier to handle lots of different assets in one place.

To check out a comparison list between coins supported by Trezor and Ledger, check out our ultimate list of supported coins table.

Multi-currency support 3/5

3rd Party Wallet Support

The Trezor Model T integrates with a wide range of third-party wallets, including MetaMask, Exodus, Electrum, MyEtherWallet, Rabby, Yoroi, and AdaLite, enabling users to manage assets across multiple blockchains. These integrations allow users to access features not available in Trezor Suite, such as staking, NFT management, and DeFi applications.

Meanwhile, Trezor Connect ensures secure communication between the hardware wallet and third-party apps, keeping private keys safely stored on the device at all times.

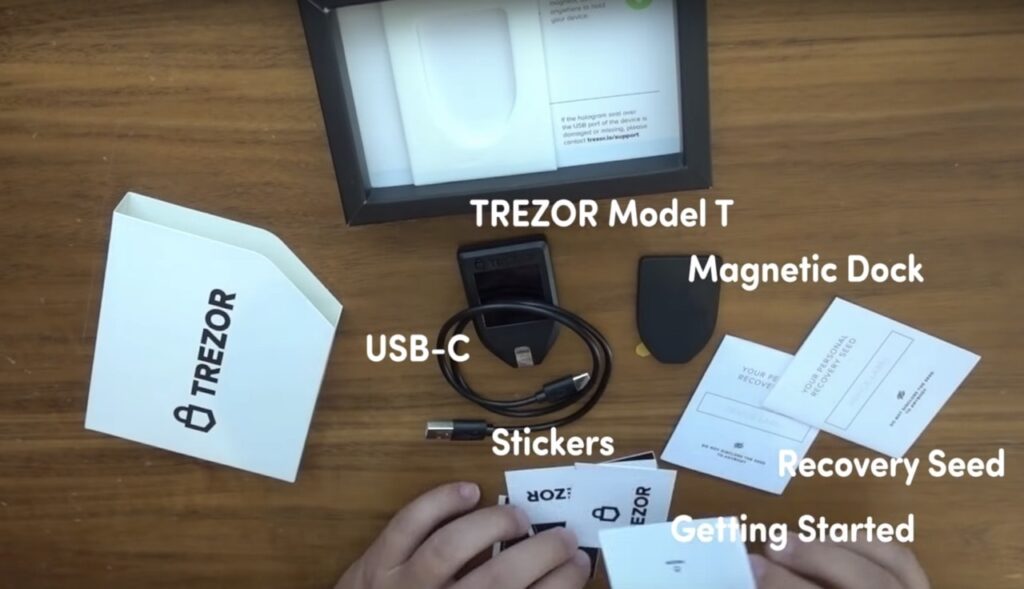

Hardware Design

The Trezor Model T has a bright 1.54-inch color touchscreen with a 240×240 pixel resolution, letting users securely enter their PIN and passphrase right on the device. It’s small and lightweight—about the size of a matchbox—and uses a USB-C connection to work with Windows, macOS, Linux, and Android systems (though not iOS). There’s also a microSD card slot that can be used to add extra security by storing a secret code required to unlock the wallet. Inside, the device uses an ARM Cortex-M4 processor, built to safely handle private keys and crypto transactions. While it doesn’t have a secure element chip like some other wallets, the Trezor Model T is open-source, and its design makes it easier to tell if someone has tried to tamper with it.

However, I find the touch screen is still small and can be hard to use. I eventually settled on pressing the screen with my pinky finger.

Hardware design 5/5

Ease of use 4/5

Mobility

In 2025, the Trezor Model T offers strong mobile support through the Trezor Suite Lite app, available on the Google Play Store for Android users. With this app, users can manage their crypto holdings, send and receive transactions, and view account details directly from their smartphones. The device connects to both mobile and desktop platforms via a USB-C port, making it compatible with most modern Android phones and computers. While iOS support is still unavailable, users can also connect the Model T to mobile-compatible wallets like Mycelium and MetaMask Mobile using Trezor Connect, expanding its functionality for users on the move.

Is Trezor Model T worth it in 2023?

In 2025, the Trezor Model T remains a strong contender in the hardware wallet market, especially for users prioritizing open-source transparency and advanced security features. Priced around $129 to $170 USD, it offers support for over 1,500 cryptocurrencies, a responsive color touchscreen, and features like Shamir Backup, passphrase protection, and microSD card encryption. While the device still lacks a secure element chip and remains vulnerable to certain physical attacks, mitigations like wipe codes and Trezor Suite Lite for Android enhance its usability and protection. For users seeking a balance of security, usability, and broad coin support—without relying on closed-source hardware—the Model T continues to be a worthwhile investment in 2025.

Verdict

Deciding whether or not to purchase the Trezor Model T over other available cryptocurrency hardware wallets has a lot to do with what features you are looking for.

The wallet supports over a thousand cryptocurrencies. Thus, virtually half of the cryptos available in the market can be stored on the device.

Its integration with exchanges such as Bitstamp, Coinmap, and Bitex also makes it a good choice.

However, one significant downside is that the device does not support IDEX or Switcheo exchanges. The findings from Kraken Security Labs on physical hacks on the device are also extremely concerning.

Security Rating: 3/5

Multi-currency Support: 4/5

Hardware design: 5/5

Ease of Use: 4/5

Final score: 4/5

GET YOUR TREZOR MODEL T!

Trezor Model T Product Specifications (Technical Specifications)

| Processors | ARM Cortex-M4 processor @ 168 MHz embedded on STM32 F2 microcontroller |

| Compatibility | 64-bits desktop computer (Windows 7+, macOS 10.8+, Linux). Compatible with Android smartphones. |

| Connector | USB type C |

| Certification | Nil |

| Size | Size: 64mm x 39mm x 10mm Weight: 22g |

| Supported Assets | 1050+ Supported assets |