Only1 ($LIKE) is the first NFT-powered social platform built on the Solana blockchain. Mixing social media, a non-fungible token (NFT) marketplace, a scalable blockchain, and the native token — $LIKE, Only1 offers fans a unique way of connecting with the creators they love. By using the Only1 platform, fans will have the ability to invest, access, and earn from the limited edition contents created by the world’s largest influencers/celebrities, all powered by NFTs.

The ultimate goal of Only1 of revamping and innovating social media could have far reaching effects. At a time when major platforms like Facebook have rebranded with an aim at crypto, the power of content creators and users is ever more apparent. Where creators choose to upload content and where users flock to consume plays a major role.

Issues with Traditional Social Media

- Unfair Creator Economy

On centralized social platforms, advertisers pay the platform for user’s attention. On decentralized social platforms, platforms pay users for their attention. Creator economy is the incentivisation structure for user-generated content. Content creators on Youtube are under constant pressure of censorship and demonetisation, while creators on platforms like Instagram and TikTok often have to rely on third parties (affiliate links, merchandise sale, paid shoutouts etc) to generate income. For a lot of the creators, social media is their full time job and their reward should be determined by their content and engagement with their fans.

- Data Exploitation

Traditional social media platforms provide end users with free services in exchange for their personal data. As the saying goes, “If you are not paying for the product, you are the product”. According to Clario, major social media apps collect up to 79.5% of personal data from users, including but not limited to name, addresses down to hobbies and interests. Let’s take the example of Facebook (recently renamed as Meta). Facebook with over 2.89 billion monthly active users is the most popular social media worldwide. With an audience base this big, there is no surprise that 98% of Facebook’s revenue is generated through advertising. Since these platforms own and store data in one single place, they can effectively manage and monetize through selling user data to third parties for marketing purposes. End users have no control over who Facebook sells their data to and how these purchasers use their data.

- Algorithms & Authoritarian Control

Discovery algorithms are built with parameters to prioritize commercialisation of the corporation and sometimes to serve some political agendas. For example, certain cartoons are banned in some countries for political reasons. China because they resemble a political figure. Also why show you a picture of your friend’s new Samoyed if they can show you a picture of an attractive person that will eventually convert you to buy the advertised into that fitness program advertisement? It is difficult to balance freedom of expression and safety of the community, it is for sure too big a power and responsibility for one corporation. The future of social platforms are looking at becoming decentralized and is community-governed.

Key Components of a Decentralized Social Platform

- Fair Creator Economy

A decentralized finance (DeFi) or SocialFi structure that pays content creators for being active on social media and providing value to the audience, instead of ad companies that pay the platform.

- Social DAO Governance

A decentralized autonomous organization (DAO) that regulates community guidelines and platform development balancing safety of the community on the platform, and freedom of expression. Users curate and execute community guidelines and development. Not one single entity can deem specific content inappropriate, and actions are carried out if consensus is reached between the network.

- Ads & Discovery

Optimized for users instead of platform, without leaking user data to third parties.

What is an NFT-Powered Social Platform?

Instead of solely focusing on NFTs, social NFT platforms allow influencers to create content, share it with their audience, and get rewarded based on engagement. Users can create NFTs and allow their fans to engage, access, and earn through collecting these NFTs. Only1 provides a decentralized NFT-powered social platform for creators and fans to interact.

What is NFT staking?

Blockchains depend heavily on their global network of transaction validators who authenticate transactions before the data gets added to a block on a blockchain. These validators (or miners) are decided based on the amount of cryptocurrency they pledge towards the operation of the blockchain network. In return, miners earn rewards in the form of the native cryptocurrency for devoting resources. This model of pledging crypto assets is called the ‘Proof-of-Stake’ model, and the process is called ‘staking’.

Similarly, you can pledge NFTs to support a project while you earn passive income in terms of rewards or fees for dedicating the asset to a blockchain. Currently, most of the NFT staking opportunities are in play-to-earn (P2E) gaming platforms such as Decentraland, Sandbox, Axie Infinity, among others. All you need to stake is a cryptocurrency wallet with NFTs.

Over 50 percent of the NFT market is attributable to in-game NFTs, which players can buy using cryptocurrencies. Axie Infinity, for example, has garnered a sales volume of over $2 billion since its launch in 2018.

However, it is important to note that all NFTs cannot be staked. So you need to check the details before buying the NFT.

Features: What Makes Only1 Special?

The Only1 marketplace will consist of several different features that sets it apart from other NFT marketplaces. Some of these features include:

Creator Genesis NFT

Genesis NFT Minting

- A genesis NFT is minted once a creator passes KYC

- Creators will then be able to mint their own Content NFTs for their fans and receive $LIKE, or native token, as a reward for engagement

Fans Bid with $LIKE

- Fans can utilize $LIKE, or native platform token, to bid for a Star NFTs on the Only1 Marketplace

Genesis NFT Perks

- Fans will have the ability to stake $LIKE on their favorite influencers profile

- The Genesis NFT Owner as well as the creator will both earn a split of the staking rewards

Content NFT Farming

Creator Post Content

- Creators have the ability to post exclusive content in form of an NFT

- Fans bid on Only1 marketplace for NFT using the $LIKE Token

- When an NFT is purchased a portion of the $LIKE tokens are burned

Community Unlock

- Other fans unlock content with $LIKE, receive lottery tickets (weekly lucky draw)

Creator and Community Earns

- Tx split between NFT owner and creator

Why Solana?

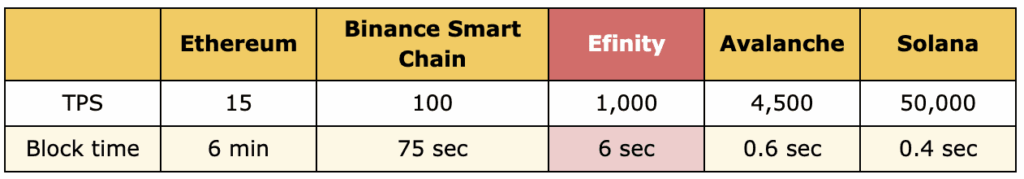

Only1 is built on the Solana blockchain for multiple reasons, including:

- Solana has a flexible virtual machine which allows programs (known as smart contracts elsewhere) to be written in native languages such as Rust, C, and C++.

- Solana’s infrastructure provides blazing fast speeds and no memory pool – providing the basis for global adoption of blockchain and/or distributed ledger technologies.

- A transaction on-chain costs only a fraction of a cent (average of $0.00025 per transaction).

Solana truly achieves the three desirable qualities of any blockchain: scalability, security, and decentralization. With Solana, users on an NFT-powered social platform such as Only1, can enjoy all the benefits of Web3 at the speed of Web2.

$LIKE Token Economy

$LIKE is the native token of Only1 that powers the creator economy within the network. Some of the initial utility for the token include:

- Bidding – Fans bid for NFTs on Only1 with $LIKE

- Staking & Governance – Fans stake their $LIKE to earn more over time

- Reward Pool – $LIKE rewarded to stars as new NFT is minted & resold

- Donating – Fans can tip $LIKE to their favorite creators

Conclusion

Since the invention of the World Wide Web (WWW) by Tim Berners-Lee in 1989, the world has been revolutionized by this technology combining computers, data networks and hypertext.

The first iteration of the WWW evolution — Web 1.0 is a “read-only” web that enables users to search and consume information. The second iteration, although deemed as a “passing fad” by many, has flourished and brought the adoption of the internet to a whole new level. Web 2.0 as a “read-write” web, has extended its functionality to highlight user-generated content, usability and interoperability for end users.

As time goes by, many people have grown tired of the data exploitation that major corporations have taken advantage of and wanted to regain control over their data and content. This is where Web3 comes in; the Semantic “read-write-own” Web that revolves around decentralization and token-based economics. Rather than compromising personal data in exchange for free services, users can become participants and shareholders by earning on the blockchain network, which in return allows you to impact decision-making over a network.

Only1 fully embraces this revolution by proportionally rewarding creators and fans for simply using the platform. The goal is to support and foster the creator economy, not profit off of it. By combining social media, NFTs, DeFi and the native token $LIKE, Only1 offers a Web 3.0 solution to creator economy and fan engagement.

Follow their media channels for more info:

Website — https://only1.io/

Twitter — https://twitter.com/only1nft

Telegram — https://t.me/only1nft

Medium — https://only1nft.medium.com/

Sources:

https://only1.gitbook.io/only1/

https://morioh.com/p/27ea8c22ad0d

https://only1nft.medium.com/barriers-for-web-3-0-social-for-the-mainstream-market-fbc12c1cddf3